FedEx's $4 Billion Cost Initiative: A Discounted Cash Flow Analysis

Summary

- FedEx is consolidating all operating companies into one, generating an expected $4 billion in savings.

- An additional $2 billion is expected to be saved through 2027 via their DRIVE initiative.

- FedEx increased their yield by 10%.

- Price target of $300/share based on Discounted Cash Flow Analysis outlined below.

Joe Raedle

Investment Thesis

FedEx (NYSE:FDX) recently announced they will be consolidating their separate delivery companies into one company as part of a $4 billion cost savings initiative. Additionally, the company also raised their dividends by ~10% or .44 cents per share. In my discounted cash flow analysis, I assumed a base case scenario where growth is softening but FedEx is able to realize $4 billion in savings and maintain improved margins in my forecast through the consolidation efforts. My model calculates a price target of $300 for FedEx.

Consolidation and Cost Savings

The full consolidation is expected to be complete by June of 2024. The company will bring FedEx Express, FedEx Ground, FedEx Services and all other operating companies into Federal Express Corporation. The company is expected to generate $4 billion in savings in 2025. The cost savings are broken out below:

- $1.2 billion in Surface Network

- $1.3 billion in Air Network & International

- $1.5 billion in General and Administrative

Additionally, the press release mentions an additional $2 billion in savings by 2027 through their DRIVE initiative, which is their cost savings program. Below I take a look at how these cost saving initiatives effect my discounted cash flow model and compare the intrinsic value to the market value of FedEx given this updated guidance.

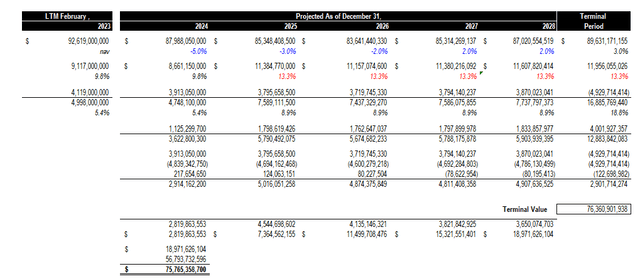

Assumptions and Model

To arrive at an implied enterprise value of the company, many assumptions are made but I will only go over the key drivers in my model. First, I focused on the revenue assumption for the next 5 years and into perpetuity for FedEx. For the first three forecasted years, I selected a -5%, -3%, and -2% growth rates in revenue for each year, respectively. I think this assumption is fair considering their guidance in the press release regarding softening revenues, and phasing out of the COVID delivery bubble. Additionally, I changed revenue growth back to positive in 2027 and 2028 by 2% each. Next, I implemented the $5 billion in cost savings in 2025, which changes the Adjusted EBITDA margin from 9.8% to 13.3% from 2025 to 2028. I think the raise in profitability margins is warranted given FedEx's consolidation plan will generate so much savings and synergies. Next, I looked at market data from Kroll and Capital IQ to arrive at a WACC of 6.8%. This analysis can be seen in my snapshot below:

Ultimately, my DCF analysis resulted in a market value of $75.7 billion, or ~300/share. Currently, FedEx is trading at ~$230/share or an implied value of $58.6 million. This implies that FedEx is trading at a 30% discount to market value and provides investors with a nice margin of safety when entering into the trade.

Risks

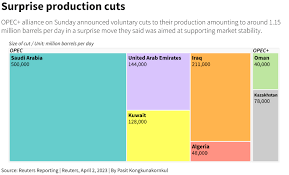

Last week, OPEC announced oil production cuts, with many other countries following suit. This oil production cut has reached as high as 1.5 million barrels a day. If this oil production cut continues, the price of gas can rise, which is a direct input to FedEx's trucks and planes. Increases in oil prices can lead to compressed margins and ultimately less profit for the company.

Reuters

Another risk includes the accuracy of my inputs within the model. Actual vs projected revenue growth, EBITDA margin, and the WACC all play a significant role in determining the value of FedEx. Different scenarios will yield different results, even though I would consider my analysis to be a base case scenario. A worst case scenario can lead to a lower than anticipated calculated enterprise value for the company.

Conclusion

FedEx has made some impressive headlines recently, raising their yield by 10% and cutting $4 billion worth of expenses as part of their mass consolidation. Looking at my model, and making several assumptions surrounding future growth and profitability margins, I believe FedEx can reach a price of ~$300/share if they execute their plans as announced. This implies that FedEx's stock is trading at a 30% discount to its market value. I believe FedEx presents a unique buying opportunity given their aggressive cost saving measures from consolidation for value oriented buyers.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.