Preferreds Weekly Review: Are Banks Going To Suspend Preferred Dividends?

Summary

- We take a look at the action in preferreds and baby bonds through the last week of March and highlight some of the key themes we are watching.

- Preferreds had a strong week as bank fears continue to recede.

- Many investors worry that banks may want to suspend their preferred dividends to protect their liquidity position in light of depositor flight.

- We also take a look at the mortgage REIT IVR common share dividend cut and highlight a portfolio rotation.

- I do much more than just articles at Systematic Income: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Darren415

This article was first released to Systematic Income subscribers and free trials on Apr. 3.

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the last week of March.

Be sure to check out our other weekly updates covering the business development company ("BDC") as well as the closed-end fund ("CEF") markets for perspectives across the broader income space.

Market Action

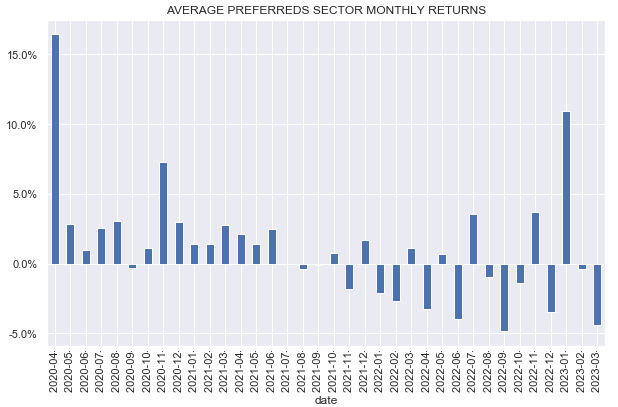

Preferreds had a strong week with a 3% return as risk sentiment bounced back in the wake of no further negative bank news and a potential Fed pivot over the next couple of meetings. Banks enjoyed a 5% bounce which left them flat year-to-date.

Systematic Income

Despite the rally this week, preferreds finished around 5% lower over March. However, the sector is still up around 5% year-to-date due to a very strong January.

Systematic Income

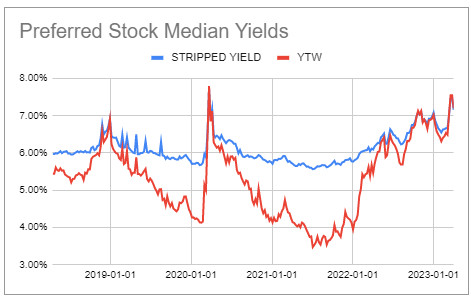

Overall, preferreds yields remain very attractive in our view, though the average yield of the sector is skewed slightly higher by a handful of depressed bank preferreds.

Systematic Income Preferreds Tool

Market Themes

A lot of interesting things are happening in today's markets. One of them is that we appear to be living through another banking crisis. And while the volatility in bank stocks is worrying, the current environment presents a great experiment in one aspect of the preferreds market: cumulative vs. non-cumulative shares.

As many investors know, bank preferreds are issued in a non-cumulative format (with some TruPS exceptions e.g. C-N, NYCB-U) while the rest of the market issues primarily in the cumulative format. The difference is that a non-cumulative stock is not obliged to repay any missed dividends whereas a cumulative one is obliged to do once it returns to paying dividends once again.

There is a general view that banks are very clever to have switched over to non-cumulative dividends as it gives them a free option to stop paying whenever they want. This is a common view and why many investors don’t like to hold bank preferreds. However, it’s important to understand a couple of things. One, issuing non-cumulative over cumulative preferreds is not as obvious a slam dunk for the issuer because, all else equal, non-cumulative preferreds will obviously be more expensive (i.e. carry a higher coupon) because they pose more risk to investors.

Two, banks issue non-cumulative preferreds not because they want to suspend the dividends but because these preferreds count as Tier 1 Capital whereas cumulative ones don’t. Banks can issue equity instead of preferreds to top up their capital, however equity is expensive (banks tend to target double-digit ROE while preferreds have tended to be issued at mid-single-digit coupons for the larger banks). Issuing a lot of equity is also unpopular with existing shareholders, which would get diluted.

Finally, many investors take the view that the bank will just take the money and run i.e. it would be happy to suspend the distribution of their non-cumulative preferreds and stiff investors. However, this is actually not that easy. A bank that suspends preferreds dividends, in effect, signs its death warrant.

Banks rely on the market, depositors and other lenders to function. Suspending a dividend on the preferreds sends a message to everyone that the bank is not a very reliable counterparty or is running out of money and this would precipitate its complete cut-off from the money market as well as a depositor flight (we can quibble about this last point now that uninsured SVB depositors were backstopped).

We can’t think of a bank that suspended its preferreds dividends and then continued to function normally. Silvergate recently suspended its preferreds dividends but it’s liquidating. Fannie Mae and Freddie Mac still have their preferreds dividends suspended, however, they are wards of the state and obviously not normal banks.

A great test case of this is if we see a lengthy suspension of preferreds dividends by banks that, nonetheless, continue to function normally. If this happens it would prove that our view is incorrect.

Market Commentary

Mortgage REIT Invesco Mortgage Capital (IVR) cut its distribution by 40%. IVR is not a mortgage REIT that is often mentioned here. And the reason is that the company continues to go through a shocking amount of book value destruction. For instance, while AGNC had a 5% drop in book value from Dec-19 to Dec-20 (i.e. over the COVID year) IVR had a 76% book value drop. And while AGNC had a 39% drop in book value over Dec20-Dec22 IVR book value fell 67%.

IVR preferreds remain "juicy", trading at elevated yields in the sector. However, this level of risk management makes the company uninvestable at all levels. There have been cases of mREITs which made changes after terrible COVID performance such as with TWO which internalized management and changed its allocation strategy. IVR has not even attempted to do anything to address its performance. Easier to just forget it.

Stance And Takeaways

This week we made a rotation within the mortgage REIT preferred sub-sector in our High Income Portfolio to an Arbor Realty preferred (ABR.PF). ABR has a relatively light capital model and a low dividend payout ratio, both of which allow book value to be very resilient. Although the yield on ABR.PF is on the lower side in the sector sub-10% it will either see a 1-3% jump in yield on its first call date in 2026 or will be redeemed at around a 20% yield-to-call, making it an attractive income choice.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!

This article was written by

At Systematic Income our aim is to build robust Income Portfolios with mid-to-high single digit yields and provide investors with unique Interactive Tools to cut through the wealth of different investment options across BDCs, CEFs, ETFs, mutual funds, preferred stocks and more. Join us on our Marketplace service Systematic Income.

Our background is in research and trading at several bulge-bracket global investment banks along with technical savvy which helps to round out our service.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABR.PF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.