Equinor: Solid Cash Returns Despite The Renewable Growth Plans

Summary

- Equinor can be bought at substantial valuation discount relative to other European majors.

- The warm winter, windfall taxes and the company's long-term ambition to become a renewables utility may all be understandable concerns.

- However, in the medium term, Equinor remains a cash cow that investors shouldn't overlook.

natatravel/iStock via Getty Images

Investment thesis

Equinor ASA (NYSE:EQNR) is the well-known Norwegian and European major that hardly needs introduction on this forum. Equinor is also a national oil company ("NOC"), with Norway's government having 67% ownership.

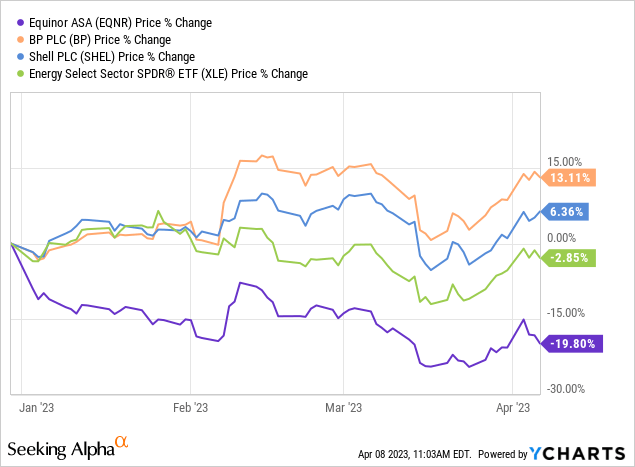

In recent months, Equinor's shares have underperformed many peers:

There are two well-known facts:

- NOCs generally trade at lower multiples relative to companies that don't have a controlling government stake;

- American majors, that is Exxon (XOM) and Chevron (CVX), trade at premium to European majors such as BP (BP), Shell (SHEL) or Total (TTE); this is largely due to XOM and CVX avoiding so far the lower return investments in renewable power generation.

Moreover, the unusually warm winter that crashed European natural gas prices from the 2022 highs (still quite high in historical perspective, though) and the windfall taxes enacted by European politicians are also valid concerns. However, Equinor is in the same boat on these issues as BP, Shell and many others; that is why, I don't see these factors as a logical reason why EQNR should trade at a discount. Rather, this looks more like a buying opportunity as market anomalies usually correct over time.

Starting valuations matter

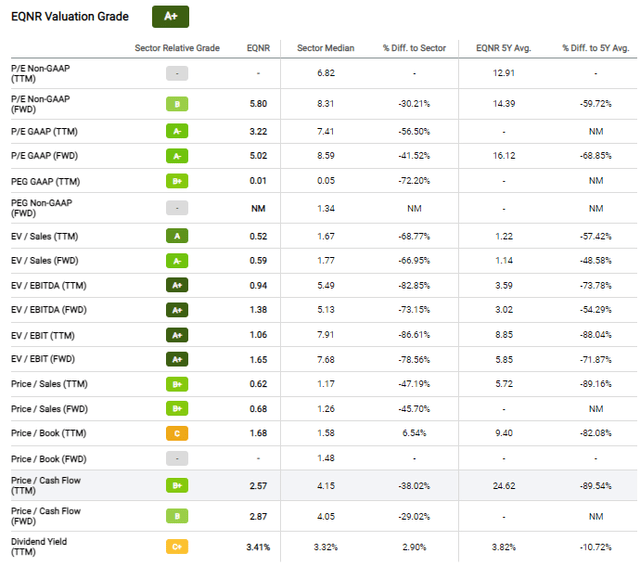

Starting valuation points matter. This applies both to the overall market level as well as to individual stocks. Seeking Alpha scores Equinor at "A+" on valuation relative to the sector averages:

Particularly eye-catching are the trailing and forward EBITDA multiples of 0.94x and 1.38x respectively; the sector averages are above 5x.

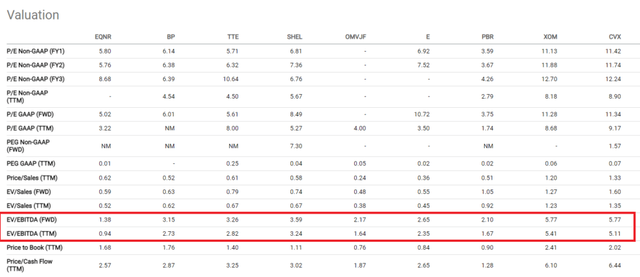

I also compared EQNR to a few other European majors: BP, TTE, SHEL, OMV (OTCPK:OMVJF), and Eni (E). For context, I also included XOM, CVX and Petrobras (PBR):

While XOM and CVX understandably boast higher multiples, the European majors have EBITDA multiples in the 2 to 3x range. Only Petrobras comes remotely close to Equinor's valuation, but at least PBR's valuation can be partially attributed to the domestic political turmoil in Brazil (EWZ). Government policy is a risk in Europe too, but it is hard to rationalize why these risks apply only to EQNR and not to the other European oil companies.

Renewables capex is set to increase

One legitimate concern for investors could be Equinor's plans to expand its renewables portfolio. Currently, this is not a big chunk:

Equinor’s renewables positions currently mainly consist of offshore wind farms in operation and development in the UK, the state of New York and Poland. In these jurisdictions the legislation is structured around a lease where permission to develop is granted following a series of approvals relating largely to environmental and social impact assessments. The government separately auctions a subsidized power purchase price either through renewable offtake certificates or contracts for difference. In both cases, Equinor and its partners take the risk for developing, constructing and operating the wind farms within a fixed timeframe.

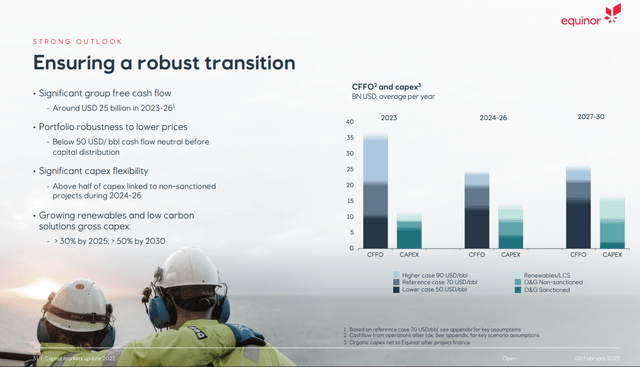

However, in the long term, the company projects that 50% of its capex will be directed to renewables, chasing the ambition to build a 12 to 16 GW renewable generation portfolio:

I have argued before that, in the longer term, renewables investors shouldn't expect more than utility-like returns. While oil exploration is a risky enterprise, building and running a windfarm is more predictable, especially when the government provides a long-term power purchase agreement plus various subsidies.

In a world that may be defined by a structural undersupply of oil investment, Equinor may indeed get a much better ROI if it focuses on its core competencies. However, on the other hand, the renewable investments don't generate negative returns either, especially when the government foots part of the bill.

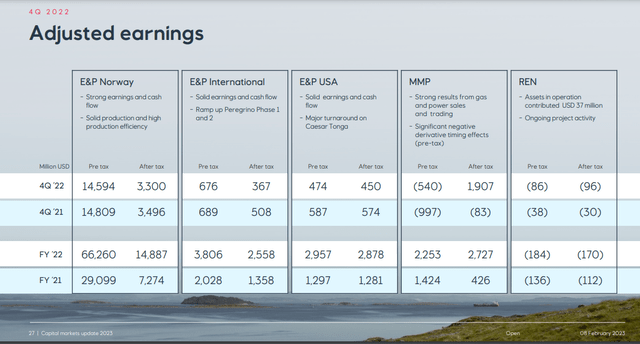

In the recent earnings, the renewables segment was close to breakeven:

Lastly, BP, Total or Shell all pursue a similar path to Equinor, yet command higher multiples.

The recent headwinds are temporary

Two other headwinds may have impacted Equinor. First, the warm winter drove a significant downward correction in the European natural gas markers:

As a major supplier to the European continent, Equinor is obviously affected. However, it is important to realize that even though prices came down a lot, they are still much higher than the historical averages before the Russia-Ukraine war. Neither is it guaranteed that next winter will be mild too.

Second, many European governments responded to the unprecedented energy prices with windfall taxes. Norway also put forward a windfall tax but this focused on hydro power and offshore wind. It is important to realize that under Norway's normal taxation regime for hydrocarbons, Equinor is paying tax at a 78% marginal rate. Norway's government is already capturing most of the oil price upside, and the earnings forecasts for Equinor do account for this taxation impact.

Now, it is often commented that Norway applies a 25% withholding tax on dividends paid to foreign investors, which is reduced to 15% for US recipients. However, at least for US investors, the withholding tax generates a foreign tax credit that can be used to offset other taxes.

Equinor is a cash cow

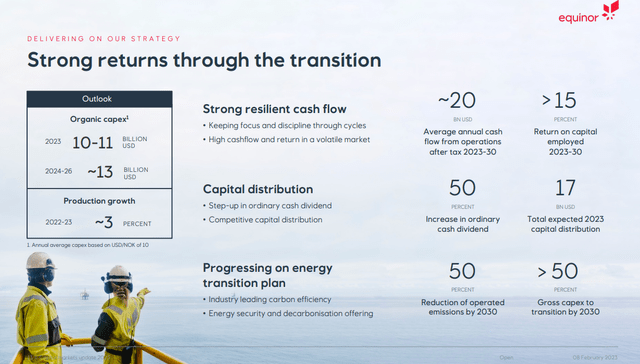

Despite the potential concerns over the long-term renewable investments, for the time being, Equinor remains a cash cow and has been very generous with shareholder returns:

For its $70/bbl reference case, Equinor projects $17 billion of capital returns for 2023. That is an 18% distribution yield on the current $90 billion market cap and not something easy to ignore. Needless to say, after the surprise OPEC+ production cuts we seem to have moved back into a $80/bbl reference case already.

The generous cash returns should also help ease investors' minds on the post-2030 future, whether Equinor at that point is just another Ørsted (DNNGY) or not; if distributions cover one's capital outlay in first 5-6 years, the future looks less scary.

Takeaway

Acknowledging the valid concerns about the ROI on its long-term renewable investments, in the medium term Equinor generates robust cash flows and distributes a lot back to its shareholders. The company is also significantly discounted, even when compared to other European oil majors who are in the same boat on renewables growth and government policy risk. It is natural to expect that, starting from a lower valuation point, Equinor has good chances to outperform its peer group.

Equinor was also just recently upgraded at Deutsche Bank precisely for lagging behind other European peers. According to Seeking Alpha, the average Wall St. price target is now $38.17, which offers a +32.90% upside.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EQNR; XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

My articles, blog posts, and comments on this platform do not constitute investment recommendations, but rather express my personal opinions and are for informational purposes only. I am not a registered investment advisor and none of my writings should be considered as investment advice. While I do my best to ensure I present correct factual information, I cannot guarantee that my articles or posts are error-free. You should perform your own due diligence before acting upon any information contained therein.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.