Don't Put All Of Your Eggs In One Basket

Summary

- I currently have 50% of my portfolio invested in REITs and private real estate.

- That's because I have rare personal expertise (35 years of experience in real estate investing).

- Even though I have significant capital invested in REITs, I consider diversification a must because it provides the free lunch of improved return and risk characteristics.

- What percentage of REITs do you own?

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

RomoloTavani/iStock via Getty Images

Happy Easter!

The only investors who shouldn’t diversify are those who are right 100 percent of the time. Sir John Templeton

As I pointed out in my weekend blog, I’m in Charleston, SC for some much-needed R&R with my family, taking “time to energize before commencing on a road trip for our new REIT ETF Index and to launch a series of private REITs.”

One other detail worth mentioning, I’m just about finished with the manuscript for my new book, REITs for Dummies, that should hit the shelf this summer.

I’m extremely excited to get the book published, so investors from all over the globe can learn more about the wonderful world of REITs.

As much as I love REITs, I think it’s extremely important to remind readers of the importance of diversification.

I currently have around 50% invested in REITs and CRE (commercial real estate) and the reason I justify the exposure is because I have rare personal expertise (35 years of experience in real estate investing) which means my skills allow me to generate market-beating returns.

Even though I have significant capital invested in REITs, I consider diversification a must, because it provides the free lunch of improved return and risk characteristics.

There’s really no definitive target asset allocation for REITs, as I remind folks regularly, personal preferences play a key role in portfolio allocation decisions.

The most important thing to remember is that the investor must adopt their own allocation targets that dovetail with their own personal risk tolerance level.

Also, to piggyback on the topic of risk tolerance, time horizon is one of the most influential variables in structuring portfolios.

Investments are generally broken down into two main categories: stocks (riskier) and bonds (less risky). The longer the time horizon, the more aggressive, or riskier, a portfolio an investor can build.

The bottom line is that unless the investor is committed to a particular portfolio structure, failure looms.

Now, I know that it’s Easter and many of you will be enjoying weekend festivities that include hunting for easter eggs. That’s fine, but when it comes to investing in stocks, always remember not to put all of your eggs in one basket.

3 Beaten Down REITs

I decided to provide readers with an update on three of my worst-performing REITs (in my portfolio). Fortunately, I have maintained responsible diversification, so these three picks have not been terribly devastating, and I continue to monitor them very closely. All three picks are yielding 10% to 14%.

Medical Properties Trust (MPW)

As viewed below, MPW has fallen by 27% year-to-date:

That’s not what you would necessarily call a “sleep well at night” pick, right?

I’m sure more readers know by now what’s causing the volatility with MPW… a combination of high leverage (recently S&P downgraded from BB+ to BB), tenant concentration (with Steward), and earnings deterioration (mid-point of $1.57 per share represents a 13.7% decline in NFFO from 2022 levels).

A few days ago, MPW announced it was exiting Australia via the sale of the Healthscope portfolio to HMC Capital for A$1.2 billion ($803.1 million). HMC Capital, which manages HealthCo, will raise $125 million in new equity to help fund its commitment, while HealthCo is planning to raise $325 million.

MPW purchased the Australian assets for $897.9 million and it was funded with an $837 million Australian term loan in July 2019 (balance as of Feb 2023 was $851 million). Thus, it appears MPW could take an accounting loss of ~$48 million.

Nonetheless, the news is positive, as MPW could reduce its short-term debt maturities, as the Australian debt is one of the largest maturities in 2024. MPW has already stated it has ample cash to cover the 2023 maturities via the sale of the Connecticut portfolio ($300 mm) and Steward repayment ($150 mm).

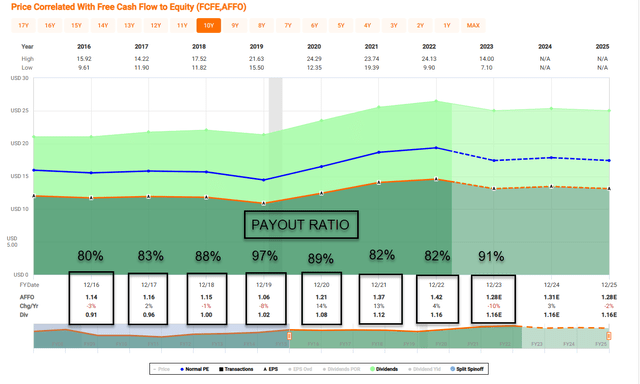

As viewed below, MPW’s payout ratio is around 91%, although the company has seen an elevated payout ratio in the past (was 97% in 2019). Although the Australian portfolio divesture will likely put the payout ratio closer to 95%, we’re generally a fan of debt reduction.

More recently, MPW announced it was suing “research” firm Viceroy for its “false accusations” which could spark a short squeeze. Our team looks at all short sellers seriously recognizing that there could be valuable clues that we’re missing.

A few weeks ago we downgraded MPW to a Spec Buy given the elevated payout ratio and debt maturities; however, we’re happy to see the latest news related to Australia and the lawsuit.

MPW is now trading at $8.10 per share with a dividend yield of 14.3% and a P/AFFO of 5.9x (AFFO yield is a whopping 17.1%).

Although iREIT considers MPW a speculative position, we suggest averaging to lower the cost basis. Debt maturities for 2023 and 2024 are manageable and the “mission critical” investment thesis is intact.

Innovative Industrial Properties (IIPR)

As viewed below, IIPR has fallen by 28% year-to-date:

Once again, this is not what I would call a SWAN?

Similar to MPW, IIPR also has high operator concentration with a total of 29 tenants. Their largest tenant, PharmaCann, makes up 13.1% of their invested capital, followed by Parallel at 8.7% and Ascend Wellness at 8.7%. In all, their top 10 tenants make up 73.5% of their invested capital.

However, IIPR’s debt metrics are exceptional with a Debt to Gross Assets at ~12% and a Debt Service Coverage ratio of 15.5x. All of their debt is unsecured, and all debt is fixed rate.

They have $306.4 million in total debt with a weighted average interest rate of 5.46% and a weighted average until maturity of 3.4 years. No debt matures until 2024 and the majority of their debt matures in 2026. As of the fourth quarter of 2022, they have a BBB+ credit rating by Egan Jones.

IIPR has commenced litigation for recovery of damages and possession against Green Peak at the Summit property in Michigan. Green Peak is current on their rent obligations at all other properties.

In addition, IIPR has filed two actions against Parallel for possession and damages at the Pennsylvania property, as well as an action at the Parallel Texas property. As for Kings Garden, they continue to occupy and pay rent for four properties and are exploring a potential merger transaction.

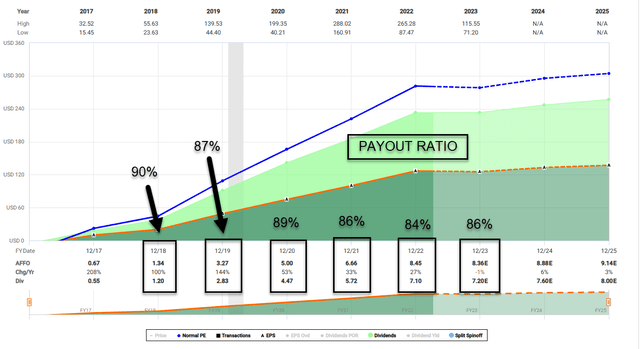

As viewed above, IIPR has maintained a sound payout ratio (less than 90%) and the company continues to target a dividend payout ratio of 75% to 85% of AFFO. For Q4-22 the payout ratio was 85%.

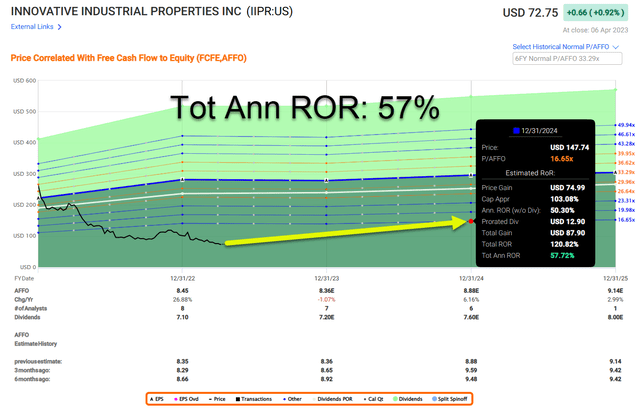

As viewed below, IIPR is cheap – shares are now trading at $72.75 with a dividend yield of 9.9% and P/AFFO multiple of 8.6x (AFFO yield is 11.6%). Once again, IIPR is a spec Buy, which means we recommend modest exposure.

Blackstone Mortgage (BXMT)

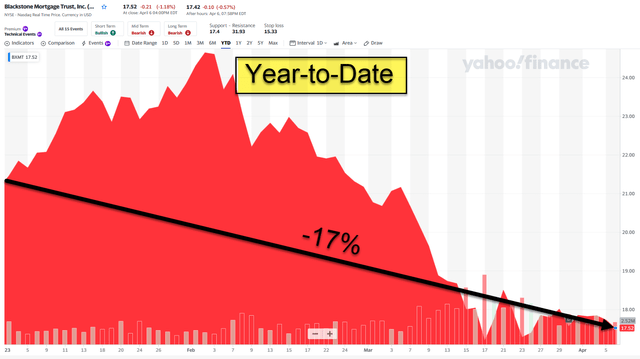

As seen below, BXMT shares have tumbled 17% year-to-date:

Much of the sell-off relates to BXMT’s 40% office loan exposure; however, 54% of these loans have an average vintage of 2021 and an average origination LTV of 60%.

34% of the office portfolio, most of the remainder, carries one or more significant credit enhancing qualities, such as particularly low leverage, high debt yield, location in high growth Sunbelt markets or material additional sponsor equity commitment.

BXMT’s four and five rated office loans round out the rest and represent only 5% of the overall portfolio - a small fraction where the mREIT has meaningfully increased reserves to account for the credit challenges. BXMT’s overall loan portfolio is 97% performing.

BXMT’s distributable earnings covered the dividend of 116% over the course of the year and 140% in Q4-22, allowing ample dividend coverage and a wide range of credit scenarios.

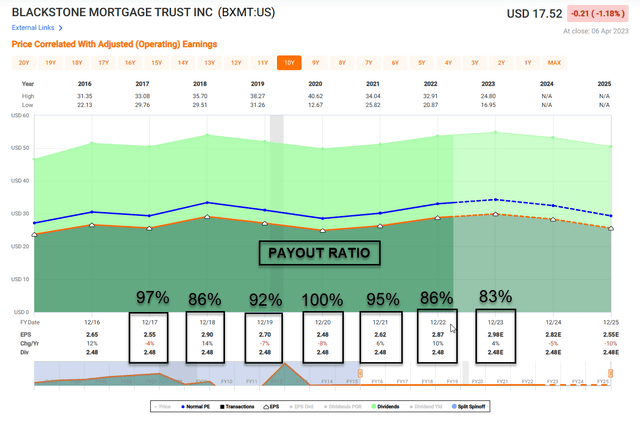

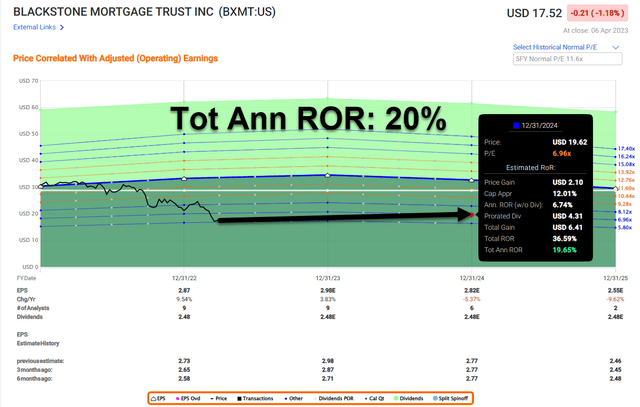

As viewed below, BXMT is cheap – shares are trading at $17.52 with a dividend yield of 14.2% and P/E multiple of 6.1x. BXMT is a Tier 1 mREIT that we believe could return 20% annually.

In Closing...

Benjamin Graham said,

"Diversification is an established tenet of conservative investment."

He also said,

"There is a close logical connection between the concept of a safety margin and the principle of diversification."

Joel Greenblatt said it best,

"Here is part of the tradeoff with diversification. You must be diversified enough to survive bad times or bad luck so that skill and good process can have the chance to pay off over the long term."

I look forward to seeing how many REITs you own...

Thank you for the opportunity to be of service.

Subscribe to Get the Sweet 16 REIT Report

When you subscribe to iREIT on Alpha you will get a free copy of our Sweet 16 REIT report in addition to access to all of our tools and resources.

Also, every new member will get a free copy of my new book, REITs For Dummies (summer 2023). Take the 2-week FREE trial and I can assure you that you will enjoy being part of the iREIT family.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 100,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 108,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Analyst’s Disclosure: I/we have a beneficial long position in the shares of BXMT, IIPR, MPW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.