Western Alliance: Positive Deposit Update Renders Q1 Earnings Disaster Unlikely

Summary

- On April 4th after market close, Western Alliance Bancorporation released to investors an update on the company's financial position.

- Western Alliance disclosed that the bank's deposit balances as of March 31st stood at $47.6 billion.

- WAL also commented that the magnitude of deposit outflows decreased significantly after the first week.

- WAL management noted that the bank's unrealized losses on securities and loans have narrowed YTD.

- The recent investor update removes some key uncertainties, and I am confident to reiterate a 'strong buy' recommendation going into Q1 earnings.

Henrik5000

On April 4th after market close, Western Alliance Bancorporation (NYSE:WAL) released to investors an update on the company's financial position, disclosing that the bank's deposit balance is down about $6 billion (11%) as compared to year-end 2022. While I view the update as positive, and better-than-expected overall, I point out that a few key questions remain unanswered: (i) why has WAL's insured deposit balance increased to 68%, (ii) did management sell AFS or HTM investments to raise liquidity, and (iii) how has WAL's profitability evolved during the banking crisis (e.g., funding costs).

I have previously assigned a 'strong buy' to WAL stock, as I argued that at x4 P/E and x0.6 P/TBV the market is pricing too much pessimism and the risk/ reward for investors is skewed to the upside. Now, going into WAL's Q1 2023 reporting (scheduled for April 18th), I continue to like the odds of a better-than-expected reporting--especially in light of the recent quarter-end update.

WAL's Quarter-End 2023

Deposits

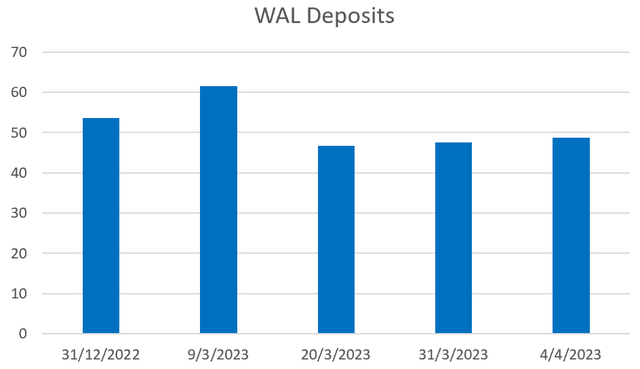

Following the SVB collapse, deposit flight away from regional banks has been one of investor's major concern. With that frame of reference, Western Alliance disclosed that the bank's deposit balances as of March 31st stood at $47.6 billion, as compared to $53.6 billion by end of 2022 (approximately $6 billion of outflows, representing a 11% decline over the stated period).

However, WAL also commented that the magnitude of deposit outflows decreased significantly after the first week of panic, and normalized by March 17. In fact, WAL added that from March 20th to March 31st, the bank's deposit balances reversed, and the bank received about $900 million of net inflows. Moreover, as of April 4th, deposit growth in the second quarter of 2023 has already reached $1.2 billion.

Kenneth A. Vecchione, WAL's CEO commented:

Western Alliance’s uniquely flexible, diversified business model positioned us to weather the liquidity tightness that enveloped the industry over the past month. Put simply, Western Alliance Bank is different; this diversification continues to distinguish us from monoline or sector-concentrated peer banks. This also demonstrates the value of Western Alliance’s scalable national funding channels and allows us to continue to serve clients across sectors, geographies, or macro trends.

Liquidity

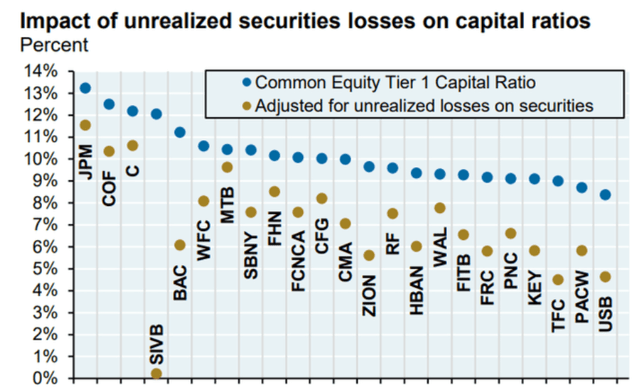

WAL management also provided an update on liquidity: According to the press release from April 4th, WAL's on-balance sheet liquidity and untapped borrowing capacity accounted for more than 140% of the bank's uninsured deposit balance. Moreover, the update stated that Western Alliance had not tapped the Fed’s discount window as of late 1Q 2023, citing the impact of 'balance sheet repositioning'--whereby it is still unclear what exactly is meant by this comment, specifically, if WAL sold some of its investment portfolio to raise liquidity. Finally, WAL disclosed that the bank's CET1 ratio as of late Q1 2023 is expected to be 'materially' consistent with its year-end 2022 CET1 ratio, which would imply a ratio of 9.3%.

Unrealized Losses

WAL management noted that the bank's unrealized losses on securities and loans have narrowed YTD, citing the impact of lower rates paired with conservative mark-to-market accounting by year-end 2022. As of April 4th, WAL estimates that the pre-tax gross unrealized losses on the bank's HTM portfolio fell to $139 million (versus $177 million by year-end 2022); pre-tax gross unrealized losses on the bank's AFS portfolio fell to -$789 (versus $811 million by year-end 2022); and the pre-tax gross unrealized losses on the bank's HFI loans contracted to -$2.9 billion (as compared to -$4.2 billion by year-end 2022. Moreover, according to the company's press release, the reduction in unrealized losses on assets were partially offset by unrealized pre-tax gains on debt and other borrowings (gains of $431 million as of April 4th, vs. gains of $121 million at year-end 2022).

High Risk!

WAL stock continues to be associated with a high risk tag, and I would like to reiterate what I have written previously:

In my view, the market is currently displaying excessive caution towards some bank stocks, and I am confident that taking calculated risks will eventually yield handsome rewards. However, it's important for investors to recognize that due to balance sheet leverage, banks, including WAL, indeed carry a higher level of tail risk compared to non-banking businesses. In light of recent events, there is a possibility that equity holders in Western Alliance Bank may lose their entire investment. It is up to individual investors to assess whether they are comfortable with such a risk.

Conclusion

In my opinion, WAL stock is trading too cheap to ignore. And with the recent investor update removing some key uncertainties about liquidity and funding, I am confident to reiterate a 'strong buy' recommendation for WAL going into Q1 2023 earnings. Reflecting on fundamentals and earnings power, I continue to view a $98/ share price target as reasonable, which would assume am approximate 2024 earnings multiple of about x8.5.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice, author's opinion and market commentary only.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.