Federal Reserve Watch: Quantitative Tightening Still In Place

Summary

- So far, so good. It looks like the Federal Reserve has managed through the recent "bank crisis" and has remained on track in pursuing its quantitative tightening.

- Although we are not finished with the concern over bank failures and bank risk, the Fed seems to have worked through the crisis and is now focused steadily on inflation.

- Interesting is the fact that the rate of growth of the M2 money stock measure has been negative since last September and this could be a signal for a recession.

- Still, there is a lot of uncertainty around, leaving the Federal Reserve in a very difficult place.

Douglas Rissing

The Federal Reserve continues to reduce the size of its securities portfolio.

In the banking week ending April 6, 2023, the Fed's securities portfolio declined by $49.0 billion, all the reduction coming in the holdings of U.S. Treasury securities.

Since March 16, 2022, the Fed's securities portfolio has fallen by $614.4 billion. If one accounts for the "unamortized premiums and discounts" associated with the securities portfolio, the total decline amounts to $661.0 billion.

The Federal Reserve has been very consistent in managing the decline. Here is the chart showing the securities held outright.

Securities Held Outright (Federal Reserve)

So, Fed Chair Jerome Powell can face the world and say that the efforts of the Fed to conduct "quantitative tightening" have been sustained now for more than one year.

What Else Is Going On?

Of course, the reduction in the Fed's securities held outright is not the only tool that the Federal Reserve has going for it at the present time.

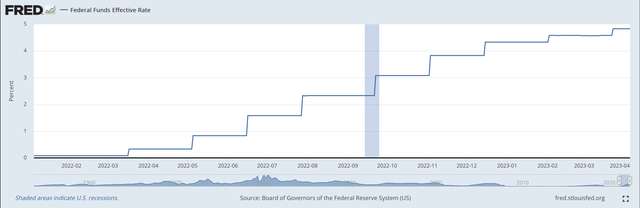

The Federal Reserve has continued to raise its policy rate of interest during this time period.

Note, too, the persistent rise in the level of the effective Federal Funds rate.

Effective Federal Funds Rate (Federal Reserve)

If you look at only these two variables, you might assume that the trip over the past year had been a smooth and steady one.

This, however, has not been the case.

The Federal Reserve has had to work very hard to achieve this amount of stability in these two variables.

Let's look a little further.

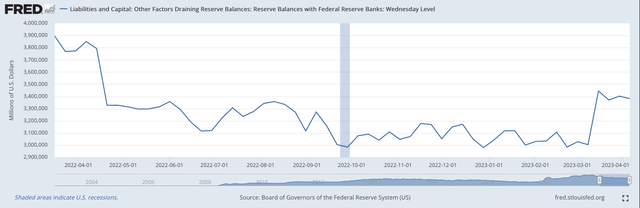

Reserve Balances With Federal Reserve Banks

The line item, reserve balances with Federal Reserve Banks, is ultimately what the Federal Reserve uses to balance off everything else going on in the banking system to achieve its policy result. These balances are quite similar to the "excess reserves" held by the commercial banking system.

These balances also are very similar to the cash assets reported by the commercial banking system and published in the H.8 Federal Reserve statistical release, "Assets and Liabilities of Commercial Banks in the U.S."

The reserve balances represent what is going on in the banking system in terms of the supply and demand of short-term financial assets.

When reserve balancers decline, this reduces the liquidity available in the money markets and puts upward pressure on the Federal Funds rate. As reserve balances rise, the banking system receives more liquidity to take pressure off of the banking system.

Reserve Balances with Federal Reserve Banks (Federal Reserve)

That is, this is the item that the Federal Reserve tries to manage to keep the Fed's policy rate of interest at the level desired by the FOMC.

Thus, we see that in the early part of this chart, the Federal Reserve wants to remove liquidity from the banking system, thereby supporting higher and higher levels of its policy rate of interest.

Then, in early March 2023, the Fed hit a "bump in the road."

The "bump in the road" was the second- and third-largest bank failures in U.S. history, along with other problems in other banks in the U.S. and around the world.

The Federal Reserve provided reserves to the banking system in various different ways.

The Fed must have done a good job, because, as can be seen in the other two charts above, there was very little disruption felt in the other two measures discussed.

That is, the Fed continued to stick to its monetary tightening program while working with the banking system so as to keep the current concern over bank insolvencies from getting away from it.

Of course, this banking disruption is not over yet. We must continue to watch the financial markets and we must continue to watch what the Federal Reserve is doing in these markets.

The story is not over yet.

And, The Money Stock

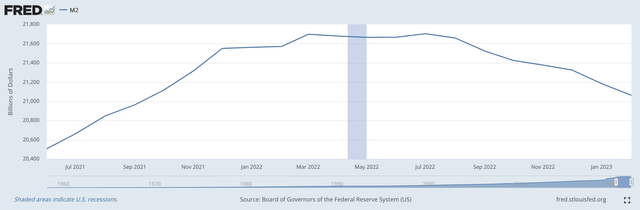

At a more macro level, we have noticed that the growth rate of the M2 money stock has been in negative territory in recent months.

We have noted that this is the first time the rise in the M2 money stock has been in negative territory for a long time.

We must continue to watch this variable because, historically, the movements in the money stock tend to precede recessions.

Here is the recent behavior of the M2 money stock.

M2 Money Stock (Federal Reserve)

Notice that the year-over-year rate of growth of the M2 money stock has been negative since September 2022.

That's a long time!

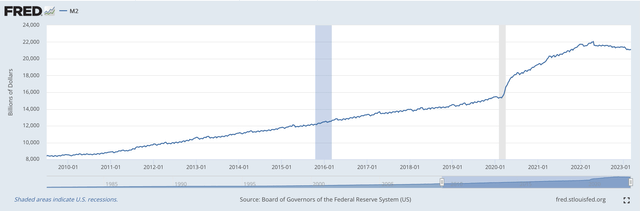

But, also note from the following chart. The growth rate of the M2 money stock has not been negative for a long, long time.

M2 Money Stock (Federal Reserve)

Can the economy and the financial system handle a declining money stock?

The only thing one can say right away is that a lot of money was created during the 2020-2022 period before the Federal Reserve began to tighten up.

But, as I have written before, the 2020-2022 period represents the period of the Federal Reserve asset bubble.

Now, we are on the other side of the bubble.

Lots of things are out-of-sync... markets are out of equilibrium all over the place.

And, this is the world that Mr. Powell and his fellow Federal Reserve leaders are facing.

Even though the Federal Reserve has seemed to "stay on target" with its quantitative tightening program so far, whether or not they are able to "stay on target" in the future is another question.

Keep your eyes open!

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.