Better High Yield SWAN Buy: Magellan Midstream Or MPLX?

Summary

- Both MMP and MPLX are sleep well at night high yield equities.

- While MMP has a higher credit rating, MPLX has a cheaper valuation.

- We compare them side by side and offer our take on which is a better buy at the moment.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios. Learn More »

muhammet sager

Magellan Midstream (NYSE:MMP) and MPLX (NYSE:MPLX) are two sleep well at night high yield investment-grade midstream MLPs. Although MMP has a higher credit rating, MPLX trades at a cheaper valuation.

In this article, we compare them side by side and offer our take on which is a better buy at the moment.

MPLX Vs. Magellan Midstream: Business Model

The fact that the vast majority of their cash flows stem from fixed-fee, take-or-pay pipeline contracts as is typical of midstream businesses has provided both MMP and MPLX with significant protection against short-term fluctuations in commodity prices. Additionally, despite paying out distributions to unitholders, both businesses are able to retain a substantial amount of cash flow, which allows them to self-fund capital expenditures and take advantage of opportunities to reduce debt and improve their balance sheets.

MPLX operates a fully integrated midstream business that encompasses pipelines, gathering and processing, and storage assets. As the primary client and shareholder of MPLX, Marathon Petroleum (MPC) has a close and interdependent relationship with the company. However, MPLX is actively pursuing diversification efforts to reduce its reliance on MPC, and currently generates 46% of its business from sources outside of MPC.

MMP is known for the reliability and profitability of its assets, particularly in its refined products midstream segment. Over the course of 15 years, MMP has achieved a noteworthy average annualized return on invested capital of 16%, which is a testament to its effective management. Moreover, the company's cash flow is significantly shielded from the impact of commodity price fluctuations, as 85% of its cash flow is derived from fee-based contracts. This provides a high degree of stability for MMP's operations, regardless of the prevailing market cycles or conditions in the energy industry.

Overall, we like both of these businesses, but we give MMP the edge here due to their superior returns on invested capital as well as their lack of interdependence on another company.

One feather in MPLX's cap is that it has outperformed MMP over the long term, especially in recent years as it has recovered very well from the COVID-19 crash whereas MMP has had a much slower recovery.

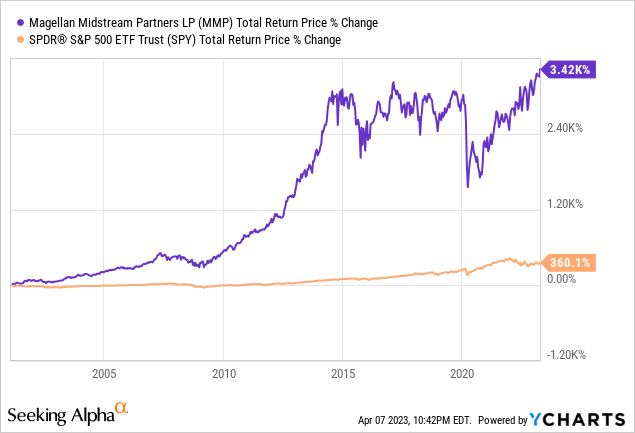

Nevertheless, MMP has still managed to significantly outperform the market over the full course of its public life, which has been much longer than MPLX's:

That lengthy and proven track record - which has enabled it to grow its distribution for 22 years in a row - counts for a lot in our view, especially given the strength and resilience of its returns on invested capital. MPLX has grown its distribution for 10 years in a row, which is impressive in its own right, especially given the industry in which MPLX operates (where the likes of Energy Transfer (ET) and Plains All American Pipeline (PAA)(PAGP) among several others have had to cut their distributions sharply over the years). However, MMP's track record is arguably second to none in the industry, giving it the edge here.

MPLX Vs. Magellan Midstream: Balance Sheet

Both businesses have strong balance sheets, with MMP slightly edging out MPLX once again in terms of credit rating (BBB+ vs BBB),

MPLX is actively reducing its leverage ratio and has achieved a conservative leverage ratio of 3.5x as of the end of 2022, the lowest it has been since 2017. Additionally, its debt maturity schedule is spread out over the next decade, ensuring a well-laddered approach to maturities. The company's anticipated annual free cash flow is projected to cover all upcoming annual maturities by at least 1.5x each year, further reinforcing its strong financial standing and limiting its refinancing risk in a rising interest rate environment.

MMP is well known for employing a very conservative strategy for capital allocation and balance sheet management, which is largely responsible for its industry-leading returns on invested capital as well as its industry-leading credit rating. The partnership has been shedding non-core assets to decrease its debt and repurchase common units in recent years as well. Its very attractive debt maturity schedule is such that none of its long-term debt will mature before 2025. Moreover, 83% of the total net long-term debt will mature in 2030 or later, with the majority not reaching maturity until 2042 or later. This approach secures low interest rates for MMP for an extended period, shielding MMP from any adverse effects of increasing interest rates and enabling it to continue compounding unitholder wealth at an attractive cost of capital for many years to come.

MPLX Vs. Magellan Midstream: Distribution Outlook

Moving forward, both partnerships' distribution levels seem very sustainable and supported by strong balance sheets and defensive assets. Furthermore, the management of each company has signaled their intention to continue growing their quarterly distributions annually going forward.

MPLX is expected by Wall Street analyst consensus to grow its distributable cash flow per unit at a 2.9% CAGR through 2027, while growing its distribution per unit at a 3.7% CAGR over the same span.

MMP is forecast by Wall Street analysts to grow its distributable cash flow per unit at a whopping 7% CAGR through 2027 thanks in large part to MMP's aggressive unit repurchase program. That said, its distribution per unit growth is expected to be much more lackluster, coming in at a mere 0.8% CAGR. This is because management seems much more focused on buying back units rather than growing the distribution. This is likely because its coverage ratio is lower than several other midstream business' is and also because MMP's concentrated focus on oil-related midstream businesses puts a shorter lifespan on its assets than what is enjoyed by natural gas and NGL focused midstream assets.

MPLX Vs. Magellan Midstream: Valuation

While MPLX appears cheaper on a relative basis to MMP, MMP is more attractively priced based on historical averages:

| MPLX | MMP | |

| EV/EBITDA | 9.52x | 10.78x |

| EV/EBITDA (5-Yr Avg) | 9.51 | 11.64x |

| P/2023 DCF | 7.17x | 9.26x |

| Distribution Yield | 9.2% | 7.7% |

Investor Takeaway

This is a difficult choice to make as both partnerships have proven track records of generating consistent distribution growth for investors through good times and bad and both have generated considerable total return outperformance.

MMP gets a slight edge qualitatively, but MPLX is not far behind. Moreover, MPLX clearly has the edge in terms of distribution yield and growth, whereas MMP looks to have a higher DCF per unit growth outlook. Ultimately if we had to choose today, we would pick MPLX simply because we think its 150 basis point superior distribution yield is hard to overcome. We rate both as Buys at the moment, but would probably not add them to our portfolio without a meaningful pullback that would bring them into Strong Buy territory.

Before purchasing the units of either business, it is important to keep in mind that both issue K1 tax forms.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

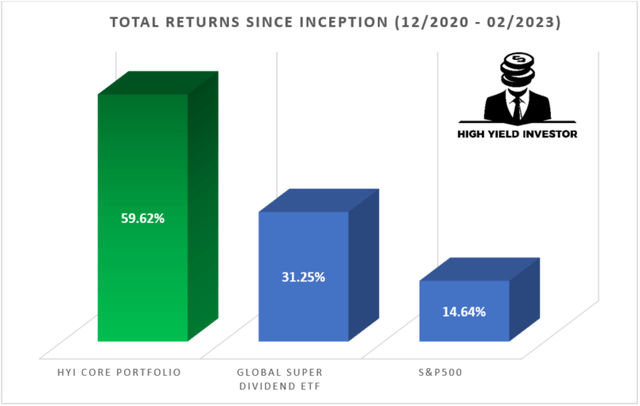

If you want full access to our Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Investor.

We are the fastest-growing and best-rated stock-picking service on Seeking Alpha with 1,500+ members on board and a perfect 5/5 rating from 150+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain. There's also a 50% discount for new members who join TODAY!

Start Your 2-Week Free Trial Today!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET, PAA, EPD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.