EWS: FY 2022 Review

Summary

- BlackRock's iShares MSCI Singapore ETF is up 9% since our last analysis.

- Singapore is still a good proxy for growth in Asia and most companies offer solid balance sheets and trustworthy management.

- Valuations are reasonable in terms of P/E, dividend yield and P/NAV.

- Our preference is for picking companies with solid fundamentals but for those that want to go the way of an ETF, this is a good alternative.

Irwan Ridwan Cholid/iStock Editorial via Getty Images

Investment thesis

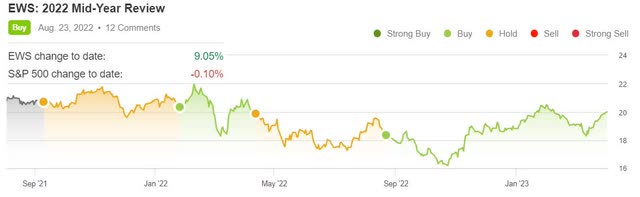

In our Mid-Year review of BlackRock's iShares MSCI Singapore ETF (NYSEARCA:EWS) back in August last year we upgraded our stance from a Hold to a Buy.

It has gone up by approximately 9% since August last year after our hike in the stance. It is not much but when we compare it to the S&P 500 being flat, it has not been a bad place to park your money so far.

EWS up 9% since August 2022 (SA)

With most of the companies in EWS having delivered their FY 2022 financial results it is a good time to review the performance of the 10 largest holdings in EWS and take a peek at how the economy in Singapore is doing.

Full-year review of EWS's main components

1. DBS Group (OTCPK:DBSDY)

DBS logo (DBS)

It does not surprise us that DBS Group is the largest component of EWS’s portfolio. It is Southeast Asia's largest bank.

We have just published an analysis of their 2022 FY results here and can confirm that we are long DBS.

2. Sea Limited ADS (SE)

SEA logo (SEA)

In our previous analysis, we pointed out that the company was losing money to the tune of USD 1 billion per quarter.

On the top line, SEA managed to increase its revenue by 25% from 2021 to 2022. However, their EBITDA got worse as the loss increased from USD 593.6 million to USD 878.1 million.

On a more positive note, the net loss reduced from USD 2 billion in 2021 to USD 1.7 billion in 2022.

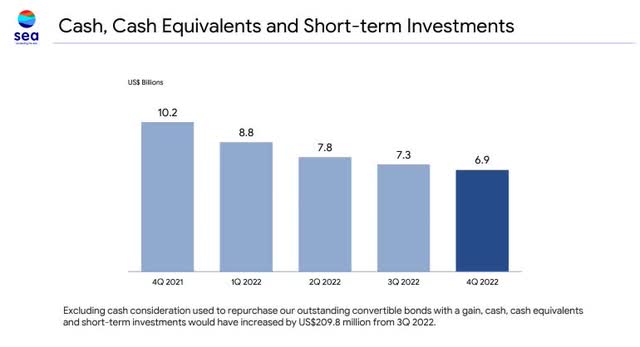

With these continued losses, the cash is dwindling.

SEA cash is dwindling (SEA FY 2022 financial results presentation)

The price of SEA is down 30% over the last 12 months. It is not a company that we have any interest in.

3. Oversea-Chinese Banking Corporation (OTCPK:OVCHF)

OCBC logo (OCBC)

Their FY 2022 net profit grew by 18% to SGD 5.75 billion. Interest income grew by 31% for the year. Their ROE was 11.1% which was an improvement from the ROE of just 9.6% it had in 2021.

The Non-Performing Loan ratio at the end of 2022 was 1.2%.

As with all the Singapore banks, they are all well-funded. OCBC had a CET1 capital ratio of 15.2%.

The interim dividend last year was raised from SGD 0.25 to SGD 0.28. The board proposed a final dividend of SGD 0.40. This leaves shareholders with a TTM yield of 5.3% based on the present share price of SGD 12.73.

Such yield is in line with its Singapore peers. Their target is a payout ratio of 50% going forward which is quite generous.

The price to TTM earnings is a reasonable 10 and so is the P/NAV of 1.12.

4. United Overseas Bank (OTCPK:UOVEF)

UOB logo (UOB)

Another Singapore bank is UOB Group, which we also covered in a recent analysis.

5. CapitaLand Ascendas REIT (OTCPK:ACDSF)

Capitaland Ascendas logo (Capitaland Ascendas)

Ascendas REIT is a part of CapitaLand Investment (OTCPK:CLILF).

It is Singapore's first and largest industrial real estate investment trust with a portfolio of 218 properties spread across the globe, valued at SGD 16.4 billion.

You might think that industrial real estate is just warehouse properties but, in fact, the bulk of what Ascendas owns are business spaces like offices and life science spaces.

The portfolio is globally spread out with 95 located in Singapore, 48 in the U.S., 36 in Australia, and 49 in the U.K. and Europe. The total occupancy improved from 93.2% at the end of 2021 to 94.6% at the end of 2022. The WALE is 3.8 years.

It has a healthy balance sheet with a gearing ratio of 36.3% with a weighted average cost of debt that has increased from 2.2% to 2.5% y-o-y.

They have managed to increase DPU by 3.5% from Singapore cents 15.258 in 2021 to 15.798 for the 2022 FY. That gives us a TTM yield of 5.32%.

As with all other REITs in Singapore, there is a dilution of shareholders' shares taking place each year as they all issue millions of shares to pay a large part of the distribution and all of their management fees. This occurs regardless of the price of the units. The lower the price, obviously the more units they all have to issue. Ascendas' number of units increased from 4,198 million to 4,204 million by the end of 2022.

NAV per share is SGD 2.30. With the present share price of SGD 2.87, we get a P/NAV of 1.25.

6. Singtel (OTCPK:SGAPY)

Singtel logo (Singtel)

After Mr. Yuen Kuan Moon became Singtel’s CEO in 2021, the company has done well under his leadership.

As their FY ends on 31st March each year we will have to wait to get their latest results.

Net profit for FH 2022 looked promising as it was up 25% from the year before, at SGD 1.17 billion.

They are also addressing the balance sheet, as net debt as of FH 2022 was reduced by SGD 3.4 billion. The net debt to EBITDA ratio was 1.3 which is comfortable. Interest rate cover is 15.4 x and as much as 93% are fixed rate debt.

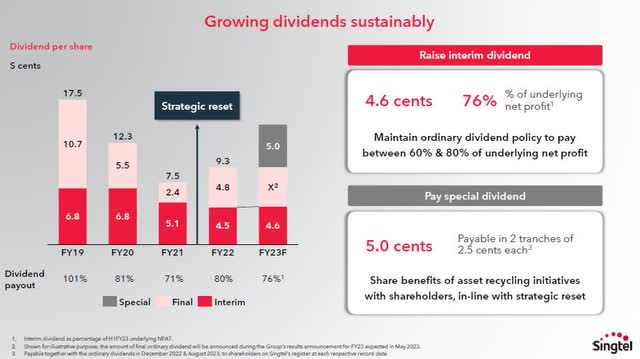

As we stated in our previous EWS analysis, Singtel has always been generous with its dividend payout. This led to some analysts questioning the sustainability of such high payout ratios. Their current dividend policy is to distribute 60-80% of underlying net profits.

Singtel's dividend policy (Singtel FH 2022 Financial Results Presentation)

We are long Singtel, although it is the smallest position in our portfolio. It is well managed and we like the fact that they have investments in several key areas in Asia. However, we do prefer to add to our other telecom position, namely China Mobile (OTCPK:CHLKF).

7. Singapore Exchange (OTCPK:SPXCF)

SGX logo (SGX)

As Singapore Exchange’s account year ends on the 30th of June, we only have FH year financial results ending 31 December 2022.

Net profit attributable to equity holders rose 30% to SGD 285 million. EPS for FH was Singapore cents 26.6.

Out of this, they paid out an interim dividend of Singapore cents 8.

NAV per share was down 5 cents to SGD 1.40. Based on the present share price of SGD 9.53 the P/NAV is high for us at 6.81.

8. Wilmar International (OTCPK:WLMIF)

Wilmar logo (Wilmar)

Wilmar is a global leader in the processing and merchandising of edible oils, oilseed crushing, sugar merchandising, milling and refining, production of oleochemicals, specialty fats, palm biodiesel, flour milling, rice milling, and consumer packed oil.

It has over 500 manufacturing plants with more than 100,000 people employed. It is one of the world's largest palm oil plantation owners with a total planted area of more than 573,000 acres.

2022 FY was another excellent year for this world-leading commodity producer and distributor. They benefited from increased palm oil and sugar prices.

The net profit for FY 2022 was USD 2.4 billion, an increase of 27% y-o-y.

EPS was US cents 38.3 which equate to Singapore cents 51.

Based on Wilmar’s current share price of SGD 4.15 we get an attractive P/E of 8.14.

Their dividend for the year was US cents 17, which was an increase of 10% y-o-y. It brings the TTM dividend yield to 5.45%.

Net debt to EBITDA is 3.96.

Palm oil and sugar are not what we consider healthy food. There is still a huge market for it, but we do not wish to invest in it from an ESG point of view.

9. Singapore Airlines (OTCPK:SINGY)

Singapore Airline logo (Singapore Airline)

What a difference a year makes. All airlines bled money over the last two years.

After several rounds of injecting capital during the pandemic, we have seen it fly like a phoenix both in Q2 and Q3 which ended on the 31st of December 2022.

Over the last 9 months, they manage to generate a respectable net profit of SGD 1.56 billion.

There obviously was no dividend paid over the last few years. However, the analyst community in Singapore expects the forward dividend to equal a yield of about 3.5%.

Singapore Airline's expected forward yield (Yahoo Finance)

One problem we see is the fact that they had to issue a lot of mandatory convertible bonds during the pandemic. Once these get converted to additional shares, the NAV per share will drop from SGD 6.55 to SGD 3.64.

This dilutive effect will surely also impact EPS and dividends going forward.

We reiterate our stance on SINGY from our last analysis where we stated:

It is one of the few international airlines that has been able to deliver profits year in and year out, but I believe its margins have been severely squeezed by the multitude of budget airlines and many other "premium" product offerings from competitors”.

10. Genting Singapore (OTCPK:GIGNF) (OTCPK:GIGNY)

Genting Singapore logo (Genting Singapore)

New to the top 10 list is Genting Singapore.

Genting Singapore’s main business is to own and operate large integrated resorts like Resort World Sentosa. These resorts have hotels and shops. They also have casinos and the Universal Studio Singapore theme park.

Similar properties are owned in Australia, the Bahamas, Malaysia, the Philippines, and the United Kingdom.

Net profit in 2022 came in at SGD 340 million, which was nearly double the SGD 183 million it posted the year before.

EPS was Singapore cents 2.82 and their dividend for the year was 3 cents. Presently the share is trading at around SGD 1.18 which gives us a yield of 2.5%.

Out from EWS's top 10 list is Keppel Corporation (OTCPK:KPELF) which fell from being the 6th largest to number 11. We assume they have sold down this position.

The dividend yield of EWS

We asked ourselves back in August why EWS had a dividend yield of 6.86% while the dividends of the top ten components, which account for 70% of their portfolio were only approximately 4%.

Here is an update on this question. This is the TTM dividend yield of the top 10 counters which is more than 70% of the portfolio.

EWS dividend yield of top 10 companies (BlackRock iShares plus yield by author)

We note that BlackRock now has a much lower dividend yield for EWS than back in August of last year.

Dividend yield of EWS (BlackRock iShares)

The difference most likely comes from the different times of the year when their dividend is received and paid out to holders of the ETF.

Singapore's economy

Singapore's Ministry of Trade and Industry ('MTI') had forecasted back in August last year that their GDP growth for 2022 would be in the range of 3.0 to 4.0%.

The official GDP growth, published on 13th February 2023, came in at 3.6%. They are guiding that the growth in the economy will be subdued this year to a growth of 0.5% to 2%.

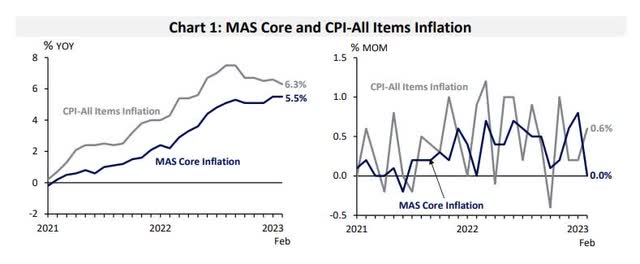

Singapore is faced with too high inflation, like most other countries. The latest figures were released on 23rd March and show that the inflation is still too high.

MAS inflation numbers (Monetary Authority of Singapore)

This inflation above 6% does not come as a surprise to us who live here. We all know that the two largest expenses in a household are a place to live and if possible, a car to drive.

You probably have heard that Singapore has some of, if not the, most expensive cars in the world, Before you can use a car you need a certificate of entitlement which lasts you 10 years. It is setting record-high prices. After you have forked out SGD 100,000 for that certificate you can buy the car.

Real estate prices have gone up post the pandemic and with higher interest rates, landlords want higher rents. It has gone up 28.5% in one year.

The resident unemployment rate remained low at just 2.8% as of the end of December 2022.

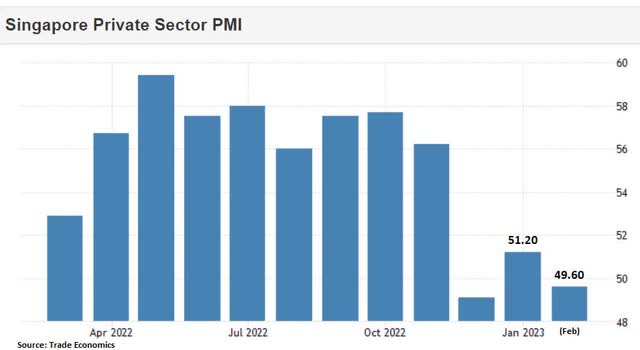

One indicator of where the economy might be going is to look at the private business PMI.

Singapore - Private business PMI (Trade Economics)

There are many dark clouds on the economic horizon. This surely influences business leaders in Singapore as well. As such, we do not see the upper 50’s level of PMI which we saw earlier last year.

Risks to the Thesis and a conclusion

The risk to the thesis lies in whether the global economy faces a recession that becomes longer and deeper than what people anticipate.

Singapore is a nation with both manufacturers, such as semiconductors, trade, financials, services, and tourism. Although it has no natural resources, it does have many legs to stand on.

We still like investing in Singapore. There are always going to be periods of uncertainty, but we believe that Singapore’s reputation and stability will be beneficial in the long run.

It is still a good proxy for investing in Asia as many companies located here do business all over Asia.

Our own preference is to buy individual companies rather than an ETF such as EWS. For those that simply have no time or interest to put in all the work to potentially find alpha, an ETF is not a bad substitute.

Our stance continues to be a Buy.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DBSDY, SGAPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.