The Softer Side Of Artificial Intelligence

Summary

- AI software companies are in the news with heightened momentum and volatility since the recent unveiling and notoriety of ChatGPT.

- There is tremendous future potential for several AI software companies to recognize substantial revenue and earnings growth from this disruptive technology, yet risks abound.

- I review several of the larger names and also discuss a few speculative, smaller companies that offer AI software solutions and services.

PhonlamaiPhoto

When my late maternal grandfather, Merrill Flood, PhD, was working under General Eisenhower in the War Department (later renamed the Department of Defense) in the 1940s, he was said to have coined the term "software". He claimed that he came up with the name to describe the softer "bits" of a computer versus the hardware that makes up the majority of the device. That name stuck and we now commonly refer to software as the integral "language" that allows computers to operate, perform computations, digest, and analyze data, and enables human-like behavior and decision-making.

Dr. Flood's research after the war at Rand Corporation and later at the University of Michigan, MIT, Princeton and other institutions, involved game theory and mathematical solutions to many different industries and social issues of the day, including research into human-computer interaction and what would later be termed "Artificial Intelligence". Some of his cohorts at the time included early researchers and developers of things like Cybernetics, first named and described by Norbert Wiener in his seminal book. His early thoughts on AI were included in the book:

"The mechanical brain does not secrete thought "as the liver does bile," as the earlier materialists claimed, nor does it put it out in the form of energy, as the muscle puts out its activity. Information is information, not matter or energy. No materialism which does not admit this can survive at the present day."- Norbert Wiener, Cybernetics (1948)

Information is information and that is what computers are especially good at processing. That is why we refer to computer scientists as being involved in Information Technology or IT. The AI aspect of software is the ability to encode human-like information processing into a computer using software programs or applications that digest enormous amounts of data and then use machine learning techniques to analyze and spit out an answer or solution. Britannica defines AI thusly,

artificial intelligence or AI, the ability of a digital computer or computer-controlled robot to perform tasks commonly associated with intelligent beings. The term is frequently applied to the project of developing systems endowed with the intellectual processes characteristic of humans, such as the ability to reason, discover meaning, generalize, or learn from past experience.

AI is the New IT Megatrend

As I discussed in my previous article on AI that focused on the supercomputing hardware needs for machine learning and language model processing, the recent megatrend in AI has suddenly risen to the forefront with the introduction of ChatGPT. There is a lot of hype around the potential for ChatGPT and other generative AI apps, and that has created some serious momentum in several AI software stocks.

The company that created this new AI app for the masses is called OpenAI and they are heavily backed by Microsoft (MSFT). In fact, MSFT has already incorporated the technology into its Bing search engine and Edge browser. According to CEO Satya Nadella:

"AI will fundamentally change every software category, starting with the largest category of all - search. Today, we're launching Bing and Edge powered by AI copilot and chat, to help people get more from search and the web."

The ChatGPT app is built using the GPT-4 large language model. The GPT-4 LLM was created by OpenAI and announced in March 2023 as an update to GPT-3. The GPT-4 model is a multi-modal input (accepting both text and images) model that exhibits human-level performance. The company is testing ChatGPT for text input with GPT-4 and currently has a waitlist for testers who are interested in trying it out. For image input, the company has developed DALL-E2 for generating realistic images.

The ChatGPT and GPT-4 models are language models that are optimized for conversational interfaces. The models behave differently than the older GPT-3 models. Previous models were text-in and text-out, meaning they accepted a prompt string and returned a completion to append to the prompt. However, the ChatGPT and GPT-4 models are conversation-in and message-out.

Microsoft has seen its share price rise more than 20% since the start of 2023, partly due to the momentum it is seeing from the AI revolution that is just getting started, and due to excitement regarding ChatGPT. In fact, it is pinning its bets on the prospect that AI will significantly accelerate the business for years to come based on their recent multi-million dollar investment in OpenAI. Although the benefits from AI to Microsoft are not discretely obvious yet, some believe that the AI megatrend that is just getting started will definitely lead to growth and that MSFT stock is currently undervalued despite its big YTD price jump.

Google AI Trends and Bard

Not to be outdone by MSFT, Google, whose stock is owned by parent company Alphabet (GOOG) has announced its own generative AI tool that they decided to call Bard. In fact, if you search (using Bing or Google) "Google AI", it brings you to the Google AI page which includes a description of Bard. The Bard webpage explains the reasons why Google announced it as an "early experiment" (which I have to believe was in response to the enormous excitement over ChatGPT), and it sounds eerily similar to Microsoft's reasons.

Bard is an experiment based on this same technology that lets you collaborate with generative AI. As a creative and helpful collaborator, Bard can supercharge your imagination, boost your productivity, and help you bring your ideas to life-whether you want help planning the perfect birthday party and drafting the invitation, creating a pro & con list for a big decision, or understanding really complex topics simply.

Bard is built upon a foundation of LaMDA, Language Model for Dialogue Applications. LaMDA is based on the early work of Google Research in 2017 that led to Transformer, a neural network architecture which other language models such as GPT-3 are also based on.

LaMDA builds on earlier Google research, published in 2020, that showed Transformer-based language models trained on dialogue could learn to talk about virtually anything. Since then, we've also found that, once trained, LaMDA can be fine-tuned to significantly improve the sensibleness and specificity of its responses.

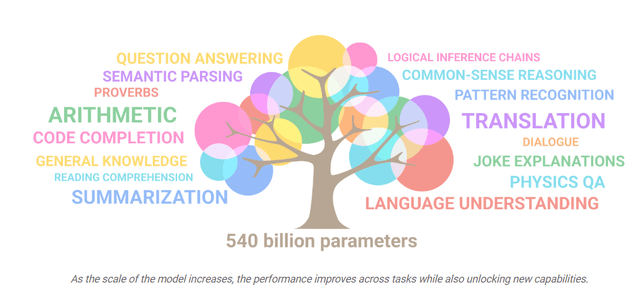

But Bard is not the only AI software solution that Google is betting on. They also introduced a new developer toolkit for AI applications, PaLM API & MakerSuite. This set of tools is intended to allow developers and customizers of generative AI technology to benefit from Google's AI models, and Google Cloud. One of those models is called PaLM, the Pathways Language Model, which supports up to 540 billion parameters, as illustrated in this graphic from the website.

The key to using this model is to be able to use "pathways" to train the model. If you really want to know how that works, I suggest you read more on their blog, but here is a brief summary:

PaLM demonstrates the first large-scale use of the Pathways system to scale training to 6144 chips, the largest TPU-based system configuration used for training to date. The training is scaled using data parallelism at the Pod level across two Cloud TPU v4 Pods, while using standard data and model parallelism within each Pod.

Meanwhile, Google recently announced a new fourth generation TPU chip for AI applications, TPU V4 that is optimized for use with PaLM on Google Cloud. Since this article is about software, I will not go into further detail except to say that it further demonstrates the commitment that Google has to advancing AI applications.

Google has a clearly defined focus on AI, and it is outlined in detail here. Essentially, they want to be the gatekeepers of the world's information and make it universally accessible and useful to everyone. Google, like others, believes that AI is foundational and transformational and has significant potential for positive social change, however, not without risks.

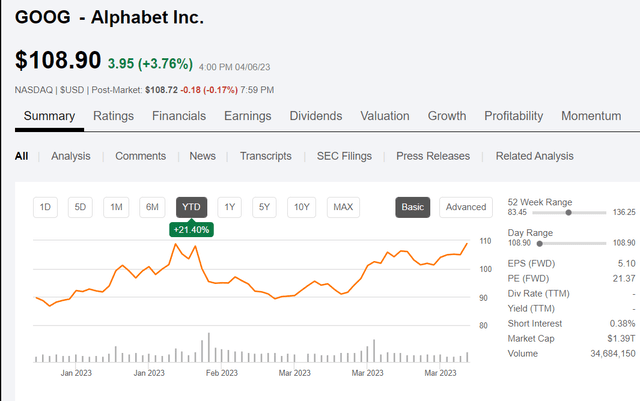

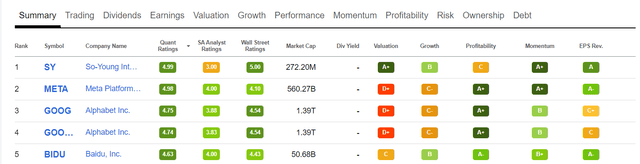

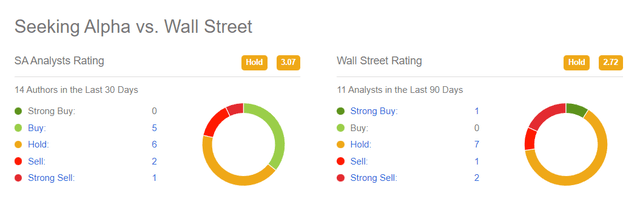

Like MSFT, GOOG stock has also benefited so far in 2023 with a more than 20% increase in price YTD. However, unlike MSFT, GOOG is still trading at just over 20 times forward earnings estimates (versus 31x for MSFT) due to the share price getting beaten down over the past year. Most analysts rate GOOG a Strong Buy and that is my belief as well with the AI-related businesses just starting to ramp up.

GOOG stock is ranked just behind Meta (META) in the SA Quant ranking system, and just ahead of Baidu (BIDU). The stock gets strong scores in Profitability but low Valuation and Growth scores. The share price could see a pullback after this recent rally if the market takes another turn down, so I would be cautious starting a new position until more clarity is revealed. The Q1 earnings report (expected April 27) should be an indication of what the next few months will bring to the table regarding forward earnings growth.

Who is C3.ai Really?

Another AI software company that has been in the news lately is C3.ai (AI). Perhaps because they were fortunate enough to acquire the AI ticker symbol, recognizing the potential for a growing megatrend to ensue, the stock is highly volatile and gets traded with heavy volume. Recent trading volume has escalated with over 60M shares trading hands on Thursday 4/6/23. The fact that a letter was sent on April 4 to Deloitte & Touche, C3.ai's audit firm, discussing the short report issued by Kerrisdale Capital a month earlier increased the volatility and the trading volume considerably. Since that time, the company has refuted the allegations of the short seller with a rebuttal posted on the company's website.

So, what sort of company is C3.ai really? Well according to their own company description, they provide enterprise AI software and services to accelerate digital transformation. Unlike the other chat-based applications from MSFT and GOOG, the software and services provided by C3.ai support the business value chain in an enterprise environment and address a number of high value AI applications including fraud detection, reliability, sensor network health, supply network optimization, energy management, customer engagement, etc.

There are industry solutions for a host of different industries including manufacturing, oil and gas, healthcare, utilities, financial services, government, retail, telecommunications, and transportation. The company claims to have customers with 24 different Fortune 500 companies with more than 120 applications deployed.

Although the company was founded by industry veteran, Tom Siebel, in 2009 it has undergone several transformations since then. Most recently, the company changed its name from C3 IOT to C3.ai in 2019. From the company's press release in January 2023 regarding the newest offering, C3 Generative AI, this description summarizes the products and services currently offered:

C3 AI is the Enterprise AI application software company. C3 AI delivers a family of fully integrated products including the C3 AI Platform, an end-to-end platform for developing, deploying, and operating enterprise AI applications, C3 AI applications, a portfolio of industry-specific SaaS enterprise AI applications that enable the digital transformation of organizations globally, and C3 Generative AI, a suite of large AI transformer models for the enterprise.

In a recent press release it was announced that C3.ai made the Financial Times list of fastest growing companies for the third year in a row, ranking #286 on the 2023 list. In a video interview on Yahoo Finance Live from March of this year, CEO Tom Siebel says that he believes that the AI software market will soon be a $600 billion addressable market.

Analyst ratings are all over the board when it comes to C3.ai stock. There is just 1 Strong Buy from Wall Street and a few Buy ratings from SA analysts, as well as lots of Hold and a few Sell ratings from both SA analysts and Wall Street analysts. Overall, I would rate the stock a Hold, at least until the short selling tapers off and investors can get a clearer picture of what the future earnings growth looks like.

Part of the issue with the stock performance is that investors initially got excited about the company's prospects in early 2021. You can see on the stock price chart from the company website how the price action shot up shortly after the company went public in December 2020 and then came crashing down, slowly starting to gain traction again now in 2023.

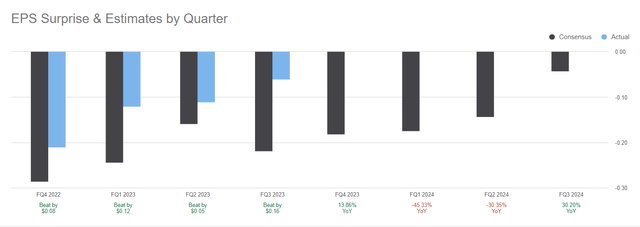

What investors are most interested in is future earnings growth. Recent history does indicate that earnings are improving but will not be positive until at least late 2024 or even 2025. Although revenues have been increasing each quarter for the past 2 years, negative earnings do not warrant a premium share price unless that trend appears to be changing for the better.

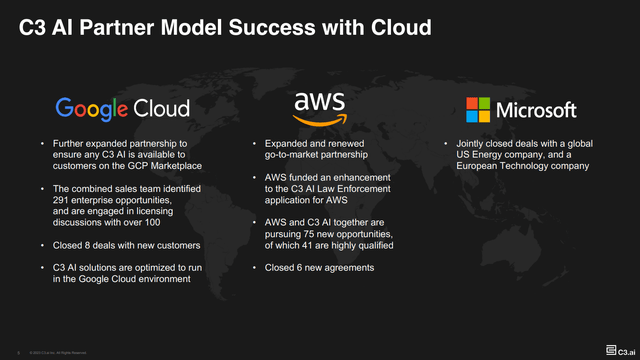

C3.ai partners with all 3 major cloud computing platforms, so that creates a win-win situation for Google, Amazon (AMZN), and Microsoft as well as for C3.ai. That bodes well for future AI application growth in the cloud environment, which is really the direction things have been heading for the past 7 years or so and looks to continue for the next decade.

In addition, the company partners with global system integrators like Booz, Allen, Hamilton; Ernst & Young; Accenture, and others; as well as industry partners such as Baker Hughes, Shell, Eni, Exxon Mobil, LyondellBasell (LYB), Petronas, Aramco, and more.

Now if the company can just start making some profits, they may be onto something good. The future looks promising but the leadership at C3.ai needs to start delivering soon. I rate the stock a Hold and own a small, speculative position in my taxable growth stock portfolio.

Other AI Software Stocks You May Not Know

If you follow the AI industry already then you may know more than I do about small companies that are involved in AI software applications. Although I have been involved in the IT industry for more than 40 years, I have not been directly involved in research or development or implementation of AI solutions. I do, however, have the ability (not using AI, but using SA) to perform research and I have uncovered a couple of companies in the AI software industry that I would like to mention. I think it might be interesting to ask ChatGPT to list other public AI software companies, but I will let one of my readers do that and let me know what they find.

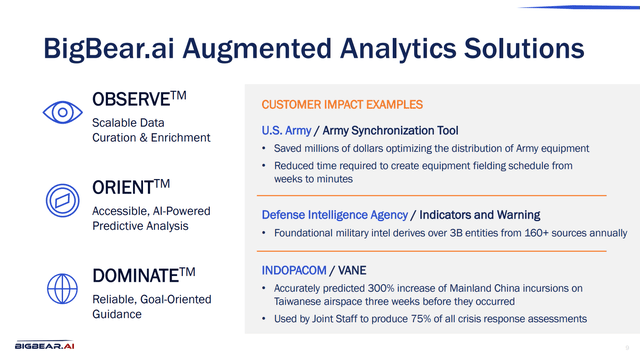

First up is BigBear.ai (BBAI), headquartered in Columbia, Maryland with 665 employees and a market cap of about $350M. According to the July 2022 investor presentation, BigBear.ai has a 22-year history and relationships with the US Navy and other DOD and Intelligence agencies. They are growing revenues at a rapid clip, and they see a $310B addressable AI/ML market opportunity by 2026.

The company has strong financials with approximately 30% YOY revenue growth and gross margins in the 60% to 70% range. Commercial sales have grown from about 1% in 2021 to over 10% in 2022. The strategy they have developed working with the DOD has enabled them to extend their software and services into the commercial market where they see additional opportunities.

In January, the company landed a 10-year multiple award $900 million IDIQ contract with the US Air Force sending their stock skyward. And what I found really interesting is this language that was included in the contract:

Under the terms of the contract, BigBear.ai can also compete for task orders supporting the research and development of new technologies, creation of rapid prototypes, capability testing, and solution implementation.

In other words, this opens the door for BigBear.ai to develop all sorts of new and innovative AI solutions for not just the USAF, but then they can turn around and sell it to their commercial customers too. It is indeed a huge win for this small company that is on the cutting edge of AI technology.

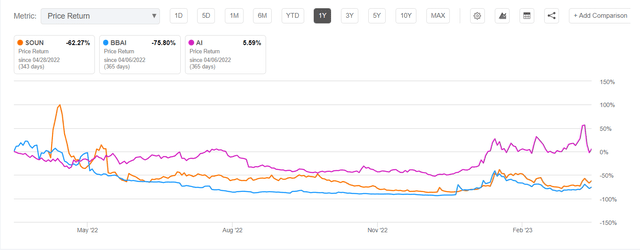

Over the past 1 year the stock price is down -75%, however YTD the stock has risen by more than 240%.

Another small publicly traded AI software company that I came across in my search is SoundHound AI, Inc. (SOUN). SoundHound AI sounds very interesting to me. They were founded in 2005 and are currently headquartered in Santa Clara, CA (i.e., Silicon Valley). They have 430 employees, and their mission is simple - to add voice AI to everything.

The co-founder and CEO, Keyvan Mohajer says on their website:

"We believe every product and service should be voice-enabled and that every person should have the same access to technology through a simple interface. Voice AI is part of that promise, making life simpler, more convenient, and safer for more people."

The Why SoundHound page explains in vivid detail why you would want to implement their Voice AI solutions. I mean, who would not want to process speech like the human brain using computers?

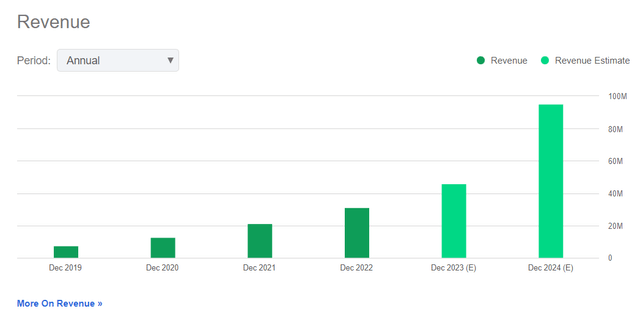

I think this is a very compelling niche application of AI software that has relevance in many businesses and industries, and I feel that SoundHound AI has a very good chance of capturing significant market share. The revenue growth has already been quite impressive from less than $8M in 2019 to more than $31M in 2022 and an estimated $95M in annual revenues by 2024.

The share price has seen a similar pattern over the past year to the other two AI software stocks that I described in previous paragraphs - AI and BBAI. An initial spike in April 2022 after the company went public via a SPAC, followed by a long descent during the remainder of 2022 followed by a slight resurgence in Q1 2023.

These companies - AI, SOUN, BBAI, may all have very big futures ahead of them and the federal government is starting to worry. The US Chamber of Commerce recently issued a 14-page report on the potential need for regulations in the AI software industry, specifically calling out companies like the ones mentioned in this article. The report is titled, Commission on Artificial Intelligence Competitiveness, Inclusion, and Innovation. In that report it states that the AI industry is expected to contribute to $13 trillion in economic growth by the end of this decade. The Foreword of the report includes the following text:

Artificial intelligence (AI) is increasingly used by all important actors in every aspect of our economy and society, both domestically and globally. Yet in many ways, in terms of technology, economic impact, and AI policy development, we are in the initial stages of a new age. By the end of this decade, AI is projected to increase global economic growth by $13 trillion.

AI is already having a positive impact by helping hospitals address nursing shortages through patient monitoring, helping emergency management officials map wildfire paths for quicker and better responses, and broadening financial inclusion by expanding job applicant pools and new avenues of credit. As with any innovative technology, important concerns have been raised as well.

Another issue raised in the report is competition with China over AI development and concerns over national security, etc. With recent news from Alibaba (BABA) getting ready to launch their own ChatGPT-like chatbot, those concerns may well be valid. Issues surrounding the current state of US-China relations could negatively impact AI software companies due to heightened concerns regarding risk, and it is also a caution for investors to be aware of when you are considering AI software stocks regarding potential competition from the likes of BABA, BIDU, and other Chinese software companies.

One other point to note for potential investors is the recent increased volatility in all 3 of the smaller names mentioned - AI, BBAI, and SOUN. All 3 are considered speculative opportunities that are seeing a lot of wild gyrations in price in recent days, both up and down. This recent note from Yahoo Finance discusses some of the potential reasons for this sudden increase in the attention being given to AI stocks and it is summarized by pointing to two factors - momentum and uncertainty. Therefore, I suggest that investors proceed cautiously if you do decide to invest and go in with eyes wide open to the potential upside as well as the risks of this disruptive new AI technology.

I hope you enjoyed reading this treatise as much as I enjoyed researching and writing it. Please leave comments as appropriate if you have something to contribute or would like clarification on my views.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have a small speculative position in AI. This article is not intended to provide investment advice but rather is offered as a starting point for further research.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.