Zuora: Excellent Value

Summary

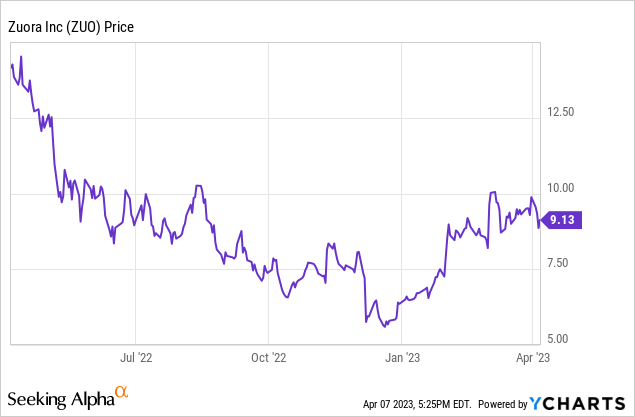

- Shares of Zuora, already up 40% year to date, have more steam left for a continued rally.

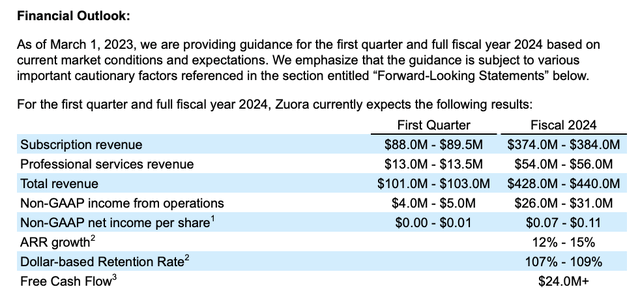

- The company has executed steady mid-teens revenue growth and is still expecting 12-15% y/y growth in ARR in the current fiscal year.

- Zuora is also projecting positive pro forma earnings and FCF.

- Trading at just ~2.5x forward revenue, Zuora still has plenty of room to re-rate higher.

Michael Vi

We've seen a lot of market headlines recently commenting on the sharply rising relative appeal of cash and bonds that are yielding much higher rates. Growth is out of vogue, but value stocks still have plenty to offer - especially as history tends to tell us that tilting toward value during recessionary periods has generally produced strong results.

Zuora (NYSE:ZUO), in particular, is a great name to choose within the tech sector (which we typically don't associate with value!) This SaaS software company, which helps with billing and revenue management for fellow subscription-based companies, has already soared ~40% year to date on the back of strong results: but I think given its low valuation base, Zuora still has plenty of room to edge higher.

I remain very bullish on Zuora stock. I find it reassuring that the company recently affirmed FY24 guidance and is continuing to expect steady growth in a softer macro environment. We note as well that Zuora's large and sturdy ARR base, on top of the fact that the company is seeing improved gross margins, sets Zuora up nicely for profitability scaling.

For investors who are newer to this trade, here is my full long-term bull case for Zuora:

- Subscription-based business models are becoming dominant. Given the fact that more and more businesses are adopting this type of model, Zuora's base of potential customers has widened significantly. Zuora's uniqueness in this regard is also important to point out: companies can choose a regular ERP, but Zuora's subscription-focused solutions help to address common pain points.

- Innovation track record is strong; the product portfolio is expanding. There's virtually no other company that markets itself as a purpose-built platform for subscription companies. Zuora has also done a good job at fleshing out its portfolio of solutions, ranging from revenue management to billing tools to CPQ (configure, price and quote) applications.

- Zuora grows along with its customers. As Zuora's clients grow their subscriber bases, so does Zuora's opportunity to monetize and grow alongside its customers. The company has noted that upsells have hit a "record pace", and highlighted several key milestones like GoPro's (GPRO) subscription-based storage and insurance program (a key feature of the company's planned turnaround) hitting one million subscribers.

- Offloading services work to partners. As Zuora has scaled, it has also been able to ramp up its third-party vendors and resellers to take on more of the unprofitable services/onboarding work that typically acts as a drag on software-company margins. Zuora's mix of subscription versus services revenue has grown over the past several quarters, helping boost gross margins and illustrating where Zuora would prefer to be at scale.

- Acquisition possibility, especially after the company hit breakeven. While I never like to base any investment decision based on high hopes that the stock will get acquired, Zuora checks off a lot of boxes for being acquired: it's small with just a ~$1 billion market cap; it offers a very unique product that many larger software companies may want to get their hands on, especially during times when organic growth is fading; and it has positive pro forma operating margins.

And of course, a cheap valuation remains the #1 reason to buy into Zuora. At current share prices just north of $9, the stock trades at a $1.24 billion market cap. After we net off the $386.3 million of cash and $210.4 million of debt on Zuora's most recent balance sheet, the company's resulting enterprise value is $1.06 billion.

Meanwhile, for the current fiscal year FY24, the company has guided to $428-$440 million in total revenue, representing a range of 8-11% y/y growth (considering Zuora is exiting Q4 at a 14% y/y growth rate, it's more likely for Zuora to land on the high end of this range or eventually boost it).

Zuora outlook (Zuora Q4 earnings release)

Nevertheless, at the midpoint of Zuora's latest range, the company trades at just 2.4x EV/FY23 revenue.

My price target for Zuora is $11.50, representing a 3.2x EV/FY23 revenue multiple and ~25% upside from current levels. Stay long here and buy into Zuora for a relatively safer, cheap entry point in a volatile market.

Q4 download

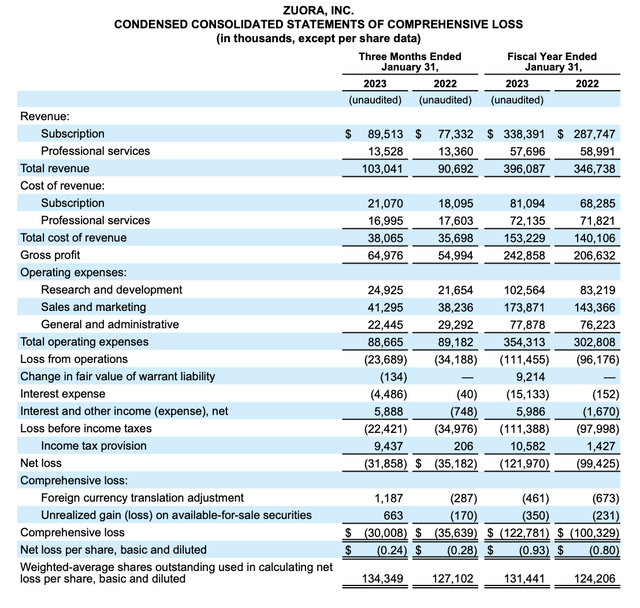

Let's now go through Zuora's latest quarterly results in greater detail. The Q4 earnings summary is shown below:

Zuora Q4 results (Zuora Q4 earnings release)

Zuora's revenue in Q4 grew 14% y/y to $103.0 million, beating Wall Street's expectations of $100.2 million (+11% y/y) by a three-point margin. Note that Zuora's total growth did not decelerate at all from its 14% y/y growth pace in Q3, and that subscription revenue growth at 16% y/y indexed higher than the company total. ARR also grew at 16% y/y to $365.0 million, which we note represents 83% of the high end of Zuora's guidance range for FY24.

As the company continues to focus on profitability and more efficient growth, it's leaning in on its partner ecosystem and system integrator strategy. Per CEO Tien Tzuo's remarks on the Q4 earnings call:

Finally, systems integrators partnership are a big part of our land and expand strategy. In the last fiscal year, our partners consistently brought us into bigger deals. In the last fiscal year, as an example, partner sourced new business deals were 3x larger than those deals that came without a partner. And those partner sourced deals have 3x better post rates. In Q4, almost 80% of all new business deals were partner influenced with the highest average selling price to date.

And finally, I'm proud to say we now have over 900 certified consultants helping to bring us into these larger deals."

Management noted on the go-to-market front that customers' uncertainty stemming from the current macro strains have started to normalize in the fourth quarter, as evidenced by some delayed projects pushing toward completion at the end of the year.

The company's more favorable revenue mix into subscription revenue also helped boost pro forma gross margins to 68%, two points higher than 66% in the year-ago quarter.

Pro forma operating margins of 2% also came in three points better than -1% in the year-ago Q4, and Zuora's guidance for FY24 implies pro forma operating margins jumping up to as high as 7% this year.

Key takeaways

There's a lot to like about Zuora as we continue to navigate through a challenging market in 2023. With such an undemanding valuation, Zuora to me represents a guilt-free investment in the face of much stronger bond and cash yields.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ZUO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.