GLD: Option Activity Indicates 'Caution'

Summary

- Since August, we've expected a price breakout in GLD to $230. There is now a high likelihood prices will stall at the trading range top of $192.

- There has been a sudden, unexpected shift in investor sentiment to the broad belief gold is going higher. This is always cause for caution.

- The "puts to calls" ratio in GLD has reversed and is rapidly approaching a sell signal.

- The surge in call buying in GLD is also approaching levels seen at prior price highs in GLD.

- We now recommend investors take profits in half of all GLD positions.

pookpiik/iStock via Getty Images

In an article last August, we forecast a major breakout in the price of GLD. It was based on the growing short position of money managers in gold futures. We confirmed the forecast just two weeks ago in this followup article suggesting a price target of $230. However, a sudden change in market sentiment in GLD and gold futures is giving us caution.

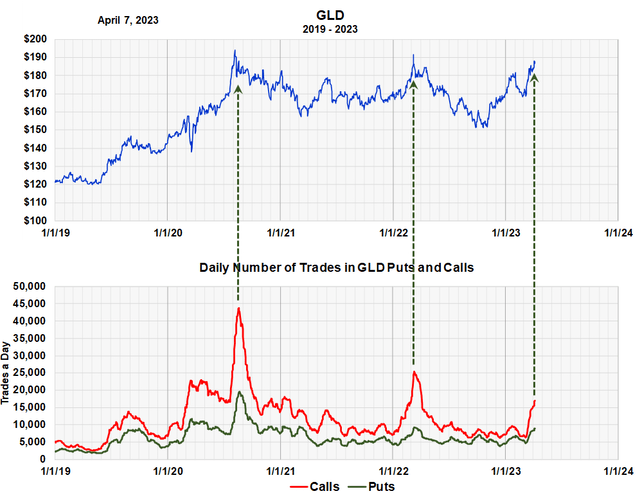

A surge in GLD call buying is signaling "caution"

Daily Put and Call Trades in GLD (Michael McDonald)

This chart shows the daily number of put and call trades in GLD since 2019. We've indicated with green arrows times when there's been a surge in the number of call trades (red line). The first two occurred at price highs in GLD. This third time is occurring as we approach the upper levels of what's been a trading range for GLD since the mid 2020’s. This means more and more people now agree with the bullish forecast and this gives us caution.

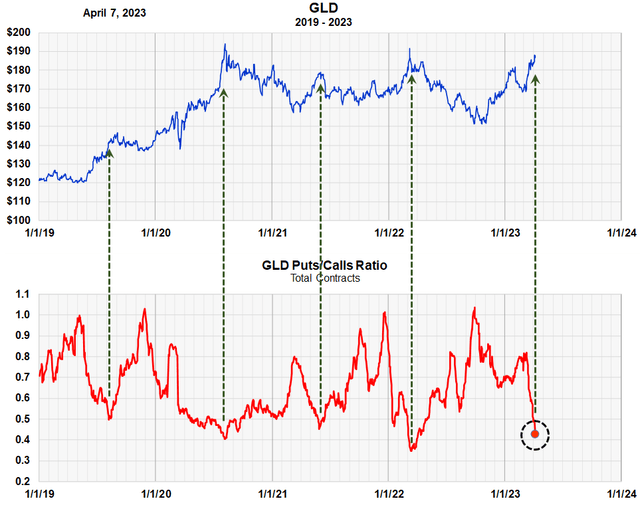

There's also been a sudden drop in GLD’s “puts to calls” ratio

If the rise in “call” buying occurred with a corresponding rise in “put” buying, we wouldn't be so worried, but it isn't as the next chart shows.

The "Puts to Calls" Ratio in GLD (Michael McDonald)

This chart plots the “puts to calls” ratio in GLD. In the last few weeks, the ratio has tumbled to one of the lowest readings of the last four years. We've indicated with four green arrows, previous low ratios and each one corresponded to a price high in GLD. We think this 5th green arrow is probably indicating another.

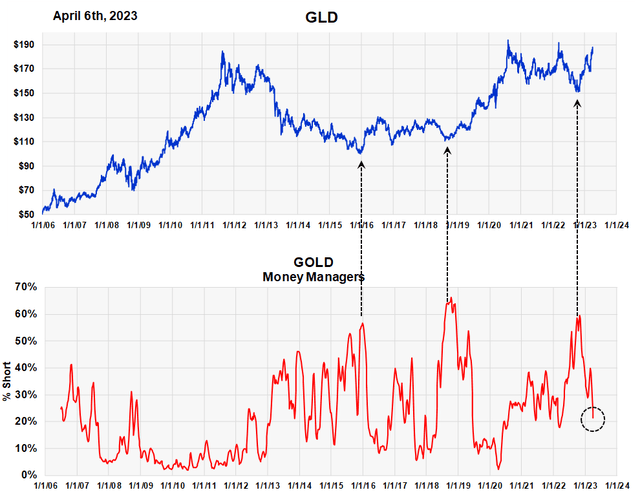

Money managers have reduced short positions in gold futures

One of the main reasons we've been bullish on gold since August has been the high short position of money managers in gold futures. That has now changed as the chart below shows. We've indicated the current number with a black circle. While it has not yet reached levels that we consider worrisome, it does represent a major shift in the condition that originally made us bullish.

Percent Short Position of Monet Managers in Gold Futures (Michael McDonald)

Recommend Taking Profits in 50% of GLD positions

While we are still bullish on GLD long term, these sudden changes in investor sentiment make us cautious short term. So we recommend taking profits in half of one's gold positions.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.