Suncor Energy: A Dividend Dynamo In A Volatile World

Summary

- Despite the sector's volatile nature, Suncor delivers reliable dividend payments.

- The company generates a lot of cash, and has been able to significantly reduce debt while buying back shares.

- Suncor maintains an efficient operation with a competitive breakeven level.

JHVEPhoto

Analyzing oil and gas companies can be tricky due to the volatile nature of the underlying commodities. However, Suncor Energy (NYSE:SU) or (TSX:SU:CA) might be an interesting stock for income investors to consider. This is because the company has relatively little debt compared to its profitability while also having a low breakeven point, providing it with a reasonable margin of safety. Nonetheless, we remain neutral on the stock.

Looking For Stability In The Volatile Energy Industry

One of the most practical ways for investors to analyze energy stocks is by focusing on their dividends. As revenues and profits swing from booms to busts, the companies with strong balance sheets and operations should be able to maintain steady dividends. Suncor has been able to do just that, as it has increased its dividend every year in the past decade with the exception of 2020, which is understandable since oil prices temporarily went negative. This provides the company with a baseline value that is tangible. Currently, it has a dividend yield of 4.88%, which is pretty good considering its current payout ratio is only 28.6%.

However, the real added value that Suncor Energy offers to investors is its use of buybacks. Indeed, Suncor bought back 8% of its shares in 2022 and 6% in 2021. In addition, the company has been working to improve its balance sheet over the past couple of years, as it deleveraged from C$22.135 billion in 2020 to C$16.032 billion at the end of 2022.

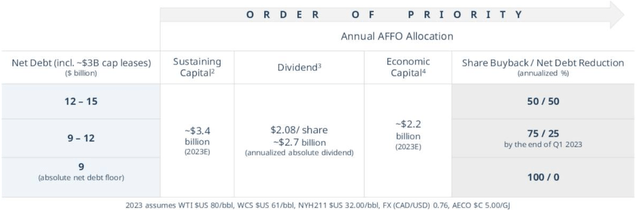

Suncor has outlined a clear path for its capital allocation strategy:

As pictured above, the firm has set a minimum debt goal of $9 billion, at which point it'll fully allocate any additional capital to share buybacks. This is done gradually as debt is paid down, with a 50/50 split while debt is in the C$12 - C$15 billion range and a 75/25 split while in the C$9 - C$12 billion range. This demonstrates that management is properly aligned with shareholder interests, as it's creating value while also derisking the balance sheet.

Can Suncor Energy Maintain Its Dividend?

What caught our attention when analyzing Suncor was the company's competitive breakeven point. CFO Alister Cowan stated that "corporate breakeven for sustaining capital and dividend is low to mid $40 WTI." Essentially, this means that Suncor would be able to maintain its current dividend rate even if oil prices were to be almost slashed in half.

This provides an excellent margin of safety, especially when considering that OPEC+ is keen on keeping oil prices elevated, as demonstrated by their surprise production cut in the past week. This also acts as a growth catalyst for Suncor. Obviously, the higher the underlying oil price, the more money it can earn, especially as it reduces its interest expenses by paying down debt.

Furthermore, Suncor is working to significantly lower its breakeven point. Alister Cowen also noted, "As we work through our performance improvement plan to drive down cost and improve reliability and production over the long-term, we are focused on driving that back then to our longer-term target of the mid-$30." This will further reduce risk and boost profitability even if oil prices were to stay flat.

Is Suncor Stock Undervalued?

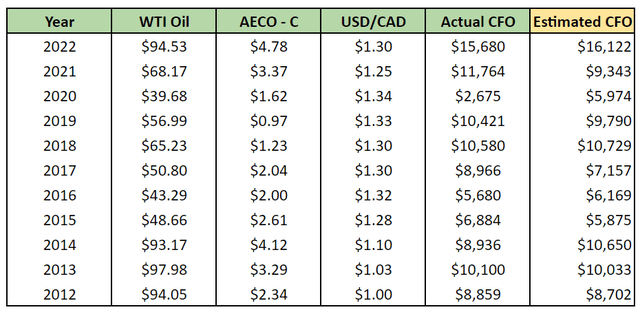

To value Suncor, we will have to consider the prices of the underlying commodities and their volatile price swings. To do so, we ran a multiple regression where we used average historical WTI oil prices, AECO - C natural gas prices, and USD to CAD exchange rates to predict Suncor's annual cash from operations.

The regression formula was:

Estimated CFO = 229.43(WTI Oil) - 418.19(AECO-C) + 27,617.98(USD/CAD) - 39,507.1

This yielded the following results in yellow:

As you can see, the formula does a fairly reasonable job predicting cash from operations, with an average error of C$1.884 billion. In addition, it explains roughly 78% of the factors that influence cash from operations.

When using the formula above to estimate 2023 cash from operations using current prices-$80.41 WTI, $2.49 AECO - C, and 1.3513 USD/CAD-we arrive at C$15,220 million (the base case), or a range of C$13,336 million to C$17,104 million when adjusting for the average error.

Since the company expects C$5.6 billion in capital expenditures at the midpoint, we could estimate that free cash flow will be C$9,620 million in our base case scenario. With a market cap of C$56.4 billion, Suncor has a forward free cash flow yield of 17%. Given that its cost of equity is 13.3% (as per Finbox), this suggests that Suncor is undervalued under current market conditions.

Risks

The most immediate and impactful risks for the company are the obvious - commodity prices. However, there are other risks specific to Suncor. To begin with, the firm's Base Plant mine is aging and depleting. Indeed, it is expected to be shut down by the mid-2030s, and Suncor will need to find ways of replacing the 270,000 bbl/day of production.

However, there have been some political hurdles, as the Canadian government warned that Suncor's initial proposal would not pass an environmental review because projected carbon emissions were too high.

In addition, the company's safety record has been criticized after a string of fatal injuries over the past few years. Indeed, the injuries have led to misses in production targets in the past, and if management can't improve on this front, it may continue to impact production.

Nevertheless, the company has taken steps to address these issues. Suncor continues to work with regulators in order to try and get approval to extend its aging Base Plant mine while also looking at other possible solutions. In addition, shareholder Elliot Management is looking to appoint new independent directors in order to help management reduce the chances of future accidents.

Final Thoughts

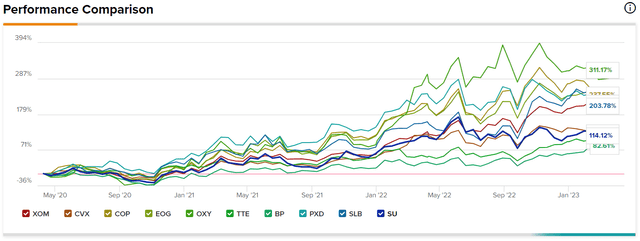

As far as oil companies go, Suncor has not been one of the best performers in recent years when compared to its peers. Indeed the image below shows that it's near the bottom of this particular list, with a 114.12% increase since April 2020.

However, this has left Suncor as an undervalued stock that continues to benefit from stock buybacks while also providing a solid dividend that is well covered. For those looking for exposure to the energy sector, Suncor is likely a good candidate at this time.

Nonetheless, we remain neutral on the stock because we do believe a recession is on the way, and energy is not the place we currently want to be investing in.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.