Chord Is Too Cheap To Ignore

Summary

- Chord Energy is one of the cheapest names in the oil patch.

- CHRD has a pristine balance sheet and a solid acreage position in the Williston.

- A poor hedge book, meanwhile, could bode well for 2024 results.

HappyManPhotography/iStock via Getty Images

Chord Energy (NASDAQ:CHRD) is one of the cheapest plays on a strong oil market. Meanwhile, the company is under-earning due to an unfavorable hedge book that begins to roll off later this year.

Company Profile

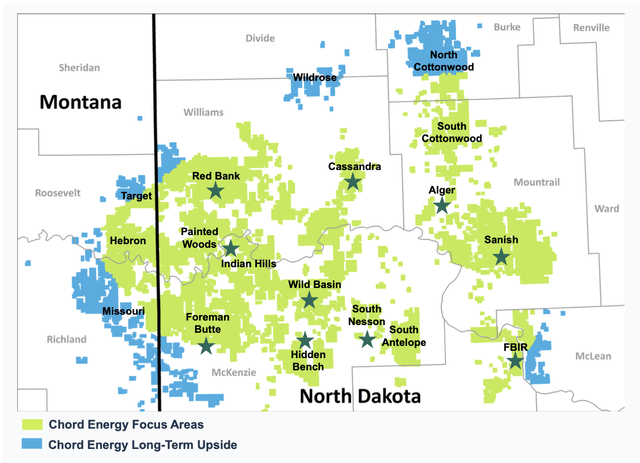

CHRD is an energy exploration and production company primarily operating in the Williston Basin (Bakken). It holds the largest acreage position in the Williston with 963K net acres, of which 94% are operated. Approximately 99% of the acreage is held by production.

Overall, it has 2,742.8 net operated producing wells, of which 2,558.6 were in the Williston. CHRD has net proved reserved of 655.6 MMBoe, of which 77% are classified as proved developed. 58% of its reserves are oil, while 21% are NGLS and the rest natural gas.

The company was formed through the merger of Whiting Petroleum and Oasis Petroleum in July in 2022. It sold its midstream assets to Crestwood (CEQP) the same year, and sold the bulk of the CEQP shares it got in the transaction later the same year.

Opportunities and Risks

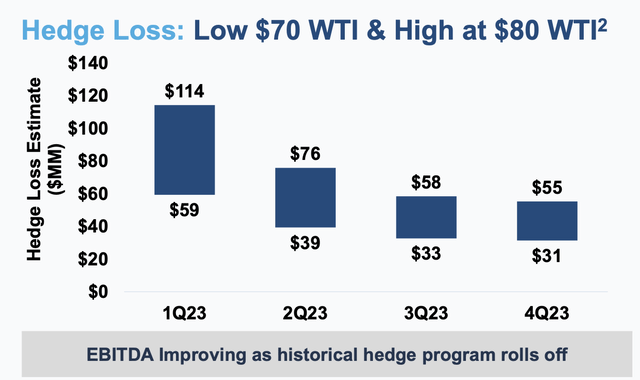

CHRD is an oil company through and through, and thus the price of oil is one of the biggest drivers of its results. However, the company does have some unfavorable hedges that will begin to roll off this year, which should be favorable to its results in the second half and more so in 2024.

The company lost -$79.4 million from unfavorable hedges in Q4 and -$208.1 million for the year. The losses could be worse if oil rallies nicely this year. Surprisingly, the company has not talked much about or disclosed much about its hedge book, despite it being a pretty big issue. Nonetheless, higher prices are still good for the company, and it will generate more free cash flow the higher oil prices are.

CHRD expects to grow volumes modestly this year, bringing on 90-94 gross operated wells. Most of its completions will take place in Q2 and Q3. As such, the big driver of its growth this year will be oil prices.

Discussing the company’s development plans on its Q4 call, CEO Dan Brown said:

“If you think about the 2022 plan, the 2022 plan was really a continuation of the legacy plans between both legacy organizations. And so, when the merger -- both legacy organizations had a bit of a back-end weighted program. And so when you combine the 2 companies, that those plans, which is where we had permits, we had rig contracts, we had completion crew contracts, that really just sort of perpetuated through the balance of the year, leading to the sort of the timing that you see noted. As we were able to take a view, an integrated view as an organization about how we really wanted to develop the asset moving forward, I think this timing of doing completions more toward the middle of the year concentrated in the middle of the year just makes a little more sense from an operational perspective.

“As Chip noted, the weather is better during that time frame. We're able to get a solid frac crew during that time frame, which we know delivers efficiencies. And so you'll see that program is a little bit different than it has been than it was last year, but it's really just an -- it's a product of us being able to sit down as a combined larger organization and put together a schedule that makes sense for us relative to schedules that made sense for the 2 legacy companies independently.”

Looking into 2024, hedges rolling off and the price of oil should help boost results. Natural gas prices can also play a role, but represented under 12% of CHRD’s revenue in 2022.

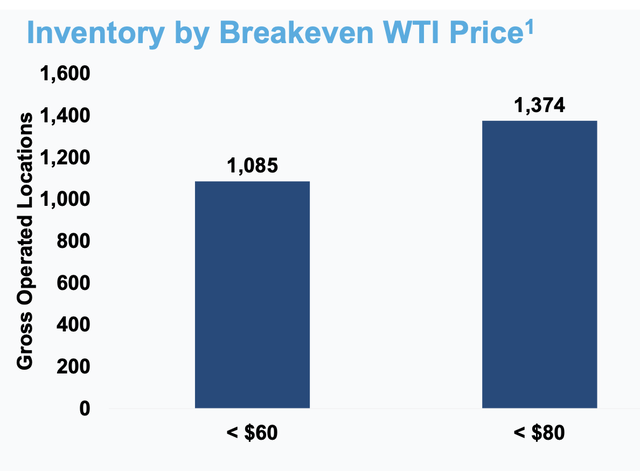

CHRD has a strong acreage position in the Williston, with an estimated 1,085 gross locations that have breakevens (20% IRR with G&A) at under $60 oil. That gives the company about 12 years of inventory. And over time, improved drilling and completion technology can drive down higher cost development acreage as well.

In addition to energy prices, CHRD is also set to benefit from merger synergies. The company originally predicted it would realize $65 million in annual synergies, but upped that to $100 million. 70% of the synergies are expected to be realized by the second half 2023, with the rest in 2024. $35 million in savings will come from G&A, while $65 million will come from capital and base production efficiencies.

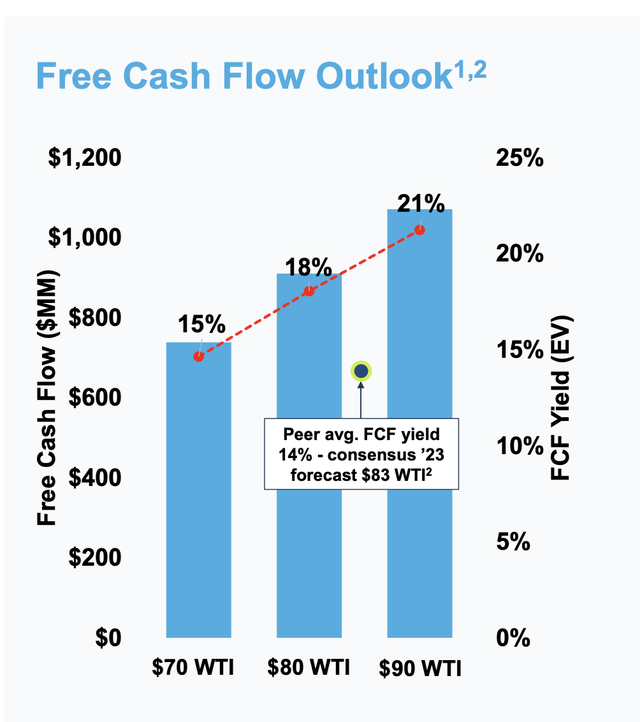

Despite its poor hedge book, CHRD was able to generate $1.3 billion in free cash flow in 2022. With only $400 million in debt and nearly $600 million in cash, it was able to take that cash flow and pay out dividends and buy back stock. The company bought back $152 million in stock, paid out a $1.25 base dividend, and a $3.55 variable dividend.

CHRD has forecast FCF of $825 million in 2023, with the expectation of oil at $75 and nat gas at $3.50. Even at a reduced level, the company should still be able to enact its capital allocation strategy.

When looking at risks outside of energy prices, CHRD does face basin risk. It’s not uncommon for the Bakken to face harsh winter weather, which can disrupt production and drilling in the region during the winter months. This was certainly seen last year, although most of CHRD’s activity will come in Q2 and Q3 of this year to avoid potential disruptions.

Meanwhile, while Bakken takeaway is sufficient, there are still legal challenges to try and shut down the Dakota Access Pipeline (DAPL). The U.S. Army Corps of Engineers is working to update a environment impact statement, which is expected to be released in the spring of 2023. The Standing Rock Sioux Tribe can file a new lawsuit once the EIS is complete. While the pipeline getting shutdown seems like a long shot, if it does it would be a big blow to CHRD, as it would need to find alternative takeaway by rail, which would be more costly.

Valuation

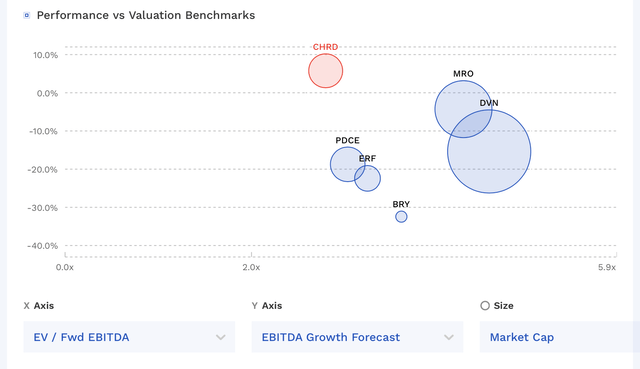

CHRD trades at 2.9x EBITDA based on 2023 analyst estimates of $1.9 billion. EBITDA in 2022 was around $9.6 billion, reflecting higher energy prices.

Based on the 2024 consensus of $2.2 billion, the stock trades at a 2.5x multiple. Of course, the price of oil and natural gas can change the actual results immensely.

CHRD is valued in the low-end of the pack compared to other independent E&Ps, despite it being debt free and under-earning because of its hedge book. Being tied solely to the Bakken could play a role, but it also trades lower than Bakken E&P Enerplus (ERF) as well.

CHRD Valuation Vs Peers (FinBox)

Conclusion

As I noted in my recent article on Devon (DVN), I think the oil E&P sector as a whole looks in good shape. Companies are much more disciplined today than in the past, and the focus is more on moderate growth and strong free cash flow versus chasing production growth.

Meanwhile, things like China re-opening, the U.S. depleting its strategic petroleum reserve, and years of oil majors underinvesting in the sector all bode well for crude prices. Since then, OPEC+ announced a surprise cut in their production, sending prices higher. With U.S. producers not chasing prices anymore, the cartel has regained its clout, which is good for oil bulls.

As for CHRD stock, it trades at a cheap valuation and has a strong asset position in the Bakken. Meanwhile, it is actually under-earning because of its poor hedge book, which will be a benefit in 2024 as they roll off. I think the stock is a “Buy” at these levels.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.