Magellan Midstream: More Future-Proof Than You Think

Summary

- Magellan Midstream is seeing record transportation volumes and plans a tariff increase in July.

- It's more future-proof than some may believe and is returning capital to unitholders via generous distributions and buybacks.

- I also highlight the distribution payout, balance sheet, valuation, and other important points.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

zorazhuang

It pays to have a basket of income-generating stocks from different sectors. That’s why I have a fair amount of allocation to energy midstream companies that get recurring fee income as a portfolio diversifier.

This brings me to Magellan Midstream Partners (NYSE:MMP) (issues schedule K-1), which has done well since my last bullish take in December of last year here, giving investors an 8.3% total return that far surpassed the 2.7% rise in the S&P 500 (SPY) over the same timeframe. This article highlights recent developments and provides an updated valuation on this high yielding MLP.

Why MMP?

Magellan Midstream Partners provides mission critical refined products and crude oil pipelines and storage assets across the central region of the U.S. This system covers 9,800 miles and has access to an impressive 50% of the country’s refining capacity, with ability to store over 100 million barrels of petroleum products.

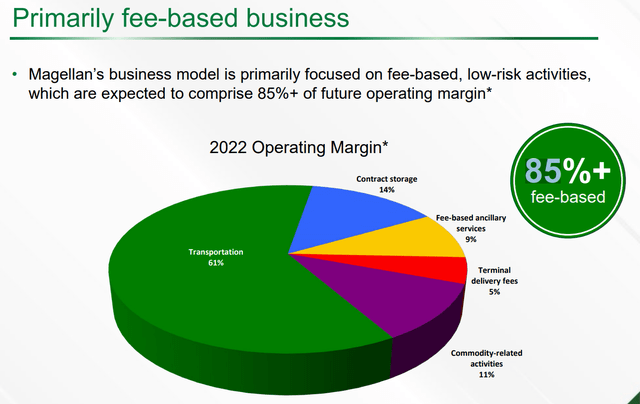

What sets MMP apart from a traditional E&P (exploration and production) energy companies is its recurring revenue model, which makes it less susceptible to commodity price swings. This is one of the reasons for why MMP has been able to raise its unitholder distributions for 21 straight years. As shown below, 85% of MMP’s operating margin is fee based, comprising of transportation, contract storage, and fee-based ancillary services.

Make no mistake, however, as MMP isn’t just a slow growth midstream provider. This is reflected by MMP’s ability to quickly react to inflation by raising prices. During 2022, MMP raised its tariffs related to Producer Price Index and market factors by 6% and its 2023 guidance assumes an 8% average tariff increase on July 1st.

This, combined with record quarterly transportation volumes during Q4 drove 2022 distributable cash flow per unit higher by 6% to $5.46. This equates to a 77% payout ratio and sits under management’s target payout percentage of 80%. As such, I would expect to see a distribution hike this year and continued unit buybacks as management does not see a material need to plow capital into growth projects. Last year, MMP spent $472 million on unit buybacks alone.

Of course, risks to MMP include the transition to electric vehicles, which obviously has no need for gasoline. However, the transition may be lower than what some may assume, considering MMP’s asset base in the Central U.S., which has adopted EVs at a slower pace than the Coastal regions.

Moreover, studies have shown the environmental degradation that comes with mining for battery materials. Plus, a report by the Institute For Energy Research released last week indicated that expensive electricity rates and lack of charging infrastructure is becoming a headache for EV owners, especially considering that not all homes have personal charging (think apartments and condominiums). An increase in EV charging could only exacerbate electricity rates and reduce the monthly cost competitiveness of owning an EV vehicle compared to an ICE vehicle.

Meanwhile, MMP appears to be well-positioned for the current higher interest environment with a BBB+ credit rating, as that should help it to secure lower rates compared to higher leveraged peers on debt refinancing. It also maintains a very low net debt to EBITDA ratio of 3.2x after the sale of its independent terminals, sitting well below the 4.5x level that most ratings agencies consider to be safe for midstream companies.

MMP also has no debt maturities until 2025, mitigating the near term impact of higher rates. Considering the looming debt ceiling vote in July, the Federal Reserve may eventually come under pressure by the U.S. Government to lower interest rates so that interest expense does not eat more into the Federal budget as well as that of American households.

Admittedly, MMP is no longer the great value that it was the last time I visited the stock in December. However, at the current price of $54.73, it still carries an EV/EBITDA of 13.1, which as shown below, sits below much of its 5-year range outside of the 2020 timeframe.

Sell side analysts who follow the company have an average price target of $57.53. The current 7.7% distribution yield combined with a very modest 2.5% long-term annual operating margin growth, not including the positive impact of unit buybacks, could safely deliver 10%+ long-term annual returns for unitholders.

Investor Takeaway

MMP’s mostly stable fee-based operating margin, defensive positioning in the midstream space, and solid balance sheet make it a compelling long-term investment. Despite the increased per unit price since December, I still see attractive positive long-term returns for investors in MMP due to low leverage, a tariff increase this year, and value creation through unit buybacks. All of these factors make it an attractive pick for those looking for a stable high and growing yield from this moat-worthy midstream partnership.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I'm a U.S. based financial writer with an MBA in Finance. I have over 14 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MMP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.