Ping An: The Recovery Is Just Getting Started

Summary

- Ping An's FY22 numbers may have been down across the board, but the real takeaway was the growing evidence of a turnaround in H2 2022 and beyond.

- The insurer also completed its planned reforms and should reap the margin upside from here.

- As its earnings and dividend growth gains momentum, Ping An should re-rate.

Robert Way

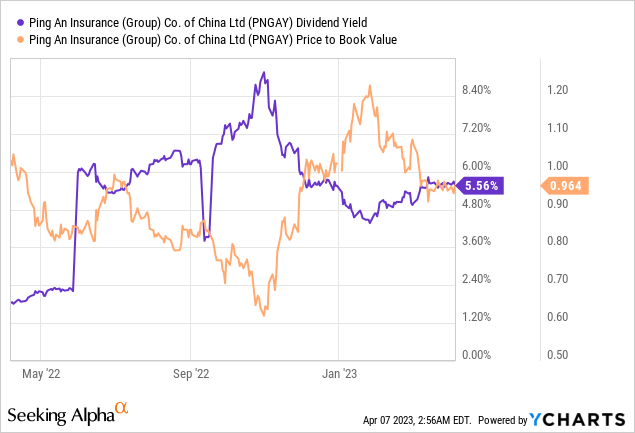

Following the post-reopening rally, Ping An (OTCPK:PNGAY) stock has fizzled out this year amid concerns about the pace of new business value (NBV) recovery in its life insurance segment. Given life is the biggest earnings contributor following group-wide agency reform and restructuring in recent years, the FY22 weakness in life NBV and profitability isn't great. Yet, the negatives are likely well understood by now, and with year-to-date numbers through February supporting the case for a turnaround, the company's reputation for high-quality business and execution should eventually shine through. Another key tailwind this year is that the three-year agency reform effort has been completed, which should further boost margins in FY23. Key catalysts in the coming months include the P&L benefits from Ping An's reform progress and life recovery, as well as upside to its dividend payout (currently at an ~6% yield).

FY22 Results Down but Year-to-Date Trends Indicate a Turnaround is Taking Shape

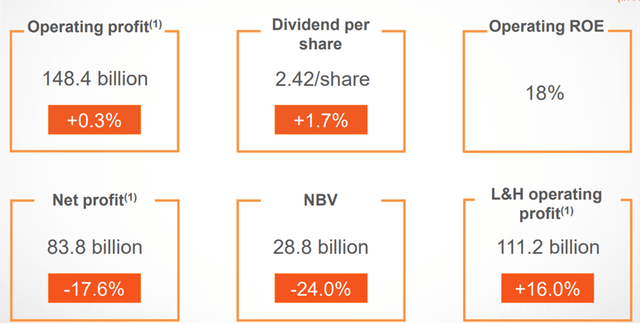

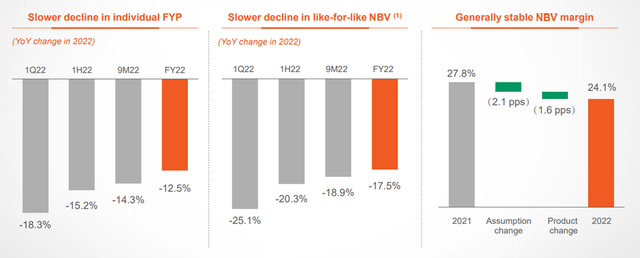

The key highlight from Ping An's full-year report was its ~24% YoY NBV decline to RMB28.8bn, with the steep YoY fall in H1 2022 decelerating to ~12% YoY over H2 2022. Key fundamental drivers were the post-reopening recovery in the Greater China region and the positive impact of life reforms, though changes in key operating assumptions were a factor as well. In particular, the expense ratio suffered from operating deleverage as lower sales volumes drove an increased cost per contract, while an improved persistency ratio also contributed to the operating variance. Per management, YTD data through February has shown an accelerated rebound, with agency-led VNB growth returning to positive territory. The momentum is expected to continue into March, underpinning management's NBV growth guidance through FY23.

Unsurprisingly, Ping An also has seen limited growth impact from the EU/US banking failures. Given its business exposure is primarily to Mainland China, the insurer should remain relatively insulated from the monetary tightening impact overseas. Its investment portfolio also is guided to experience no adverse impact, benefiting from a balanced through-cycle investment strategy that has yielded a solid 10-year average return of >5% (slightly above the company's long-term investment return assumption). While the current easing cycle and declining rate backdrop in China could see returns come under pressure near-term, Ping An retains ample safety margin vs. its low-single-digits % liability cost (per the typical guaranteed return profile on its products).

FY22 Profitability is also Down, but the Margin Expansion Runway is Intact

In line with the NBV decline, group operating profitability also was down across all business lines. The contraction in the life segment's new business margins stood out at -3.7%pts on broad-based weakness across product lines and an unfavorable mix shift. The only bright spot for the segment was short-term products sold through the agency channel, which proved to be surprisingly resilient throughout the year. Meanwhile, group embedded value (i.e., the adjusted net worth of the underlying business) was impacted by several one-offs, including the exclusion of ~RMB21bn of goodwill related to the acquisition of state-owned New Founder Group (NFG). Yet, efforts are underway to unlock synergies, for instance, by leveraging the acquired NFG medical resources to enhance Ping An's product reform.

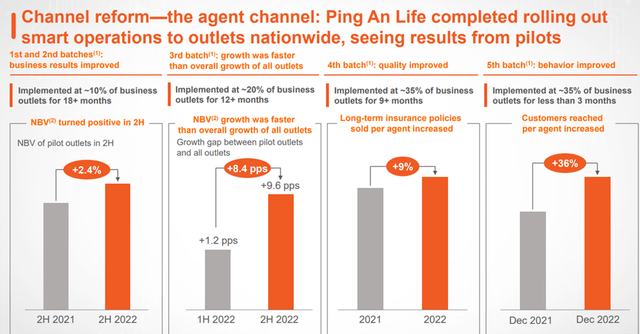

A key catalyst for improved margins in FY23 is the completed life reforms. The rollout of smart operations across outlets, in particular, will be worth monitoring. Most initial batches of reformed outlets already have delivered up to ~9% YoY NBV growth (per management) while underperforming batches are set to see similar uplifts following quality improvements. Retail also presents upside - capitalizing on the growing demand for savings-type products, Ping An is ramping up hybrid product offerings with integrated savings and protection functions in pursuit of a ~30% margin target. Thus, expect upside to Ping An's profitability and best-in-class high-teens % operating ROEs in the coming months.

New Accounting Standards to Kick in, No Material Profit or Dividend Impact

The big change coming for Chinese insurers in FY23 is the shift to IFRS 17. Much of the changes to financial reporting are cosmetic, though, with Ping An management guiding to a limited impact, given the similarities between IFRS 17 and the existing CAS 25 standard in China. The one change to keep an eye out for is the timing of profit recognition, though the total profit of a policy will remain largely intact. Accounting wise, the gap between operating after-tax profit and net income also will narrow, as the discount rate impact can now be absorbed in the other comprehensive income line on the balance sheet (vs. the net income line on the income statement previously).

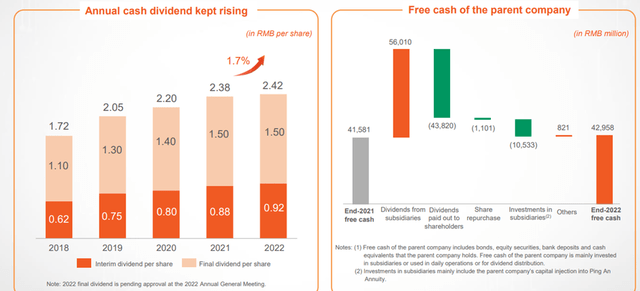

As dividend growth is tied to operating profit, there won't be any material impact here post-IFRS 17. As of FY22, the payout remains fairly low at ~30%, implying RMB2.42/share of dividends (+2% YoY), leaving ample room for upside going forward. As for the new financial regulatory regime, Ping An, as an integrated financial service provider, could be subject to incremental capital requirements. For now, though, management has not guided to any regulatory impact on future shareholder returns.

The Recovery is Just Getting Started

Following a downbeat FY22 report, the market has set a low bar for Ping An stock. Yet, with key agency reform and restructuring initiatives now in the rear-view mirror, there's a clear path to more outperformance alongside the post-reopening life NBV recovery. Given the company's track record of execution and high-quality business, as well as the low NBV base at <40% of pre-COVID levels, the risk/reward for underwriting a fundamental turnaround remains favorable. In the meantime, investors get paid an attractive mid to high-single-digits percent forward dividend yield to wait.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.