Waste Management Looking To Turn Green Initiatives Into Greenbacks

Summary

- WM will look to power growth and improve margins through renewable energy and recycling initiatives.

- Combined these projects are expected to add $740 million to EBITDA by 2026.

- That said, the stock looks appropriately valued making it a solid "Hold."

Salameh dibaei

Waste Management (NYSE:WM) has some solid margin improvement and growth initiatives in place, but the stock looks fairly valued at the moment.

Company Profile

WM is a waste disposal firm operating in the U.S. and Canada. It offers collection, transfer, disposal, and recycling and resource recovery services, serving residential, municipal, commercial, and industrial customers.

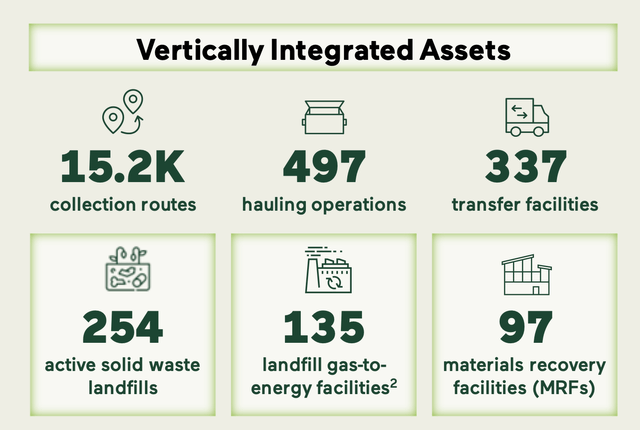

At the end of 2022, it operated over 250 landfills, representing the largest landfill network in North America. It also managed 337 transfer stations, where it consolidates and compacts the waste before transporting to a landfill. It also operates 97 MRFs (material recovery facilities), of which 46 are single stream, where it recovers recyclable items such as glass, cardboard, and plastics to be resold and used for other purposes.

WM also operates projects that capture methane gas from landfills. At the end of 2022, it had 135 landfill gas projects, with 95 of the projects using the gas to produce electricity and 23 of them having the gas delivered by pipeline to industrial customers. It also produces renewable natural gas (RNG) through five facilities, which is uses in its compressed natural gas (CNG) fleet of vehicles. It also generates RIN credits in the process.

Opportunities and Risks

Margin improvement is one of the big near-term opportunities for WM over the next couple of years. The company will look to achieve this through price increases as well as reducing operating expenses. WM plans to take a 6.5% to 7% increase in core pricing this year. As it has in the past, it is also willing to sacrifice some low-margin volumes from some business lines to improve its overall operations. There was a period of time when WM and its rivals would fight for volumes, but overall the industry has become more disciplined.

On the cost side, the company is making several moves to help improve the costs of the business. One big one is its investment in recycling automation, which will help reduce labor costs, increase capacity, and improve product quality. In Q4 the company saw labor costs per ton reduced by 35% from these actions, while it is looking for a 15% increase in processing capacity by then end of 2023.

Its recycling automation will continue over the next few years as well. At its analyst day earlier this month, the company laid out plans to invest in 43 recycling facilities, including 31 automation projects and 12 new markets. These investments are projected to add $240 million in EBITDA by 2026.

Replacing its aging fleet of vehicles will also help on the cost side, as maintenance and repair costs have been elevated. Fleet deliveries are expected to normalize this year, and management thinks getting these vehicles onto the streets will help reduce costs, especially in the back-half of the year.

Discussing its margins of its Q4 call, CFO Devina Rankin said:

“I think that overview that you provided is spot on in terms of how it is that we're looking at margin for the year ahead, 60 basis points of margin expansion at the midpoint indicates our confidence that the momentum that we saw in the back half of 2022 should continue into 2023. We expect some of the margin pressure from the recycling part of the business to continue in the first half. So we are seeing strong fundamentals in the solid waste part of our business that should help to offset that as they did in Q4. That being said, some of the cost execution, we really are laser focused as a management team on what we're doing on the cost side of the business. And that's not just looking at inflation and responding to it but being proactive in terms of what we can do to manage it appropriately. And truck delivery trends are favorable now relative to where we started 2022, and that should give us some relief both in repair and maintenance and in truck rental costs. Our frontline retention efforts are showing really strong benefits, and we expect that to continue in 2023. We're managing down professional fees, particularly in our SG&A.

“And then on the SG&A front, we're also leveraging technology to automate our processes, which is improving the customer experiences and reducing our cost to serve. So all of that gives us confidence that it's our strong execution on the cost side of the equation that will complement the yield that Jim just spoke to in terms of delivering that margin expansion and exiting 2023 with 100 basis points above kind of this current run rate feels like the right target for us.”

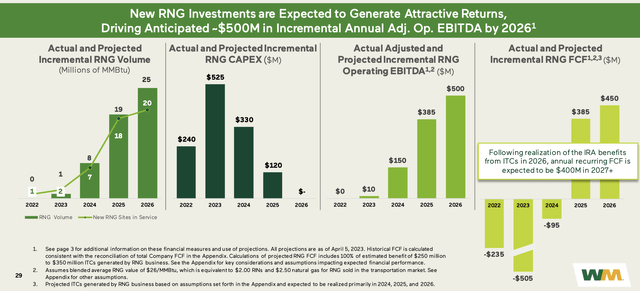

WM’s renewable energy businesses offer nice opportunities. The company has been at the green forefront for a while, and as the bulk of its vehicle fleet runs on compressed natural gas that its landfills produce. Meanwhile, at its analyst day, the company said it will look to build 20 new renewable natural gas plants. The new facilities are expected to generate $500 million in EBITDA in 2026.

On its Q4 conference call, CEO James Fish said:

“Historically, we've been collecting our landfill gas, converting much of it into electricity, which provides an earnings stream for us. Fast forward to present day, with landfill gas designated as a renewable resource, we are increasing the value of the gas that's an inevitable byproduct of most landfills. These RNG plants are simply taking gas that's naturally produced from the landfill and converting it into a cash-generating machine with a 3-year projected payback and a far better environmental outcome than the status quo. And our returns far surpass those of our competition by virtue of our CNG fleet, which today represents 74% of our routed vehicles. As a result, we're better positioned to close the loop and capture extremely valuable regulatory RIN credits. At the same time, the recently enacted Inflation Reduction Act will provide tax credits and benefits that served to amplify the value creation of WM's renewable energy business.”

On the risk side, WM has commodity exposure, as prices and demand for recyclables fluctuate. In fact, the company saw big declines in commodity prices for recycled materials in the second half of 2022, which it expects to continue to be a headwind in 2023. This could be about a $50 million EBITDA headwind this year. The price of the biogas and electricity it sells can also move up and down as well. At the same time, while much of its fleet is powered by the CNG it produces, over 25% is exposed to fuel prices.

WM is also not immune to a recession or things like a slowdown in housing. When a recession hits, it often leads to less consumer consumption and thus the volumes of waste produced. It has business lines in the commercial and industrial space, as well as construction that can also decline.

And while the industry has been more disciplined, there have been periods where companies have chased volumes. This has generally been bad for WM and the industry as a whole.

Valuation

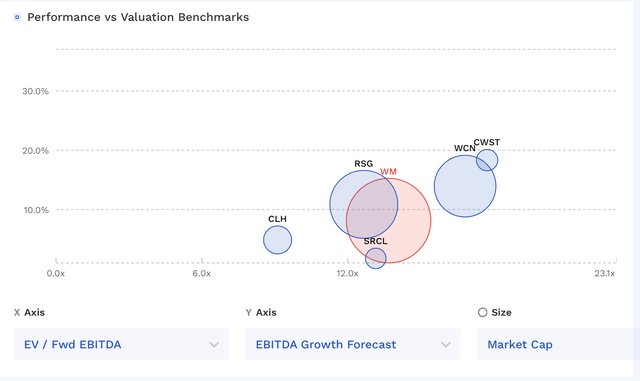

WM trades at 13.8x adjusted EBITDA based on 2023 analyst estimates of $5.91 billion. Based on the 2024 consensus of $6.34 billion, the stock trades at a 12.9x multiple

On a PE basis, it trades at 27x the 2023 consensus of $6.00.

It is projected to grow revenue 5% this year and next.

WM is valued in the middle of the pack compared to other waste management and environmental service companies.

WM Valuation Vs Peers (FinBox)

Conclusion

WM is a solid company that has some nice margin and growth drivers ahead of it. The company has always been at the forefront of green initiatives, and it is benefiting from the tax credits it will receive due to the Inflation Reduction Act. While it faces some commodity headwinds in the recycling space, it has been working to reduce the impact of commodity prices on its business.

Overall, I think WM is a well-run company, but the stock looks appropriately valued at the moment. As such, I view it as a solid “Hold.”

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.