Dynatrace: Differentiated Platform Driving Strong Growth

Summary

- Dynatrace is a leader in APM with a highly differentiated AI-enabled software platform.

- Dynatrace has broadened its opportunity set beyond APM to include Infrastructure Monitoring, Application Security, and Log Analytics.

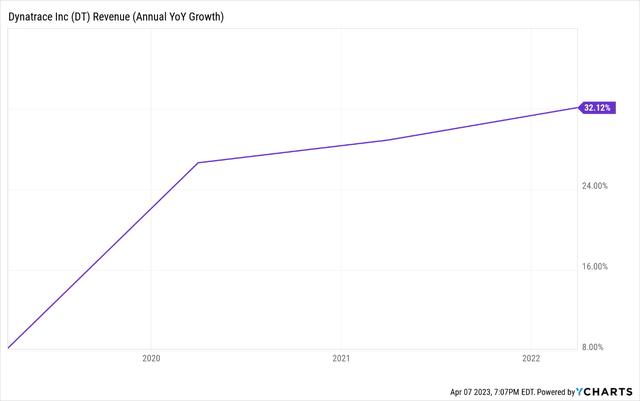

- The company has a strong financial model with +30% y/y revenue growth and ~80% gross margins.

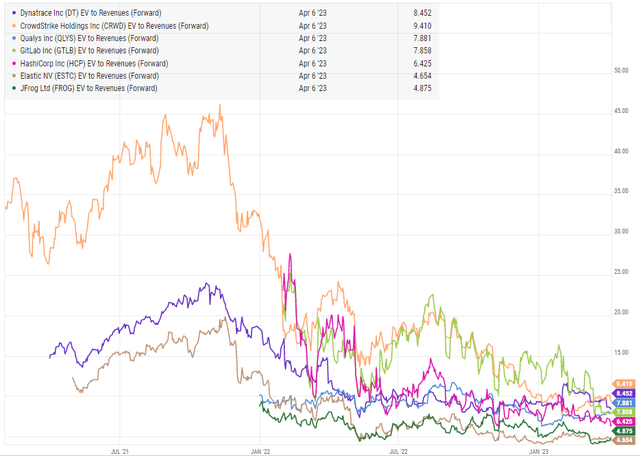

- I initiate a buy rating on DT stock and keep a December 2023 price target of $56 based on a forward ~12x EV/Sales multiple and FY2024 revenue estimate of $1.3 billion.

Guillaume

Thesis

Dynatrace (NYSE:DT) is a leader in the Application Performance Monitoring [APM] market and has expanded its offerings to include observability solutions. Its software intelligence platform allows customers to monitor various metrics and ensure application reliability and consistent customer experience. The company's position as a leader in a growing market for digital transformation, highly differentiated AI-enabled software platform, and expansion into infrastructure monitoring, logs, and application security make it well-positioned for continued success. The company has a solid financial model with high revenue growth and a strong GAAP FCF margin. I initiate a buy rating on DT stock and keep a December 2023 price target of $56 based on a forward ~12x EV/Sales multiple and FY2024 revenue estimate of $1.3 billion.

Highly Differentiated AI-Enabled Software Platform

Dynatrace's AI-enabled software platform is highly differentiated due to its strong underlying AI Ops foundation. The company re-architected its platform around five years ago, focusing on modern cloud native workloads and creating the Davis AI engine to drive its AI Ops functionality. The platform continuously feeds telemetry data to the AI engine to detect patterns and identify the root cause of problems. Dynatrace is an industry leader and scores better than other tools in problem identification and analysis with minimal human intervention. The platform's single-agent concept reduces implementation time and accelerates time to value by auto-instrumenting the overall environment from application to infrastructure. Distributed tracing allows transaction analysis at every level of the application stack, leading to faster resolution of problems through effective root cause analysis. Dynatrace's solid execution and differentiated platform have enabled the company to drive share gains in the worldwide IT operations management market.

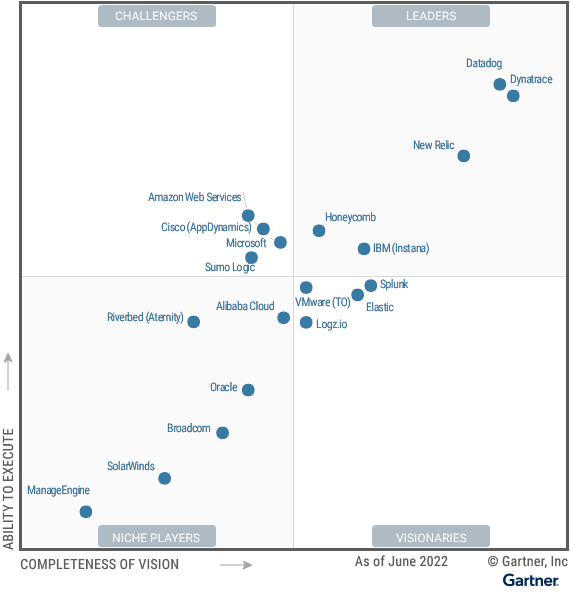

According to Gartner, Dynatrace is an industry leader due to its highly differentiated platform. The platform's advanced features and automation capabilities have made it a preferred choice for companies looking to optimize their IT operations. Dynatrace's constant investment in its sales capacity underscores its confidence in the demand environment and positioning for accelerated growth. The company's net-retention rate remains strong, driven by its growing customer base and opportunities for cross-selling and upselling. Dynatrace's focus on the indirect channel, particularly with global system integrators, provides an opportunity to drive growth and leverage partnerships. Dynatrace's attractive financial model, with high revenue growth, gross margins, and operating margins, positions it as a leading growth software company.

Gartner

Expanding beyond core business

Dynatrace, mostly known for its APM business, has expanded its platform to offer broader observability solutions. The company added Infrastructure Monitoring several years ago, followed by Application Security, and is now gearing up to enter the Log Monitoring space. Dynatrace still has a significant opportunity to grow within its existing customer base. The company entered the Application Security market in late 2020-early 2021 and has continuously enhanced its capabilities. The company expects Application Security to act as another growth driver across existing and new customers as the product continues to mature. While Dynatrace already offers support for logs, it plans to launch a new log-monitoring and log analytics solution called Grail in the near future, likely in the fall or Dec-22 quarter. The company anticipates that Grail will have a similar ramp pattern to its Infrastructure Monitoring products, with a revenue run rate of approximately $100M within two years. Overall, Dynatrace's expansion into these new areas broadens its opportunity set and provides additional avenues for growth.

Dynatrace has been aiming to achieve an accelerating annual recurring revenue [ARR] growth rate beyond 30%, but macroeconomic headwinds have affected these plans in the short term. However, the company has indicated that it remains on track to increase its quota-carrying sales capacity by 30% in the current fiscal year, which ends in March. In the past, Dynatrace has achieved a higher growth rate in its ARR and revenue than in its quota-carrying sales capacity in the previous fiscal year. While the macroeconomic conditions may challenge maintaining this trend in the current year, Dynatrace's continued investment in sales indicates its confidence in the demand environment. This positioning is expected to put Dynatrace in a good place to support an accelerating growth profile when the macroeconomic headwinds eventually subside. Overall, the company's focus on expanding its sales capacity suggests strong growth potential.

Valuation

My December 2023 price target of $56 is based on a forward ~12x EV/Sales multiple and FY2024 revenue estimate of $1.3 billion. DT trades at a slight premium to its comp group; however, I think the premium is warranted given its faster growth profile. I believe DT will be able to grow its revenue at a CAGR of 20% over the next five years, driven by DT’s differentiated technology and secular tailwinds driving the market. Moreover, DT is expanding into new segments, allowing it to upsell and cross-sell its products to an already established base. Below I have shown DT’s multiple in comparison to peers. The comp group consists of software companies with growing FTM revenue of over 10%, with over 70% gross margins (CRWD, QLYS, GTLB, HCP, ESTC, and FROG).

Risks

One of the main risks facing Dynatrace is the possibility that it may be unable to execute its "land and expand" strategy effectively. This approach involves offering customers a free trial and then expanding their usage across the company's six modules, resulting in high net expansion rates. If Dynatrace fails to continue driving customer expansion, it could have a negative impact on its annual recurring revenue [ARR] growth rates and slow down its overall business performance. While Dynatrace has been executing well to date, it is difficult to predict how it will perform in an uncertain macroeconomic environment. Moreover, Dynatrace faces competition from higher-growth peers such as Datadog and New Relic. Despite its impressive application performance management [APM] capabilities and expansion into infrastructure monitoring and log management, Dynatrace's growth may be hampered by these competitors, potentially affecting its ability to attract new customers, maintain top-line growth, and improve margins.

Final Thoughts

I remain positive on Dynatrace and initiate a buy rating on the stock due to its position as a leader in a growing market for digital transformation. The company's software platform is highly differentiated and ensures the reliability and security of software applications, providing a consistent digital experience for end customers. I believe Dynatrace will continue to gain market share as it expands beyond its core APM capabilities into infrastructure and logs monitoring, as well as application security. I see ample opportunity within its installed base to drive multi-module adoption, which could continue to fuel its greater than 120% net retention rate. I have a December 2023 price target of $56 on the stock based on a forward ~12x EV/Sales multiple and FY2024 revenue estimate of $1.3 billion.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Business relationship disclosure: This article was researched and written by Mohammed Saqib, reviewed, and submitted by Bryan Seiler.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.