A Sticky CPI Along With Hot Jobs Report May Kill Hopes For Rate Cuts

Summary

- The jobs report was stronger than expected, and repriced rate hike odds.

- The CPI report is likely to show that inflation is sticky.

- The market will be upset when it finds out there will be a rate hike in May and no rate cuts in 2023.

- Looking for a helping hand in the market? Members of Reading The Markets get exclusive ideas and guidance to navigate any climate. Learn More »

Kameleon007

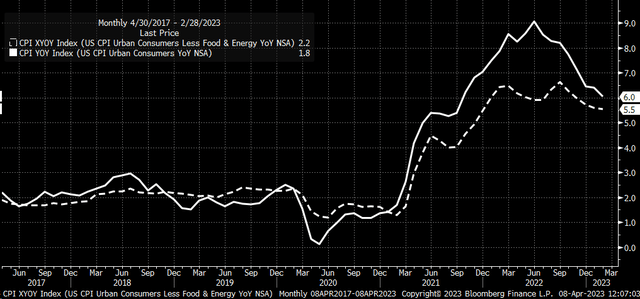

This week, the focus will shift from the jobs market to inflation, with the CPI report due April 12. The report is expected to have a significant wrinkle, as core CPI is likely to have risen by more than the headline CPI for the first time in a while, providing clear evidence that inflation is sticky.

If the headline CPI meets expectations or misses some, it isn't going to matter; the Fed is still likely to raise rates by 25 bps in May. The odds of a Fed rate hike have increased to 70% from around 50% before the jobs report. Unless there is a significant miss on the CPI, it won't matter; the Fed's goal is to get the Fed's Fund rate above 5% because inflation remains too high.

This development may upset the equity market, as it has already priced in a Fed pause and rate cuts, given the recent rally since mid-March and the strong performance in the technology-heavy and interest rate-sensitive NASDAQ.

Jobs Report Was Stronger Than Expected

The jobs report on the headline non-farm payroll establishment survey was stronger than expected, with 236,000 jobs added, higher than estimates for 230,000. Last month's numbers were also revised upward to 326,000 from 311,000. The household survey saw even bigger beats, with the unemployment rate falling to 3.5% (below estimates for 3.6%) and the labor participation rate rising to a new cycle high of 62.6% from 62.5%. Wage growth continues to increase at a pace inconsistent with a 2% inflation rate.

Headline CPI Is Becoming Less Important

For March, CPI is expected to rise by 0.2% month over month and 5.1% year over year, which is slower than the February reading of 0.4% and 6.0%, respectively. Meanwhile, core CPI is expected to rise by 0.4% month over month and 5.6% year over year. In February, core CPI rose by 0.5% and 5.5%. If core CPI rises by 5.6%, it will be the first time since September that it has increased and the first time since the beginning of 2021 that core CPI is rising faster than headline CPI.

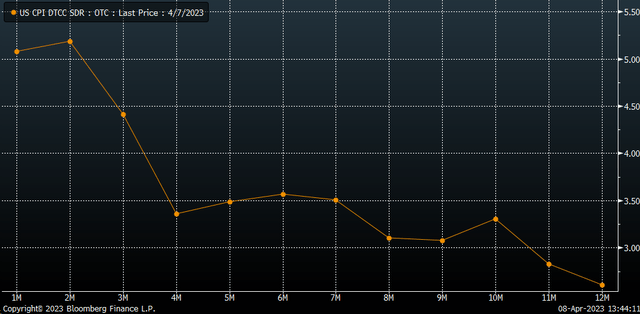

Meanwhile, the Cleveland Fed is projecting core CPI to rise by 5.7%, slightly higher than the analyst median estimate of 5.6%. Unfortunately, we can't rely on inflation swap pricing this time because there is no pricing available for core CPI, only for headline CPI. The swap market suggests that headline CPI will rise by 5.1%, which aligns with analysts' expectations. However, based on those swaps, inflation is expected to increase in April, with year-over-year gains of 5.2%.

Odds Increase for May Rate Hike

Given the strong March jobs report and the expected sticky core CPI report, the odds of a 25 bps rate hike in May will likely increase further from the current 70% odds for the May meeting. Although a 25 bps rate hike would be much lower than anticipated before the Silicon Valley Bank meltdown, as the stress in the banking system eases, it may give the Fed more room to keep pushing rates higher beyond May.

The market had been pricing in increasing odds of rate cuts in June. However, following the release of the jobs data, those odds have vanished, and no rate cuts are now expected in June.

Recent Stock Market Rally Overdone

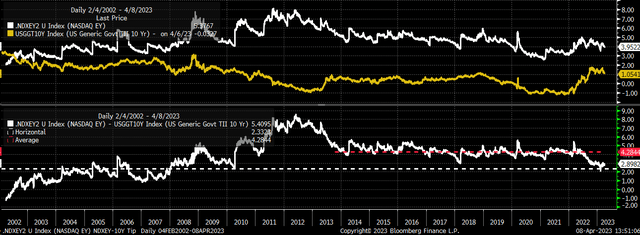

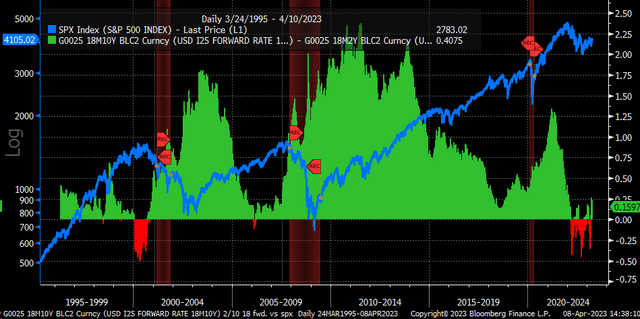

The recent rally in technology and mega-cap stocks suggests that the equity market has been pricing in rate cuts. If the data continue to support another rate hike in May and the possibility of no rate cuts in 2023, then the recent rally in stocks may be overdone and must be corrected. It's also possible that nominal and real rates could begin to rise again soon.

Furthermore, despite the recent rally, the NASDAQ earnings yields minus the 10-year TIP rate are still very low. This suggests that the NASDAQ remains overvalued compared to real yields, more so than at any other point over the past decade.

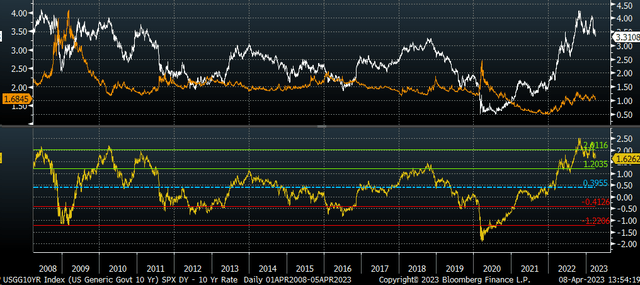

It's not just the NASDAQ that's overvalued compared to bonds. The S&P 500 dividend yield is also very low compared to the 10-year rate, and the spread between the two is trading at its highest level in over a decade.

The equity market wants the Fed to be done with rate hikes and is betting that rates will begin to fall given the wide spreads and the recent rally in the NASDAQ and the S&P 500. However, the data that the Fed is focused on, such as the jobs data and the inflation data, does not support the Fed's rate-hiking cycle being over or for rate cuts.

Softening Economy

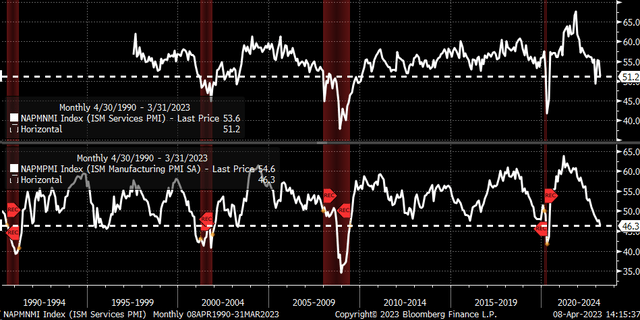

On the other hand, survey data supports that the Fed is done with rate hikes and suggests a substantial economic slowdown is occurring. The ISM manufacturing data fell to 46.3 in March, and levels this low tend to be associated with recessions. Meanwhile, the Services survey showed the index fell to 51.2, close to recession levels.

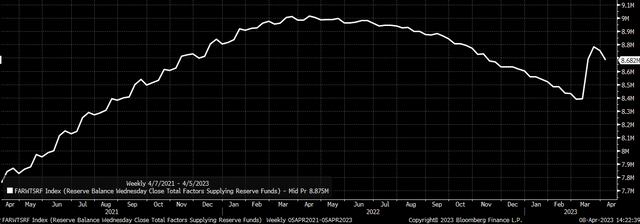

In addition, it's now clear that the Fed is not conducting QE as the size of its balance sheet shrinks. This is due to the usage of the Fed's discount window continuing to decline and the pace of banks using the lending facility slowing down materially.

Over the next couple of days, as the equity market continues to digest the fact that there is no QE and that the Fed is likely to continue to hike rates in May and potentially beyond, that bank stress continues to ease, and no rate cuts. The recent rally in the NASDAQ will need to unwind, and the market will need to voice its opinion that the Fed needs to stop raising rates because the soft data suggest that the economy is slowing dramatically.

Currently, the 18-month forward 10-2 spread is steepening dramatically, and typically when that spread begins to rise, it is lights out for the equity market.

Stocks aren't cheap and offer no earnings growth in 2023, while the outlook for 2024 is becoming increasingly shaky.

Join Reading The Markets Risk-Free With A Two-Week Trial!

(*The Free Trial offer is not available in the App store)

Find out why Reading The Markets was one of the fastest-growing SA marketplace services in 2022. Try it for free.

The market is more complex than ever, and Reading The Markets is here to help you cut through all the noise and to help you better understand what is driving trading and where the market is likely heading, both short and long-term.

This article was written by

I am Michael Kramer, the founder of Mott Capital Management and creator of Reading The Markets, an SA Marketplace service. I focus on long-only macro themes and trends, look for long-term thematic growth investments, and use options data to find unusual activity.

I use my over 25 years of experience as a buy-side trader, analyst, and portfolio manager, to explain the twists and turns of the stock market and where it may be heading next. Additionally, I use data from top vendors to formulate my analysis, including sell-side analyst estimates and research, newsfeeds, in-depth options data, and gamma levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Charts used with the permission of Bloomberg Finance LP. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Past performance of an index is not an indication or guarantee of future results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index may be available through investable instruments based on that index. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.