Schnitzer Steel Industries: Strong Earnings Potential Boosted By Ferrous Exports

Summary

- Schnitzer posted a net income of $4.4 million on revenues of $755.95 million after it had registered a net loss of $17.8 million in Q1 2023.

- SCHN plans to integrate ScrapSource with its national accounts platform while also launching integrated recycling services activities.

- Ferrous sales volumes grew by almost 50% (on sequential analysis), which the company attributed to December 2022 shipments that had been delayed from Q1 2023.

Vladimir Zapletin

Schnitzer Steel Industries (NASDAQ:SCHN) posted mixed Q2 2023 results with revenue topping estimates by $33.41 million while the EPS of $0.14 missed forecasts by $0.05. Schnitzer's revenue of $755.95 million represented a decline of 3.48% (Y/Y) even as the stock fell 40.74% in the last 12 months. SCHN has over 100 years of experience in sourcing, processing, and selling steel globally. With up to 99 recycling facilities across the U.S., Hawaii, and Puerto Rico, Schnitzer prides itself on a hallmark of sustainability in the steel manufacturing business.

Thesis

Schnitzer's management believes the tight supply conditions for ferrous scrap metal in the US are likely to continue into 2024 coupled with strong export demand. The company's bullish sentiment has been supported by four consecutive months of domestic positive price adjustments. Schnitzer's ties to Turkey are also a factor to consider as the country seeks to rebuild its infrastructure after the February 2023 earthquake.

Robust Scrap Metal Sales in Q2 2023

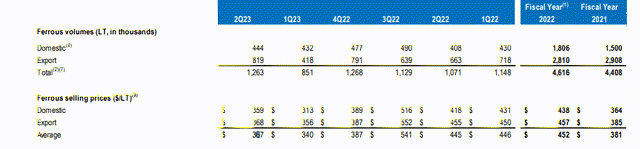

Oregon-based, Schnitzer posted a net income of $4.4 million on revenues of $755.95 million after it had registered a net loss of $17.8 million in Q1 2023. In the fiscal Q2 2023, SCHN's shipments of ferrous scrap metal rose 17.76% (YoY) or by 851,000 Long Tons (lt) to 1.26 million up from 1.07 million lt in the prior year.

Domestic Ferrous selling prices rose 14.7% (QoQ) from $313 per lot in Q1 2023 to $359 per lot.

Despite the average ferrous selling prices declining 17.53% (YoY) on quarterly analysis in Q2 2022, they still managed to rise 18.64% (YoY) in the Fiscal year 2022. This increase comes even as nonferrous volumes grew 15.85% in FY 2022 to 687.4 million pounds from 593.4 million pounds in FY 2021.

On sequential analysis, ferrous sales volumes grew by almost 50% which the company attributed to December 2022 shipments that had been delayed from Q1 2023. Margin expansion was however, tampered with by lower industrial/ consumer activity from Q1 2023 which had caused tighter scrap flows (than expected).

What About Export Prices and the Turkish Factor

Since the end of Q2 2023, ferrous export prices are expected to continue strengthening before we see a flattening of the curve. SCHN hopes the prices will remain in the mid-to-high $400s per ton after hitting a high of $552 in the quarter.

Operations of various Turkish mills were temporarily suspended after the February 2023 earthquake in Turkey leading to an increase in scrap demand in the country. This situation in turn triggered a surge in prices. In FY 2022, Turkey imported about 20.6 million tons of scrap averaging 1.7 million tons per month. In 2021, top scrap iron exporters included the "US ($7.8 billion), Germany ($5.43 billion), Netherlands ($4.17 billion), UK ($3.9 billion) and Japan at ($3.77 billion). At the same time, the top importers of this commodity were Turkey ($10.3 billion), India ($3.48 billion), Italy ($3.22 billion); Germany ($2.95 billion) and Belgium imported $2.83 billion."

As seen, Turkey's imports of scrap iron in 2021, exceeded the amount exported by the US by $2.5 billion. We can here see that Turkey, before the earthquake was a dominant player in the scrap metals dynamics and is expected to increase its importation into 2024 as the rebuilding progresses. In the catastrophe, more than 160,000 buildings with at least 520,000 apartments collapsed- indicating the largest calamity in the country's history. Further scrutiny also reveals that the cost of rebuilding Turkey will be an upside of $3 billion.

In its Q2 2023 earnings call, Schnitzer's CEO Tamara Lundgren stated:

"Recently, the Turkish government announced the country's need for 5 million tons of steel to support those efforts in the Iskenderun region. This implies a need for around 6 million tons of ferrous scrap. We expect that even accounting for Turkish domestic scrap generated by earthquake cleanup activities, Turkey scrap imports should rise materially to meet this need."

Domestic Steel Demand

On the domestic front, we are likely to see tighter scrap and rebar metal demand onwards into 2024. An aspect to consider on this front is the US Bipartisan Infrastructural Law which seeks to invest about $5.4 billion in upgrading recycling and waste management. Through the Build America, Buy America Act (BABA), we are likely to see a 65% increase in rebar production into 2024 as compared to the Fixing America's Transportation (FAST) Act. Reports indicate that the demand for recycled materials will spur rebar production since it mainly consists of heavy melting scrap. This situation helps explains why SCHN had an increase in ferrous volumes in 2022 as compared to FY 2021.

Upon ratification of the FAST Act in 2015, the Federal government authorized infrastructural spending of about $305 billion, translating to $153 billion per year (from 2016 to 2020). Fast forward, the Biden Administration pledged a grant amounting to $180 billion towards infrastructure, EV battery production, and other clean energy initiatives. In December 2022, a total of $1 billion was committed to the construction of bridges, tunnels, and highway interchanges.

These laws and infrastructural expenditures have had a drastic impact on steel rebar prices.

As seen above, steel prices reached a record high of 6198 CNY/T in May 2021 driven by high manufacturing PMI in both the US and China as the two countries sought recovery post Covid19.

Acquisition of ScrapSource

Schnitzer is expanding its asset portfolio after acquiring ScrapSource- a company providing metal recycling management services to more than 500 clients (including manufacturers) across the US. The company intends to scale its national accounts platform and expand into new territories. While explaining its importance, Lundgren stated,

"The integration of ScrapSource with our national accounts platform is well underway and we are launching our integrated recycling services activities under our trademark 3PR brand. 3PR stands for third-party recycling. 3PR involves activities where Schnitzer is providing recycling services, including, among other activities, scrap management and recycling solutions for our customers' reverse logistics processes."

Arguably, SCHN has quite a vision with this acquisition considering it only spent $25 million while acquiring its operating assets in 2022. Earlier in 2022, SCHN had bought assets from Encore Recycling and Columbus Recycling in 2021- a move geared towards growing its retail customer base.

Valuation

SCHN has a forward price-to-sales ratio of 0.26 which is 76.71% lower than the industry average of 1.13. This ratio is slightly higher than the price-to-sales (TTM) ratio of SCHN which stands at 0.25. This increase indicates the company may experience lower sales into 2023. The company's CapEx in Q2 2023 was down 43.75% (QoQ) at $27 million from $48 million spent in Q1 2023. However, SCHN provided a guidance of $110 million to $120 million on its CapEx for the Fiscal Year 2023 with at least a third left for growth projects. Further, the price-to-cash flow (TTM) ratio of 3.83 (about 54.57% below the industry average of 8.42) also connotes the fact that the stock is slightly undervalued.

Risks to Consider

Steel prices have been on a downward trend since the record high of 6198 CNY/T in May 2021. The decline is attributed to inflationary pressure and the global economic slowdown caused by the energy crisis. Further, SCHN's margin expansion has been adversely affected by tighter-than-expected scrap supply.

Bottom Line

Schnitzer has a promising upside due to the strengthening ferrous export prices and expected growing steel demand. The company is looking to expand its CapEx while increasing acquisitions in North America. I believe this stock is worth consideration in 2023 and for these reasons I am raising my rating from sell to hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.