Sumitomo Mitsui Financial Group: Quite A Lot Of Foreign Bond Exposure, But Lots Of Cash

Summary

- With the banking crisis being a primary concern, we point out that SMFG has quite a lot of foreign bonds which have lost meaningful value.

- However, we think that deposit flight is not likely in Japan. Moreover, SMFG's business depends on a lot of other things than just loan and deposit businesses.

- Recovering consumer sentiment in Japan is supporting the credit card businesses. Consumer finance is also less of an issue.

- SMFG is also going to be a beneficiary of an initial burst of higher rates in their loan and deposit businesses, if that ends up happening in Japan.

- They are also achieving income growth despite low equity volatility. Solid yields and buybacks make SMFG relatively interesting among banking picks.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

Scott Barbour

Sumitomo Mitsui (NYSE:SMFG) is a Japanese banking pick that actually stands out in quality in the current banking make-up. While there is exposure to declining bonds in their portfolio, they are very cash rich and their balance sheet is not exposed to the same risks as the US banks. Improving consumer confidence is doing a lot for some of its segments. The Japanese credit situation is favourable for the company, and even a slight rise in interest rates in Japan are likely to result in a positive increment for the company. With a robust buyback and yield, SMFG actually looks pretty decent relative to other financial picks.

Balance Sheet

Starting with the balance sheet, 30% is cash, with much half of that being held in securities of which foreign bonds are only a component. Overall foreign bond exposure on the SMFG balance sheet is less than 7%. While it is common for Japanese banks to hold outsized amounts of foreign bonds, in SMFG's case, the large cash balances in particular insulate them meaningfully from any of the banking stability narratives that have been hitting banks generally. In our opinion, the Japanese banking system has little to worry about, also on account of their own monetary policy and the fact that there are large multi-service banks that are upholding the economy.

Note that while deposits are substantial, SMFG has other businesses that contribute meaningfully to income.

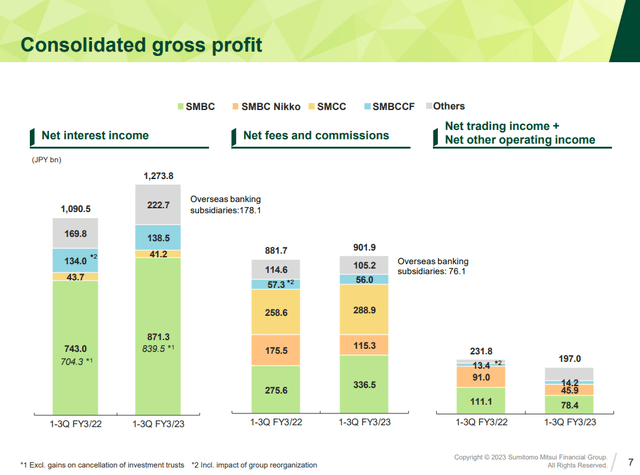

SMFG Snapshot

The SMCC and SMBCCF businesses are credit card and consumer finance businesses. While they are also part of the savings and loans structure of the balance sheet, the profile of shorter term loans means that the issues with duration gap and solvency risk aren't really contributed to by these segments. Restoration of consumer sentiment in Japan, particularly around the recovery of the Yen, has helped these consumer facing businesses recover nicely. In general, loan growth has also helped grow net interest income.

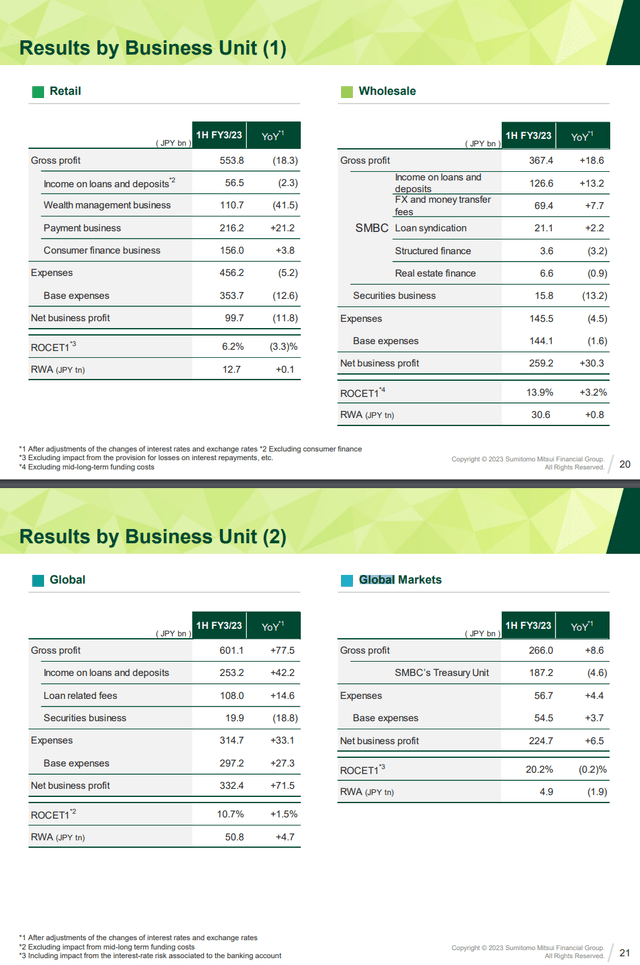

Alternative Segment Breakdown (Q3 2023 Pres)

Businesses facing corporates have been doing well too, with resumed treasury management and working capital demand helping out the global markets businesses, as well as the selling of derivative products associated to greater supply chain and inflation concern amid geopolitical instability.

Otherwise, securities facing businesses suffered, primarily on lacking trading revenue from equities, where the Nikkei has been relatively stable and volatility in the Japanese stock markets pretty minimal over the last year associated with continued monetary accommodation and relatively limited inflation.

All of SMFG's businesses that depend on consumer confidence have done decently this year, with weakness primarily being in trading revenue and the selling of investment products including local investment trusts. In general, retail sales of investment funds and domestic investment products has been a bit of a disaster; the wealth management business is responsible for almost all the negative forces on the Q3 and cumulative Q3 results. Despite this, net income is up in the lower teens YoY.

Reportable Segment Breakdown (Investor Report as of Q3 2023)

Bottom Line

Some of the major macro factors concerning Japan-facing investors are related to the new leadership at the BoJ and likely changes in monetary policy. While perennially low inflation in Japan has motivated an accommodative policy, the decline of the Yen has been the primary issue, reflected also in the resilience of SMFG's business in selling foreign bonds, possibly the only product that Japanese investors are still buying meaningfully. BOJ Chief Ueda is likely to raise rates slightly, but this should energise the trading and other segments of the global markets business. It also gives them space to deploy their large cash balances at higher rates, where they hold relatively low levels of securities compared to other major banks. There could be some fund inflows back into Japan as retail investors become confident once again in the Yen, which has burned households heavily in 2022.

Rates will not rise enough, not even close, to create the sort of credit and banking concerns that exist right now in the US around recent banking fragilities.

Finally, we should comment on SMFG's capital return policy. It is quite aggressive, a departure from typical Japanese activity. Buybacks are quite high at around 3%, and that's on top of a 4% yield that is likely to be defensible.

We think SMFG demonstrates resilience in the likely range of economic scenarios for Japan, and actually is a very strong datapoint for why investors should generally be considering Japan, whose environment is highly insulated from that of the West due to its differing credit environment. It is not an isolated economy, but credit conditions are going to be a huge differential across markets and make a big difference to the economy, with Japan being very favourably positioned with what will be continued monetary accommodation, at least relative to other countries. SMFG is a refreshingly solid institution thanks to cash balances.

However, we still see better opportunities in the market. A 9x PE is low, but we don't see the need to force a banking exposure when there are so many sectors out there that trade at even lower valuations in more unmined places in the market. SMFG is not going into our portfolio.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.