AvalonBay: Wait For A Better Entry Point

Summary

- AVB is a blue-chip REIT with a proven track record. However, the tide is turning for the Multifamily sector and REITs in general.

- There is limited potential for internal growth.

- NAV scenario analysis provided here helps with risk management.

AndreyPopov/iStock via Getty Images

Investment Thesis

As many articles on SA have emphasized, AvalonBay (NYSE:AVB) is a Blue-chip REIT with specific qualities that differentiates it from most other REITs. These strengths include a robust balance sheet, extensive regional market knowledge/connections, and a proven track record of deploying capital effectively to create value for shareholders. But even the best of the best REITs are subject to ups and downs of their sector's cycle. Hence, a strategic long-term outlook can be enhanced by adopting a tactical approach in the short-term. It is essential to dive deep into Multifamily fundamentals and have a capital market expectation before making the decision. While an overall negative portfolio beta exposure makes sense to me in the current environment, I still believe AVB offers a great idiosyncratic risk/reward and positive beta exposure with a right option strategy and price targets. The article will present net asset valuation of AVB , simple scenario analysis and justification for the assumptions made based on the research on Multifamily fundamentals and the macro environment. At the end, an option strategy is presented to potentially reduce the risk of an investment and also possibly generate some income.

Net Asset Valuation Update and Scenario Analysis

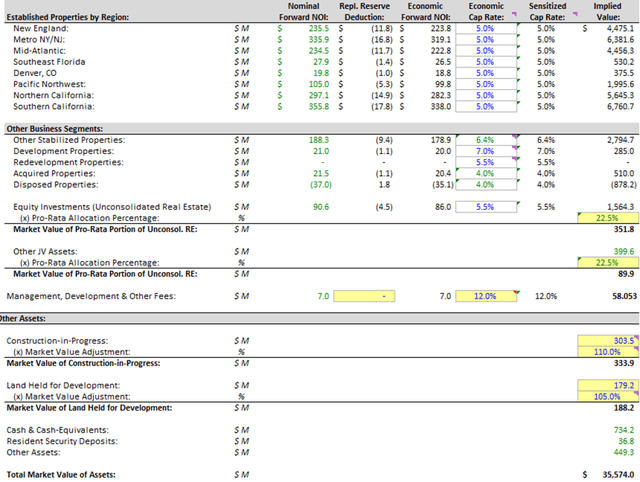

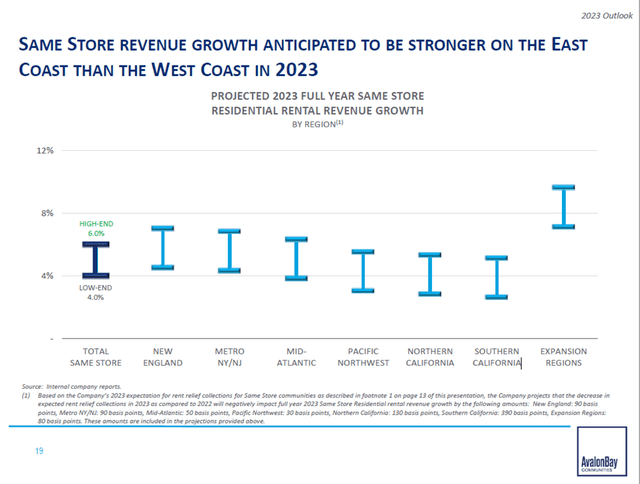

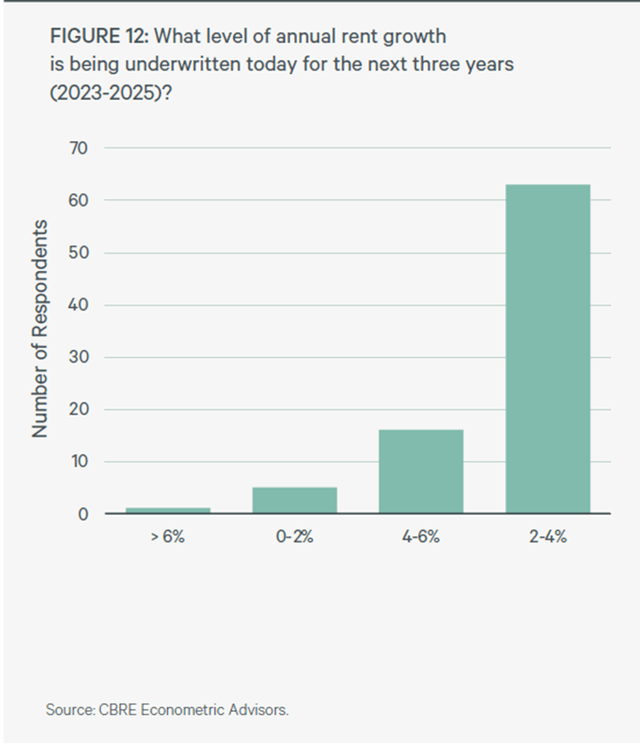

For 2023, simply and conservatively assumed same-store rental revenue growth of 3% in base case, 5% in best case and -10% in worse case for all regions except -5% for New England (based on past recessions). Assumed current NOI margins for base case and -4% decline in worse case. Conservatively, assumed replacement reserve of 5% to calculate the economic NOI. Assumed a cap rate of 5% for all established regions for simplicity but later sensitized as shown below.

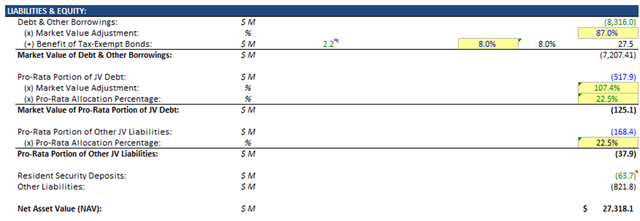

As seen above, 6.4% economic cap rate was assumed for other stabilized properties which is again very conservative as it should in reality be more in line with established properties cap rate. Assigned a higher cap of 7% for development properties and 5.5% for redevelopment segment because of lower risk. Adjusted the book value of debt to fair market value close to the number provided on 12/31/22 10-K , when 10-year rate was 3.83%. With 10 year rate being much lower today, FV of debt must be higher than the number provided on 12/31/22. Assuming the book value of debt, NAV per share in base case would be approximately $7 lower.

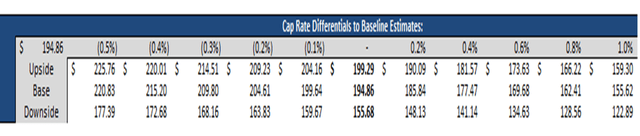

Net asset value per share: NAV / Diluted shares outstanding is at $194.86 in the base case. This signifies AVB trading at a discount and an economic cap rate of 5.8% based on share price of $168.06. The calculated NAV per share is lower than the consensus of $208, primarily because of the conservative assumptions regarding the established properties' cap rate of 5% and next year rental revenue growth of 3%, which contributed to a lower estimate of the property's value. In reality the current weighted average cap rate is lower since most of these properties are Class A. Is the discount to NAV justified? Here is my scenario analysis:

So in a recession(Downside) scenario, if in 2023, cap rates expand by 1% to 6% and rental revenues drop by around 10%( low probability) and NOI margins drop by 4% then NAV would be around $122 as shown below. Even though this scenario is the worse possibility in my opinion, it provides us a number to work with. For the most risk averse investor, $122 a share is a no brainer to go all in. For a more risk tolerant investor $150 is still a great entry point. We all know about garbage in, garbage out so let's justify the assumptions made.

Multifamily Fundamentals and Future Assumptions

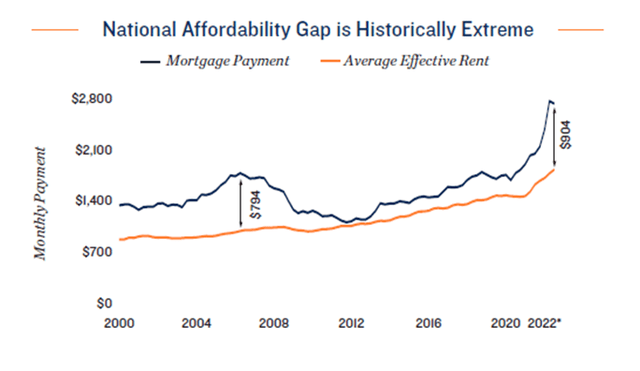

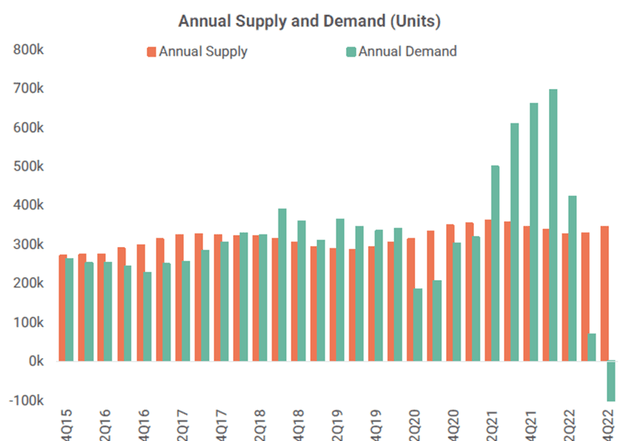

All major Real Estate data sources such as Fannie Mae & Freddie Mac anticipate an oversupplied Multifamily sector this year because of the substantial number of new units projected to enter the market vs. a lower growth of job opportunities. The recent surge in housing supply mainly consists of high-end Class A units, in metros where AVB operates. Furthermore, it seems that rental demand has suffered from the effects of persistent inflation pressures, reduced savings levels among households, and continued expectations of a recession. As a recession has been anticipated, lower-than-average rent growth along with a slightly higher national vacancy rate has been projected. On the positive side though, the high cost to own a single family could help prolong the demand for Multifamily rental.

Historically, based on RCA, rent dropped by as much as 10% in many regions that AVB operates in 2009-2010. And in 2002-2003 recession NOI margin fell by 6% but only by 1%-2% in 2009. Below is AVB’s forecast on rent growth however the national consensus for base case is on average, 3% growth as could been on CBRE report.

Balance Sheet Strength & Flexibility

AVB's excellent compliance with all its debt covenants and its A-rated balance sheet enable it to enjoy significant flexibility and liquidity, resulting in lower financing costs. This strong financial position allows AVB to access capital markets easily and on favorable terms, providing the company with greater financial stability and flexibility to pursue its strategic goals. The company has access to around $2.2 Billion available under its credit facility and may expand it up to $3 Billion. The interest rate applicable to this credit facility is based on SOFR plus a spread. Even though SOFR is currently very high but: 1.There is the possibility of rates cuts in case of a recession 2. This rate could be refinanced with a lower long-term rate. Having access to an ample amount of liquidity is a result of an investment grade balance sheet that not many Apartment REITs possess. With this competitive advantage, AVB would be a winner in terms of acquisition in the event of an economic downturn/recession.

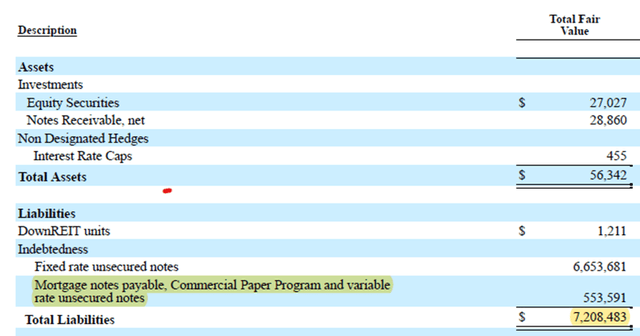

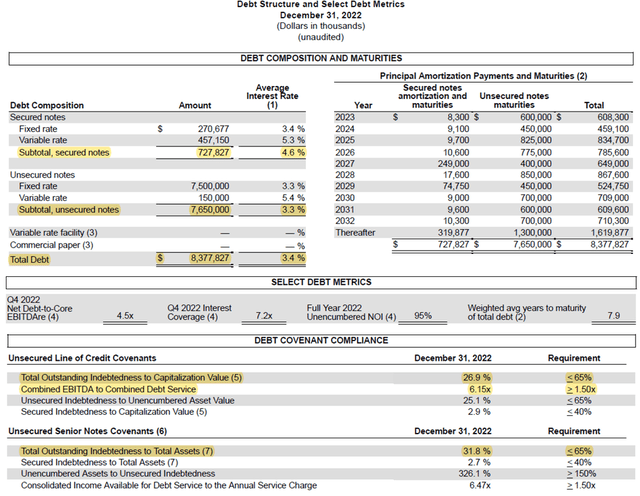

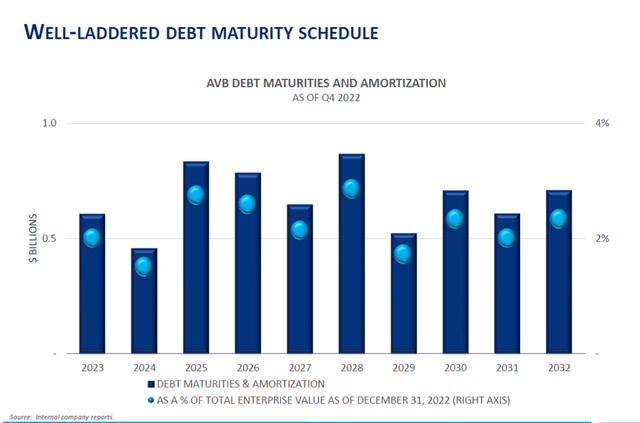

Moreover, AVB’s well laddered debt maturity strategy essentially balances price and reinvestment risk. By staggering its debt maturities over a longer period of time, AVB has reduced the risk of having to refinance a large portion of its debt all at once, which can be challenging if credit markets are restrictive or interest rates have risen significantly. This will ensure AVB has access to capital when needed and avoid a potential liquidity crisis. Additionally, a well-laddered debt maturity schedule boosts it’s credit profile, as lenders view a company with a more balanced and manageable debt maturity schedule as less risky. This lowers borrowing costs and provides greater access to credit over time. Weighted average interest rate for AVB is 3.4% when today’s rates are above 4.5% and going up. Essentially being short the debt, the increase in rates has improved NAV. Debt's fair value based on 12/31/22 10K is $7,208,403 Vs. book value of $8,377,827.

Insignificant variable rate exposure is another positive attribute about this REIT. AVB has only around 7% of its total debt as variable which is also hedged by different derivatives. According to AVB most recent 10K, even if variable interest rate/ SOFR was 100bps higher in 2022, annual interest incurred would have increased by approximately $6,850,000, only a 3% increase to total interest expense.

External Growth

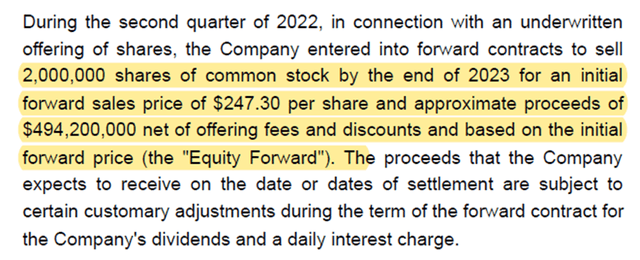

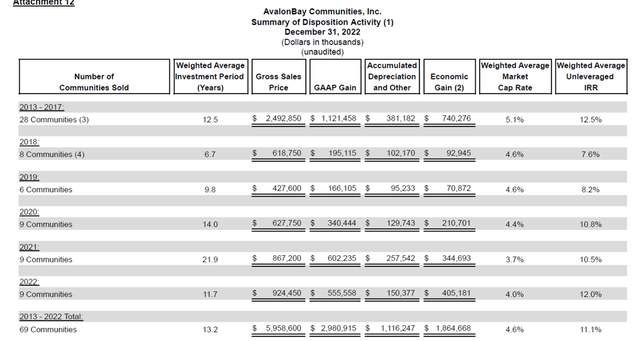

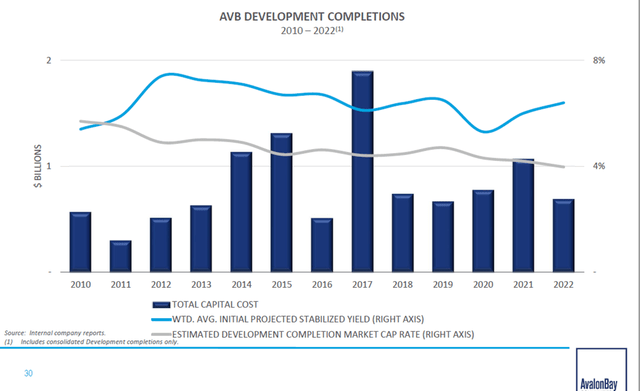

In 2022, AVB entered into a forward contract to issue 2M shares at a price of $247.30 for an approximate proceeds of $494.2M net of fees. Let's assume AVB can find an investment opportunity to deploy the $494.2M for an initial cap rate of 6% which will provide an NOI of $29,644,000 (494.2M *6%). This will increase the current consensus FFO for 2023 to $1.5B from $1.47B. The new FFO per share considering the dilution will be $10.5 ($1.5B FFO/ 142.7M diluted shares outstanding). Nominal cost of equity would be 4.25% ($10.5 FFO per share/$247.3 Sold share price =4.25%). The spread between cap and Nominal cost of equity will contribute to FFO accretion. With a more long-term perspective, value will be created by targeting opportunities with higher IRR vs. WACC. AVB’s WACC is currently around 7% to 7.5% while it's weighted average unlevered IRR has been around 11% as shown below from company’s 8-K (levered IRR being much higher).

AVB Investor Presentation 2022

Risks

1.Internal Growth is Limited in Today’s Environment

It would be much more challenging to grow internally in today’s market as occupancies are already extremely high, rents seem maxed-out as they have been increasing tremendously for the past couple of years, turnover is low as rents are expensive everywhere and inflation has made it hard to cut down costs. However it should be noted AVB could focus on effective capital recycling by selling low growth properties and buying back shares up to $326.148M under its current program if it finds its share price discounted. It could also find higher growth potential properties to redeploy the proceeds. Management was able to dispose of 9 wholly-owned properties at a weighted average cap of 4% in 2022.

2.Commercial Real Estate Sector is At High Risk

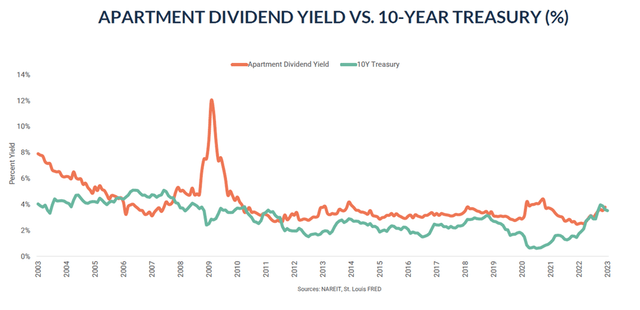

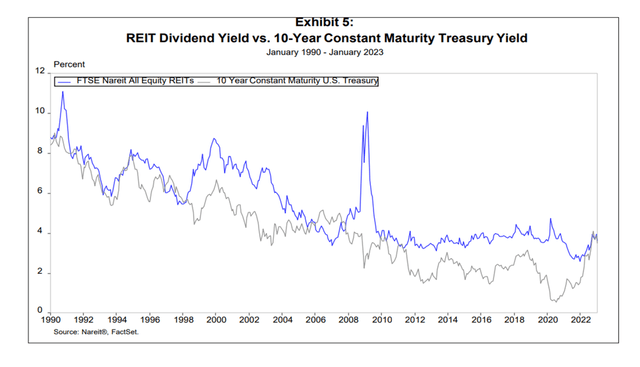

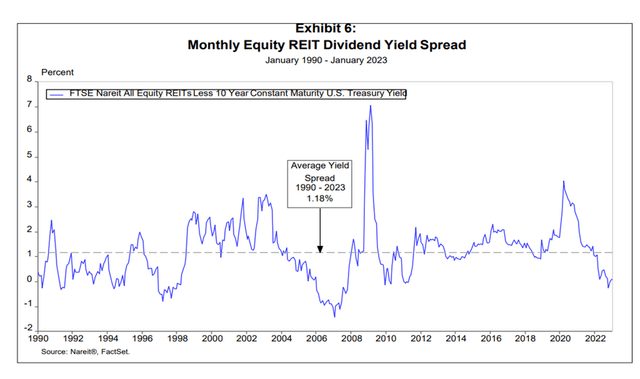

REITs/Real estate sector is overvalued. As shown below, historically REITs have provided dividend yield modestly above the 10 year rate with average yield spread been around 1.18%. Recently, the spread has narrowed significantly for the overall equity REITs as well as the Multifamily sector. Considering how much rents have risen, and occupancies maxed out, there is very limited potential for NOI growth. So, drop in prices and mean reversion makes sense.

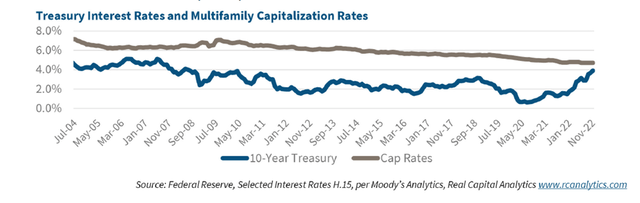

3.Cap Rates Expanding

There is a higher probability of cap rates rising according to the consensus. Cap rate= Required rate of return – NOI growth. NOI growth is going lower for the reasons mentioned above and could even become negative in a downturn. There is also a high probability of required rate going up. Required rate of return( discount rate) consists of the 10-year rate and the risk premium. As 10-year rate goes up, cap rates also expand but in a lag. Bond investors' expectation of a weakened economy and a potential reversal of the Fed's aggressive inflation stance has caused the 10-year Treasury rate to drop back to 3.5% as of today from its peak of 4.25% in the fall. Although lower rates could increase transactions by reducing mortgage costs, if rates fall due to an economic downturn, demand is likely to decrease. Hence, risk premium which closely follows the OAS on 3–5-year B-rated bond will most likely increase as a result of more uncertainty/volatility, less supply of credit/ financing and etc. With apartment mortgage rates surging to 5.5% by December of 2022, many deals with lower cap rates no longer pencil. The data below indicates a significant narrowing of the spread vs. historical which will have to widen and expand cap rates.

Verdict

While the Multifamily sector appears relatively more attractive than other sectors such as retail or office, any weakness in these sectors is likely to have a spill-over effect. In other words, the good and the bad may be indiscriminately impacted. Based on the net asset valuation, $130 is a great entry point even for a risk averse but long-term investor. One way to generate income is to sell puts on AVB at a strike of $130 expiring Dec 2023 when implied volatility picks up and when share price is lower at around $155. Additionally, a riskier strategy would be to sell puts expiring 2 months ahead at $140 or $150 again when implied volatility picks up. However, when selling puts you need to be comfortable owning AVB long-term if it is put to you. Furthermore, you could also buy put spread on iShares U.S. Real Estate ETF (IYR) to hedge the beta risk. For example: buy put at strike of $75 and sell put at strike of $65 expiring 1/19/24.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.