Representative image.

MC30 is a basket of 30 hand-picked, investment-worthy, mutual fund (MF) schemes curated by Moneycontrol for you to choose from. Our rationale is simple: an investor needs just 6-10 MF schemes to build a solid portfolio. But with over 1,000 schemes out there, choosing the right one becomes difficult. MC30 can make your life easy.

Through a rigorous risk-return testing process, we curate a list of 30 schemes, across equity and fixed income categories and active and passive funds, to give a shorter basket.

Every year, some schemes go out of MC30 and get replaced with newer ones. Our aim is to keep this churn minimal. But some schemes are bound to fall by the wayside, may be due to underperformance or unethical practices (a rare case scenario, though) that don’t justify their continuance in MC30. Or, some schemes outside MC30 become attractive, especially in light of their long-term performance. Here, change is inevitable but as promised, our aim is to keep this change to a bare minimum.

2023 review

In this year’s review, we have replaced five schemes with better alternatives. Of these, three are in the midcap category and one each from the focused and smallcap categories. As mentioned earlier, these schemes were shortlisted from among 5-star and 4-star rated schemes from our annual review. We arrived at the conclusion after having a detailed discussion with the fund managers of these schemes to understand their investment philosophy, current conviction on the market dynamics and future course of action.

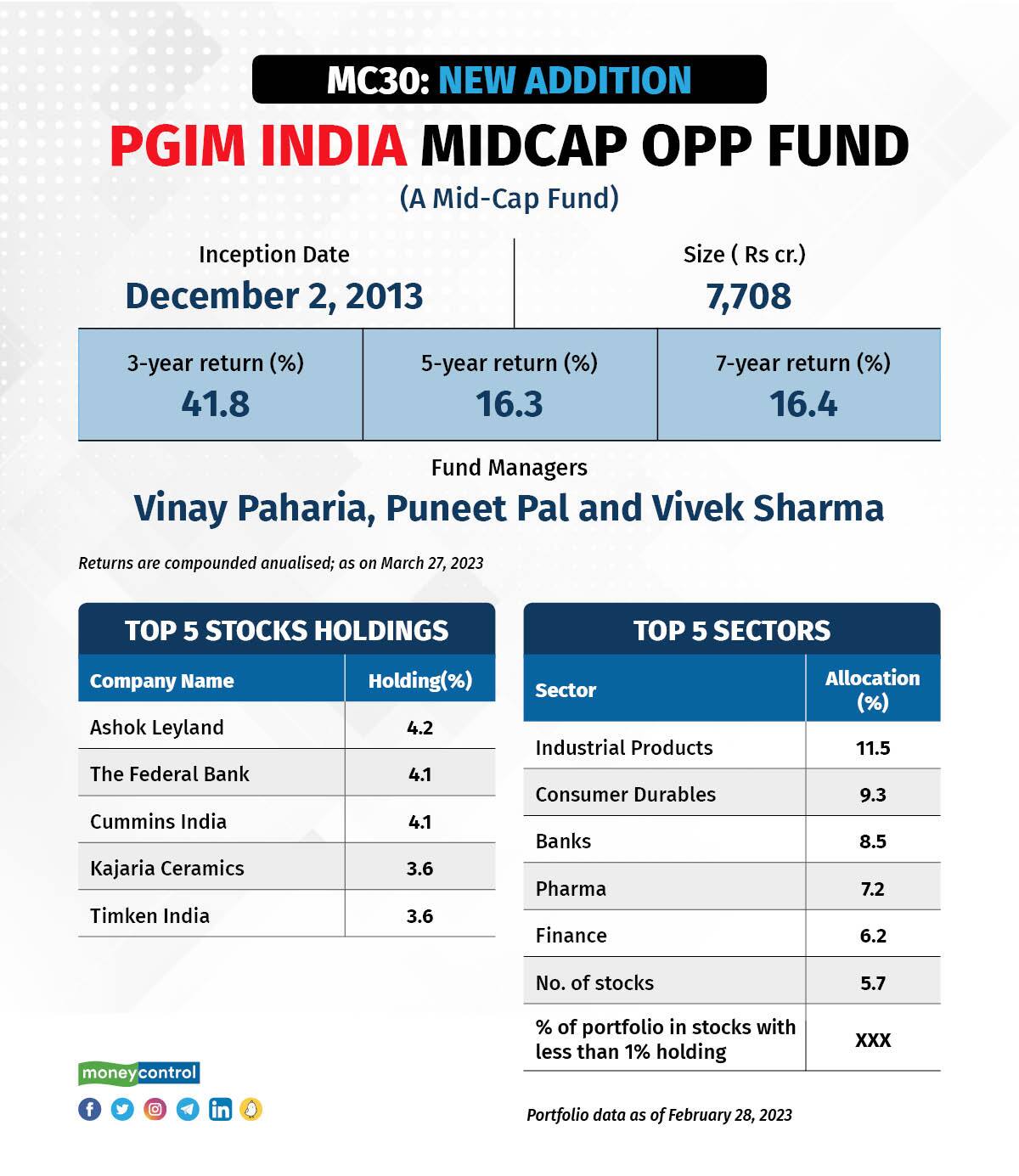

PGIM India Midcap Opportunities Fund

PGIM India Midcap Opportunities Fund (PMF) is one of the three new entrants in the MC30 in the midcap category. Launched in December 2013, PMF has managed to deliver better risk-adjusted returns over the long run. It has been jointly managed by Vinay Paharia, Puneet Pal and Vivek Sharma. Aniruddha Naha, who managed the scheme since 2018 moved to the alternate business of the AMC recently. Paharia holds a strong track record of managing better performing equity schemes in his earlier stint with Union mutual fund.

Fund managers tried to curtail the risk of this high-risk, high-return equity fund by selecting “good businesses” with strong cash flows and clean balance sheets. About 65 percent of the assets were invested in 30 stocks that were chosen from the AMFI-defined midcap stocks. The remaining assets were allocated to large and smallcap stocks. Its smallcap holdings are mostly kept for the long term. Over the last three years, its average allocation to smallcap stocks was 20 percent.

PMF underperformed the category over the last one year mainly due to its relatively underweight position in PSUs and an overweight position in consumer discretionary.

Fund managers are positive on some of the sectors including capital goods, industrials and financials.

With about Rs 8,000 crore in assets under management (AUM), PMF is positioned to capture the market dynamics very well. It was one of the top three schemes that had a higher turnover ratio (average of 130 percent) over the last three years.

Also read: How to use MC30?

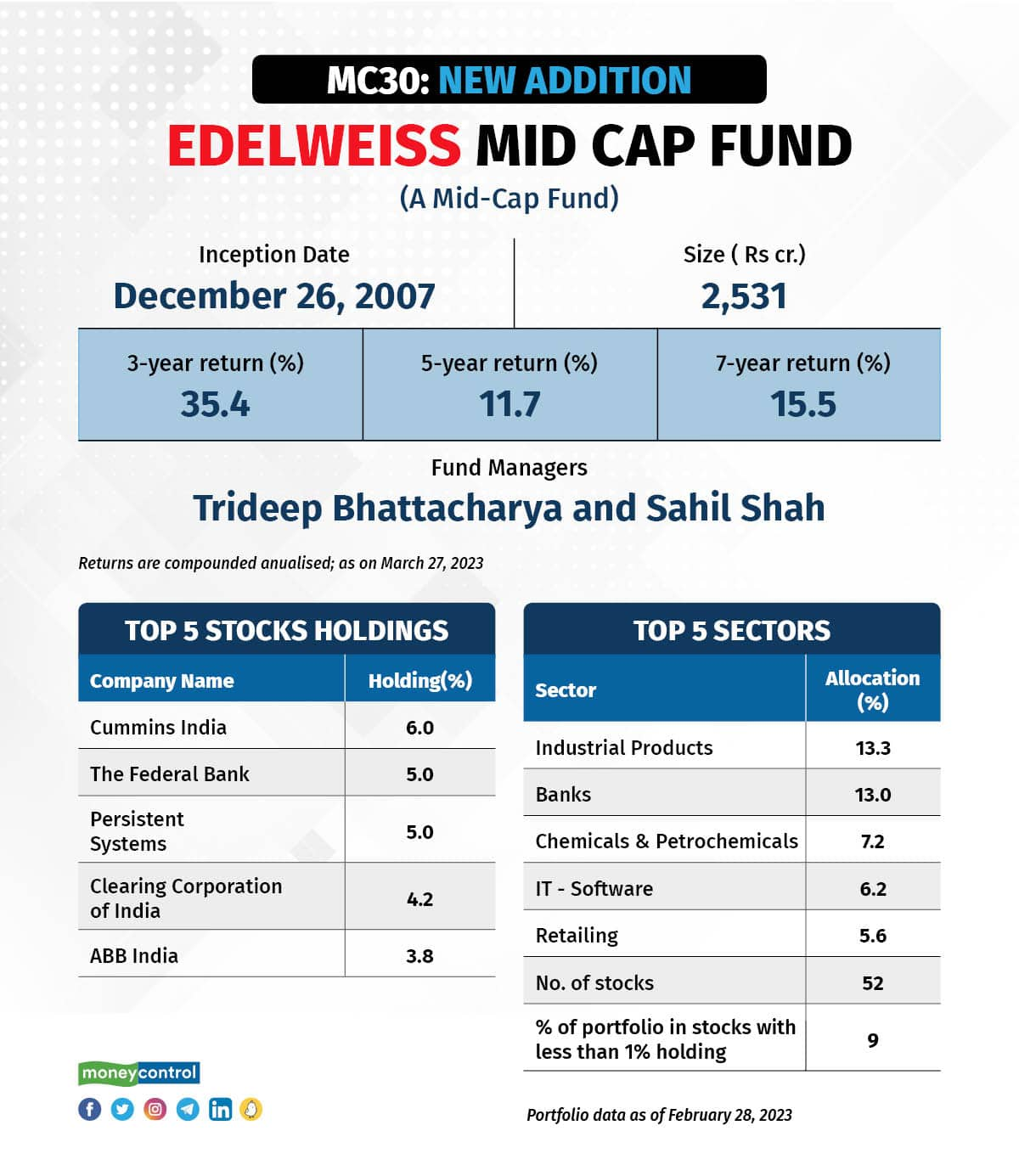

Edelweiss Mid Cap Fund

Edelweiss Midcap Fund (EMF) is jointly managed by Trideep Bhattacharya and Sahil H Shah. EMF’s AUM is Rs 2,534 crore. Bhattacharya tells us that EMF invests in quality businesses having profitable products and services and run by good managements. It follows a blend of both growth and value investment styles.

“We manage EMF as a true midcap fund and we do not want to hide behind the largecaps,” says Bhattacharya. Over the last three years, EMF allocated just an average of seven percent to largecap stocks. “We invest in largecaps only in those areas where we do not find good alternatives in the mid and smallcap space,” adds Bhattacharya.

Bhattacharya doesn’t like taking cash calls; usually restricts cash holdings to under 5 percent of the portfolio’s corpus. “We don’t take very lopsided sectoral calls. Our allocation to the sector is less than or equal to benchmark +/- 5 percent,” he adds. The fund does not track the macroeconomic indicators when it comes to picking stocks. In other words, the scheme follows a bottom-up stock-picking strategy.

EMF has been consistent in delivering above-average returns across market cycles. Typically, it has appeared in the first two quartiles within the category in most timeframes.

Some stocks that rewarded the schemes well in the last 2 years include Solar Industries India (200 percent), Mold-Tek Packaging (144 percent) and Bharat Electronics (107 percent).

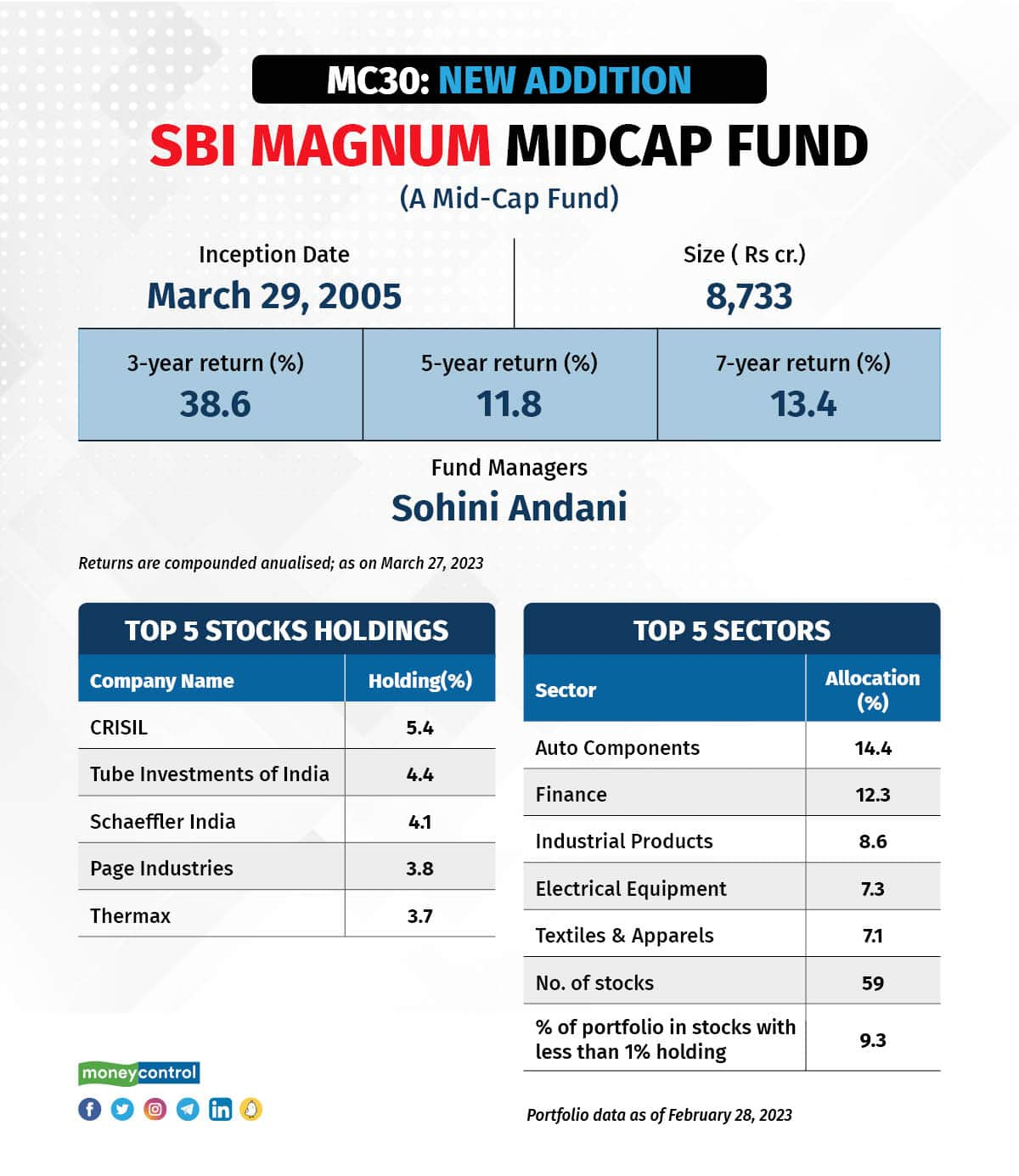

SBI Magnum Midcap Fund

SBI Magnum Midcap Fund (SMMF) has managed to deliver a compounded annual return of 16 percent since its launch in March 2005. Sohini Andani has been managing the scheme for more than a decade since July 2010.

“Our stock selection is based on a bottom-up approach and holding them for the long term,” says Andani. She looks for companies that have a long runway of growth, good management track record, less capital-heavy companies and higher promoter ownership. She avoids companies that often raise funds from the capital market for growth. She follows a blend of growth and value style of stock-picking.

SMMF has been managed as a mid and smallcap-heavy portfolio. It is one of the two schemes in the category with a larger allocation to smallcap stocks. Over the last five years, its average allocation to smallcap stocks was 26 percent. Its largecap allocation has been minimal, so to that extent, the fund is more true-to-label than some of its peers.

Some sectoral allocations worked well for the scheme including consumer discretionary, industrial, auto and auto ancillary.

It is almost fully invested as its average cash level was at 4 percent over the last three years.

With about Rs 8,733 crore AUM, this mid-sized fund is well-positioned to capture the market dynamics very well. However, the fund's ‘buy and hold’ investment approach has made it a solid long-term wealth creator.

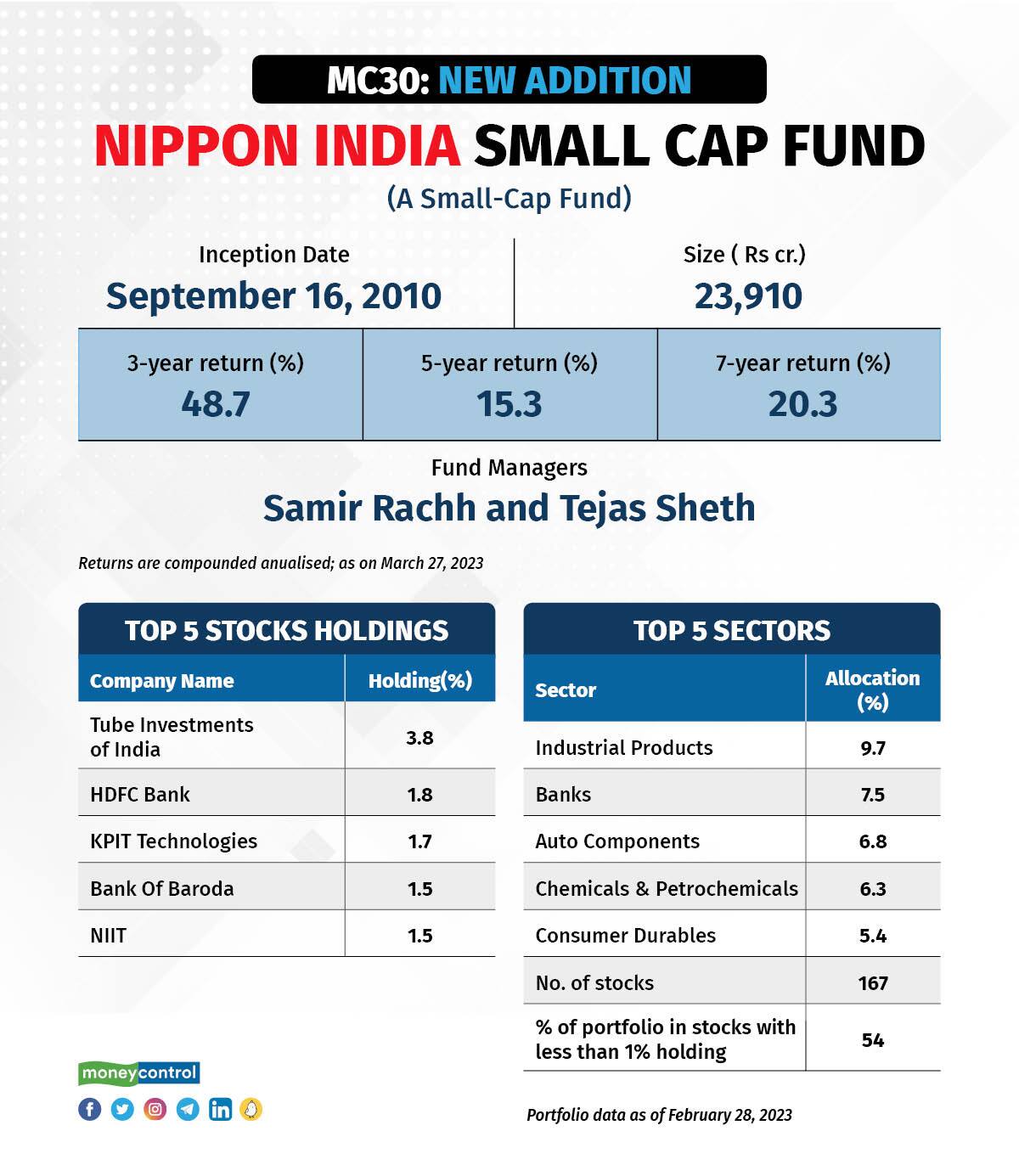

Nippon India Small Cap Fund

Despite a gigantic corpus (for a smallcap fund, by our standards) at Rs 23,910 crore, Nippon India Small Cap Fund (NSF) makes an entry into MC30. The scheme is one of the largest smallcap schemes. This might pose a bit of a challenge if the scheme is outstretched on low liquidity days. But here’s why we feel it is a good pick.

NSF has consistently beaten the category average and its own benchmark index. The fund does well on a rolling-return basis as well.

It has a very well-diversified investor base of about 1.8 million (of which 90 percent are retail investors).

Samir Rachh, who has been managing this fund since January 2017 along with Tejas Sheth, has taken precautions to limit the scheme’s risk.

The scheme is diversified, in proportion to its large size. As of February 2023, it held 171 equity stocks, of which 135 are smallcap stocks. “In the small-cap space, diversified investment strategy works well to our advantage because it gives you the ability to hold stock for a longer period of time. The risk of running a too-diversified strategy is that there are chances that it will become a very ordinary portfolio and alpha generation will become difficult. The key to generating alpha is how you are able to continuously bring winners into the top 25 stocks,” says Rachh.

As per the latest data, about 36 percent of the assets were invested in the top 25 stock holdings.

Though the scheme has done well in the past with a larger asset base, its rising asset base has some drawbacks. Rachh explains, “Major challenges in the smallcap category is the liquidity tends to be poor and impact costs are higher. You cannot churn the portfolio as other equity categories do. The best way to do in the smallcap space is long-term investing and diversification. Since we want to associate with a company for a long term, we put a lot of focus on the quality of promoters and good businesses. Entering at the right price also matters.”

NSF also invests 10-12 percent in largecap companies, not only for liquidity purposes but also for taking exposure to some sectors that are not available in the smallcap space. It keeps 18-20 percent in the midcap space.

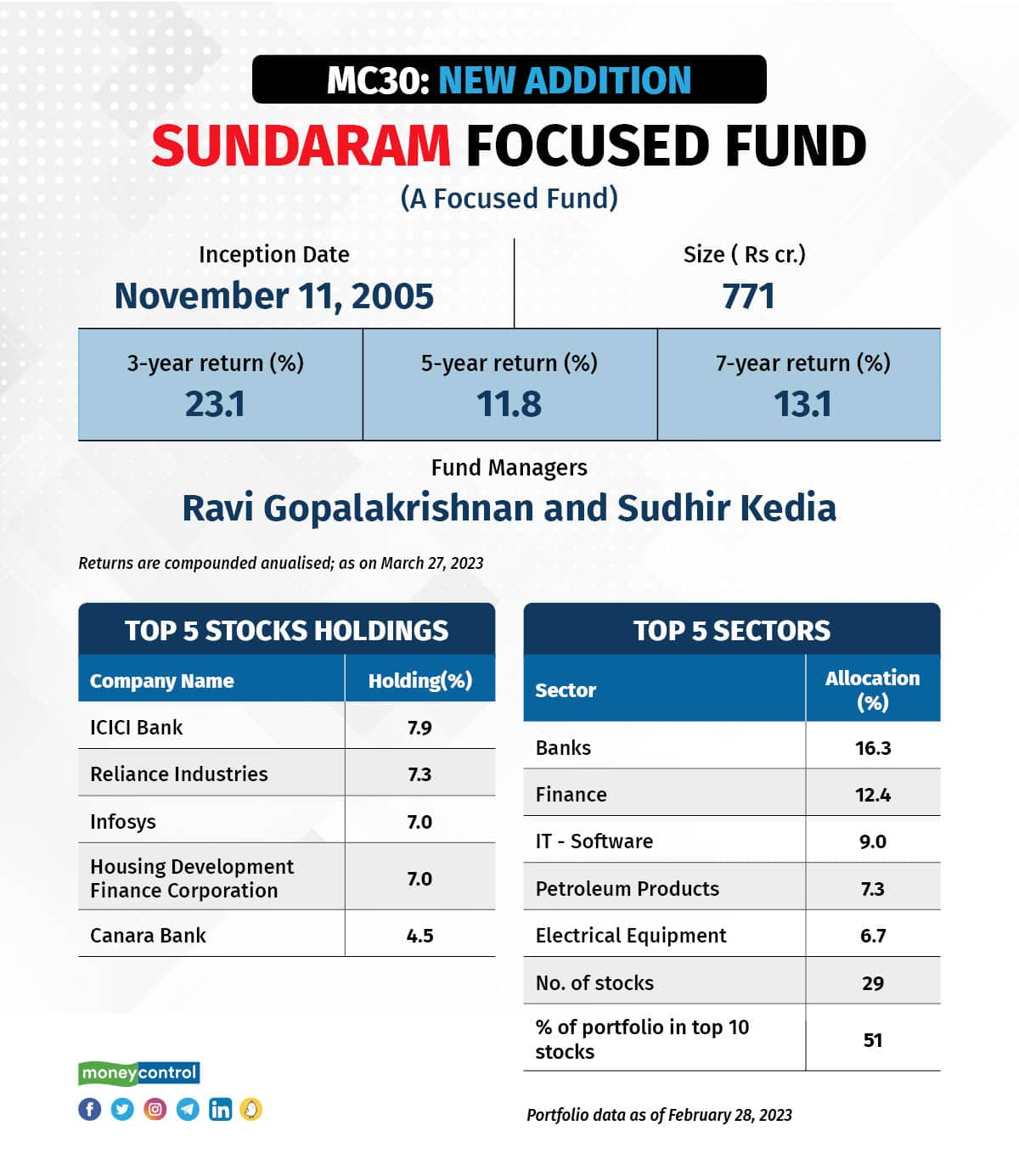

Sundaram Focused Fund

Being a focused fund, Sundaram Focused Fund (SFF) can hold up to 30 stocks in its portfolio. It follows a flexi-cap approach of investing across large, mid and small-sized companies. But it is largely tilted towards largecap stocks (at least 50 percent of the portfolio at any time) for mitigating risk.

Ravi Gopalakrishnan and Sudhir Kedia are in charge of this scheme.

“SFF is managed with high conviction quality ideas; more of ‘buy and hold’ strategy,” says Gopalakrishnan. This has reflected in the performance too. Interestingly, at any time in the past, SFF has been a relatively average performer in the short term but one of the best in the long term.

A few stocks that multiplied its wealth over the long term include ICICI Bank, Reliance Industries, Infosys and HDFC Ltd.

Over the last three years, it has increased exposure to smallcaps while pruning its largecap holding. Its cash level has also been increased to 10 percent level giving rope to tap newer opportunities.