Acomo: 5.6% Dividend Yield Fair Compensation Until Price Appreciation

Summary

- Acomo N.V. focuses on trading, processing and distributing food products with nuts as a specialty.

- The company closed a large acquisition about two years ago, and the net debt level is slowly decreasing.

- As interest rates are increasing, Acomo's net income and free cash flow results are impacted.

- I expect a flat performance in 2023 from Acomo.

- Looking for a helping hand in the market? Members of European Small-Cap Ideas get exclusive ideas and guidance to navigate any climate. Learn More »

Mariia Polskaia

Introduction

Acomo N.V. (OTCPK:ACNFF), previously known as Amsterdam Commodities, is a Dutch company focusing on the sourcing, trading, processing, and distribution of food products. In my previous article about Acomo, published in January, I compared Acomo to the Dutch East India Company, which had a similar business model.

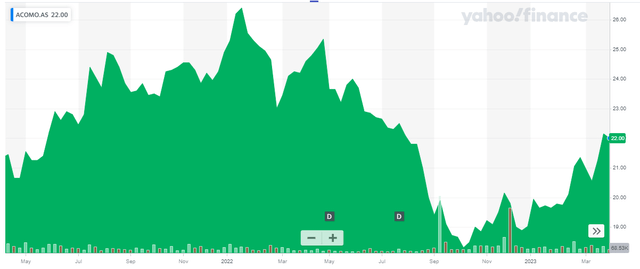

Acomo's main listing is on Euronext Amsterdam, where it is trading with ACOMO as its ticker symbol. The average daily volume in Amsterdam is approximately 23,000 shares per day, and that makes the Dutch listing clearly superior in terms of volume. The company ended 2022 with 29.6M shares outstanding. This results in a market capitalization of almost 650M EUR based on the current share price of just under 22 EUR per share.

This article is meant as an update on a previously published article, which you can read here. That article also provides background information on the company and its recent large acquisition, which caused the net debt to increase.

The cash flows remain strong, but I do not anticipate FCF growth in 2023

As Acomo only provides detailed financial statements every six months, I was looking forward to seeing the company’s full-year results as that allows me to have a closer look at the H2 performance.

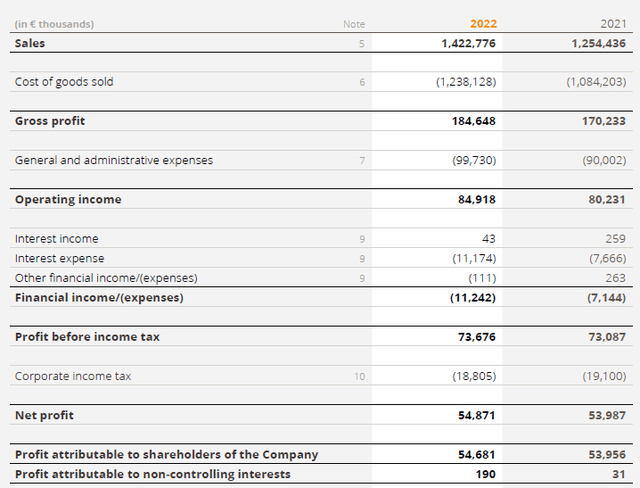

In the entire financial year, Acomo reported a total revenue of just over 1.4B EUR, resulting in a gross profit of just under 185M EUR. This compares quite well with the results in 2021, and although the margins came under pressure, the gross profit margin of approximately 13% in 2022 was only slightly lower than the 13.5% recorded in FY 2021.

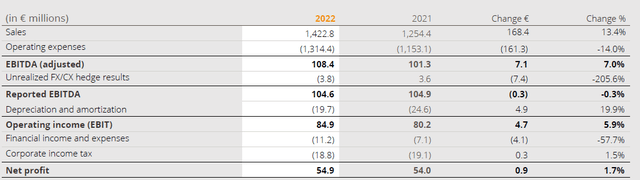

It’s also hardly a surprise to see other operating expenses increase as well. The higher G&A expenses were expected, while the higher net interest expense shouldn’t come as a surprise, either, as the large acquisition of Tradin Organics USA LLC from SunOpta was partially financed with debt. While the interest expenses increased by more than 50% in the second half of the year (the net finance expenses were less than 4M EUR in the first half of 2022), the increasing interest rates on the financial markets will likely continue to keep the pressure on the interest expenses and Acomo’s financial performance. Additionally, the pressure from inflation had a negative impact on the consolidated EBITDA as well. I expected Acomo to be in a position to beat last year’s 105M EUR EBITDA, but the 2022 performance was pretty flat with a 104.6M EUR reported EBITDA. Looking at the adjusted EBITDA result, Acomo did perform better than in 2021

That being said, we can’t be unhappy with the reported net income of 54.7M EUR, which works out to 1.85 EUR per share. Acomo will pay a dividend of 1.25 EUR per share (subject to the standard Dutch dividend withholding tax of 15% for foreign investors), which means it will retain about 60 cents per share in earnings.

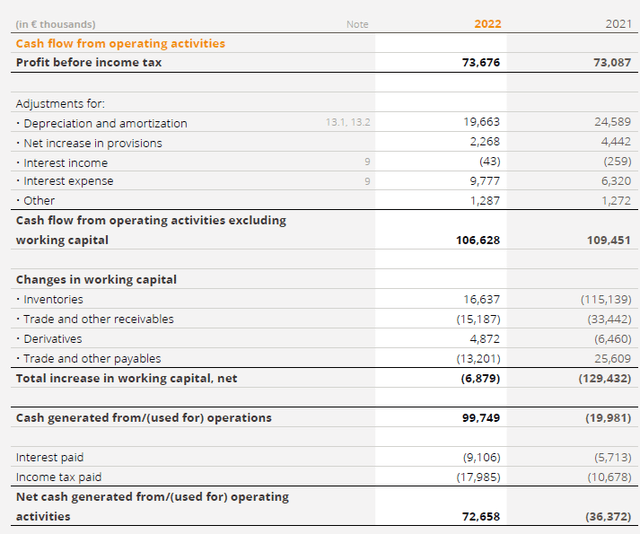

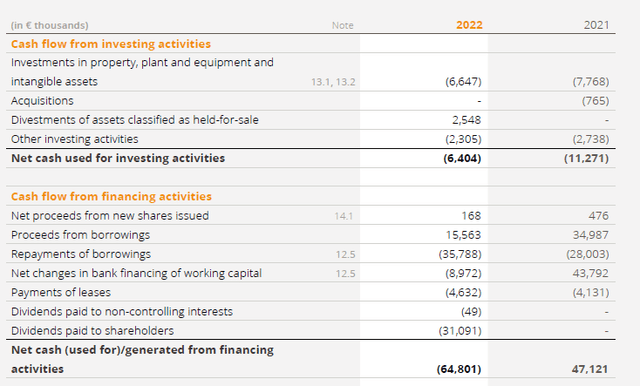

As I would like the company to reduce its net debt more aggressively, the cash flow result is very important. Fortunately, we know the total capex (investments and lease payments) are traditionally lower than the depreciation and amortization expenses. This trend continued in 2022.

As you can see above, Acomo reported a total operating cash flow of 72.7M EUR, including a 6.9M EUR investment in the working capital position. That being said, Acomo also owed about 0.8M EUR more in taxes than it has paid, so on an adjusted basis, the operating cash flow came in just below 79M EUR.

I should also deduct the 4.6M EUR in lease payments from this number, and this means the underlying operating cash flow was approximately 74M EUR.

We also know the total capex was just 6.65M EUR, resulting in an underlying free cash flow result of in excess of 67M EUR. Divided over the current share count, this represents about 2.27 EUR per share. That’s slightly lower than in 2021, and we can blame the increased interest expenses for that. I do expect the total interest expenses to increase again this year as the impact was pretty benign in the first half of last year.

As the company is proposing to pay a dividend of 1.25 EUR per share, it will retain approximately 30M EUR in free cash flow ("FCF") on the balance sheet (in theory, as a small portion had to be used to cover working capital needs as well) and a lower net debt and gross debt level will obviously help to keep the further increase of the interest expenses relatively limited.

As of the end of 2022, Acomo had just 5M EUR in cash while it had 163M EUR in current financial debt and 120M EUR in longer term financial debt for a total of 278M EUR in net debt. Considering the adjusted EBITDA (excluding lease payments) was approximately 100M EUR, I am not too concerned about the debt ratio, which came in below 3.

Investment thesis

Based on the full-year results for 2022, Acomo N.V. is still trading at a free cash flow yield of in excess of 10%. I do not anticipate a substantial increase this year, as higher interest expenses will likely absorb the increasing EBITDA I am anticipating for this year.

This likely means both earnings and free cash flow performances will be flat, but as investors get a fully covered 5.7% yield (with a payout ratio of 68% of the earnings and 55% of the adjusted underlying free cash flow), shareholders are rewarded nicely while waiting for the net impact of interest rate increases to decrease.

I currently have no position in Acomo N.V., but I still have the company on my shortlist to consider a long position.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.