Marriott International: Continued China Expansion Provides Growth Opportunity

Summary

- Marriott International is set to see significant expansion of its Ritz-Carlton and W Hotels brands in China this year.

- The stock looks attractively priced from an earnings standpoint.

- I continue to take a bullish view on Marriott International.

yujie chen

Investment Thesis: I continue to take a bullish view on Marriott International (NASDAQ:MAR) given the expansion of the Ritz-Carlton and W Hotels brands into Greater China.

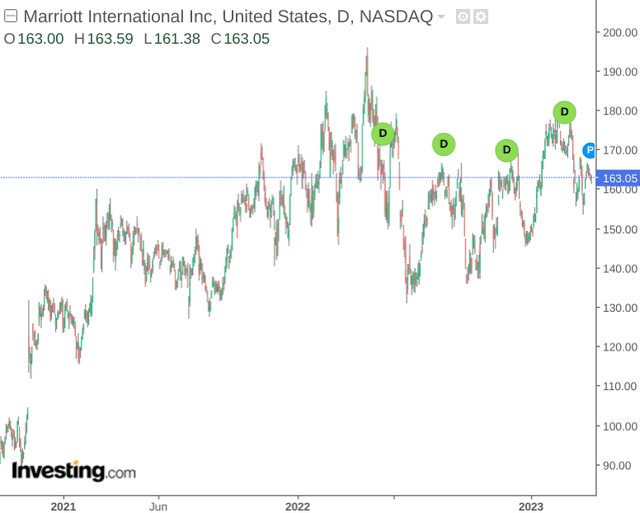

In a previous article back in February, I made the argument that I took a bullish view on Marriott International given an attractive P/E ratio as well as strong RevPAR (revenue per available room) growth despite inflationary pressures.

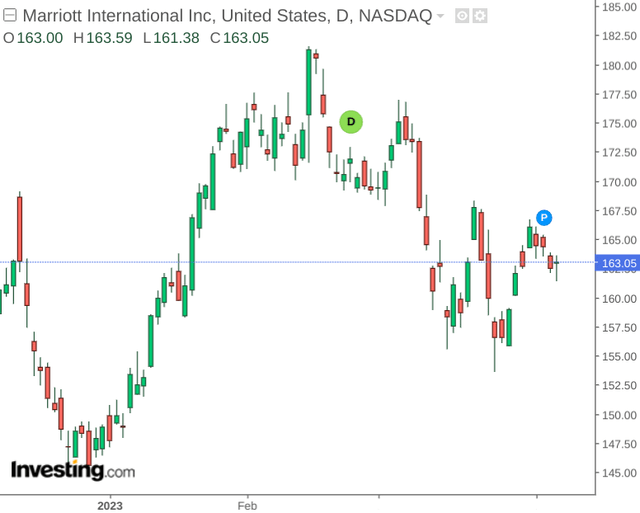

Since my last article, the stock has seen some consolidation:

The purpose of this article is to analyse Marriott's RevPAR and ADR trends by brand in further detail, along with analysing future growth prospects in order to determine whether my prior case for bullish upside still holds.

RevPAR and ADR Analysis

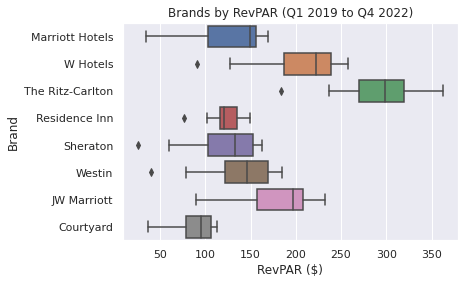

When analysing RevPAR across each of Marriott's brands for the period Q1 2019 to Q4 2022 inclusive by use of a boxplot, we can see that RevPAR for Ritz-Carlton is clearly the highest - as this is the hotel chain's flagship luxury brand with the highest ADR (average daily rate).

Boxplots generated by author using Python's seaborn library. RevPAR figures sourced from historical Marriott International Quarterly Reports (Q1 2019 to Q4 2022).

With a RevPAR of $329.80 in the most recent quarter - there is still scope for RevPAR to approach the upper bounds of $350+ that we have seen across previous quarters in the period. Indeed, I take the view that investors will be analysing performance carefully heading into the summer months to determine whether RevPAR can still grow sustainably, or whether price growth will place pressure on demand.

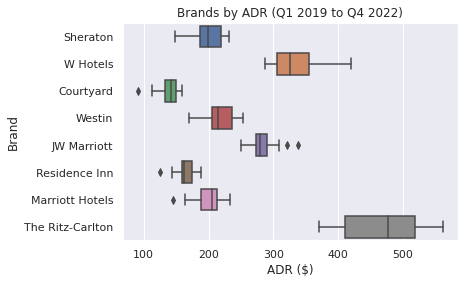

Here is a boxplot of ADR by brand. The maximum ADR for the Ritz-Carlton over the period was $560.94. With an ADR of $516.85 in the most recent quarter, there could still be scope for ADR to rise in the summer months without significantly affecting demand. Again, investors are likely to watch whether this proves to be the case.

Boxplots generated by author using Python's seaborn library. ADR figures sourced from historical Marriott International Quarterly Reports (Q1 2019 to Q4 2022).

Investors are also likely to pay attention to the performance of W Hotels - which ranked second in overall RevPAR and ADR over the period.

Looking Forward

Going forward, I take the view that the full reopening of the Chinese market post-COVID could present a significant opportunity for Marriott International as a whole - and particularly for the Ritz-Carlton and W Hotels brands.

For instance, Marriott International intends to add 47 hotels to its portfolio across Greater China this year, with the adding of Rissai Valley near the Chinese city of Jiuzhaigou marking one of only five Ritz-Carlton Reserve properties globally.

Additionally, the upcoming opening of W Macau - Studio City in the third quarter of 2023 could also provide significant growth opportunity for the brand as a whole.

Moreover, it is worth noting that with Marriott expanding significantly in China this year - revenues as a whole could still stand to see significant growth - even if RevPAR itself starts to plateau from here.

In this regard, given the growing exposure of two of Marriott's luxury brands to the Greater China market - I take the view that performance for the brands as a whole in subsequent quarters is likely to drive the trajectory for the stock overall.

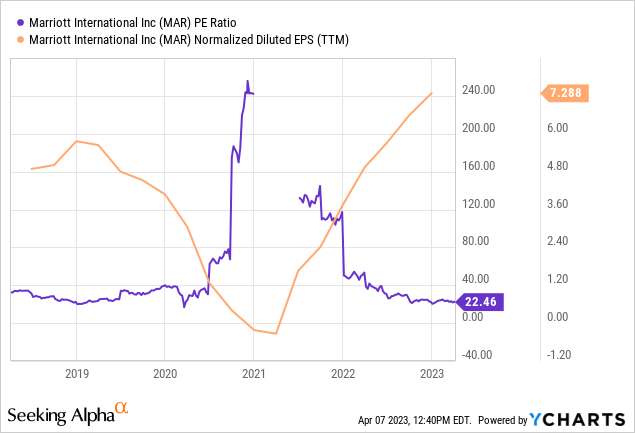

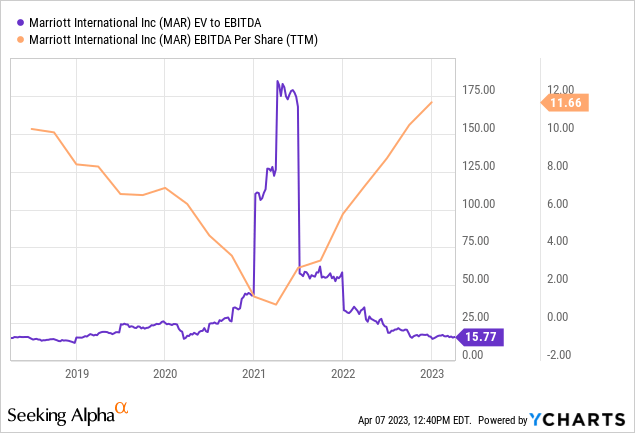

With regard to my previous point about the stock's potential valuation, I still take the view that Marriott International is trading at an attractive value at the present time - given that both the P/E and EV/EBITDA ratios are trailing near five-year lows, while normalized diluted EPS and EBITDA per share are currently at five-year highs.

P/E Ratio

ycharts.com

EV/EBITDA

ycharts.com

From this standpoint, I take the view that the stock still has potential for upside.

Taking a longer-term view - I see potential for the stock to rebound to above the $195 level last seen in April 2022 - should revenue and earnings growth continue in spite of inflationary pressures.

Conclusion

To conclude, I take the view that the short-term consolidation that we have been seeing in Marriott International is market-related. Marriott International has continued to show strong growth in RevPAR across its luxury brands, and expansion of these brands in the Chinese market could prove a significant growth driver. I continue to take a bullish view on Marriott International.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written on an "as is" basis and without warranty, with no guarantee of accuracy or completeness. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.