What To Make Of Green Plains Partners' Juicy 14% Dividend Yield

Summary

- Green Plains Partners is a midstream company operating in the ethanol industry. The company owns the storage assets of its parent company GPRE.

- The company has a juicy 14% dividend yield, which is safe under normal circumstances, thanks to steady ethanol volumes, very low CapEx requirements, and a healthy balance sheet.

- As long as investors incorporate recession-related risks, GPP could add significant income to one's portfolio.

hudiemm/iStock via Getty Images

Introduction

By now, I believe that most of my readers know that I'm not a big fan of ultra-high-yielding dividend stocks. Most of them come with significant risks and barely any capital gains - if any at all. However, there is demand for high-income stocks for a wide variety of reasons. Hence, in this article, I want to give you a high-yielding stock that I've had on my radar for many years. However, until now, I never covered it. That company is Green Plains Partners LP (NASDAQ:GPP), the midstream partnership of ethanol giant Green Plains (GPRE), which I recently covered as well.

In this article, I will walk you through my thoughts on GPP's 14% dividend yield and the business behind it.

So, let's get to it!

What Is GPP?

Headquartered in Omaha, Nebraska, Green Plains Partners provides fuel storage and transportation services. In 2015, the company was created by Green Plains, one of America's largest ethanol producers. It has a $300 million market cap, which makes it a very small player in the midstream industry.

The company is a publicly traded master limited partnership. According to GPP (and the law in the US), partnerships are generally not subject to federal or state income tax. Instead, each partner is required to report their share of taxable income, gains, deductions, or losses on their individual income tax returns. Green Plains Partners' LP taxable income is reported to unitholders each year on Schedule K-1.

As of December 31, 2022, Green Plains owns a 48.8% limited partner interest in Green Plains Partners, consisting of 11,586,548 common units, along with a 2.0% general partner interest and all of the incentive distribution rights.

The remaining 49.2% of limited partner interest is owned by the public.

Green Plains Partners

GPP has a number of Commercial Agreements with GPRE, including minimum volume commitments, storage, and throughput agreements. For example:

"Under our storage and throughput agreement, as amended, Green Plains Trade is obligated to deliver a minimum volume of 217.7 mmg of product per calendar quarter at our storage facilities and pay $0.05312 per gallon on all throughput volume. The rate increased on July 1, 2020 from $0.05 per gallon to $0.05312 per gallon in accordance with the terms of the agreement."

Needless to say, GPRE is the biggest driver of sales. GPP generates more than 95% of its revenues from GPRE. While that number is unlikely to come down soon, GPP is consistently looking for ways to increase its footprint in the industry.

The company is also not impacted by competition, as it is basically the owner of GPRE's midstream assets.

That said, the company owns and leases 27 ethanol storage tanks and roughly 43 acres of land. These tanks are located close to GPRE's 11 ethanol plants in Illinois, Indiana, Iowa, Minnesota, Nebraska, and Tennessee. These facilities have a production capacity of 958 million gallons per year.

All of these assets are close to major rail lines. The total storage capacity is 25.1 million gallons.

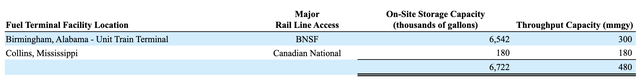

GPP also owns and operates two fuel terminals located in Alabama and Mississippi. These terminals have a combined total storage capacity of roughly 6.7 million gallons and are strategically positioned with access to major rail lines.

With that said, GPP is not a fast-growing business. However, that's OK, as the company has a high yield. It's an income play, not a growth stock.

What About Its 14% Yield?

GPP currently pays $0.455 per unit per quarter. This translates to $1.82 per year and a yield of 14.3%.

Just like its volumes, the dividend is consistent. However, during the pandemic, the company had to cut its dividend, as global energy flows were imploding.

In April 2020, the company cut its dividend by 75%. In October 2021, the dividend was hiked by 263%. Since then, the dividend has been raised a few times by low single-digits.

When dealing with a yield this high (or any dividend in general), we need to assess how safe this dividend is.

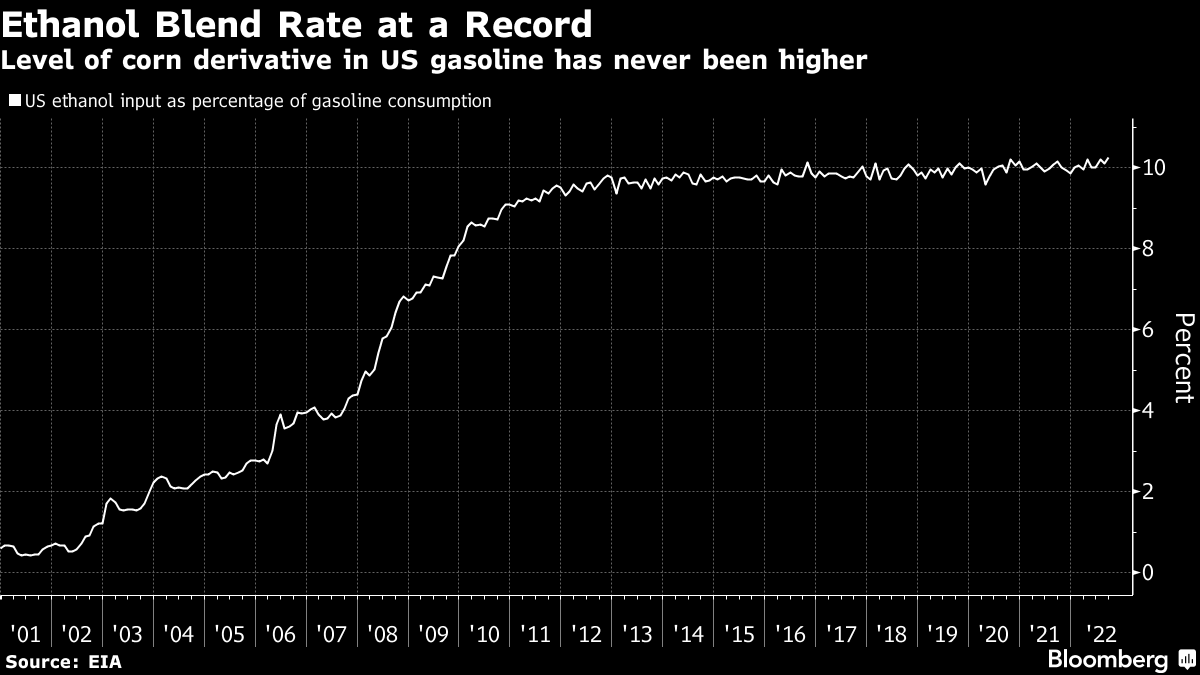

Generally speaking, I'm bullish on the ethanol industry. As I wrote in the aforementioned article on GPP's parent GPRE, the government is pushing for larger adoption of ethanol.

- The EPA proposed an RFS (renewable fuel standard) of 15-25 billion gallons per year, as it is pushing for higher ethanol blends.

- This proposal aims to allow the sale of E15 during the summer for the fourth straight year.

- E15 is only available at fewer than 2,700 gas stations in the United States.

On top of that, earlier this year, the governors of various corn-producing states, including Iowa and Minnesota, started pressing the EPA to stop giving E10 a pass from the volatility requirements in their states. This would put both E10 and E15 on the same footing. In other words, it would be great for ethanol sales.

Bloomberg

Buying ethanol midstream assets is a great way to benefit from long-term demand growth. While the upside is limited as well, the downside is somewhat limited as volatile margins aren't a big issue.

For example, in 4Q22, GPRE sold 225 million gallons of ethanol. This was up from 200 million gallons in 4Q21. It resulted in a revenue boost from $802 million to $914 million.

Unfortunately, high costs caused a net loss of $32 million. This is because ethanol producers are highly dependent on production margins. They need to buy corn and turn this into ethanol and byproducts. While they can hedge certain risks, they remain dependent on commodity costs - on top of demand risks. In some situations, this mix can be extremely profitable. In other situations, the company can end up losing money despite rising production.

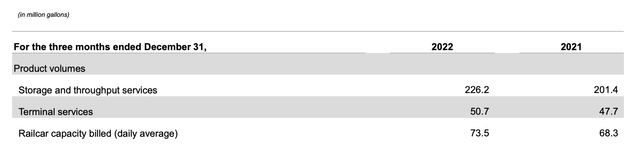

GPP was in a much better situation. The company's 4Q22 storage volumes were 226.2 million in 4Q22, up from 201.4 million in 4Q21. Terminal services saw 3 million more gallons. Railcar capacity was also up.

These volumes resulted in $20.9 million worth of sales.

Operating expenses were $9.7 million resulting in $11.2 million in operating income. After interest payments, net income came in at $9.6 million.

On a full-year basis, the storage and throughput volumes were roughly 16% higher than in 2021, coming in at 876 million gallons. The company expects to generate similar volumes in 2023.

So, what does this mean for dividend safety?

According to the company:

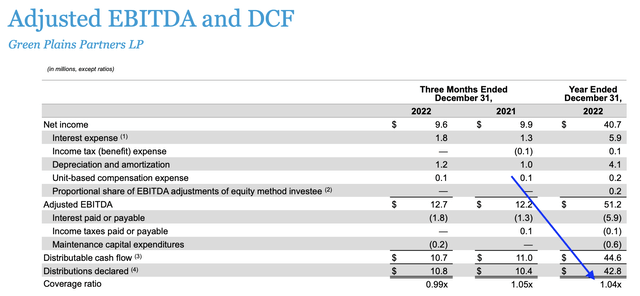

Over the last 12 months, the partnership produced adjusted EBITDA of $51.2 million, distributable cash flow of $44.6 million and declared distributions of $42.8 million, resulting at a 1.04 times coverage ratio, excluding any adjustment for the principal payments made in the in the past year.

The table below shows what this calculation looks like. On a full-year basis, the company generated $40.7 million in net income. Adjusted EBITDA was $51.2 million. This turned into $44.6 million in distributable cash flow after interest, taxes, and capital expenditures ("CapEx"). This covers 104% of dividends paid.

So, what does this mean?

- Under normal circumstances, the dividend is safe. If ethanol demand remains stable, the company can maintain its 14% yield.

- There is room for the dividend to grow if demand increases. The 2022 utilization rate was 93%. While this doesn't leave a lot of upside potential (100% is not possible due to maintenance needs), there is some margin for growth without the need to boost CapEx.

- The company has very low CapEx requirements.

According to the company:

Given the nature of our assets, we expect to incur only modest maintenance-related expenses and capital expenditures in the near future.

Unlike major midstream players that are heavily investing in new pipelines, storage facilities, and related infrastructure, GPP has everything in place.

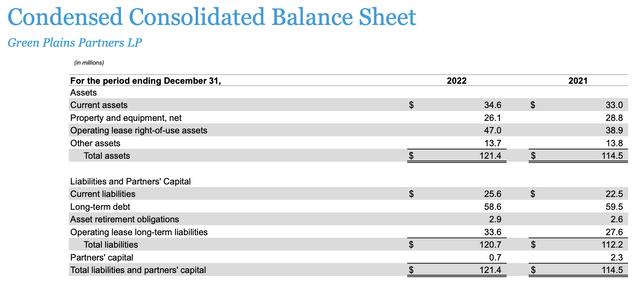

The balance sheet is also a part of dividend stability. It has $58.6 million in long-term debt. This is part of the company's Term Loan Facility. This debt matures in 2026. It's a LIBOR +8.00% term loan, which resulted in a 2022 interest rate of 12.77%. While this rate is high, the company's net debt ratio ended the year at 0.8x EBITDA, which is low. Moreover, because the total debt load is low, interest payments do not burden the company's ability to protect its dividend.

So, with all of that said, let's discuss how GPP performs versus its peers and its valuation.

Valuation & Performance

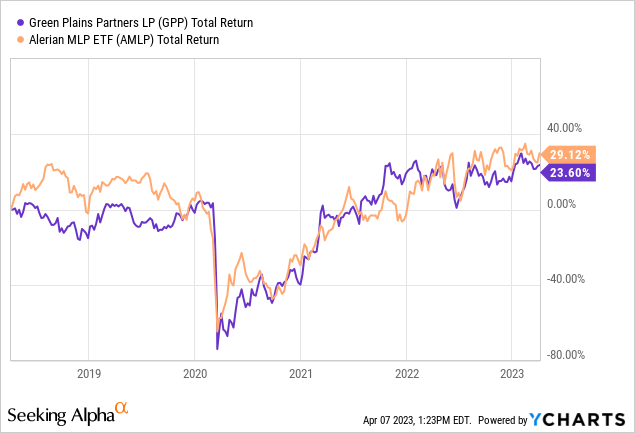

Over the past five years, GPP has performed slightly better than the ALPS Alerian MLP ETF (AMLP).

Over the past three years, GPP has outperformed this benchmark by 20 points.

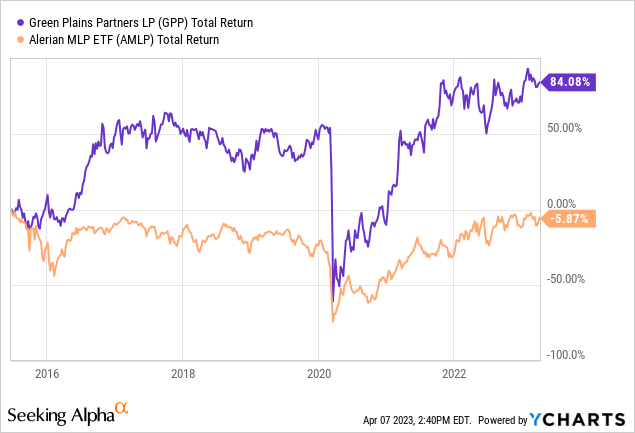

Since its IPO, the company has outperformed AMLP by a very wide margin. It only fell during the recession. AMLP had a rather consistent downtrend prior to the pandemic.

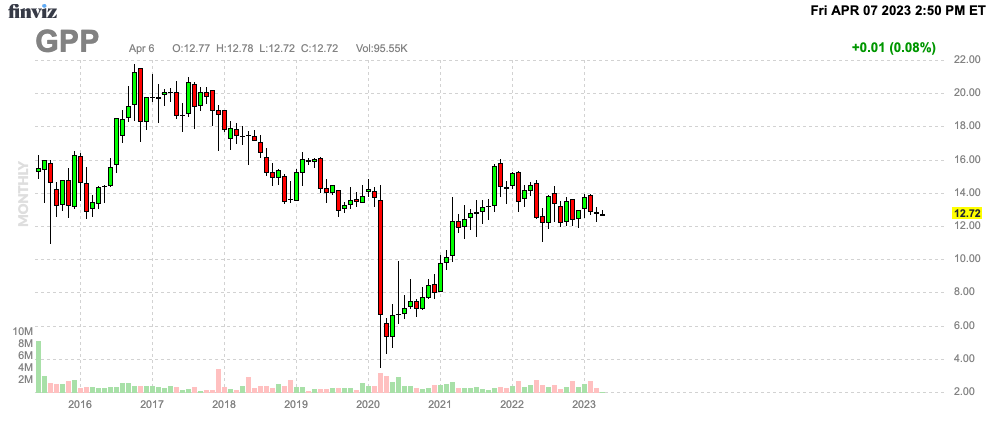

Valuation-wise, GPP is currently trading at 6.4x NTM EBITDA. I believe the stock is about 10% below what I consider to be fair value.

The current average price target is $15, which implies 18% more upside.

FINVIZ

That said, here's my takeaway.

Takeaway

Green Plains Partners is a very straightforward yet fascinating company. This Omaha-based company runs storage and related operations for its parent, the ethanol giant Green Plains.

GPP isn't a growth stock. While it has room to grow its operating cash flow, it is best seen as a cash cow.

Under current circumstances, the fat 14% dividend is sustainable. The company has very low CapEx requirements and a healthy balance sheet (despite a high rate on its debt).

A big pro is that GPP's income is rather stable. It makes money from ethanol flows and storage, and it did not suffer from the margin implosion of its parent company last year.

However, the company also has limited upside in a situation of rising ethanol margins, as its earnings are mainly dependent on flows and fees.

Furthermore, the biggest downside risk is slower economic demand for energy. In a recession, ethanol demand could fall, related to a decline in gasoline consumption. In such a scenario, we can assume that GPP will cut its dividend to protect its balance sheet.

That said, given its history and financials, economic rebounds will more than likely lead to a quick rebound in dividends.

So, while GPP is not without risks, it's a very decent way to get a big payout in the midstream industry. I put the stock on my watchlist and might add it if I require a higher income.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.