UPS: Cheaper, But Not Cheap Enough

Summary

- UPS reported solid results for fiscal 2022, but the guidance for fiscal 2023 is underwhelming.

- While UPS can fend off competitors due to its wide economic moat, the upcoming recessions will most likely have a negative impact on the business.

- The company raised the dividend with an aggressive pace in the last few years.

- UPS is probably fairly valued at this point, but most likely not a bargain.

400tmax/iStock Unreleased via Getty Images

My last article about United Parcel Service (NYSE:UPS) was published almost two years ago and at this point the stock was trading for about $210, and I argued that the stock has limited upside. In the article I concluded:

In my opinion, UPS is overvalued at this point. Considering how overvalued the US stock market is in general, UPS is certainly not among the extremely expensive stocks, but it is certainly no bargain at this point, and I also don't consider the stock fairly valued. One might consider UPS trading at a reasonable price, but the assumptions we have to make to justify the price seem a bit too optimistic in my opinion - especially when considering the return to a pre-COVID-19 normality and the increased threat from Amazon (AMZN).

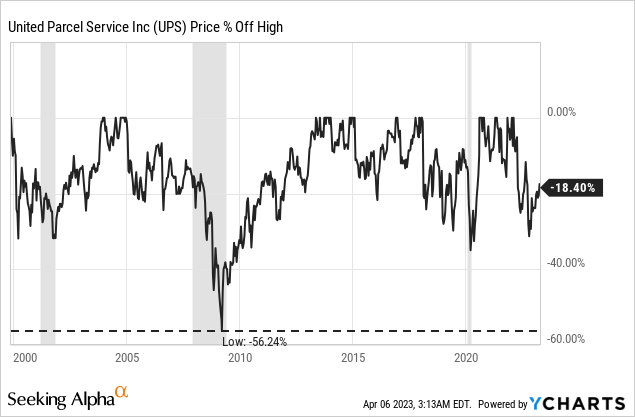

Since then, the stock declined about 10% and when looking at the bigger picture it seems like UPS' stock is correcting the previous upward wave and is now trading rather in large sideway range between $155 on the lower end and about $230 on the upper end. Let's look at UPS once again to determine if the stock is a good investment right now.

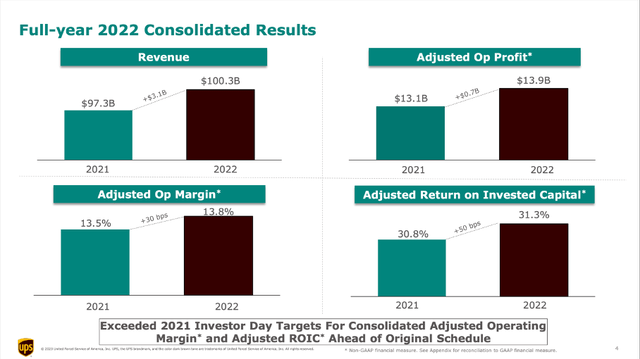

Full Year Results

Following an impressive fiscal 2021 with extremely high growth rates (at least for a company like UPS), results for fiscal 2022 were still solid. For the full year, UPS generated $100,338 million in revenue and compared to $97,287 million in revenue in fiscal 2021 this results in 3.1% year-over-year growth. Operating profit also increased 2.2% YoY from $12,810 million in fiscal 2021 to $13,094 million in fiscal 2022. When looking at the bottom line, diluted earnings per share declined 10.1% YoY from $14.68 in fiscal 2021 to $13.20 in fiscal 2022. However, adjusted diluted earnings per share increased from $12.13 one year earlier to $12.94 - resulting in 6.7% YoY growth.

UPS Q4/22 Investor Presentation

And finally, free cash flow (non-GAAP) declined from $10,889 million in fiscal 2021 to $9,038 million in fiscal 2022.

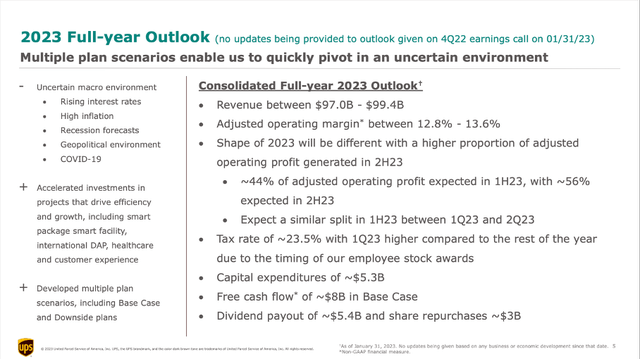

For fiscal 2023, UPS is expecting to struggle even a bit more. And we can assume that the COVID-19 crisis pulled a lot of revenue growth forward to fiscal 2021 and we are now seeing a reversion to the mean. Revenue is expected to be between $97.0 billion and $99.4 billion resulting in a slight top line decline. And with higher expected capital expenditures for fiscal 2023, free cash flow is expected to be around $8 billion (and therefore lower than in the previous year).

UPS Q4/22 Investor Presentation

Recession?

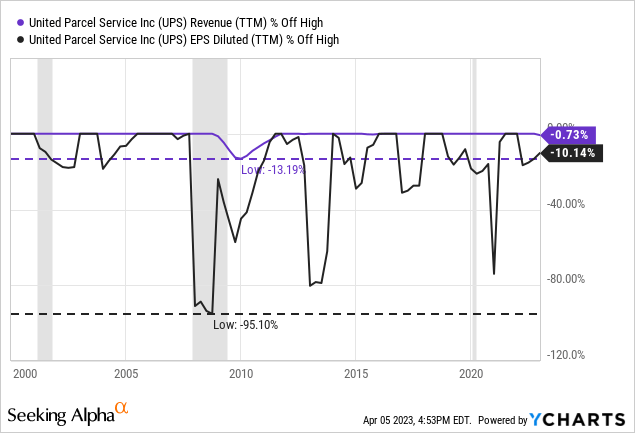

While the COVID-19 crisis most likely pulled revenue growth forward to fiscal 2020 and fiscal 2021, another explanation for the rather soft guidance is probably the recession which is looming on the horizon. When looking at the performance of UPS during past recessions, we can look at data since 1998 and therefore three different recessions. And in two of these three recessions we don't see any impact on the company's top line. Only during the Great Financial Crisis, revenue declined about 13%. Of course, we should not ignore that the 2020 recession was untypical and companies like UPS rather profited from the lockdowns.

When looking at earnings per share, the picture is extremely messy. While we can see a reaction to every one of the last three recessions, we also saw earnings per share decline between recessions.

And when thinking about the business model of UPS, it is not surprising that the top and bottom line will be affected by recessions and economic contractions. People will purchase less online, and this will have an impact on the freight volume.

But over the long run, the ongoing shift towards ecommerce should be a tailwind for UPS. And after expecting lower revenue and lower earnings per share in fiscal 2023, analysts are also expecting solid growth rates for revenue as well as earnings per share following the years 2023.

Competitors

Aside from the recession on the horizon, increased competition is also mentioned quite frequently and could be seen as a challenge for UPS. According to Statista, UPS controlled a market share of 37% in the United States with FedEx (FDX) being close with a market share of 33%. Amazon's market share at that point was about 12%.

One of the biggest threats for UPS - aside from rival FedEx - might be Amazon. However, we should keep in mind that Amazon as a business is only profitable due to its AWS business (if the company is profitable at all). Most of the time, Amazon is losing money on its "core" business, which is also implying Amazon is not able to deliver packages profitable so far. In my last article about Amazon, I talked about Amazon investing in the future and the impact this had on profitability. And I get that Amazon is trying to move aggressively in new business segments, but questions remain. In my last article I wrote:

And in my opinion, we must be really cautious not to get sucked in by a baseless optimism. What if Amazon is not able to increase its margins and if it will struggle to be profitable? What if these high investments will also be necessary in the future and without high investments Amazon will suddenly report only mediocre growth rates and still low margins? What if Amazon has created a cut-throat industry with extremely low prices, quick shipping, and great customer services, but companies that will struggle to be profitable?

Of course, Amazon is well positioned to take on UPS as it has a good logistics network already in place. And Amazon will certainly continue to deliver its own packages, and this is a business which UPS will continue to lose (although it already has lost a big part of that business). But right now, I am highly skeptical if Amazon can profitably deliver packages for other business or individuals as well and really steal market shares from UPS.

Aside from Amazon, several other companies are often named as competitors. On-demand delivery companies like Uber Technologies, Inc. (UBER) or Postmates (acquired by Uber) as well as DoorDash, Inc. (DASH) are often seen as competitors to UPS as well as FedEx. In my opinion, these companies are not really competitors for two major reasons. First, these companies are mostly delivering meals from restaurants and that is a market UPS is not active in and therefore not a competitor. Additionally, these companies can deliver quickly (within an hour or less) but only on a local scale. To compete with UPS these companies must deliver door-to-door on a national or international scale and are clearly lacking the infrastructure to achieve that goal.

And similar to Amazon's logistic business, Uber, DoorDash and the other on-demand delivery companies are struggling to be profitable. And with tougher times ahead (economy struggling and the U.S. stock market heading for a bear market), it will get more difficult for these businesses to raise cash and continue business operations which are not profitable - not even to mention expanding and trying to attack companies like UPS or FedEx.

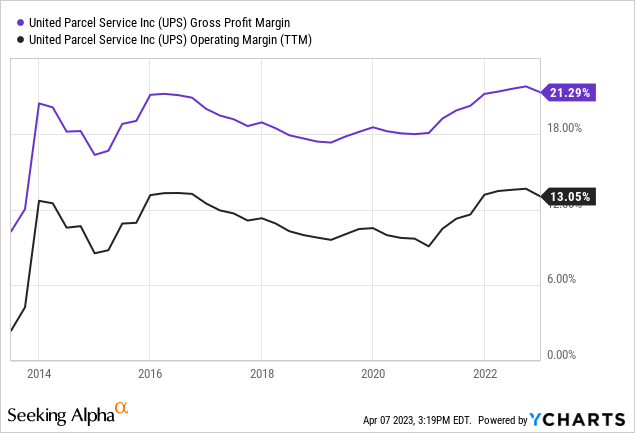

Operating margin and gross margin are pretty stable for UPS in the last few years, which is a good sign that they are able to fend off competitors.

Competitive Advantage

Stable margins are already a good sign for a wide economic moat around a business. And UPS clearly has a competitive advantage that is hard to overcome for competitors. I have already explained in a past article two different reasons why these distribution networks are very hard to replicate and attack:

High upfront costs: In a first step, a lot of money is necessary to build a distribution network. Usually a company needs distribution centers in strategical places (which are often expensive as these locations are highly coveted by other companies as well) and - depending on the source of transportation - either trains, trucks or airplanes are necessary to deliver the products. These transportation vehicles are usually expensive as companies need not only one truck, but plenty of them. Altogether, a company has extremely high expenses before it can even start delivering and generate revenue.

Low costs for existing companies: But even if a distribution system is in place and a new company spent millions on building such a distribution system it is still important how dense such a distribution network is. The density and strategical location of distribution centers will determine the costs of goods sold as well as the profitability of a company. And as the distribution networks of already existing companies are most likely denser, the existing companies can still lower prices to put new competitors under immense pressure.

And although from time to time a company manages to overcome this moat and enter the market, it is extremely difficult. Amazon is still losing money and FedEx had huge initial problems to get the business running (for background information, a podcast series about UPS vs. FedEx). Strong distribution networks can also be seen with other companies like the medical delivery companies McKesson Corporation (MCK) or Cardinal Health (CAH) for example.

There are at least three reasons why it is difficult for competitors to enter the business and take on UPS. First, we can mention the regulatory hurdles, which are important but certainly not the biggest obstacle to overcome. Additionally, economies of scale are playing into the hands of UPS and FedEx as the additional costs for additional packages are close to zero when the distribution network is already in place and the planes are already flying and trucks already driving. And not only is it difficult for smaller companies and new competitors to match these economies of scale, but there are also high upfront capital requirements for trucks and airplanes and distribution centers and having that much cash available is a challenge for small and young businesses.

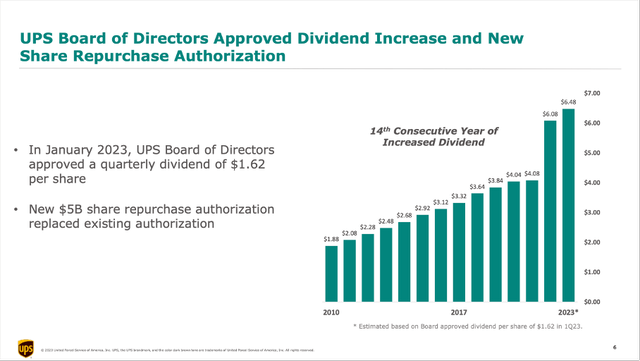

Dividend

UPS is also interesting for its dividend and recently raised the quarterly dividend from $1.52 to $1.62 and we should always keep in mind this is on top of a huge dividend increase from $1.02 to $1.52 in the previous year. The company increased the dividend for the 14th consecutive year and in the last five years, UPS increased its dividend with a CAGR of 12.69%.

UPS Q4/22 Investor Presentation

The current quarterly dividend is resulting in an annual dividend of $6.48 as well as a dividend yield of 3.4%

Aside from the dividend, UPS is also using share buybacks as form of capital allocation. In 2022, UPS spent about $3.5 billion on share repurchases and has now a $5 billion share buyback authorization. For 2023, it is planning to spend about $3 billion on share buybacks and about $4.5 billion on dividend payments.

Intrinsic Value Calculation

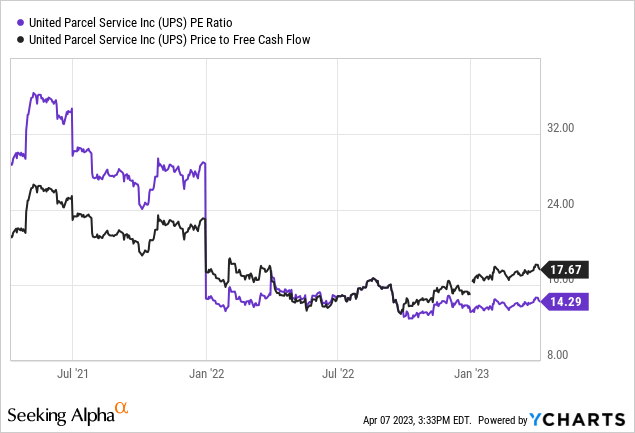

When looking at the simple valuation metrics UPS is trading for, UPS can be seen as fairly valued. Right now, UPS is trading for 14 times earnings and 18 times free cash flow. Especially in the last two years, the stock got cheaper and seems to trade for reasonable valuation metrics.

Aside from looking at simple valuation metrics, we can also use a discount cash flow calculation to determine an intrinsic value for the stock. As basis for our calculation, we can use $8 billion in free cash flow - according to UPS' own guidance for fiscal 2023. When assuming 5% growth from now till perpetuity (and a 10% discount rate as well as 871 million outstanding shares), UPS is fairly valued right now.

Of course, we can make the case for higher growth rates in the years to come and when assuming 6% growth in the years to come, the intrinsic value for UPS would be $230. On the other hand, we should also be cautious if current earnings per share and free cash flow are sustainable - especially considering the looming recession.

Conclusion

UPS seems like a better investment than two years ago when my last article was published. The stock is trading about 10% lower and the business improved in the meantime. And UPS can be seen as fairly valued right now, but I don't see UPS as a bargain at this point and would not yet invest in the stock.

In my opinion, UPS will stay in its sideway range and I don't want to purchase the stock before it is declining to about $155 to $160 (the lower end of the sideway range). And while we don't have much data about UPS' performance during past recession (the 2020 recession doesn't really count) we can assume the stock to decline lower than "only" 18% during a recession.

Buying UPS right now would certainly not be the worst investment, but I think we can purchase the stock for a better price in the coming quarters.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.