Pioneer Natural Resources Is Heavily Undervalued

Summary

- Pioneer Natural Resources has dropped more than 25% from its 52-week highs impacted by fears over oil prices.

- The company has one of the strongest low-cost shale portfolios with a proven execution strategy and ability to generate returns.

- The company's dividend policy + share buybacks will enable strong shareholder returns. The company's low emissions production will continue to be favored.

- The acquisition potential by Exxon Mobil places a floor on the investment and highlights the company's value.

- We're currently running a sale for our private investing group, The Retirement Forum, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

ISAREE K TIMMS/iStock via Getty Images

Pioneer Natural Resources (NYSE:PXD) is a large hydrocarbon and shale driller with an almost $50 billion market capitalization. The company has an impressive portfolio of assets and dividend yield. We expect it'll be able to generate substantial shareholder returns from its unique portfolio of assets. Additionally, a potential acquisition by Exxon Mobil (XOM) could drive strong returns.

Pioneer Natural Resources 2022 Overview

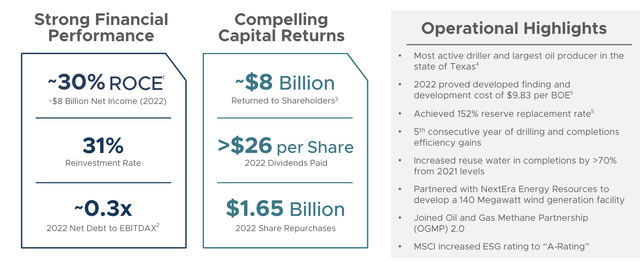

Pioneer Natural Resources had an incredibly strong 2022, supported by strong oil prices and a strong portfolio of assets.

Pioneer Natural Resources Investor Presentation

The company had an incredibly strong 2022, supported by high oil prices. The company was the most active driller and largest oil producer in the state of Texas with finding and development costs incredibly low at <$10 / barrel and a 152% reserve replacement ratio. The company has continued to improve its efficiency versus 2021.

The company returned $8 billion to shareholders with a 13% dividend yield and a net 16% shareholder return. The company repurchased $1.65 billion in share repurchases, which helps to reduce its dividend expenses. With low debt, the company is one of the few crude oil companies that doesn't need to worry about paying off debt versus shareholder returns.

Pioneer Natural Resources Execution Strength

Pioneer Natural Resources has continued to execute with its high-grade portfolio of impressive assets.

Pioneer Natural Resources Investor Presentation

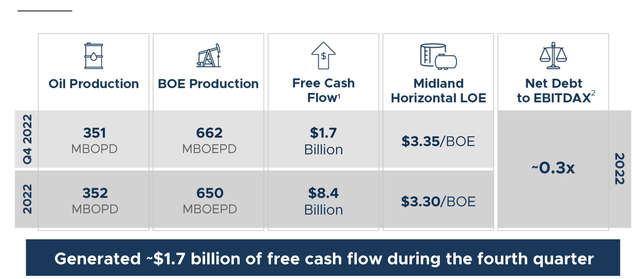

The company had incredibly strong execution through 2022. Its FCF for the year came in at 17% and its net debt to EBITA is effectively negligible for the company which has just a few billion in debt and just over $100 million in annualized interest expenses. That also positions the company much better than its peers in a rising interest rate environment.

From its production, higher oil prices, helped the company to generate FCF of $34 / barrel. The company's 2022 corporate breakeven of $39 / barrel means it needs ~$75 / barrel to generate a 10% FCF yield post-tax. That means in a higher priced environment, the company can generate even higher returns, and much stronger dividends especially.

Pioneer Natural Resources 2023 Guidance

Pioneer Natural Resources' 2023 guidance shows its ability to continue driving strong shareholder returns.

Pioneer Natural Resources Investor Presentation

The company's 2023 guidance highlights the strength of its portfolio. The company expects 685 thousand barrels / day in production with $4.6 billion in capital spending. That represents a relatively low capital budget of $18.4 / barrel that will help keep the company's breakeven low. The company expects >$4 billion in FCF, or an 8% FCF yield.

That is effectively the bare minimum of what we call long-term a good investment. That highlights how despite having a strong portfolio of assets, its relatively higher valuation could hurt shareholder returns.

The company's corporate breakeven with maintenance capital is $39 / barrel. The company's base dividend is included at $47 / barrel, and is a base 2% that it can easily afford. The company expects that in 1Q 2023 it'll be providing closer to a 10% annualized dividend given its base + variable dividend policy. After $47 / barrel the company will invest in growth and returns.

Pioneer Natural Resources Exxon Mobil

Rumors are that Exxon Mobil is looking into acquiring Pioneer Natural Resources and we think it's a brilliant decision.

Pioneer Natural Resources Investor Presentation

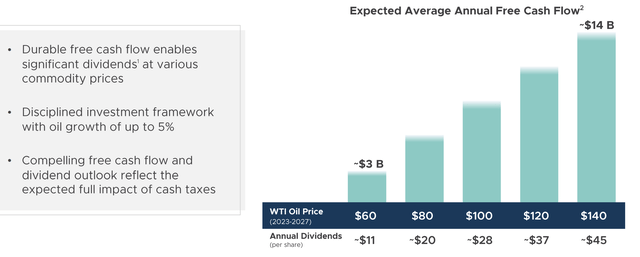

The company has strong cash flow generation at a variety of prices. At $60 WTI it has a 6% FCF yield, with 5% annual dividends. At $80 / barrel WTI that becomes a 12% yield with 10% dividends. Looking at the top side at $140 / barrel, peaks that are only reached with a major supply decrease such as the Russia-Ukraine war, its cash flow is much stronger.

The company in that scenario would earn $14 billion in FCF, a 28% FCF yield, with annualized dividends at a staggering 22%. The company could build a strong net cash position, with continued share buybacks, with its leftover cash. Exxon Mobil is working to build a massive Permian Basin business of almost 1 million barrels / day with a breakeven competitive with Middle Eastern oil.

Acquiring Pioneer Natural Resources, especially if the company can utilize stock as its share price reaches all-time highs, could be massively profitable. Even a cash acquisition could be profitable though, if the company pays 5% for debt, the breakeven on an acquisition would be at roughly $55 / barrel WTI. That could be profitable.

More importantly, an acquisition by Exxon Mobil could place a strong price floor for the company for those who invest.

Our View

Pioneer Natural Resources is more expensive than many other smaller shale companies. However, with almost no debt and a breakeven of less than $40 / barrel, the company is one of the strongest companies in the industry, especially in the case of an industry downturn. The company has a base dividend of 2% and a strong variable dividend.

At the same time, the company has continued to opportunistically repurchase shares. An acquisition by Exxon Mobil could represent a strong price floor and enable overall stronger returns. A great company at a fair price is a good deal and that's what Pioneer Natural Resources represents. We recommend investing with a small starter position.

Thesis Risk

Pioneer Natural Resources' value is based on crude oil prices, with current WTI prices at >$80 / barrel. The company's threshold for a double-digit return on its market capitalization is roughly $75 / barrel WTI, which is almost 10% below current prices. However, below that and the company is overvalued and at risk of performing.

In a volatile commodity market with the risk of a hard landing from inflation, the company is susceptible.

Conclusion

Pioneer Natural Resources has one of the strongest portfolio of assets in the shale region. It's turned that into a stringent and efficient portfolio of operations. The company has worked to replace reserves (150% 2022 reserve replacement ratio), keep costs low ($39 2023 breakeven), and maintain a strong balance sheet.

Especially with rumors of an acquisition by Exxon Mobil, we view the company as a strong investment candidate. The company can generate double-digit shareholder returns on its enterprise value at a breakeven of $75 WTI, below current prices. While prices in the crude oil markets remain volatile, Exxon Mobil represents a floor, and overall the company is a strong investment.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don't miss out because you didn't know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.

This article was written by

#1 ranked author by returns:

https://www.tipranks.com/experts/bloggers/the-value-portfolio

The Value Portfolio focuses on deep analysis of a variety of companies across a variety of sectors looking for alpha wherever it is to maximize reader returns.

Legal Disclaimer (please read before subscribing to any services):

Any related contributions to Seeking Alpha, or elsewhere on the web, are to be construed as personal opinion only and do NOT constitute investment advice. An investor should always conduct personal due diligence before initiating a position. Provided articles and comments should NEVER be construed as official business recommendations. In efforts to keep full transparency, related positions will be disclosed at the end of each article to the maximum extent practicable. The majority of trades are reported live on Twitter, but this cannot be guaranteed due to technical constraints.

My premium service is a research and opinion subscription. No personalized investment advice will ever be given. I am not registered as an investment adviser, nor do I have any plans to pursue this path. No statements should be construed as anything but opinion, and the liability of all investment decisions reside with the individual. Investors should always do their own due diligence and fact check all research prior to making any investment decisions. Any direct engagements with readers should always be viewed as hypothetical examples or simple exchanges of opinion as nothing is ever classified as “advice” in any sense of the word.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PXD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.