FXF: Fade This CHF Play

Summary

- With Swiss headline and core inflation coming under control, the SNB’s monetary tightening runway could prove shorter than expected.

- FX interventions can stem sharp moves, but at this point, depreciation pressures on the CHF outweigh the tailwinds.

- Either way, expressing a view on the CHF via a pricey fund like FXF offers an unfavorable risk/reward.

assalve/iStock via Getty Images

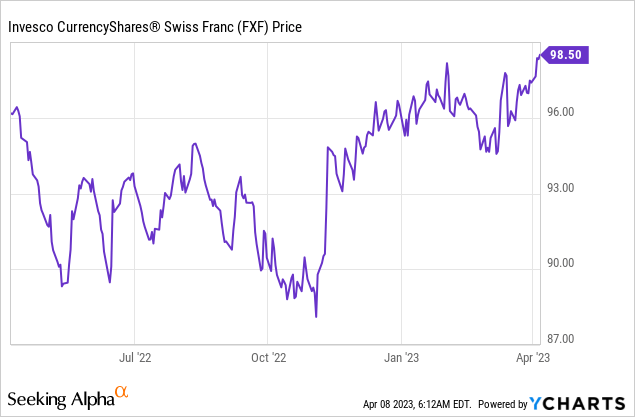

The CHF has strengthened relative to the USD in recent weeks, as the scale of the state-backed Credit Suisse (CS) rescue reassured investors about the long-term sustainability of Switzerland's banking system. Calmer markets have allowed the Swiss central bank (Swiss National Bank or ‘SNB’) to prioritize price stability over growth risks, further raising rates at its latest policy meeting. The SNB has also been actively conducting FX interventions via the sale of its foreign currency reserves to cap CHF downside and by extension, imported inflationary pressures. While these factors create an optically bullish setup for the CHF, the recent downward trend in the EUR/CHF pair indicates the SNB policy ‘put’ may be limited in its efficacy. Plus, recent Swiss data points indicate slower inflation and economic growth weakness (domestically and abroad) vs. the extended tightening cycle implied by the SNB’s hawkish statement. With limited policy-driven upside and a fading ‘safe haven’ appeal (vs. other G10 currencies), the risk/reward on pricey CHF plays like the Invesco CurrencyShares Swiss Franc Trust (NYSEARCA:FXF) doesn’t seem particularly compelling.

Fund Overview - A Pricey Vehicle for Exposure to the CHF

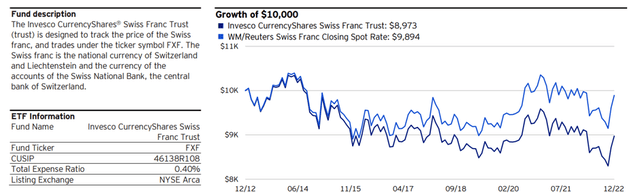

The US-listed Invesco CurrencyShares Swiss Franc Trust provides investors exposure to changes in the value of the CHF via a depository account with JPMorgan Chase Bank (London Branch). The fund held ~$197m of assets at the time of writing and charged a 0.4% expense ratio, making it a fairly pricey vehicle for CHF exposure. A summary of key facts about FXF is listed in the graphic below:

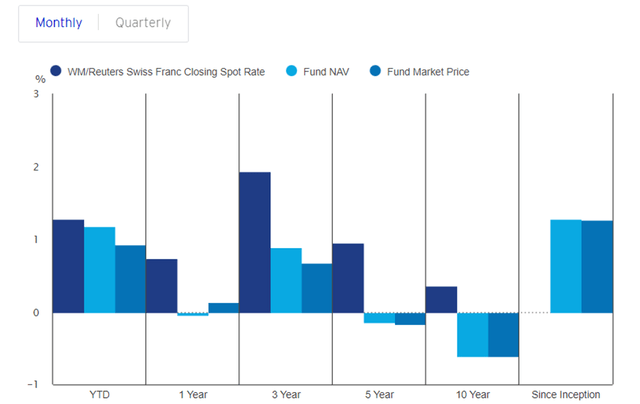

On a YTD basis, the fund has risen by 3.4% but has annualized at a 1.3% pace in market price and NAV terms since its inception in 2006. On a five and ten-year basis, FXF has compounded at -0.1% and -0.6%, respectively. By comparison, the benchmark WM/Reuters Swiss Franc Closing Spot Rate posted a 1.0% and 0.4% gain over a similar period.

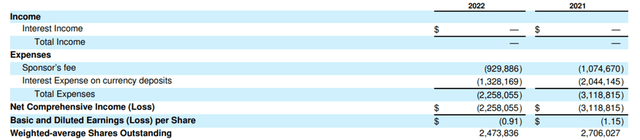

Even after accounting for the 0.4% expense ratio, FXF’s tracking error appears to be significant. A key contributor has been persistent excess expenses (over and above the interest income generated), which the manager retains the right to pay for via withdrawals from the Trust. Per the latest annual report, interest expenses have run significantly higher than the sponsor’s fee in recent years (due to negative rates), implying a ‘true’ expense ratio closer to >1%.

Shorter Tightening Runway as Inflationary Pressures Fade

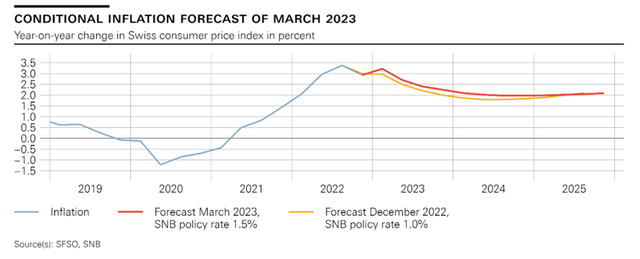

The tone of the SNB’s March policy statement turned significantly more hawkish on inflation, citing “additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term.” Yet, last week’s inflation print came in well below the SNB’s conditional forecast at +2.9% YoY in March (vs. 3.4% YoY in February) on the back of continued energy price declines. Importantly, core inflation also slowed to 2.2% YoY (down from 2.4% YoY prior), signaling that the tightening cycle is already impacting inflation expectations.

The slowdown in price growth will be a welcome development for consumers and CHF bears alike, given it shifts the policy needle away from the current 50/25bps rate hike trajectory heading into the June/September policy meetings. Alongside weakening global growth and tighter financial conditions globally, the SNB has room to be more dovish on the rates front going forward. As upcoming inflation prints move closer to its mandate, I suspect the SNB’s tightening runway could prove shorter than many expect.

FX Intervention Adds Stability but Depreciation Pressures Loom Large

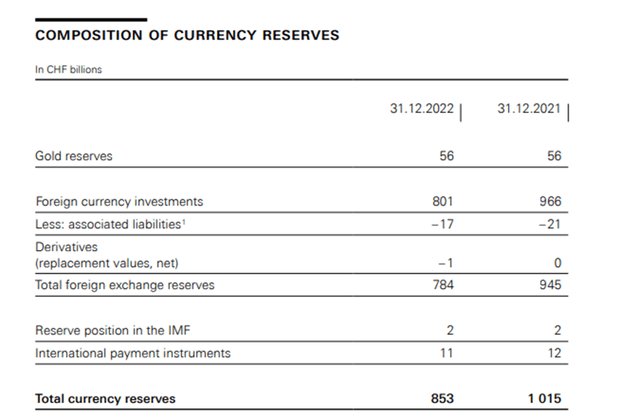

While the SNB again pointed to using FX intervention “as necessary” at the last meeting, more intervention doesn’t necessarily mean CHF upside. In its recently published annual report, the SNB disclosed net foreign currency sales of ~CHF22bn in 2022, with a massive ~CHF27bn coming in Q4. And on a YoY basis, total currency reserves have already declined by >CHF160 bn to ~CHF853bn, partly due to sales and partly due to asset devaluation. Plus, the SNB made clear its counter-cyclical approach to interventions, implying a focus on stability rather than directionality. Per the Chairman’s latest statement, “we conversely also remain willing to buy foreign currency if necessary, i.e., if there were to be excessive appreciation pressure on the Swiss franc.”

Given the focus on inflation, however, the risk for the CHF remains on the downside, and thus, these unusual comments by the SNB on FX intervention imply a commitment to protecting the CHF from near-term depreciation. Whether the SNB has a sufficient war chest to counter mid to long-term pressures is another matter entirely, given the Swiss economic backdrop of a narrowing trade surplus and persistent portfolio outflows on top of shrinking SNB reserves. Should the central bank be forced into slowing its relative pace of tightening vs. its counterparts in the US and Euro area, where core inflation is running at a far hotter pace, ‘hot money’ outflows could soon weigh on the CHF as well. So even if the SNB can control the pace of depreciation, it may ultimately be limited in its ability to prevent a sizable downward move over time.

Fade This CHF Play

The ‘safe haven’ appeal of the CHF may have taken a hit following the Credit Suisse failure, but government intervention in the banking sector and ongoing SNB intervention in FX markets have kept the CHF strong. While markets have priced in more monetary tightening in the months ahead (per SNB guidance), the latest inflation print indicates pressures are already slowing. Instead, the risk seems to have tilted toward growth, given the emerging economic weaknesses domestically and externally. Hence, a more dovish outcome seems likely and, with that, a weaker CHF vs. the rest of the G10. Either way, exchange-traded CHF vehicles like FXF, which offer zero to negative yields (unlike, for instance, the low-single-digit % money market rates of the Chinese Yuan Fund (CYB)) to offset expenses, offer unfavorable risk/rewards.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.