KMLM: A Different Combination Of Futures Used In Their ETF

Summary

- The KFA Mount Lucas Strategy ETF (KMLM) uses an in-house index. The Index includes futures contracts on 11 commodities, 6 currencies, and 5 global bond markets.

- Both the index construction and weighting are reviewed, along with the current holdings of the ETF.

- So far, this two-year old ETF is proving its strategy works, both CAGR and yield wise. KMLM also scores well on risk and has a negative correlation to US stocks.

- Based on 2022 results, KMLM is a Buy but its limited history and poor start to 2023 drops that down to a Hold rating.

- Looking for more investing ideas like this one? Get them exclusively at Hoya Capital Income Builder. Learn More »

Sacura14/iStock via Getty Images

(This article was co-produced with Hoya Capital Real Estate)

Introduction

An old investment saying is "Don't have all your eggs in one basket!". By that, smart investors diversify the "eggs" they hold. Most seasoned investors own stocks and bonds, probably across the various sub-classifications in each sector. More experienced investors might add options and leveraged funds, sometimes just to add income or as market-timing bets. Just maybe as a means of effecting a different kind of diversification, known as correlation. By adding assets that do not move in sync with the rest of one's portfolio, the overall risk can (should) be reduced.

With the advent of funds that invest using futures contracts, the average investors has a chance to add a new asset class to their portfolio mix. Some are single-asset focused, like the SPDR Gold Trust (GLD) or the United States Oil Fund (USO). Others, like the Invesco DB Multi-Sector Commodity Trust (DBA) invest in futures across different commodities but still in one segment of the market. The KFA Mount Lucas Strategy ETF (NYSEARCA:KMLM) takes a different approach by investing in futures across multiple market segments, adjusting the allocations based on market expectations.

KFA Mount Lucas Strategy ETF review

Seeking Alpha describes this ETF as:

KFA Mount Lucas Managed Futures Index Strategy ETF was launched and managed by Krane Funds Advisors, LLC. The fund is co-managed by Mount Lucas Index Advisers LLC. It invests in fixed income, commodity, and currency markets of global region. For its fixed income portion, it invests through derivatives and through other funds in debt instruments including government securities and corporate or other non-government fixed-income securities with maturities of up to 12 months. For its currency portion, it invests through derivatives in British pound, Canadian dollar, Australian dollar, Euro, Japanese Yen, and Swiss francs. For its commodity portion, the fund invests through derivatives in corn, crude oil, copper, gold, heating oil, cattle, natural gas, soybeans, sugar, wheat and gasoline. It uses derivatives such as futures to create its portfolio. The fund also invests in futures contracts on commodities through its wholly owned subsidiary. It seeks to track the performance of the KFA MLM Index. KMLM started in early 2021.

Source: seekingalpha.com KMLM

KMLM has $278.2m in AUM and comes with a 92bps fee. The TTM Yield is 13.7%, but FM's short history says investors should not assume that will always be the case.

Index review

In 1988, Mount Lucas Management introduced the MLM Index as the first passive index of returns to futures investing. The objective of the MLM Index strategy is to provide pure systematic trend following exposure in a consistent, efficient, and cost effective manner which captures the price risk premium offered by those who seek price certainty.

Source: mtlucas.com/mlm-index

The design/strategy of the index was explained when KFA partnered with Mount Lucas on managed futures index ETF, KMLM. In short:

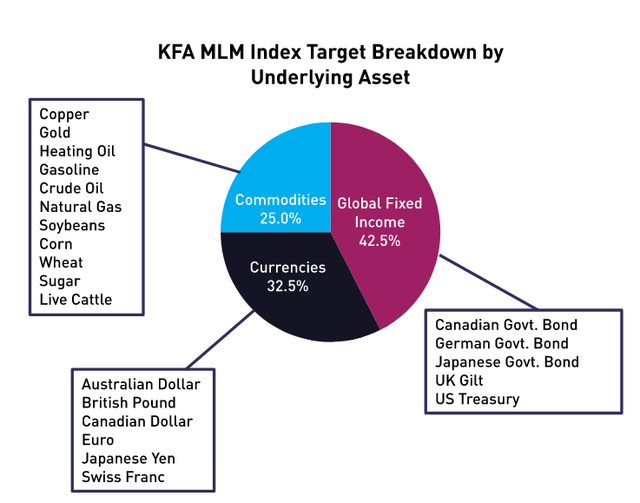

The index consists of 22 across three distinct asset classes, which I list next.

- 11 commodities (corn, crude oil, copper, gold, heating oil, cattle, natural gas, soybeans, sugar, wheat, and gasoline),

- 6 currencies (British pound, Canadian dollar, Australian dollar, euro, Japanese yen, and Swiss franc),

- 5 global bond markets (US Treasuries, UK gilts, German bunds, Japanese government bonds, and Canadian government bonds).

The weight of each asset class is determined on an annual basis by an index committee. Each futures contracts can be either a long or a short position for the following month. Weightings are based on proprietary volatility and trend-following signals. That said, within each asset class, the futures contracts are equally weighted. The index has a target annualized volatility of less than 15%.

They provided the targeted allocations and assets used are shown in the following index chart.

I found an online chart that shows the total history of the index, which dates back to the start of 1988.

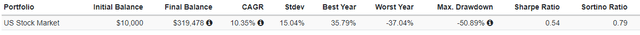

Using another site, these are the same statistics for the US stock market.

I'm my view the potential value of an ETF based on the KFA MLM index isn't enhanced returns compared to US stocks, which are ahead by 68bps, but better downside results and its negative correlation to US stocks.

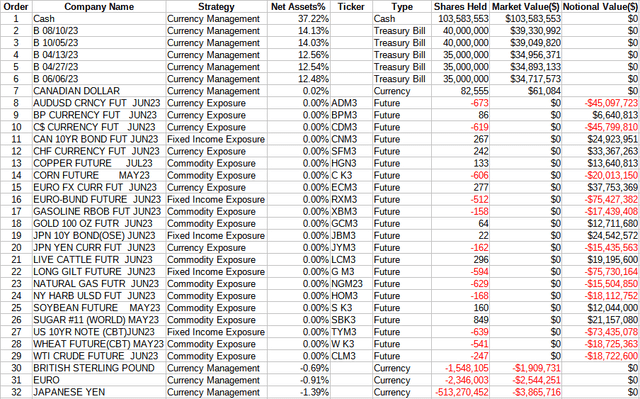

Holdings review

KMLM has three investing strategies (Commodity, Currency, Fixed Income) and uses Cash/Currency Management. This is the total holdings.

kfafunds.com/kmlm; compiled by Author

KMLM has Long and Short positions in each strategy.

| Strategy | Long | Short |

| Commodity | 5 | 6 |

| Currency | 3 | 3 |

| Fixed Income | 2 | 3 |

| Cash/Currency Management | 7 | 3 |

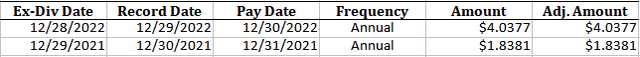

Distribution review

Payouts are only done in December. Their documentation did not mention income source of the distributions but did say investors get a 1099.

Portfolio strategy

For readers asking why KMLM and why now, here is my take. We live in very uncertain times. While inflation is dropping, it is still 3X the Fed's target level. The war in Ukraine has both an uncertain timeline and final outcome, which is effecting both the grain and energy markets. Add the debt ceiling "debate" and recent banking crisis here and in Europe, all markets are subject to wild swings. Adding a negatively correlated ETF like the KFA Mount Lucas Strategy ETF to an investor's portfolio should help "iron out" some of those down-market movements. Long/Short funds try to do that too but many are totally in equities so their correlation might be low but most are still positively related to stocks because of that fact. With KMLM having no equity exposure, it is a good ETF for investors to consider in today's market environment.

Those are some of the good reasons to add a unique strategy fund like KMLM to their portfolio, but why complicate things if you do not gain either return, yield, or a low correlation benefit. So how does the KMLM ETF score on any of those measurements? For this analysis I picked three popular ETFs; all three are equities, one that enhances income via ELNs/options.

- SPDR S&P 500 Trust ETF (SPY)

- Vanguard Total Stock Market ETF (VTI)

- JPMorgan Equity Premium Income ETF (JEPI)

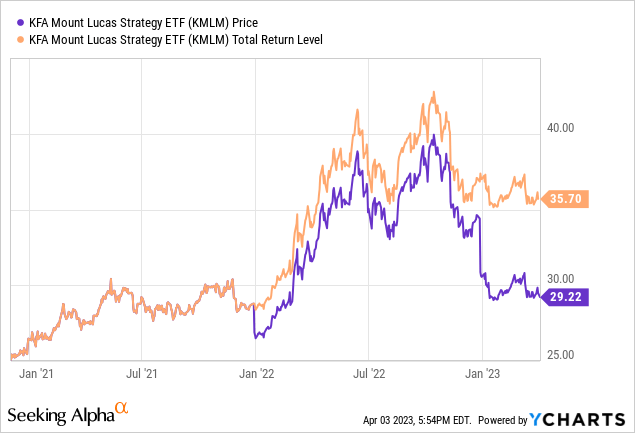

Keeping in mind history is just over two years and 2022 was a "black swan" event for the stock/bond markets, here is how KMLM has done so far:

- CAGR shows strategy worked fabulously during 2022, but so far in 2023, it's gone from 1st to 4th.

- It places 1st in Best & Worst Year return; 2nd in StdDev & Max Drawdown.

- By wide margins, it has the best Sharpe & Sortino ratios.

- It actually has a negative correlation to the US stock market.

- Payouts easily beat SPY & VTI, and match up well against JEPI except for they only occur at year-end.

With the caveat mentioned above, the KMLM ETF is achieving across the board. I would rate the KMLM ETF a Buy on its low correlation to US stocks and 2022 results, BUT I give it a Hold for now as 2023 results are poor so far and its history is limited.

Final thoughts

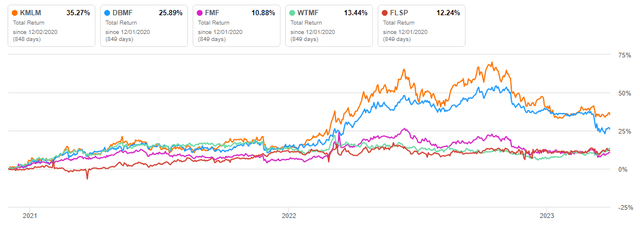

Using the Seeking Alpha Peers, then Charting functions, they had three other Managed Futures ETFs, plus one closely related ETF as old as KMLM. This chart compares their CAGR movements since 12/2/20.

seekingalpha.com Peers Charting

Only the iMGP DBi Managed Futures Strategy ETF (DBMF) compares in CAGR. This ETF was recently reviewed by another SeekingAlpha Contributor (article link).

The Simplify Managed Futures Strategy ETF (CTA) was too new to be included in the above analysis but was recently reviewed by me: CTA: Managed Futures ETF Celebrates Its First Anniversary.

When I compared against low-volatility or high-yield equity ETFs, KMLM provided better returns though slightly more risk and less income. A unique year like 2022 proved KMLM's value; 2023 should tell us how well that works as the issues causing 2022 work themselves out.

As I was completing my article, another Contributor posted this, which you tell from the title, took a slightly different view of KMLM: KMLM: A Decent Bond Alternative.

I ‘m proud to have asked to be one of the original Seeking Alpha Contributors to the 11/21 launch of the Hoya Capital Income Builder Market Place.

This is how HCIB sees its place in the investment universe:

Whether your focus is high yield or dividend growth, we’ve got you covered with high-quality, actionable investment research and an all-encompassing suite of tools and models to help build portfolios that fit your unique investment objectives. Subscribers receive complete access to our investment research - including reports that are never published elsewhere - across our areas of expertise including Equity REITs, Mortgage REITs, Homebuilders, ETFs, Closed-End-Funds, and Preferreds.

This article was written by

I have both a BS and MBA in Finance. I have been individual investor since the early 1980s and have a seven-figure portfolio. I was a data analyst for a pension manager for thirty years until I retired July of 2019. My initial articles related to my experience in prepping for and being in retirement. Now I will comment on our holdings in our various accounts. Most holdings are in CEFs, ETFs, some BDCs and a few REITs. I write Put options for income generation. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VTI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.