ZIM Integrated: Last Dividend Paid, Now What

Summary

- ZIM paid the last major dividend of this cycle on April 3 with an ex-dividend date of April 4.

- The container shipping market remains under massive pressure, with index rates still falling.

- ZIM stock trades above $17, but the company faces years of losses pressuring the stock due to the lack of dividend payouts ahead.

- Looking for a helping hand in the market? Members of Out Fox The Street get exclusive ideas and guidance to navigate any climate. Learn More »

Daniel Wright

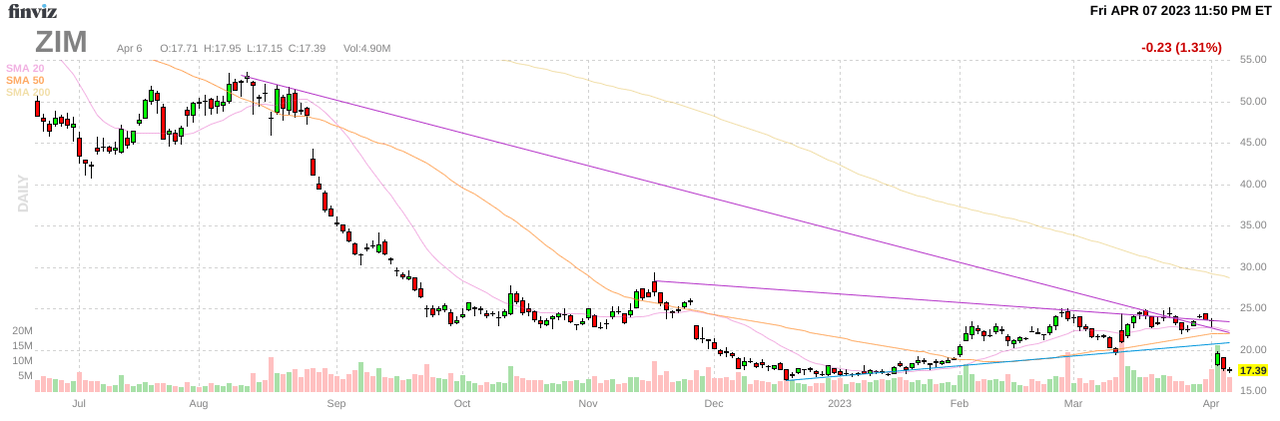

On April 3, ZIM Integrated Shipping Services (NYSE:ZIM) paid a large dividend to shareholders. As expected, the stock fell to offset the dividend payout, though the amount didn’t originally match the large dividend as forecast. My investment thesis remains Bearish on the stock with shareholders not fully appreciating the lack of dividends in the next few years ahead.

End Of Material Dividends

A lot of people have got stuck on whether ZIM will pay dividends in the years ahead. The key is whether the company pays material enough dividends to warrant owning the stock above $17.

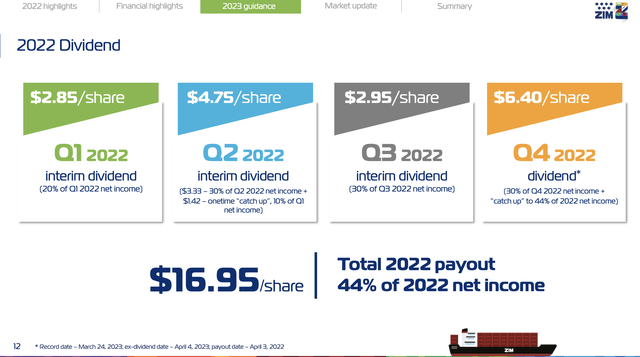

ZIM paid the following large dividends for the profits earned during 2022.

Source: ZIM Q4'22 presentation

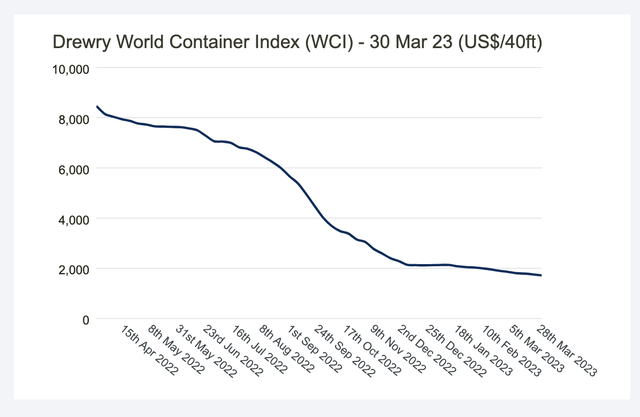

The problem is that shipping indexes continue to plunge. The Drewry Index is down another 4% in the couple of weeks since last reporting on the metric. The March 16 shipping rate for a 40ft container was $1,790 and has already dipped to only $1,717 for March 30.

The financial picture for ZIM has definitely deteriorated for their business in the last few weeks. Remember, management predicted shipping rates were set to bottom and rebound this year, yet the flood of newbuilds to the market remains detrimental to shipping rates as the progresses.

Analysts continue to cut EPS targets for the next few years. The predicted losses now amount to $7.17 over the next 3 years and some analysts are clearly predicting much larger losses over the period.

With 120 million shares outstanding, this amounts to a combined loss of $860 million. The loss is sizable for a stock still trading at $17+.

The odds of ZIM paying a dividend over the next few years appear next to zero. Of course, the container shipping company could squeeze out a profit in one of the shoulder quarters and pay a small dividend. Either way, the dividend yield won’t warrant a $17 stock price.

Survivor

Right now, ZIM does have a strong balance sheet. The stock is definitely holding up due to the cash and investments balance of ~$3.8 billion after the large $769 million dividend payout for the Q4'22 dividend and the true-up for the rest of 2022.

ZIM has ~$32 per share cash entering this weak container shipping market. The shipping company has an equity value of $5.9 billion amounting to nearly $49 in equity value, though the amount dips to $42 after paying the recent Q4'22 dividends. Also, the vessel and container handling equipment combining for $5.7 billion in value could get written down in this environment.

The company will be a survivor and can potentially use the strong balance sheet to snap up assets on weakness. On the Q4'22 earnings call, CFO Xavier Destriau was clear on this opportunity:

We will continue to renew our container fleet and we continue to explore inorganic growth to the potential acquisition of regional liners in key market, such as Southeast Asia or Latin America.

These data points definitely make one want to be constructive on the stock prospects in the next year or so after the peak of the losses pass. The key here is to not remain blindly bullish when the market is likely pounded with quarter after quarter of losses for several years.

A lot of investors are still used to getting large quarterly dividend payouts. As quarterly losses mount and dividend payouts don't occur, the stock is likely to trade lower no matter the remaining equity value.

Takeaway

The key investor takeaway is the ZIM just paid the last major dividend for this cycle. The container shipping company has the balance sheet to survive a long downturn, but the stock isn't appealing at $17.

Too many investors are still holding on to ZIM hoping management's guidance for 2023 EBIT of at least $100 million turns out accurate. Even this best case scenario leads to limited profits and only a small dividend while the worst case is massive losses for years and no dividend payouts.

Investors should just sell the stock and look for a better entry a few years from now when the market is more in balance with supply and demand.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause after several bank closures, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

This article was written by

Stone Fox Capital launched the Out Fox The Street MarketPlace service in August 2020.

Invest with Stone Fox Capital's model Net Payout Yields portfolio on Interactive Advisors as he makes real time trades. The site allows followers to duplicate the model portfolio in their own brokerage accounts. You can find the portfolio and more details here:

Net Payout Yields model

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.