Trending Topics

State eyes double-digit revenue growth in FY24

Panaji: Chief minister Pramod Sawant remains optimistic that the government’s tax and non-tax revenues will post a double-digit growth in the coming fiscal. The “buoyant revenues” will enable the government to meet its operating and administrative expenses from tax and non-tax earnings of the state, allowing market borrowings to be used for infrastructure and development projects.

While Sawant has projected a revenue surplus of Rs 669.5 crore for 2023-24, the finance department’s data shows that the government used “borrowed funds towards current consumption” in the earlier fiscal years.

“Revenue receipts are expected to be greater than the revenue expenditure in 2023-24, improving significantly from 2022-23,” said the finance department’s medium-term fiscal plan 2023. “This improvement is mainly due to buoyant revenues and rationalization of revenue expenditure. Hence, for FY24, it is projected to meet the entire revenue expenditure out of revenue receipts of the state.”

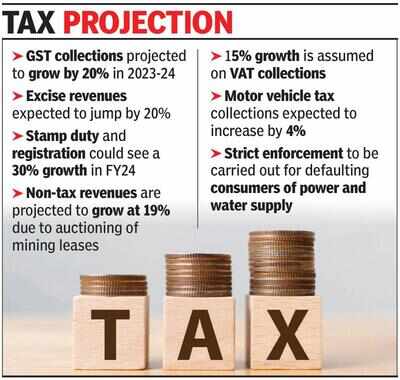

The finance department’s plan hinges on GST collections, motor vehicle tax, iron ore mining, and excise collections to rapidly grow, which will help the government meet its revenue targets.

For example, GST collections are projected to grow by 20% in 2023-24 with revenues from the sale of alcohol expected to jump by a similar figure.

Given the strong demand for real estate in Goa and the introduction of new stamp duty slabs in the future, registration and stamp duty collections could see a 30% growth in FY24, the plan states.

Auctioning of iron ore mining leases could help the government rake in additional non-tax revenue and the finance department expects to record a 19% growth from the sector.

“As the GST, VAT, and excise are showing a better growth rate, it is assumed that the share of own tax revenue will continue to grow in the total tax revenue,” said the fiscal plan. “As mining activities are about to commence and strict enforcement is carried out on defaulting consumers of power and water supply, it is assumed that the share of own non-tax revenue will continue to grow in the total non-tax revenue.”

The plan also says that the strong demand for motor vehicles has increased motor vehicle tax collections.

While Sawant has projected a revenue surplus of Rs 669.5 crore for 2023-24, the finance department’s data shows that the government used “borrowed funds towards current consumption” in the earlier fiscal years.

“Revenue receipts are expected to be greater than the revenue expenditure in 2023-24, improving significantly from 2022-23,” said the finance department’s medium-term fiscal plan 2023. “This improvement is mainly due to buoyant revenues and rationalization of revenue expenditure. Hence, for FY24, it is projected to meet the entire revenue expenditure out of revenue receipts of the state.”

The finance department’s plan hinges on GST collections, motor vehicle tax, iron ore mining, and excise collections to rapidly grow, which will help the government meet its revenue targets.

For example, GST collections are projected to grow by 20% in 2023-24 with revenues from the sale of alcohol expected to jump by a similar figure.

Given the strong demand for real estate in Goa and the introduction of new stamp duty slabs in the future, registration and stamp duty collections could see a 30% growth in FY24, the plan states.

Auctioning of iron ore mining leases could help the government rake in additional non-tax revenue and the finance department expects to record a 19% growth from the sector.

“As the GST, VAT, and excise are showing a better growth rate, it is assumed that the share of own tax revenue will continue to grow in the total tax revenue,” said the fiscal plan. “As mining activities are about to commence and strict enforcement is carried out on defaulting consumers of power and water supply, it is assumed that the share of own non-tax revenue will continue to grow in the total non-tax revenue.”

The plan also says that the strong demand for motor vehicles has increased motor vehicle tax collections.

Start a Conversation

FOLLOW US ON SOCIAL MEDIA

FacebookTwitterInstagramKOO APPYOUTUBE