EWZ: Brazilian Currency Strength To Drive A Recovery

Summary

- Over recent months, the Brazilian currency has appreciated while the local stock market has fallen, leaving the iShares MSCI Brazil ETF broadly unchanged.

- Local market weakness has been in part the result of extremely tight monetary policy, which has outweighed the impact of soaring sales, earnings and dividends.

- This currency strength has brought down inflation and should allow the Brazilian central bank to roll back interest rates, triggering a recovery in local stocks and EWZ.

- While any decline in commodity export prices would likely weigh on EWZ, regardless of monetary policy conditions, it would take a significant drop in order to justify the degree of undervaluation we currently see.

da-kuk/E+ via Getty Images

I have been bullish on Brazilian stocks via the iShares MSCI Brazil ETF (NYSEARCA:EWZ) for several years, and while the ETF has paid double-digit annual dividends, its price has stagnated, even as sales, earnings, and dividends have all soared higher. This has created an opportunity to add to long positions as current valuations are unlikely to last long.

In my most recent article on EWZ in February I argued that high real borrowing costs were positive for long-term returns primarily due to the positive impact that they have on the Brazilian real, which is a significant driver of EWZ gains. Since then, we have seen the real appreciate but higher real rates have weighed on the local equity market, sending EWZ lower.

This real strength has anchored inflation, which has begun to fall sharply, giving the Brazilian central bank room to cut rates aggressively over the coming months. We should then finally see the local stock market begin to recover, driving EWZ higher. The main risks comes from weakness in Brazil's commodity export prices, but it would take a commodity price crash to justify such cheap valuations.

The EWZ ETF

EWZ tracks the performance of the MSCI Brazil index and charges an expense fee of 0.57%. The ETF holds 50 companies at present and is heavily weighted towards commodities. The Materials sector accounts for a record 23% of the index, thanks to iron ore giant Vale (VALE), which has an 18% share. The Oil & Gas sector accounts for an additional 17% due to oil major Petrobras (PBR). The ETF currently offers a dividend yield of 13.0%, but this should fall over the coming months back towards the yield on the underlying MSCI Brazil index which is currently 10.3%.

Currency Strength Is Supporting EWZ In The Face Of Local Market Weakness

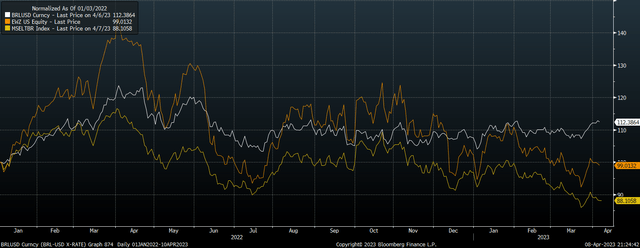

The performance of EWZ is determined just as much by the performance of the Brazilian currency as it is by the local stock market. Over the long term, high levels of inflation have resulted in the local stock market gradually rising and the value of the currency gradually falling against the US dollar. Since the start of 2022, however, and particularly over the past two months, the currency has appreciated while the local stock market has fallen.

BRLUSD, EWZ, and MSCI Brazil Local (Bloomberg)

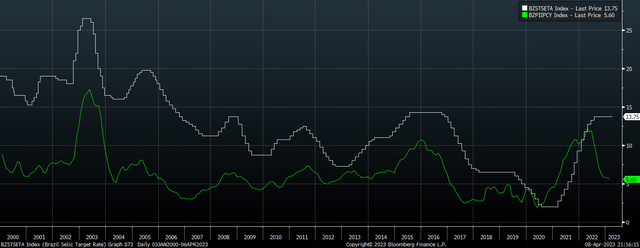

This strength in the Brazilian real and weakness in local stocks is a very rare occurrence. Typically, strength in the real coincides with local equity strength as foreign investment flows and commodity prices are the key drivers of both markets. The past 14 months has reflected the extreme tightening measures by the Banco Central do Brasil which have resulted in the overnight Selic rate rising to 13.75%, which compares with 5.6% trailing CPI and 7.2% 12-month breakeven inflation expectations.

Brazil Overnight Interest Rate Vs Headline CPI (Bloomberg)

Rate Cuts Could Be The Trigger For A Bull Market Reversal

These tight monetary conditions have raised the opportunity cost of owning local stocks relative to cash and bonds, which has outweighed the positive impact of rising sales, earnings, and dividends. This has seen valuations fall to near their lowest valuations on record, creating the ideal conditions for a bullish reversal once monetary easing begins.

The MSCI Brazil now yields 10.3% and trades at a PE ratio of 5.3x. Even if short-term rates remain elevated, current valuations suggest strong long-term returns. For instance, with 10-year inflation expectations at 6.6%, this means that we should see local stocks return almost 17% annually over the next decade if dividends grow merely at the pace of inflation, assuming no change in the dividend yield. However, deeply undervalued markets like this one do not tend to remain that way for long, and any sign of BCB easing could be the trigger for a major rally.

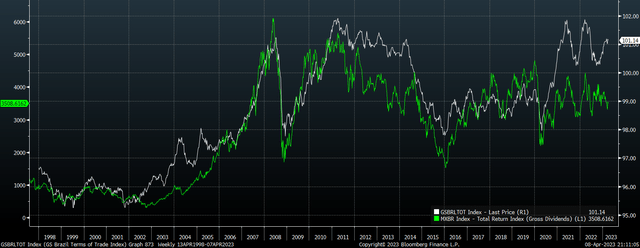

The main risk comes from a downside reversal in iron ore or soybean prices, which would reassert downward pressure on the Brazilian real. There has been an incredibly close correlation between Brazil's terms of trade index and the performance of the MSCI Brazil over the past 25 years, with an r-squared of 0.83. As the chart below shows, the MSCI Brazil has typically been much higher when trade conditions have been similarly favorable. While any decline in commodity export prices would likely weigh on EWZ, regardless of monetary policy conditions, it would take a significant drop in order to justify the degree of undervaluation we currently see.

Brazil Terms Of Trade Index vs EWZ Total Return (Bloomberg, Goldman Sachs)

Summary

Strength in the Brazilian real has allowed EWZ to hold water even as local stocks have moved lower in a stark reversal of the long-term trend. With real interest rates now extremely high, the Brazilian central bank has significant room to cut rates, which may act as a trigger for a recovery in local stocks. Unless we see a dramatic downside reversal in commodity prices, EWZ should rise sharply as this cycle takes place. With a dividend yield of 13% on EWZ, and 10.3% on the MSCI Brazil, this attractive value opportunity is unlikely to last long.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EWZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.