Plus500: High-Risk Investment With Cash Upside

Summary

- Plus500 has grown at 31%, driven by increased trading volume and overseas expansion.

- Revenue has further scope for growth long-term due to an expansion into the US, and the scope for new products.

- Margins are fantastic (NI-M of 45%) and the business is asset-light, with no material debt.

- Plus500's valuation suggests it is in line with historical trading. We think the business has improved since then, justifying a premium.

- With a bear market forward FCF yield of 13.6%, investors look set to be rewarded handsomely once markets return to normal.

Andrzej Rostek/iStock via Getty Images

Investment thesis

Our current thesis for Plus500 (OTCPK:PLSQF) is:

- Plus500 is a fantastic business that is developing via expansion overseas and targeted marketing.

- A high-quality product will help retain customers, and Plus500 has done a good job of generating more revenue from them.

- Margins should remain relatively sticky due to the variable nature of operating costs.

- Valuation suggests some upside due to the company's improvements.

Company description

Plus500 Ltd. is a fintech company that operates technology-based trading platforms globally. It offers an online and mobile trading platform that allows its international customers to trade CFDs on various financial instruments such as shares, indices, commodities, options, ETFs, foreign exchange, and cryptocurrencies.

The company also operates Plus500 Invest, a share dealing platform, and TradeSniper, an intuitive futures trading platform for the US retail trading market.

For US investors, it may be worth defining what CFDs are, as they are far more popular in Europe (and the UK especially) than in North America. A contract for differences is "an arrangement made in financial derivatives trading where the differences in the settlement between the open and closing trade prices are cash-settled". Essentially, CFDs work similarly to opinions in that you are making a bet on directional movements, however, you have no right to the underlying asset.

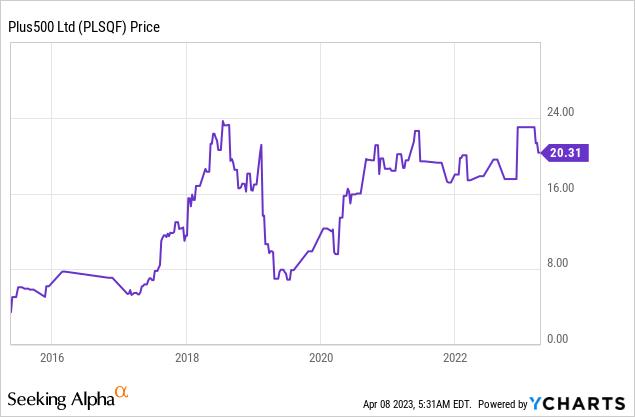

Share price

Plus500's share price has made impressive gains in the last decade, with over 400% returns. This has been driven by strong sustained growth in the business, driving impressive profits.

Financial analysis

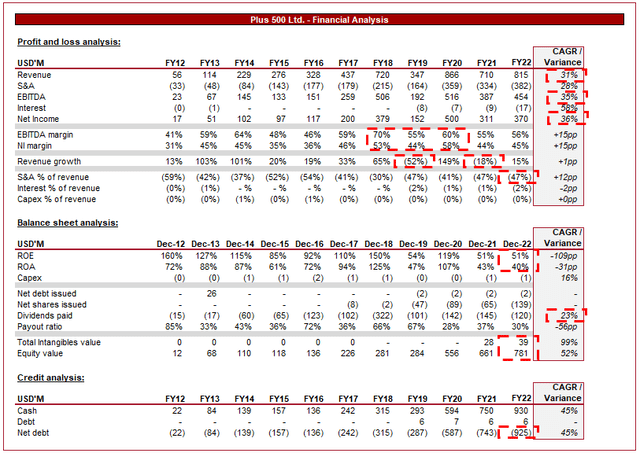

Plus500's financials (TIkr Terminal)

Presented above is Plus500's financial performance for the last decade. The business has performed extremely well while being asset-light, the perfect combination. The key risk is trading volatility.

Revenue has grown at an impressive 31% growth rate in the last 10 years, driven by several bullish factors which have increased trading volume.

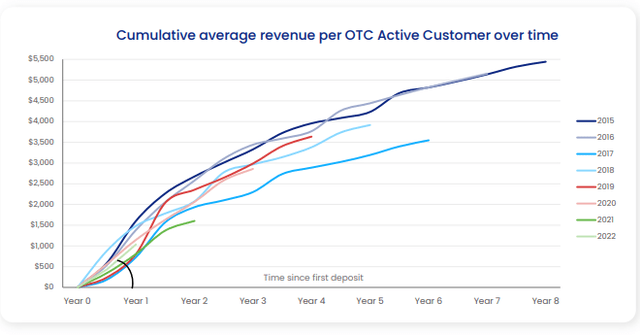

The financial services industry is increasingly adopting new technologies as a means of driving improved economics through customer acquisition, customer satisfaction, cost efficiencies, and product innovation. Plus500 has been at the forefront of this, referring to itself as a "Fintech" business. One of the avenues Plus500 has focused on is technological marketing investment to not only target those consumers most likely to use the service but to drive customer retention. As the following graph illustrates, Plus500 has been able to improve its ARPC over time.

Cumulative average revenue per OTC Active Customer over time (Plus500)

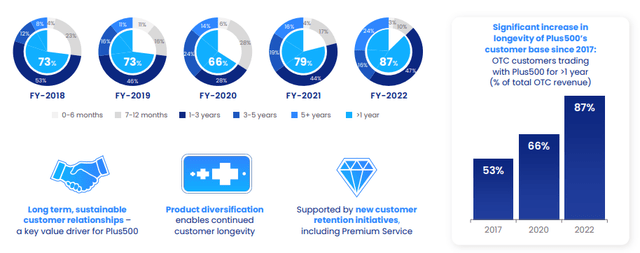

Another technological focus has been the development of its product. Plus500 has invested a considerable amount in making its app user-friendly and product rich, ensuring that there is little difference between a full web experience and the app. 85% of OTC revenue generated was from mobile devices in FY22, suggesting this has succeeded. The reason we have this highly is because mobile trading offers a level of convenience that is unmatched, bringing a lot more consumers into the market as potential users. Not only this but simply put, consumers want to use services that they like. If the product is good, consumers are far more likely to continue to use the product, thus driving recurring revenues over time. As the following graphs suggest, Plus500 is seeing its average customer tenure increase over time.

The online trading industry is highly competitive, with many players vying for market share. Plus500 faces competition from established players such as CMC Markets, IG Group, and Saxo Bank, as well as new digital entrants. So far, Plus500 has done well to develop market share in its niche rather than offering a wide range of services like these other businesses. This being said if Plus500 does plan to expand in the future, it will not be easy.

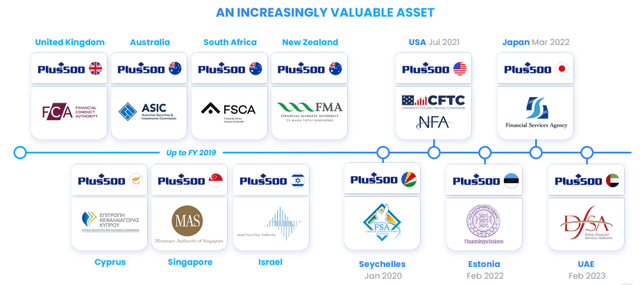

Another revenue driver has been international expansion. Plus500 has been aggressive with expanding overseas, receiving regulatory approval in 12 countries in the last few years. As an asset-light business, the company can essentially "copy/paste" its services in different countries, with the key being to market its services in line with local customs. It is not a surprise that this British company expanded primarily to former British colonies, which have a similar culture.

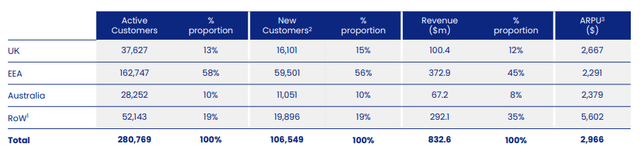

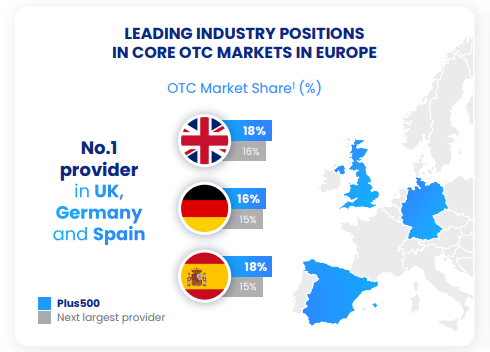

Not only this, but Plus500 is the market leader in several large markets, including the UK and Germany. This gives the business consistency with trading volume, although does create a level of dependency on Europe.

Market leading positions (Plus500)

Further, Plus500 is focusing on expanding into the US Futures market, having launched a retail trading platform. The US market is the largest in the world, representing a significant opportunity to gain trading volume. The market is equally as competitive, but similar to how Plus500 gained market share through offering a retail niche, the business has the scope to do the same in the US.

As the following table shows, Plus500 generates material revenues from many different countries globally. This is good for diversification but also creates FX risk, as income is translated into Stirling for reporting purposes.

Looking ahead, Plus500 has further scope for growth through expanding its product offering. Currently, the company focuses on OTC trading but could expand into share dealings, ETFs, etc. IG Group (OTCPK:IGGHY), a competitor, offers such services alongside CFDs and it generated a NI-M of 49%, which suggests profitability can be maintained. Further, these types of services are less volatile, which will help to generate more sustainable revenues, which investors like to see.

The financial markets are highly volatile normally, but when including margin trading and leverage, this is multiplied. Plus500's revenue is directly linked to the trading volumes of its clients, which can be affected by changes in market conditions such as interest rate movements, political events, and economic data releases. Growth in the most recent year is the slowest of any year of positive growth since FY12, suggesting the current bear market is having an impact.

The financial services industry is highly regulated and subject to ongoing changes in regulations. This has the potential to have a significant impact on the operations of Plus500 if legislation moves against the business. We have seen tighter regulations on advertising, leverage limits, and risk warnings, which could impact the company's revenue and profitability. The issue is that an estimated 75-80% of retail investors lose money trading CFDs, which encourages Governments to reduce consumer exposure.

Margins

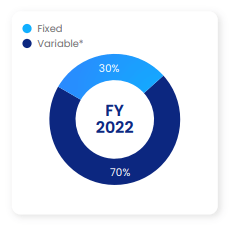

Plus500's margins have improved over the last decade, with the business gaining 15ppts. in both EBITDA and NI. This being said margins are below the peak Plus500 was able to achieve in FY18. The reason for this is market conditions, with margins generally improving as consumers trade more and new customers join the site. The good news is that the majority of costs are variable in nature and so we do not see wild swings in margins when trading volume softens.

Cost split (Plus500)

It is difficult to assess what a normalized level of trading would be, but our expectation would be for an EBITDA-M of >50% and a NI margin of >42%.

Balance sheet

The asset-light nature of the business is reflected in its balance sheet efficiency, with the business returning over 50% of equity every year since 2012.

Plus500 currently has no meaningful levels of debt, holding cash for regulatory purposes. With this in mind, the company still has a substantial surplus which it can hold as a buffer and distribute all other amounts of cash generated.

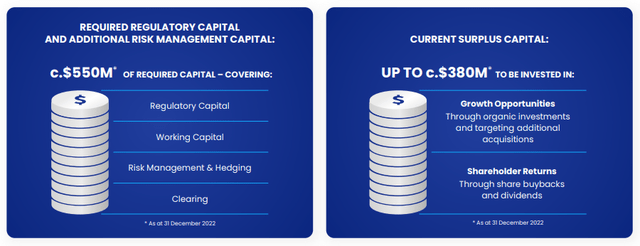

Capital requirements (Plus500)

Dividend payments have grown at a rate of 23%, with 30% of NI distributed in the most recent year. This is because the business is also buying back shares at a similar rate, with a total of £260M returned to shareholders in FY22. This is while the business has a market cap of £1.5BN, implying a cash return of 17%.

Outlook

Given the nature of the business, it is extremely difficult to give an outlook on how the business will perform in the coming periods. Management's guidance is that Plus500's performance will be "in line with current market expectations" which suggests they think analysts know best (Very strange).

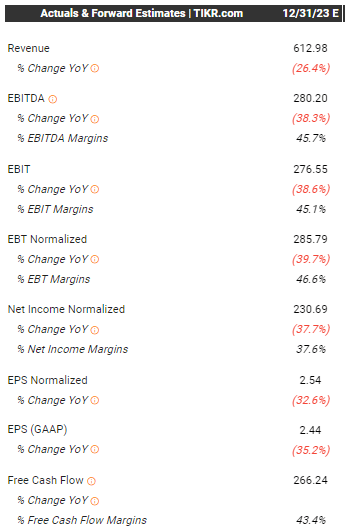

Management guidance (Plus500) Analyst guidance (TIkr Terminal)

Analysts are currently assuming a sharp decline in revenue, likely on the back of soft trading conditions following the bear market. We concur with FY23 being a softer year, although the degree is slightly concerning.

With a free cash flow conversion of 43.4% in FY23F, this implies a FCF yield of 13.6%, which is still impressive. By contrast, the current yield is 29%.

Valuation

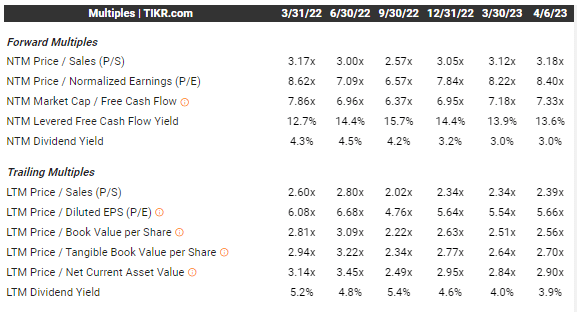

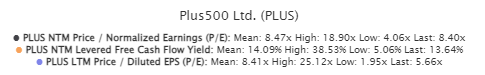

Plus500 valuation (TIkr Terminal)

Plus500 is currently trading at a NTM P/E ratio of 8.4x, noticeably higher than its LTM multiple of 5.7x. It is difficult to assess which metric is more useful. The forward basis is highly subjective and will likely not be close to accurate, yet the LTM view is of performance level which certainly will not be replicated in the coming year.

Our view is that the best way to assess the company's valuation is to look at both metrics in conjunction with its forward FCF-Y.

Plus500 valuation (TIkr Terminal)

Plus500 is currently trading at a discount to its historical LTM P/E ratio, reflecting the near-term performance decline, which looks reasonable. On a NTM basis, on the assumption that the forward guidance is equally as reliable as in the past, suggests Plus500 is trading at about fair value. This is supported by the company's FCF-Y, which on a forward basis is in line with what was historically achieved.

We do think there is reason to suggest the business is in a better position when compared to its historical levels, however. Firstly, the business has several hundred million in excess cash, which could realistically be used to support 2023 distributions. Secondly, the business generates far more revenue from other geographies, diversifying its income stream. Finally, the business is expanding into the US, which should help support volume.

Final thoughts

Plus500 is a high-risk investment choice. The business is essentially fully tethered to trading volume, which history has shown to be volatile. The business has experienced periods of >50% revenue growth, as well as declines of >10%. We like the company's margins and how Management is choosing to grow the business. We see future potential with the US expansion, new geographies, and new products.

Plus500 is trading at its historical level, which from a conservative view would suggest it is at fair value. Our view would be that the business has improved since then, allowing for some upside at today's share price.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.