THNQ: Brace For The Next Big Wave Of Artificial Intelligence

Summary

- THNQ invests in companies centered on artificial intelligence development and implementation.

- Artificial intelligence has taken the world by storm, but many are still treading lightly as AI’s capabilities for harm are still up in the air and should not be underestimated.

- Even with risk at hand, treading too lightly could also mean falling behind in the technology race against China, which could force more aggressive AI innovation in the United States.

- I rate THNQ a Buy, as I believe AI development and societal use could become greater priorities in the future, and could generate significant long-term profit with the right regulations in place.

XH4D

As we enter a new dimension of artificial intelligence, AI could soon take on a significant role in society and the workforce after surging in popularity and price not even a year ago. Alternatively, AI could also turn out to be too powerful for its own good, which will likely prompt strict regulations from the government or smaller entities. Either way, I believe AI could invigorate the ongoing technology race between the United States and China, which could ultimately force innovation within the AI market. For these reasons, I rate the ROBO Global Artificial Intelligence ETF (NYSEARCA:THNQ) a Buy.

Many have still been treading lightly with new AI systems, particularly generative AI like ChatGPT. With time I believe that more business owners may make AI a more central part of their operations, as it has already shown to be more efficient than humans in certain respects. Therefore, AI could experience serious growth down the line if more businesses take it upon themselves to aggressively adopt this technology rather than just treating it as a supplementary option or accessory.

Despite the potential valuation and volatility issues indicated by its metrics, THNQ could be a quality investment in the medium-long term. During this time we could see a technology market reversal that may even happen in tandem with another AI explosion. Though it's merely a prospect now, the momentum behind the artificial intelligence rally could push this towards reality sooner rather than later.

ETF Profile

Strategy

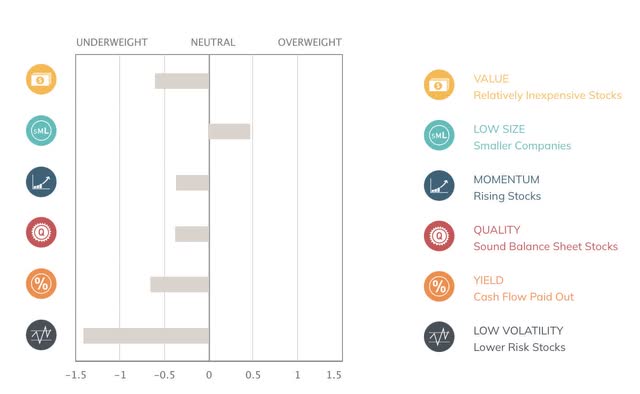

THNQ tracks the ROBO Gbl Artificial Intelligence USD Index and employs a full replication technique. This index aims to track companies that derive a significant amount of revenue from the artificial intelligence market, and are therefore most likely to profit from the industry's expansion. THNQ is slightly overweight towards smaller institutions, giving this ETF somewhat of a small-tilt compared to its benchmark.

Companies held in this ETF are first distinguished based on their focus towards either artificial intelligence infrastructure, or artificial intelligence applications and services. This classification then narrows to identify more specific focuses. Such focuses include but are not limited to semiconductors, big data, and network and security. Eligible stocks within these domains are then assessed on their AI revenue on a scale of 0 to 100, 50 being the minimum requirement before also accounting for liquidity and market cap characteristics. Each stocks' weighting is based on their score. THNQ also holds between 50 and 100 stocks at all times.

Holdings Analysis

This ETF holds most technology companies, with just over a quarter of total holdings identifying as non-technology. The main non-technology sectors within THNQ include consumer cyclical, communication, and healthcare.

THNQ Sector Composition (Seeking Alpha)

This ETF dabbles mainly within United States public equity markets, leaving roughly 15% to non-U.S. locations. These locations are in Europe and East Asia. Therefore, though this ETF is slightly more diverse than U.S. pure-tech funds, its distinguishing factors are not likely to tremendously impact THNQ's overall performance.

The top 10 holdings in this ETF comprise 19% of the entire fund while the top 25 also account for 43%. THNQ consists of 75 holdings, meaning this ETF is not particularly top-heavy. THNQ's individual holdings are also quite dispersed, with not one single company accounting for more than 2% of the entire fund. Therefore, investors are spared of most single-stock risk while also incurring less concentration risk than potential alternatives.

ETF Fundamental Features

Preparing For Launch: A Small-Cap ETF That Tracks A Rapidly Growing Market

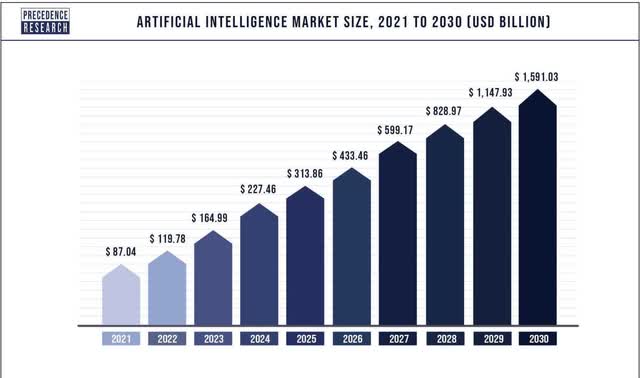

The growth forecasts for the artificial intelligence industry are quite strong. The market for AI could grow to over $1.5T in 2030 at a rate of 38%. Such growth could drive up the price of THNQ and increase investors' returns in the long-term.

AI market growth forecast (Precedence Research)

This ETF's focus on small-cap companies could also serve it well in the long term. Smaller funds could have some advantages over larger counterparts pertaining to lesser valuation issues and more opportunities to capitalize on early growth stages.

Small-cap assets could also have a silver lining during periods of economic recovery. In the event of a market reversal, ETFs like THNQ could be well-positioned for profits as they're yet to exhibit their full potential. Though the prospect of a nearing market reversal is still very much up in the air, investors might want to keep in mind the aptitude of small ETFs during these periods.

This ETF Might Need More Time To Prove Itself

THNQ has fairly high expenses, which could eventually eat into investors returns in the event that this ETF doesn't pick up enough momentum in the coming periods. Furthermore, this might require that investors pay a premium for this ETF which is still quite new and possessing uncertainty.

THNQ also has a limited track record that many could deem too brief to determine whether this ETF might make a good long-term investment. Despite THNQ's low AUM possibly providing exposure to early stages of long-term profit, this aspect also brings its own unique caveats. Small-cap funds tend to have lower liquidity and greater volatility, as they've often had less time to develop a solid grounding and adequate audience of investors. THNQ also appears to underweight low-volatility assets, which might make its strategy more oriented around high risk/reward rather than safety.

Past Performance And Future Implications

THNQ vs. Alternatives: Not Bad For The Smallest Of The Bunch

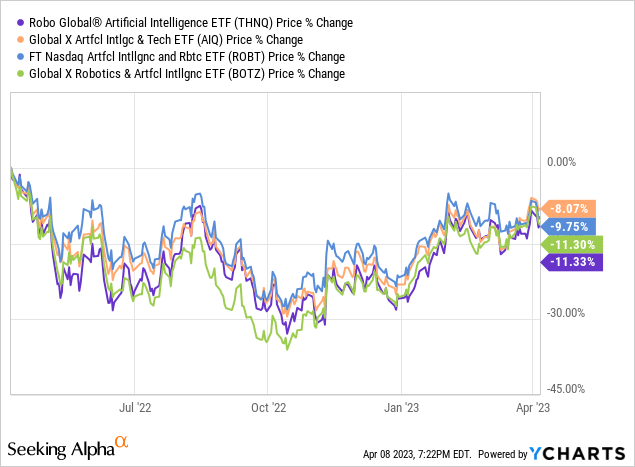

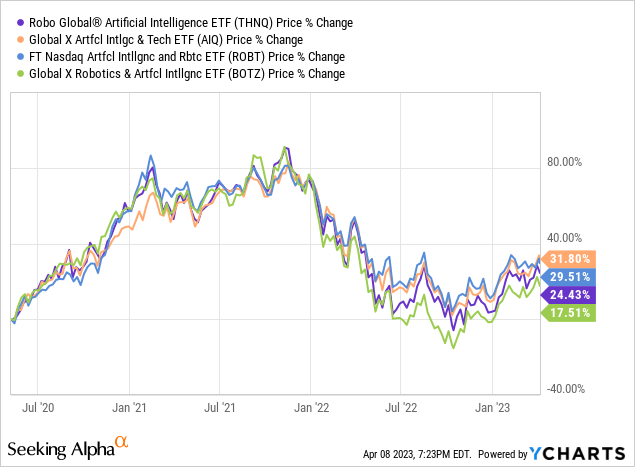

THNQ has slightly underperformed against its peers during the last year. However, the gap isn't tremendous, and this ETF's performance has been close to on-par with its potential alternatives. I have classified THNQ's peers into both ETFs focused on pure-AI as well as those focused on AI and robotics.

The gap between THNQ and its peers is less apparent when looking back three years, as it only widens slightly after the first quarter of 2022.

In the long-term, I could see this ETF performing comparatively to its alternatives for the most part. On this same note, I don't believe this ETF's past performance reflects any major cautionary notes.

THNQ vs. LRNZ: A Mostly Better, Very Similar Alternative

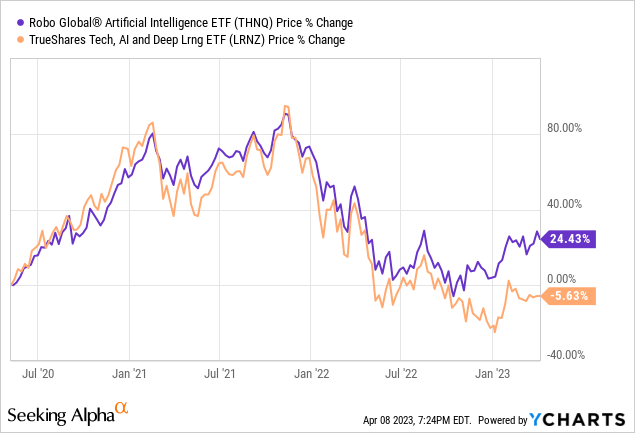

THNQ has also outperformed the TrueShares Technology, AI & Deep Learning ETF (LRNZ) for the better part of three years, which happens to be roughly the same amount of time since these ETFs both emerged. LRNZ is similar to THNQ in many aspects, which is why I chose to include it as a representative peer.

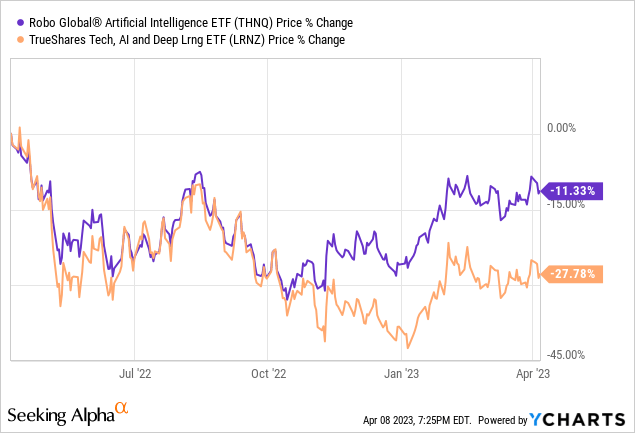

Based on these ETF's performance in the past year, THNQ also appears to have had a less adverse reaction to market downturn during late 2022 compared to LRNZ.

This could potentially indicate a greater resilience to unfavorable market conditions, which may carry THNQ as economic conditions continue to recover and investor sentiment remains mixed.

LRNZ's similarities to THNQ include its pure-AI focus, its overweight in small-cap companies, and its similarly-divided sector composition. However, LRNZ's individual holdings are not as numerous, which likely exposes this ETF to greater single-stock risk. I believe this component could explain its underperformance. On this note, THNQ's equal-weight aspect combined with its greater stock count could positively distinguish it from such alternatives in the future. This could evidently contribute to its outperformance against otherwise similar funds, as more could emerge as AI gains popularity.

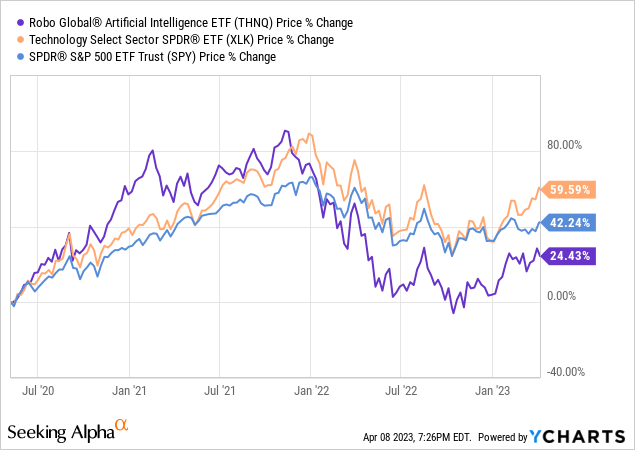

THNQ vs. The Broader Market: This ETF Is Yet To Build Its Inflation Shield

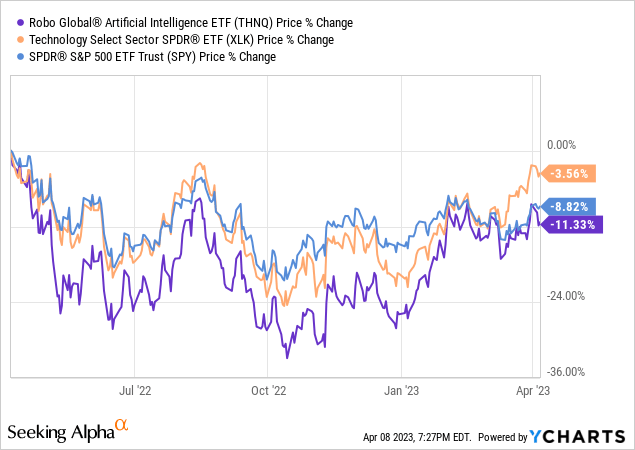

THNQ somewhat consistently outperformed the S&P and the rest of the technology sector for more than a year following its inception. However, the deteriorating economy that first showed signs in early-mid 2022, hit this ETF quite hard.

This ETF has also not surpassed the S&P or the broader technology sector within the past year.

In this regard, THNQ is by no means recession-proof and clearly displays greater price fluctuations compared to larger, more established funds. This is likely attributable to this ETF's small-cap focus. Small-cap companies are relatively volatile as their earnings and performance are often less predictable. Therefore, though THNQ could offer exposure to the early growth stages of AI, the journey to long-term rewards could be quite bumpy and likely to test one's patience.

Price Trend Analysis

Since its most recent rebound during last November, this ETF has seen mostly positive momentum. Following its August to October decline, THNQ broke back above the 50-day moving average the following month. This ETF has stayed above this indicator for the better part of five months now, only briefly dipping below at two instances since.

Since the beginning of this year, THNQ's price trend appears to be quite solid and characterized mainly by upward pressure.

The Future Of THNQ And The AI Market

Unleashing The Beast: Letting AI Roam Freely

Artificial intelligence integrations have already appeared across several non-technology sectors. Some examples include virtual assistants within online shopping sites and AI-based image analysis systems for inspecting large power plants and pipelines. In the future, AI could also take a more significant role in industries like cybersecurity and fintech, which I have mentioned in my previous articles.

Foreign entities like China have already started fully capitalizing on AI, as its proficiency in fields like healthcare are worth noting. For example, AI-based Ping An Good Doctor is a virtual system for traditional healthcare services in China like diagnoses and custom treatments. Ping An Good Doctor was created to combat the healthcare shortage in China, and has gained serious traction just this year.

THNQ does not dabble much in Chinese companies, but developments such as these could inspire United States entities to more aggressively capitalize on artificial intelligence. This is especially salient now as China is a primary competitor in the ongoing technology race with the United States. Tom Davenport, the Author of The AI Advantage, recently claimed that artificial intelligence poses too many profitable opportunities for us not to be going all-in and forming the larger part of our business models around this revolutionary system.

Containing The Beast: Giving AI A Leash And A Shock Collar

The capabilities of artificial intelligence are surely vast, but at what point do we place limitations on this entity which is only getting more powerful? At what point do we shift our minds towards the potential risks on top of the many ways in which AI can benefit us? These questions bring to the light the necessity of AI regulation in the future. This predicament was also the reason for the most recent AI pause, which led many to re-evaluate their stance on the artificial intelligence industry.

Furthermore, the degree of this regulation is likely to also correlate with the profitability and general use of AI. Such regulation could be as tame as lawsuits, and as serious as government regulation like that only put toward nuclear weapons. Heavy scrutiny towards artificial intelligence could impact its accessibility, potential uses, and societal image alike. All of these components alike could inhibit the performance of companies that derive a greater part of their revenue from AI, just like those held in THNQ.

ETF Investment Opinion

I rate THNQ a Buy with a 3-5 year timeframe in mind. The power of artificial intelligence to both benefit society as well as hurt it are still very much under question by developers and investors alike. However, with the appropriate amount of regulation, I believe AI could gain significant momentum in the long-term. Ultimately, this could drive up the price of THNQ and make it a more compelling investment. As it's trending pretty close to its larger peers, I am eager to see how THNQ reacts to both the increasing AI hype as well as economic downturn down the road. For this reason, I plan to follow this ETF closely.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.