Enact Holdings: Undervalued With Expansion Potential

Summary

- The PMI sector has risen to prominence, solidifying the bedrock upon which mortgage lending operates in the contemporary epoch of the American housing market.

- Enact Holdings is a leading presence in the American private mortgage insurance (PMI) market, specializing in residential mortgage guaranty insurance for prime-based, individual underwritten loans.

- Enact Holdings boasted an impressive $242 billion in insurance in force, buttressed by a pristine balance sheet and a book value of equity totaling $4.1 billion, and tactfully incorporated reinsurance.

Thomas Barwick

Thesis

In the contemporary epoch of the American housing market, the private mortgage insurance, or PMI sector, has risen to prominence, solidifying the bedrock upon which mortgage lending operates. Enact Holdings, Inc., an eminent figure in this sphere, has delivered robust financial outcomes and exhibited adept risk management. Nevertheless, as we navigate the capricious economic terrain of 2023, characterized by mounting interest rates, doubts have been cast over the horizon for Enact and its fellow mortgage insurance underwriters. This analysis endeavors to scrutinize the fiscal performance of Enact Holdings, Inc., weighing both the Bull and Bear scenarios to furnish a nuanced understanding of the company's present position, potential trajectory, and peer comparison amid the ebb and flow of the economic tides.

Brief Company Overview

As a leading presence in the American private mortgage insurance market, Enact Holdings, Inc. (NASDAQ:ACT) specializes primarily in authoring and assuming residential mortgage guaranty insurance for prime-based, individual underwritten loans. Initially founded as Genworth Mortgage Holdings, Inc., the company underwent a strategic transformation in May 2021, embracing its contemporary identity as Enact Holdings, Inc. With a storied past that can be traced back to its establishment in 1981, the firm's headquarters are nestled in Raleigh, North Carolina.

So in the realm of private mortgage insurance (PMI), a business centered on shielding mortgage lenders from the perils of default, the prevailing mechanism entails mandating those with relatively diminished equity in their properties to contribute a premium. This fee is customarily incorporated within monthly mortgage repayments. Once homeowners attain adequate equity, typically around 20%, the insurance prerequisite can be dispensed with. Alas, the repercussions of escalating interest rates have rendered the 2023 prognosis for the mortgage sector rather arduous, as the projected sales appear to be inferior to those of 2022.

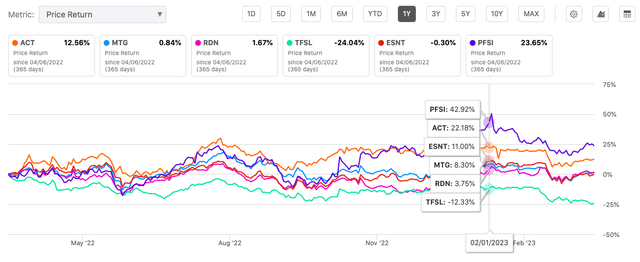

Within the United States, the PMI landscape is dominated by a select few underwriters of significance, among them Enact Holdings. And in terms of price returns for shareholders in the past year, the company trails behind in second place after PFSI.

As the curtain fell on Q3 2022, Enact Holdings boasted an impressive $242 billion in insurance in force, buttressed by a pristine balance sheet and a book value of equity totaling $4.1 billion. Furthermore, the firm has tactfully incorporated reinsurance into its policy portfolio, thereby fortifying its position in anticipation of any potential downturn in the housing market in 2023.

Enact Holdings Bear Case:

- Diluted EPS decreased in Q4 2022 compared to both Q4 2021 and Q3 2022.

- New insurance written (NIW) decreased 32% YoY and 4% sequentially, excluding a one-time transaction.

- Base premium rate declined by 2.4 basis points YoY.

- Net premiums earned decreased 1% sequentially and 2% YoY.

- Operating expenses in Q4 2022 increased compared to Q3 2022 and Q4 2021, with a higher expense ratio.

- Loss ratio for Q4 2022 was higher compared to the same period in 2021.

- New delinquencies increased sequentially by 1,200.

I think it's vital to initially recognize the robust GAAP net income and adjusted operating income results disclosed by Enact Holdings for the year; nevertheless, the 4% sequential and 32% year-on-year contraction in new insurance written (NIW), prompted by the recent surge in interest rates, could cast a shadow on Enact's prospects for future expansion.

Furthermore, I believe that the erosion in net premiums earned and base premium rate merits closer scrutiny. Although Enact has withheld its base premium rate forecast for 2023, the anticipated change, reportedly less than the 2.4 basis point decline in 2022, does admittedly offer a glimmer of hope. However, I think it's crucial to bear in mind that base premium rate fluctuations hinge on numerous factors and are inherently challenging to predict with accuracy, particularly in this economic climate.

So, while Enact's unrelenting dedication to operational efficiency and cost-cutting is laudable, paving the way for a targeted $225 million in 2023 operating expenses, a 6% annual reduction from the previous year, it is, however, worth highlighting that the company's fourth-quarter expenses exceeded those of the preceding quarter and the analogous period in the prior year, potentially ascribable to the restructuring expenses arising from a voluntary separation scheme.

Moreover, Enact's quarterly loss ratio of 8% was spurred by better-than-anticipated peer performance on 2021 and earlier delinquencies, leading to a $63 million reserve release. This positive outcome was partially offset by $21 million in reserve reinforcement on 2022 delinquencies and incurred but not reported reserves. And despite Enact's robust credit performance, potential hazards stem from the sizable new books maturing through their customary loss development pattern, which might, in my opinion, precipitate a surge in new delinquencies in 2023.

Enact Holdings Bull Case:

- Solid annual performance: GAAP net income increased to $704 million in 2022 from $547 million in 2021, while adjusted operating income grew to $708 million from $551 million.

- Insurance-in-Force increased 10% YoY to a record $248 billion.

- Rising interest rates positively impact investment income, which grew 27% YoY in Q4 2022 and 10% YoY for the full year.

- New money yield for the quarter increased to above 6%.

- Delinquency rate stabilizing near pre-pandemic levels at 2% (excluding delinquencies from natural disasters).

- Strong PMIERs sufficiency at 165% and potential elimination of GSE restrictions, providing greater financial flexibility.

- Return of over $250 million of capital to shareholders in 2022, including special cash dividend and share repurchase program.

The quarterly GAAP net income of the company was reported to be $144 million, which translates to an impressive per diluted share figure of $0.88 - though slightly lower than that of last year's Q2 at $0.94. But when looking at the annual report, a much more encouraging picture is painted with their GAAP net income reaching an incredible total of over 700 million dollars compared to the previous year's 547 million.

Enact's persistency rates, an often-overlooked but crucial indicator, have shown an encouraging trend, peaking at 86% in the fourth quarter compared to 69% in the same quarter of 2021. And with interest rates anticipated to remain elevated in the short term, persistency is expected to stay strong, boding well for the future profitability of the company's in-force insurance portfolio. The record-setting insurance-in-force at $248 billion, driven by new insurance written and increased persistency, is another feather in the cap that highlights the firm's progress and potential.

I also think it's important to note that the investment portfolio benefited significantly from the recent rise in interest rates, as the new money yield for the quarter exceeded 6%. The reduction of unrealized losses in the portfolio by $56 million to $487 million by the year-end reflects a very welcome and prudent approach to risk management. From my view, the company's stance on not realizing these losses unless opportunities arise to generate long-term value within the portfolio seems reasonable and strategically sound.

Moreover, the pricing environment has remained constructive, with industry pricing experiencing an upswing during the quarter. Enact Holdings, Inc.'s implementation of multiple price increases on new business, and continuing these actions into the first quarter, looks to be a sign of a company that understands the market dynamics and seizes opportunities to enhance shareholder value. This optimism, in my opinion, bodes well for its ability to consistently write new insurance that yields appealing risk-adjusted returns.

Finally, the company's credit risk transfer strategy has borne fruit, as evidenced by the successful execution of three excess-of-loss reinsurance transactions. I think that this showcases the firm's ability to secure cost-effective PMIERs capital and loss protection in a period of market volatility and widening spreads. The PMIERs sufficiency of 165% and the fact that nearly 89% of its risk in-force is covered by its credit risk transfer program underscore the company's ability in managing credit risk.

Takeaway

The Bearish viewpoint underscores potential difficulties for Enact Holdings, manifested in the decline of new insurance written, dwindling net premiums earned, and an elevated expense ratio in the fourth quarter of 2022, as contrasted with both the preceding quarter and the same period in the prior year. On the other hand, the Bullish scenario accentuates the robust annual performance, encapsulating a historical peak in insurance-in-force, burgeoning investment income, stabilizing delinquency rates, and a sturdy balance sheet.

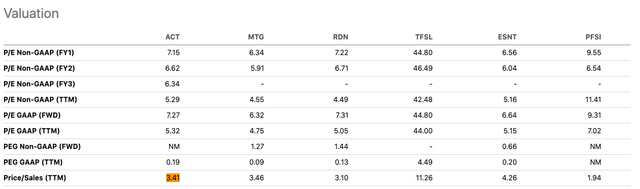

And finally, it is worth noting that Enact appears to be undervalued when compared to its industry counterparts. The company's forward P/E ratio stands at a modest 7.15 (excluding TFSL), below the median for its peer group, and its Price/Sales ratio of 3.41 similarly falls just under the 3.10 to 4.26 median range.

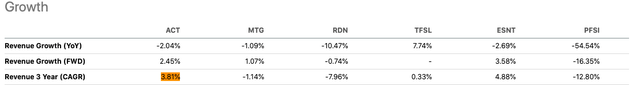

Examining the firm's growth prospects reveals a rather lackluster picture, though not entirely out of step with the sector. Enact's revenue growth rate slipped by 2.04% year-over-year, while the 3-year CAGR clocks in at 3.81%.

These figures, while not particularly awe-inspiring, remain within the bounds of its peers' performance.

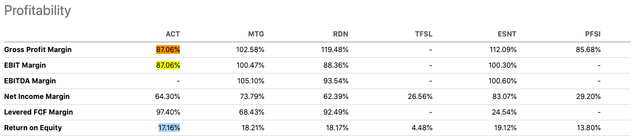

Turning to profitability ratios, we see Enact's gross profit margin at a respectable 87.06% and its return on equity at 17.16%.

While these numbers might not surpass those of some competitors, they still maintain a reasonably high position, further reinforcing the notion that Enact Holdings is an undervalued player in its field and therefore rated a "buy" with a mild scope for expansion.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ACT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.