JD Sports: We See Continued Strong Profits Ahead

Summary

- JD Sports Fashion plc is a retail company that offers branded sports fashion.

- Revenue has grown at an impressive 22% in the last decade, with margins improving gradually over time.

- JD's balance sheet is strong, allowing for future debt raising if required.

- We are forecasting continued strong growth, which should mean impressive returns for shareholders in the coming years.

- JD is valued in line with a group of peers that it outperforms. We see upside at the current share price.

Philip Openshaw

Investment thesis

Investing in retail can be difficult due to the lack of retailer strength, as consumers generally go where the brands are and those pricing attractively. JD Sports (OTCPK:JDSPY/OTCPK:JDDSF) looks to be different, producing impressive margins and growth, bucking the trend in the industry.

Company description

JD Sports Fashion plc is a retail company that offers branded sports fashion, outdoor clothing, footwear, and accessories for kids, women, and men. It has two segments, Sports Fashion and Outdoor. In addition to selling sports goods, it also distributes sports apparel and accessories, footwear, and apparel.

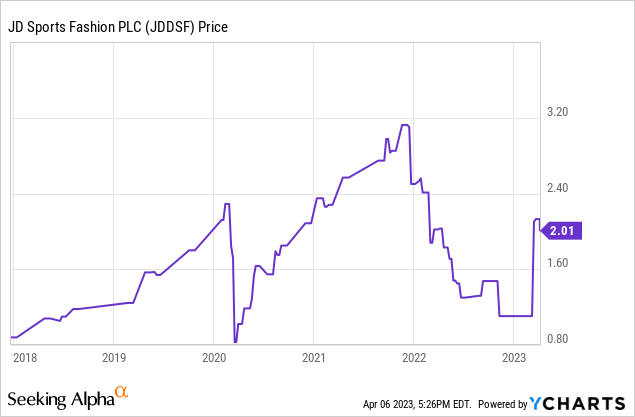

Share price

JD's share price has trended up in the last few years, driven in large part by significantly improving financial results through growth. The share price increase arguably does not wholly reflect the improvement in the business, which could pose an opportunity for investors in the coming years.

Financial analysis

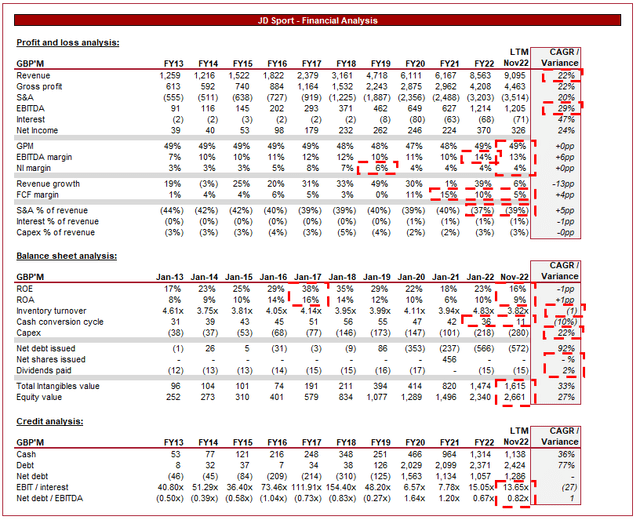

JD Sports financials (Tikr Terminal)

Presented above is JD Sport's financial performance for the last decade. The company has grown incredibly quickly but in an accretive fashion for shareholders.

Revenue

Revenue has grown at an impressive rate of 22%, driven by several bullish factors.

The global athleisure and sportswear market has been growing rapidly in recent years, with more and more "casual" consumers being brought into the market rather than just health-conscious individuals. The reason for this is an increased awareness of health and fitness, the growing popularity of sports, and the rise of the casual workwear trend. These factors are trend-like in nature but we would argue are structural shifts in consumer behaviors, and importantly are to the benefit of consumers, so is more likely to continue. This has been beneficial for JD as it has increased the company's total addressable market, while also serving as a tailwind for greater sales.

The growth of e-commerce has been a major trend in the retail industry over the last decade, with consumers increasingly shopping online. The pandemic has accelerated this trend, with many more consumers realizing the benefits of shopping online. JD has a large retail footprint and is the primary distribution channel for the business, however, it has always kept an eye on the e-commerce segment. For several years, JD has offered consumers the option of purchasing online and/or collecting their orders in-store. Further, it has developed a quality website, which gives the consumers the option for whatever suits them. For this reason, JD has not fallen behind like many other brick-and-mortar retailers but has instead thrived.

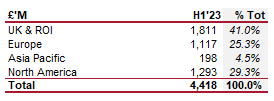

Another reason JD has been able to grow at the rate it has is due to international expansion. Many European businesses have failed to expand overseas, especially to the US, due to the level of competition in the domestic markets, with the incumbents having a better understanding of consumer preferences. This has not been an issue for JD, which has expanded outside of the UK to much success. As the following table shows, only 41% of JD's revenue is derived from the UKI, with the other geographies growing far more quickly.

Sales by region (JD Sport)

JD has achieved this by acquiring retailers overseas, as well as developing its own brand. This dual strategy has allowed the business to accelerate its penetration in the markets. One of the reasons it has been successful is due to the general uniformity in what consumers are looking for. The key is having a wide variety of in-demand brands. JD has been able to build its portfolio due to its scale in the UK, allowing it to stock all of the key leading brands.

We see two potential headwinds which may negatively impact JD going forward. Firstly, we have seen a trend toward brands focusing on direct-to-consumer (DTC), reducing their retailer distributions. A big example of this is Footlocker (FL), which suffered greatly when Nike decided to reduce its allocation. JD's response to this has been to continue its brand diversification, reducing its reliance on any one of them. Further, we have seen a greater focus on own label & licensed brands, as JD has greater control over this segment. So far, this issue has not stopped JD from growing well but we do expect it to be a drag on growth going forward.

The other headwind JD is facing is short-term in nature, that being economic conditions. We are currently experiencing inflationary pressure, contributing to a decline in consumers' discretionary income as they expend a greater proportion of income on living costs. As a result of this, consumers are far more likely to be defensive with their spending, reducing discretionary purchases where possible. Apparel and footwear are classic examples of this type of spending, as it is unlikely consumers will run out of clothes if they defer spending. H1'23 sales were down 13% compared to H1'22, suggesting JD is feeling the slowdown already. Looking ahead, we expect that things will continue as they are for another 3-6 quarters as central banks continue to focus on bringing inflation under control.

Margins

JD has done a fantastic job with its cost controls in the last decade. Firstly, GPM has remained flat across the historical period, suggesting the business has not been pressured from a pricing perspective to any material degree. This is an underrated performance area as many of the e-commerce retailers have gained market share by offering discounts and pricing aggressively, forcing the likes of JD to discount themselves or lose ground.

Further, S&A expenses have grown at a lower rate than revenue, allowing EBITDA-M to trend upward in the last decade. A portion of this is likely due to the large outperformance post-Covid, which means we may see a slight normalization. However, JD has shown it can achieve 11/12% consistently over many years, which is still a strong performance.

Balance sheet

Inventory turnover has declined by 1x since Jan22, suggesting the business is experiencing a noticeable slowdown as inventory begins to accumulate. This is usually an issue as it suggests Management may be more likely to discount products to keep inventory moving. This is still the case here, however, history suggests JD is unwilling to compromise margins.

Growth has also been supported by organic means, as JD has expanded its footprint. Capex spending has grown at a rate of 22%, with no evidence of this slowing down in the most recent periods.

Despite the rapid expansion, JD remains conservatively financed, with a ND/EBITDA ratio of only 0.82x. This gives the business a lot of flexibility to grow inorganically if required and invest as needed.

Interestingly, Management has chosen not to distribute to shareholders but instead deleverage, while accumulating cash. JD's efficiency metrics have trended down for this reason. Our view is that the company can reward shareholders at a comfortable level through bigger dividends and buybacks. The only reason we see this happening is that Pentland Group, JD's majority shareholder, does not want Management to do this.

Overall, Management has done a fantastic job with this business. It is growing very well, driven by industry tailwinds and good management. Further, profitability is good and margins are sticky. Its balance sheet is equally solid, leaving upside long term should Management decide to increase leverage.

Outlook

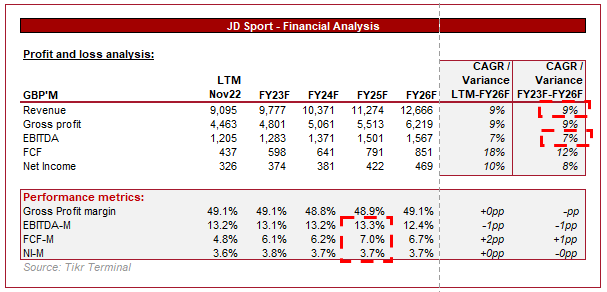

JD Sports outlook (TIkr Terminal)

Presented above is Wall Street's consensus view of the upcoming 5 years.

Revenue is forecast to grow at a CAGR of 9%, lower than its historical performance but still at a healthy rate. This is a reasonable estimate from analysts as JD moves toward maturity. Much of its growth will now come from developing its brands outside of the core "JD" brand, especially overseas.

Further, margins are expected to remain flat, with very little in the way of upside. This seems reasonable as JD's margins have been quite sticky, with some improvement over the historical period. This is difficult to price in without evidence.

Overall, we believe JD is likely to continue its quality performance going forward.

Peer comparison

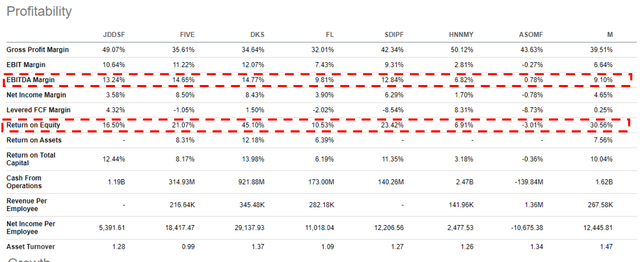

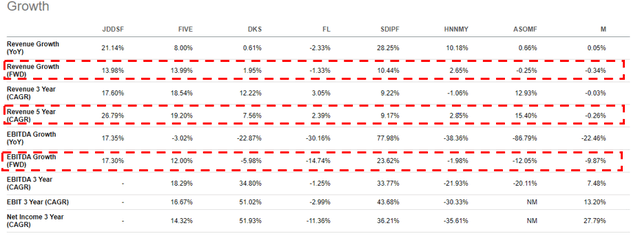

To assess JD's relative performance, we have compared the business to a host of retailers.

From a profitability perspective, JD is a leading business, only outperformed marginally by Five Below and Dick's on an EBITDA-M basis. This supports our view that profitability is highly attractive, especially given how sticky they have been.

Moving onto growth, this is where JD really shows its outperformance. The company is the fastest growing from a revenue and EBITDA perspective, reiterating that its revenue growth is accretive in nature and not based on undercutting the market.

Valuation

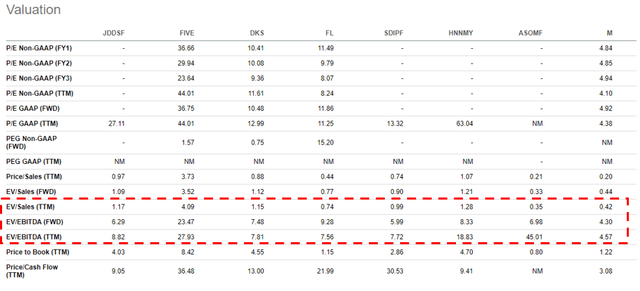

Based on the peer analysis, JD should be trading at a premium to the group. The business is only slightly less profitable than the leading companies while growing at a far greater level. Based on this, the returns for shareholders are far larger.

JD is currently trading at a surprising discount on a forward basis. Only Macy's (M) and the Frasers Group (OTCPK:SDIPF) are cheaper. Even on an LTM basis, the business does not look remotely overvalued. It is difficult not to suggest JD has upside from here, based on the current retail options available.

Final thoughts

JD is a well-run business, growing well and producing fantastic margins. When compared to peers, the business is a clear outperformer in our view. From a commercial perspective, we believe this growth has come from a natural shift in consumer spending habits, which are unlikely to move negatively in the coming years. Looking ahead, we are bullish on the company's growth prospects, which will rapidly contract margins if the markets continue to price JD this cheaply.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.