Carlisle Companies: An Attractive Entry Point

Summary

- Carlisle Companies Incorporated is trading at a very low valuation given the quality of the company and the revenue they are generating.

- With a dedication to providing shareholders with value through either dividends or buybacks, I think there is a long-term case to be made here.

- Given the industry's positive growth outlook and the quality of the company mentioned, I will be rating them a buy for now.

onurdongel

Investment Summary

Carlisle Companies Incorporated (NYSE:CSL) is an American diversified industrial company that operates through four different business segments. The company provides roofing systems, waterproofing solutions, and insulation products for commercial and residential buildings through Carlisle Construction Materials. This diversification has led the company to have impressive top-line growth, increasing almost 2x since 2016, whilst also buying back a lot of shares and increasing shareholder value.

The company is trading at a very low valuation right now and I think the risk-to-reward ratio is very favorable. Trading at a forward p/e of 10 whilst earnings estimates remain solid I think makes for a good investment case right now. As mentioned, the company holds a priority to give value to shareholders by either buybacks or distributing a dividend. With a solid balance sheet and fundamentals, I think the company is at a good entry point for interested investors looking for exposure to the broader materials sector.

Catalyst

The building products industry is expected to experience continued growth in the next several years. As shown in the report by Research And Markets the CAGR between 20220 and 2030 is expected to be about 5.5%. Given the position of CSL and its strong ability to capitalize on demand and successfully deliver makes me believe it will be able to least grow at the same rate as the industry.

Market Outlook (Research and Markets)

The company has a strong history of buying back shares which I think will further help increase the bottom line at more than a 5.5% rate. If the company then rises to the same valuation as the rest of the sector there is a lot of value to be had here in my opinion. The US might have experienced a slight slowdown in building permits compared to 2022, but it still remains strong. As we enter a slowing economy I can see there being some challenges ahead for CSL but the US still has an issue with affordable housing and it seems more buildings need to be constructed, which of course is directly beneficiary to CSL.

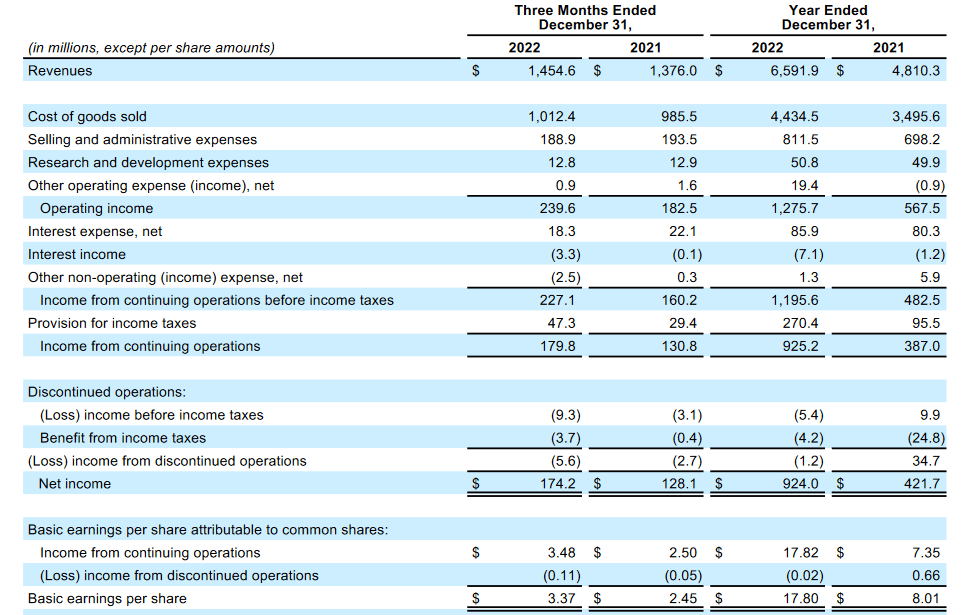

Quarterly Result

Carlisle Companies Incorporated, a diversified industrial company based in the United States, has reported strong financial results for the year ending December 31, 2022 in my opinion. The company's revenues increased from $4.81 billion in 2021 to $6.59 billion in 2022, which is a remarkable 37% YoY growth.

Income Statement (Earnings Report)

As a side note, the interest expense increased by 7% YoY, which could impact the company's net income in the long run. It's comforting to see that the increase in interest expenses hasn't taken a toll on the bottom line though. This makes me think the company is in a position to continue taking on more debt and solidifying its market position.

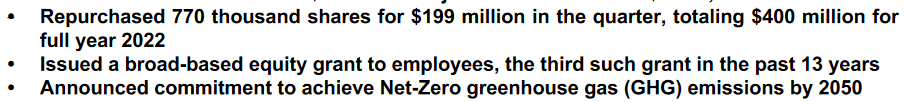

This resulted in basic earnings per share of $17.82, which is a significant improvement from $7.35 in 2021. This really highlights the quality of the management running the company and how they are able to massively increase top-line growth while also making that translate into even better margins.

Earnings Report Highlights (Earnings Report)

In conclusion, while Carlisle Companies Incorporated's financial results are impressive, the company should keep an eye on its cost of goods sold and selling and administrative expenses to maintain its profitability in my opinion. Nonetheless, the significant increase in operating income and income from continuing operations is an indicator of the company's strong ability to satisfy demand and generate immense revenues, and further strengthen its position. Moving forward I will be keeping an eye on whether commodity prices will have any meaningful impact on the net margins. Drastic changes in these prices could bring some inconsistency in the performance quarter over quarter, but looking at the big picture I expect the company to face those challenges successfully.

Risks

Building products companies face several risks that can impact their financial health and market position. One of the significant risks is the impact of economic cycles on construction activity. During a recession, demand for new construction projects can fall, leading to lower sales and revenue for building product companies. This can be challenging, especially for firms that have high fixed costs or rely heavily on a few key customers or markets. Moreover, fluctuations in raw material prices can impact profit margins and operational costs for building product companies. It hasn't been seen for CSL though as they were able to increase their bottom line at an unprecedented level and it seems they will be able to maintain it as well.

In the building products industry, competition poses a major risk to companies. With numerous players already in the market and new ones joining the fray, the competition is intense. To stay ahead of the competition and maintain or grow their market share, a company like CSL however I think has managed to make build up a strong reputation and customer base so that they can better handle competition compared to a smaller company not operating at the scale CSL does.

As mentioned in the last earnings report, Chris Koch the CEO had the following to say, “The past three years have been one of the most challenging operating environments in over a decade. By staying focused on our vision, delivering on our key initiatives, and developing exceptional talent globally, we continue to execute our plans, staying focused on the key pillars of Vision 2025. These pillars include: driving greater than 5% organic revenue growth annually”. After reading this I think the company rightfully recognizes the challenges the industry has had and that it remains strong despite this and that through this demand company like CSL is able to grow at impressive rates. It further cements the company's strong position.

Valuation & Wrap Up

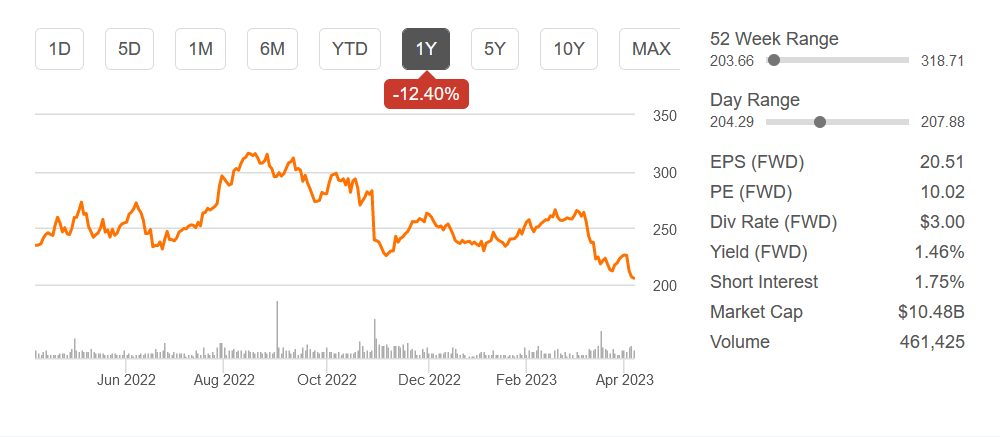

CSL stock is trading at a far bit below the sector's average p/e of 15 and whilst the sector's forward p/e is increasing, indicating a slowing level of revenues, CSL does the opposite and their forward p/e is at just 10. The company experienced a lot of growth in 2022 as mentioned before and they seem to be able to keep the top and bottom line and also slightly increase it in 2023.

The company has a strong cash position, that might perhaps not be able to cover the long-term debt of around $2.2 billion. But CSL generated over $800 million in free cash flow in 2022 which makes quite a dent in the debt they have. This makes the company able to run a very flexible balance sheet and they are in my opinion in a good position to make fast and strategic investments to further solidify their market position.

Stock Chart (Seeking Alpha)

As mentioned in the beginning, the company has a history of giving back to shareholders through either buybacks or dividends, and I think this is another reason why buying at these prices offers plenty more reward than risk. In the first few months of the year, there has been a run to high-growth companies in the technology sector, and companies viewed as safer like CSL have seen a decline instead. I think that when the trend shifts and investors realize companies like CSL are at a discount a more fair and higher valuation might present itself. Until then I will maintain a buy rating for the company.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.