Why Cross Timbers Royalty Trust Should Perform Well

Summary

- Renewable sources would contribute to a healthier environment, but cannot replace hydrocarbons because these commodities are strategic and too important for countries for geopolitical reasons.

- The market will continue to bet on oil and gas and the assets that depend on those commodities such as Cross Timbers Royalty Trust.

- Cross Timbers Royalty Trust is a Texas-based express trust that collects net income from fossil fuel royalties and working interests, and then it returns the net income to shareholders in the form of dividends.

- The stock offers a very attractive dividend yield compared to certain financial benchmarks. Cross Timbers Royalty Trust is poised to benefit from anticipated increases in oil & gas prices and sales volume.

bymuratdeniz

Continue to Hold the Cross Timbers Royalty Trust

This analysis supports a Hold rating on a position in Cross Timbers Royalty Trust (NYSE:CRT) stock as the total return from owning shares of this Texas express Trust, which is engaged in the oil & gas exploration and production industry, should benefit the positive outlook for North America hydrocarbons.

Dallas [Texas] based Cross Timbers Royalty Trust owns 90% net profits interests in certain royalty-bearing gas properties in Texas, Oklahoma and New Mexico and 75% net profits interests in certain working interests in crude oil properties in Texas and Oklahoma.

Thus, 90% net profits interests asset is exposed to changes in sales volumes or prices but is not subject to production or development costs, while 75% net profits interests asset suffers production and development costs.

These mineral properties belong to XTO Energy Inc.

The 90% net profits interests asset and 75% net profits interests asset produce the net profit income which the Trust collects from the operator XTO Energy Inc. and then distributes to its shareholders in the form of monthly dividends.

Based on the company's estimates as of December 31, 2022, the underlying properties in Texas, Oklahoma and New Mexico allow for 12 years of production from proven reserves which implies future net cash flows of approximately 62% natural gas and 38% crude oil.

Prospects for Natural Gas and Crude Oil

It is believed that renewable energy sources can make a great contribution to the fight against climate change since these clean energy sources are not involved in the emission of CO2 and other toxic substances that cause the problem by increasing global warming.

These are the energy sources of the future for households and businesses. However, it will take many years, perhaps even decades, before solar, wind, biomass, hydropower, etc. will replace traditional energy sources such as the combustion of natural gas, oil and coal.

As long as conventional ones are available, they are an amazing source of profit for multinational hydrocarbon giants and governments. They also represent powerful geopolitical tools that governments use to leverage their bargaining power in the marketplace with other countries. In addition, several countries, especially in the Middle East, have economies almost entirely dependent on fossil fuel exploitation, and helping them continue to profit from this colossal business means maintaining excellent and friendly relations with these countries.

There is no doubt that natural gas and oil will remain the main energy sources in the long term, enabling consumption and driving production and various other activities.

The price will develop positively as it has for decades.

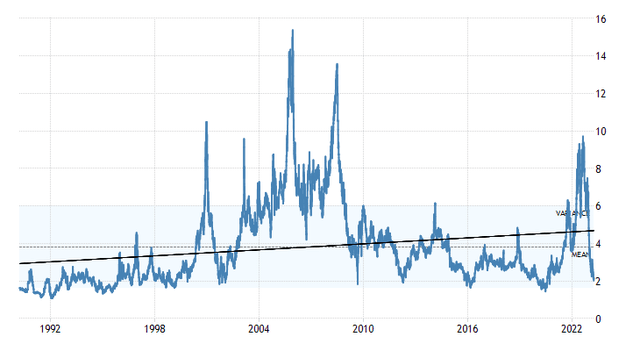

The Trading Economics chart shows the evolution of the US Natural Gas Futures price through fluctuations over time and the underlying positive trend.

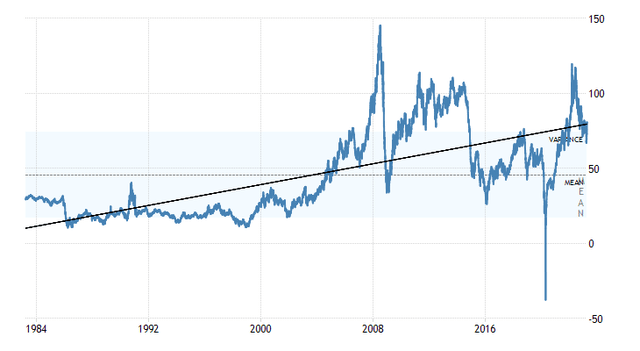

The Trading Economics chart shows the evolution of the West Texas Intermediate [WTI] crude futures price through fluctuations over time and the underlying positive trend.

The long-term trends for both commodities are positive, supporting the thesis that investors are better off holding onto natural gas and crude oil, as well as stocks like the Cross Timbers Royalty Trust, which tracks the commodities, despite the renewable energy propaganda.

The Expected Benefits of Owning Shares in Cross Timbers Royalty Trust

These commodities do not develop regularly over time, but through cyclical fluctuations that can be more or less pronounced depending on volatility.

Geopolitical tensions due to the war in Ukraine and the US-China dispute over Taiwan's independence are factors currently driving increased volatility in commodity prices relative to a long-term trend or average value used as a benchmark. These fluctuations can be used to add to positions or sell shares and make some profit before the price rises or falls.

Cross Timbers Royalty Trust shares are a wise investment to hold, even though the peak of the cycle appears to be nearing. Cross Timbers Royalty Trust has grown but a sale would not be on the best terms as the market had much better offers in the recent past.

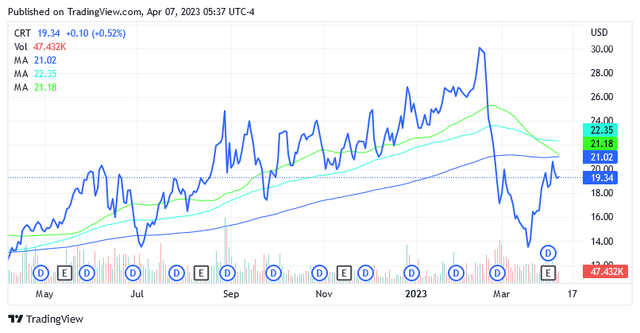

Also, the current stock price of $19.34 per share is still below the trends defined by the 200-day moving average of $21.02, the 100-day moving average of $22.35 and the 50-day moving average of $21.18.

The next few months should be no different from the first quarter of 2023, which includes a price peak above $30 in mid-February. There could be new or even better highs as the current geopolitical situation is such that some of the factors that fueled bullish sentiment in early 2023 are very likely to reappear.

Owning shares of Cross Timbers Royalty Trust means benefiting from a monthly dividend that could potentially continue to rise given expected higher natural gas and crude oil prices. Like rising profits, even higher dividends are a great catalyst to boost stock prices.

Cross Timbers Royalty Trust's dividend could also benefit from higher oil and gas supplies from Texas, Oklahoma and New Mexico, should North America increase resource use to offset OPEC+'s recent decision to cut daily crude oil shipments in global markets by 1.16 million barrels.

The OPEC+ decision will put significant upward pressure on crude oil prices, which will bode well for Cross Timbers Royalty Trust's dividend.

Interestingly, among the factors predisposing to the longevity of the Cross Timbers Royalty Trust dividend and its stability, the occurrence of the following trend draws investors' attention. The withdrawal of commodities from US crude oil and fuel stocks is occurring at higher rates than expected, according to weekly US Energy Information Administration [EIA] data reported by Trading Economics.

Therefore, optimistic investors may see an opportunity for the Cross Timbers Royalty Trust to capitalize on producing more barrels of crude oil on properties in Texas, Oklahoma and New Mexico to replenish domestic commodity inventories.

In addition, Saudi Arabia's move to raise the price of the barrel of crude oil it sells to Asian buyers again is likely to drive up the price of the commodity produced in North America, as the markets are global.

As for natural gas, analysts expect the price, which also determines the success of the Cross Timbers Royalty Trust dividend, to rise in the coming months of 2023.

There are two factors currently driving analyst forecasts.

The continued increase in gas supplies to the major US LNG exporters, as they also help the EU achieve energy independence from Russian natural gas.

In March 2023, a record 13.2 billion cubic feet per day [bcfd] of natural gas reached US export facilities. The following month broke the March record as 13.9 bcfd was delivered, for a 5.3% month-on-month increase, Trading Economics reports.

In addition, a higher withdrawal of natural gas is observed compared to market estimates. Trading Economics indicates 23 billion cubic feet [BCF] of natural gas were withdrawn from US storage in the last week of March 31, while market expectations were for 21 bcf.

Investors in Cross Timbers Royalty Trust stock will also be pleased with these trends in the volume of raw materials being shipped to major US LNG exporters or withdrawn from storage for the country's energy needs.

Analysts Expect Higher Natural Gas and Crude Oil Prices

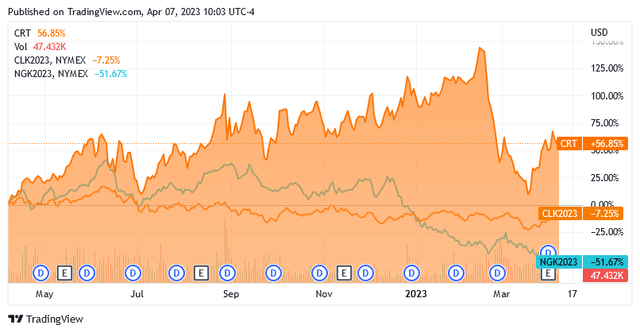

For the reasons just outlined, analysts expect the price of the barrel traded via Crude Oil WTI Futures - May 23 (CLK3) to increase from $80.47 (at the time of this writing) to $88.47 by the end of 2023, which means an increase of 10%.

While the price per metric million British Thermal Unit [MMBtu] of natural gas traded through Natural Gas Futures - May 23 (NGK3) is expected to increase by almost 58% from $2.035 (as of now) to $3.19 before the end of 2023.

Analysis of the Cross Timbers Royalty Trust Dividend

This dividend payment with the contribution of the share price generates a very attractive return on Cross Timbers Royalty Trust shares, which investors should not remain indifferent to and which they should definitely not give up.

On April 14, 2023, the Cross Timbers Royalty Trust will pay a monthly dividend of $0.179 per common share, which translates to an annualized dividend of $2.148 per share, assuming the payout rate remains stable.

The payout level means an annualized dividend yield that ranges between 16.7% and 7.07% based on stock prices that have fluctuated between a floor of $12.85 and a ceiling of $30.40 over the past 52 weeks.

Even if the stock was bought at a high price compared to the 200-, 100-, or 50-day simple moving trends, the investment still allows for a return that is more than four times the US stock market benchmark of the S&P 500 dividend yield of 1.66% (at the time of this writing). Cross Timbers Royalty Trust's dividend yield is also, on average, higher than the interest rate one would receive by lending money despite rising interest rates to curb increased inflation.

With oil and gas prices on the rise and the potential for higher sales volumes too in 2023, it is likely that Cross Timbers Royalty Trust will decide to hike its dividend, which could propel the stock higher than it is today.

The Finances of the Cross Timbers Royalty Trust

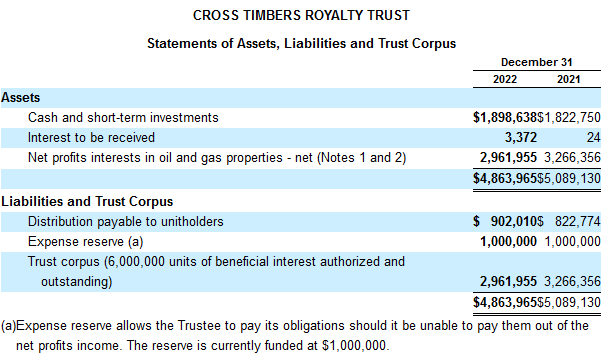

As of December 31, 2022, the balance sheet reported approximately $1.9 million in cash and short-term investments which could be used as follows: should net income be lower than expected, the cash would be used to meet trustee expenses and ensure the payment of dividends in line with shareholder expectations.

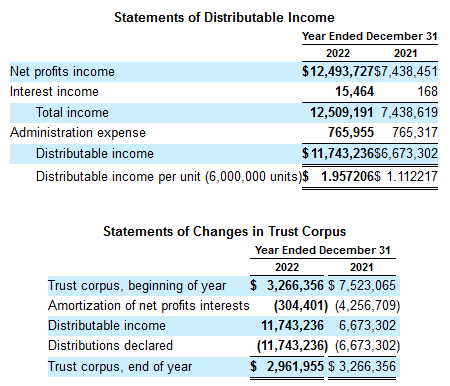

The following screenshots are from Cross Timbers Royalty Trust (CRT) - FORM 10-K | Annual Report Mar. 30, 2023, 4:49 PM ET.

Source: Cross Timbers Royalty Trust (CRT) - FORM 10-K | Annual Report Mar. 30, 2023 4:49 PM ET

The net profits interests of which 62% natural gas and 38% crude oil are valued at $2.96 million, down 9.5% year-on-year. These are estimated to guarantee an additional 12 years of income for distribution to shareholders, based on proven reserves as of December 31st, 2022.

Liabilities consist of dividends payable to shareholders and the expense reserve, the latter enabling the company to meet obligations should this not be entirely possible from net income.

The chart below shows that the distributable net income for 2022 was approximately $11.74 million or approximately $1.96 per share with the latter going up by almost 77%, thanks to the strong contribution from higher oil and gas production and helped by a rise in the selling price of the fossil fuels.

Source: Cross Timbers Royalty Trust (CRT) - FORM 10-K | Annual Report Mar. 30, 2023 4:49 PM ET

The Risk of Owning Cross Timbers Royalty Trust

An investment in Cross Timbers Royalty Trust carries the risk that the asset will cease to provide good returns if the two commodities trend downwards and sales volumes fall sharply from current levels.

This type of risk is possible given the volatility of the oil and gas markets and the impact of changes in commodity market prices on sentiment regarding Cross Timbers Royalty Trust shares.

As can be easily seen from the chart below, this stock can greatly amplify small fluctuations in the price of futures contracts.

The likelihood of an economic recession as a result of central banks tightening policies to combat high inflation increases the risk, as unfavorable economic conditions would hurt the demand for commodities and the magnitude of the impact on the stock is easy to imagine given the chart.

It must be said, however, that the likelihood of an economic recession faces strong resistance from the following tailwinds.

First, global geopolitics are creating favorable conditions for higher oil and gas prices, and the US should increase fossil fuel exports to help Europe gain energy independence from Russian gas and offset OPEC+ oil supply cuts.

Second, the disinflation process due to monetary tightening and the adjustment of wages and pensions following the various demonstrations against the high cost of living will give new impetus to consumer demand thus stimulating the economy to increase the use of fossil fuels.

In addition, the ongoing recovery of the Chinese economy will play a major role.

Conclusion

The outlook for fossil fuels is very positive. These will continue to be used as energy carriers. Renewable sources would contribute to a healthier environment but cannot replace hydrocarbons, mainly for geopolitical reasons.

Based on these considerations, it is better to continue to place our faith in oil and gas and the assets that depend on these commodities for returns.

As such, it makes sense to maintain a position in Cross Timbers Royalty Trust as this stock should continue to benefit from anticipated increases in oil & gas prices and sales volume, potentially in the form of higher share prices and dividends.

The stock offers a very attractive dividend yield compared to certain financial benchmarks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.