IMCG: Not So Well Placed For Potential Fed Pivot

Summary

- IMCG has a lot of tech exposures, but they're not the kind that are as well positioned as a rate pivot play.

- We aren't 100% convinced the Fed will pivot at all, but the banking crisis is likely to lead to credit tightening that should be a big difference-maker for demand.

- On a technical level, IMCG exposures are likely to have many benefits from lower WACCs offset by recessionary pressures on cash flows. We think for broad investors large-cap ETFs win.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

Torsten Asmus

The iShares Morningstar Mid-Cap Growth ETF (NYSEARCA:IMCG) tracks a portfolio weighted towards pretty well-known mid-cap names in the US market. We think that while there's a skew towards tech names, and that should normally position IMCG ETF well for the macroeconomic happenings related to the banking crisis and a potential Fed pivot, they are not an optimal basket. Mid-cap tech names aren't the best place to be in the current economic setup, and as such we think investors are actually better served by taking on larger cap tech names, even though it's a more vanilla idea.

IMCG Breakdown

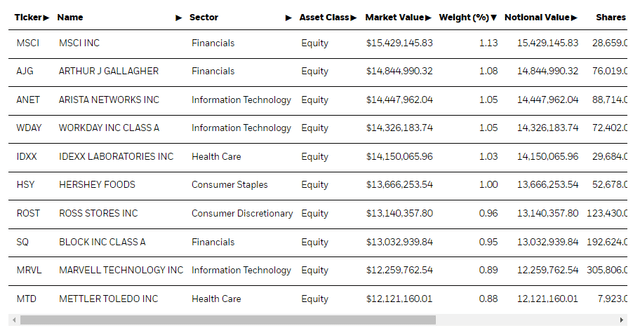

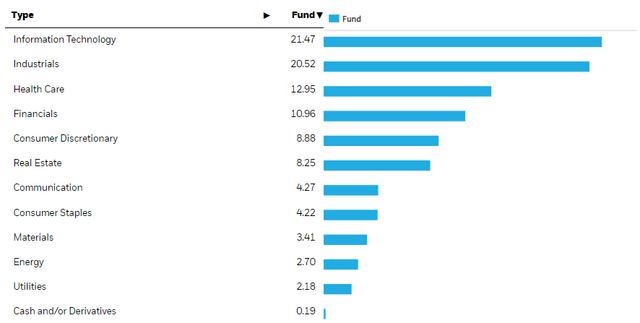

IMCG is a mid-cap basket with mainly IT exposures but also a fair bit of healthcare and industrial stocks.

Top Holdings (iShares.com) Sectors (iShares.com)

It is quite a broad portfolio of mid-caps with 327 elements. Expense ratios are also very low at 0.06%.

Since banking issues have been grabbing headlines, we should first mention that there isn't much regional banking exposures. Most of the financial exposures are insurance, with some regional banking, real estate-oriented companies, and some exchanges and index companies. Overall financial exposure is only 10%, and it's not driven by regional banking.

The tech exposures are more relevant. In the mid-cap space, the tech exposures are more things like IT and lately cloud integration and cloud consulting companies. There is also a certain degree of cybersec exposure folded into some of these exposures, but things like the cloud are some of the main exposures here. Other things are corporate facing apps and tech solutions, like Workday (WDAY) as an example. There are also some semiconductor exposures. The point is, these more marginal exposures in tech are not going to be as resilient or secularly sound as the large-cap tech stocks that drive US markets. While they depend meaningfully on horizon values in terms of how their value is modeled, they are more exposed on the cash flow side in the event of a rate pivot, which would come with lower rates but only because the demand environment suffers.

Bottom Line

We think that given the persistently low rates, the economy cannot take the reduction of credit availability lightly that will come with the issues faced by banks. To be precise, the issues faced by the banking sector are right now that whether large national banks or regional, deposit rates will come up and reduce profitability of the lending business, requiring more lending discipline. More critically, regional banks which are more vulnerable to runs but also have larger balances of less secure loans like commercial real estate, exposed to things like the office sector, are going to have to revise their lending discipline more sharply. Moreover, these businesses are much less fee dependent, they count heavily on their lending business to drive profitability, and cannot subsidise these activities with other more robust sectors like a national multi-service bank can.

In our coverage we've seen very uniform discussion about lengthened sales cycles with enterprise tech projects. In many cases that has caused revenue growth deceleration despite secular effects still being in play. This was before major non-linearities started that could impact credit availability. If headcounts start falling even further, many businesses which depend on seat-based models will see deceleration, and the extent of internal tech consulting and the breadth of services will fall too, along with corporate budgets. While there is a secular argument for tech, the stuff in IMCG is a little more exposed because they are more at the margins of the industry, hence their valuations in the mid-cap range. While lower costs of capital in a Fed pivot will help things, their cash flows are going to be less robust.

We think while IMCG is possibly the best pick in the mid-cap growth space, looking in particular at the low expense ratios relative to peers, investors may be more interested in large-cap tech which is going to see more benefits from a change in costs of capital while sustaining less downward revisions on their forecast cash flows.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.