Why Federal Realty Is Now A No-Brainer Buy

Summary

- Federal Realty Trust's stock price has fallen amidst broader concerns around commercial real estate.

- Yet, its carefully curated portfolio of premium shopping centers differentiates it from the rest of the pack.

- I also highlight the dividend and why now may be an excellent buying opportunity on this premier REIT.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

naphtalina/iStock via Getty Images

Commercial real estate has seen plenty of ups and downs over the past three years to say the least, and it now appears we’re in another down cycle. However, not all real estate is created the same.

With office REITs facing the biggest headwinds at the moment, it appears that retail REITs have also come under pressure, considering broader headline risk around commercial real estate.

This brings me to Federal Realty Investment Trust (NYSE:FRT), which as shown below, is down by 19% over the past 12 months. I covered FRT back in December here, highlighting its durable attributes. The stock has declined 13% since then, and in this article, I cover recent developments and why it’s an attractive income stock at current levels.

Seeking Alpha

Why FRT?

Federal Realty Trust is sometimes referred to as the “grandfather” of modern day REITs, considering its history dating back 60 years, and almost a similarly long dividend growth track record of 55 consecutive years. At present, it has 103 properties covering 3,300 tenants and 3,000 residential units.

While office REITs have come under pressure this year under renewed concerns around vacancies and return-to-office amidst remote and hybrid working arrangements, retail REITs remain well-positioned. This is was highlighted by Cushman & Wakefield regarding retail, industrial, and hotel properties in a recent article as follows:

Vacancy rates in warehouse and industrial space nationally are low, according to Cushman and Wakefield. The national retail vacancy rates, despite the migration of shoppers to online shopping, is only 5.7%. And hotels are garnering record revenue per available room as both occupancy and prices surged post-Covid, according to research firm STR. Banks’ commercial real estate lending also includes apartment complexes, with rental vacancies rates at 5.8 percent in Federal Reserve data.

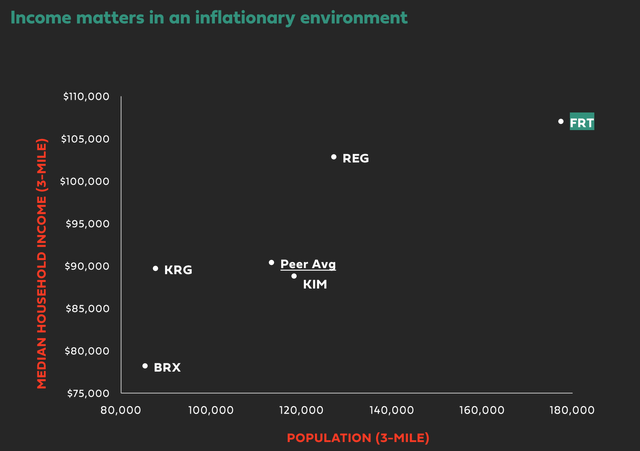

Meanwhile, FRT has built a hand-selected portfolio of high quality properties that are primarily located in high barrier to entry coastal markets with attractive population demographics. As shown below, FRT’s population density and household income metrics score the highest amongst its peer group.

Investor Presentation

Plus, FRT’s portfolio metrics have meaningfully improved over the past year, with same property operating income growth of 7.7% in 2022. This was driven by attractive leasing activity, with FRT signing 475 leases on comparable properties with 6% and 15% growth in rents on a cash and GAAP straight-line basis, respectively.

Occupancy also improved by 170 basis points YoY to 92.8% (94.5% leased) and small shop occupancy grew by an impressive 260 basis points to 90%. For reference, small shop occupancy over 85% is generally considered to be good. For those familiar with shopping center real estate, small shops are an important part of the equation, since anchor tenants pay less per square foot and have lower rent escalators on an annualized basis (rents usually raised once every five years). FRT’s management see themselves as being careful curators of small shop mix, and aims to build a better mousetrap with small shops, where they have more leverage.

Near term headwinds include the potential for a recession, as exacerbated by the recent slate of regional banking troubles. This is when quality of properties and income demographics matter the most, as highlighted by the CEO during last month’s Citigroup (C) Global Property Conference:

I've heard people say to me, it [income demographics] doesn't matter nearly as much. Nothing could be further from the truth. Take a look at any previous recession. I've been at this company since '98, I've been running it since '02. Think about economic conditions over that period of time. It is crystal clear. People need to have money to spend in down cycles.

They need to be able to choose where they're going to spend it in lower demographic areas, of course, much more to food and only essentials. And higher demographic areas, they've got much more flexibility to be able to determine where that money is being spent. It's critically important and time shows it, it's not my opinion, it's what happens through cycles.

Importantly, FRT carries a strong A- rated balance sheet with $1.3 billion in total liquidity and a safe long-term debt to gross assets ratio of 39.5%. This lends support to the 4.5% dividend yield, which is well-protected by a 68% payout ratio. It’s also worth noting that FRT is also the only shopping center REIT to grow its dividend over the past three years, continuing its cumulative 55-year track record of dividend growth.

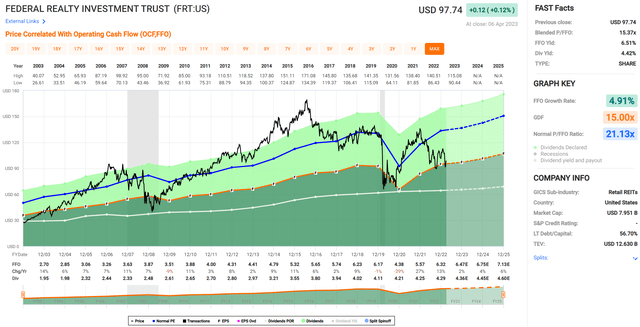

Turning to valuation, FRT appears to be in bargain territory at the current price of $96.73 with a forward P/FFO of 15.0 which as shown below, sits well under its normal P/FFO of 21.1. Analysts have an average price target of $118, which equates to a potential double digit total return of 26% over the next 12 months.

FAST Graphs

Investor Takeaway

Federal Realty Trust is a premier quality shopping center REIT that has maintained strong occupancy metrics and same property operating income growth due to careful curation and high barrier-to entry coastal markets. The company’s balance sheet is sound, and its dividend yield of 4.5% is well protected by FFO. Lastly, FFO appears to be well within bargain territory at present, giving conservative investors excellent value at current levels.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I'm a U.S. based financial writer with an MBA in Finance. I have over 14 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FRT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.