Union Pacific's Aggressive Debt Financing And Capex Reduction: A Cause For Concern?

Summary

- Union Pacific dominates the North American railroad sector, but its aggressive debt financing and reduced capex raise concerns about long-term sustainability.

- UNP's debt has grown by 238% to $33 billion since 2010, while its dividend has increased by 863%, significantly outpacing the growth of its industry peers.

- UNP has funded its share repurchases and dividends by reducing capex from 17.3% before 2010 to an industry-low average of 16.3% after 2010, with guidance suggesting further reduction to 15%.

- UNP's long-term underinvestment in its business may result in gradually deteriorating margins and less efficiency.

- I recommend avoiding the shares as I see a 26% downside to $145.

Wentao Li/iStock via Getty Images

Union Pacific (NYSE:UNP) is a key player in the North American railroad industry, boasting an extensive network that serves as a vital transportation link across various markets and regions. While UNP's competitive advantages and financial performance are noteworthy, I am concerned about its aggressive strategy of returning cash to shareholders through increased leverage and underinvestment in its business. This article will delve into UNP's strengths, financials, and outlook, as well as examine the potential long-term consequences of its debt financing and capex reduction policies. If UNP continues in this trend of underinvestment, I expect margins to gradually deteriorate valuing the shares at $145.

Competitive Advantages

UNP's expansive rail network serves as a substantial competitive edge. Spanning the Western US, from the Pacific to the Mississippi, the network accounts for around half of the rail volume in the area. UNP Railroad, the primary operating company of UNP Corporation, is one of the most prominent American corporations. By connecting 23 states in the western two-thirds of the nation via rail, UNP plays a crucial role in the global supply chain.

UNP caters to several rapidly growing US population centers, extends from all major West Coast and Gulf Coast ports to eastern entry points, connects with Canada's rail systems, and is the sole railroad accessing all six primary Mexico gateways.

Company website

This comprehensive infrastructure creates a steep barrier to entry for potential competitors, as obtaining contiguous rights of way and laying continuously welded steel rail across a substantial portion of North America is an immense challenge. UNP's dominant presence in the industry helps protect its market share and profitability.

Efficient scale is another crucial advantage for UNP. Massive upfront infrastructure costs and potential excess capacity deter rational competitors from entering the market. The seven North American Class I railroads are:

BNSF Railway Co.

CSX Transportation (CSX)

Grand Trunk Corporation, Canadian National's operations (CNI, CNR:CA)

Kansas City Southern Railway

Norfolk Southern (NSC)

Soo Line Corporation, Canadian Pacific's operations (CP, CP:CA)

UNP Railroad

Among them, they have thousands of customers across numerous end markets, resulting in significant freight volumes across their networks. This efficient scale has emerged from industry consolidation which allowed for rail line sales and combinations. As a result, UNP enjoys a cost advantage relative to new entrants.

UNP gains advantages from its fuel efficiency and cost-effective utilization of labor. Generally, rail shipping is more affordable than truckload shipping, and UNP's efficient resource management enhances this benefit. This is due to several factors. Rail transportation is considerably more fuel-efficient, and railcars can accommodate a higher volume than trucks; a single railcar is equivalent to approximately four full truckloads. Additionally, the maintenance costs for railcars are significantly lower.

2022 Financial Performance

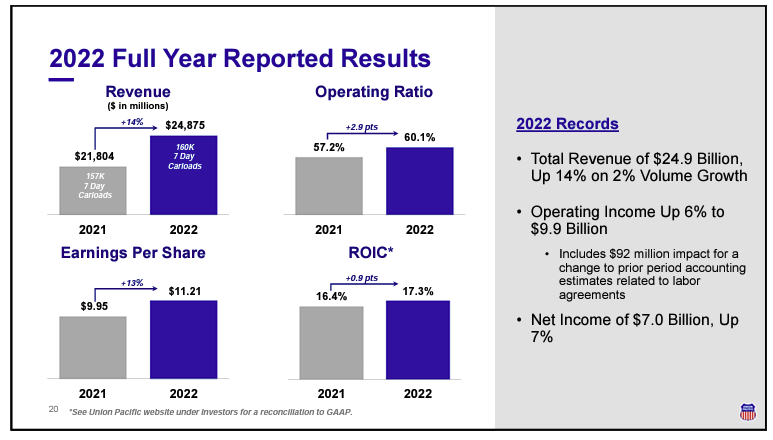

In 2022, revenue increased by 14% due to strong yield expansion, while volume growth reached 2% as a result of service challenges, intermodal congestion, and rail strike threats. The yield improvement led to an improvement of 290bps in the operating ratio to 60.1%, and ROIC rose by 90bps to 17.3%, significantly exceeding its cost of capital.

Company presentation

2023 and Beyond

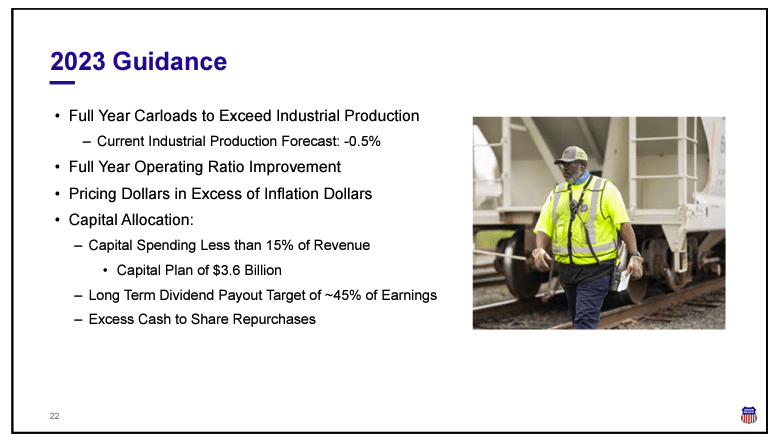

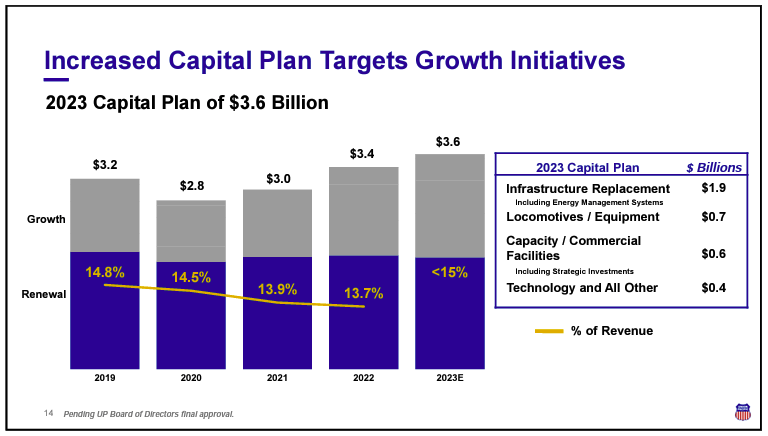

Looking forward to 2023, I anticipate revenues to remain stable. UNP aims to price above rail-cost inflation, but the increase is likely to be offset by a decline in industrial production. Yields could experience pressure from decreasing fuel surcharges and easing storage revenue, as well as competition from dropping contract rates in the truckload market. Although UNP projects an improvement in the operating ratio, I believe this will depend on volume growth and incremental cost savings, both of which might be challenging to achieve this year. UNP plans to allocate $3.6 billion to capex where half will be deployed to replace infrastructure.

Company presentation

As for the long-term allocation, UNP is guided to not exceed more than 15% of revenues in capex, 45% for the dividend, and any excess cash into share repurchases.

Company presentation

Dividends and Share Repurchases

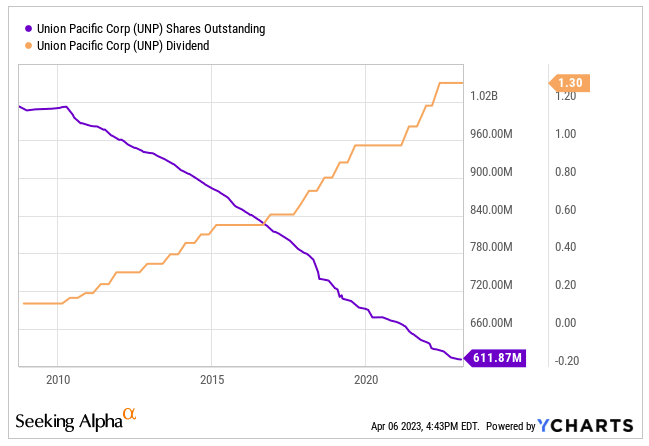

From 2010 onwards, UNP accelerated its return to shareholders. Since then they increased the dividend and started buying back shares.

Ycharts

In 2009, UNP distributed $1.02 per share in dividends, which grew to $5.08 in 2022. During the same period, UNP decreased its outstanding shares by 38%, from one billion shares to 611 million shares.

Aggressive Debt Financing and Capex Reduction

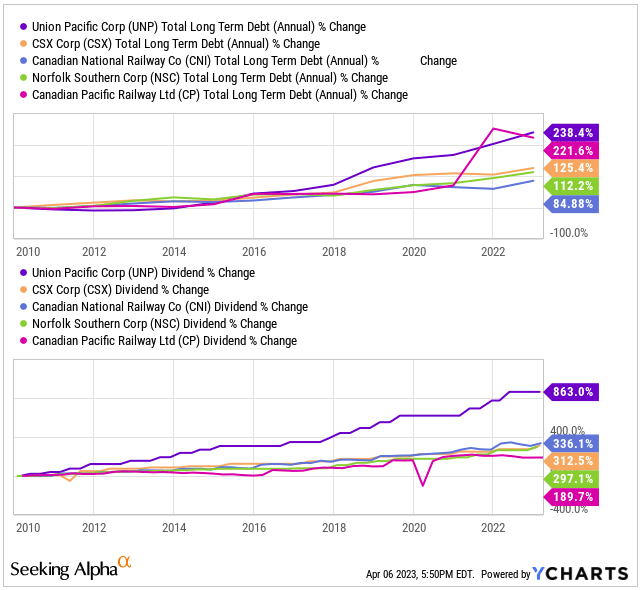

As Michael Hooper highlighted in his article, UNP has significantly increased its debt level. Since 2010, all railroad companies have raised their debt, increased dividends, and repurchased shares. However, UNP's approach appears more aggressive. During this period, UNP's debt has grown by 238% to $33 billion, while most of its peers have increased their debt by 85% to 125%. UNP has grown its dividend by 863%, while its peers experienced growth rates between 190% and 336%.

Ycharts

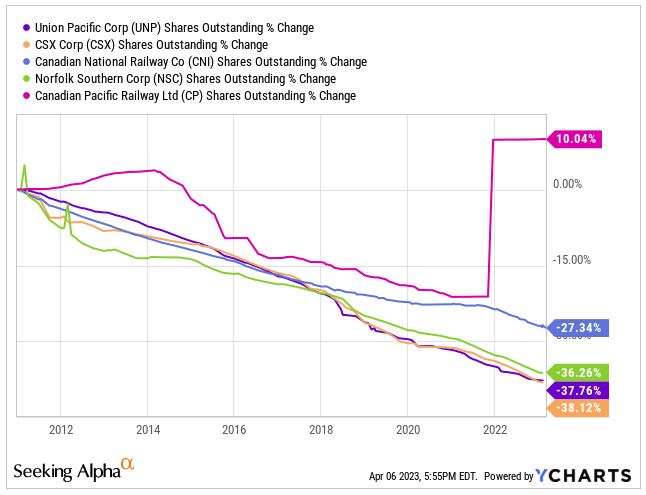

UNP's 38% share reduction is comparable to that of NSC and CSX.

Ycharts

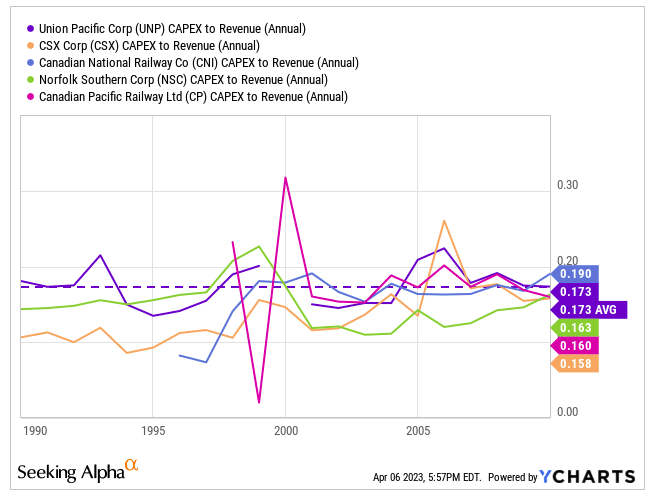

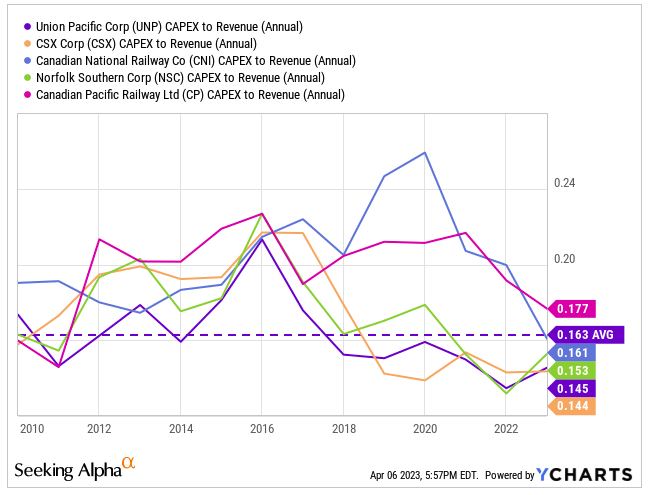

In addition to aggressive debt financing, UNP has been funding its share repurchases and dividends by reducing its capex. Before 2010, UNP's capex level was 17.3%, comparable to its peers.

Ycharts

However, since then, it has lowered its capex to the industry's lowest averaging 16.3%. This trend may worsen, as UNP has guided long-term capex levels not to exceed 15% of revenues.

Ycharts

There is a 26% downside in the shares if underinvestment continues

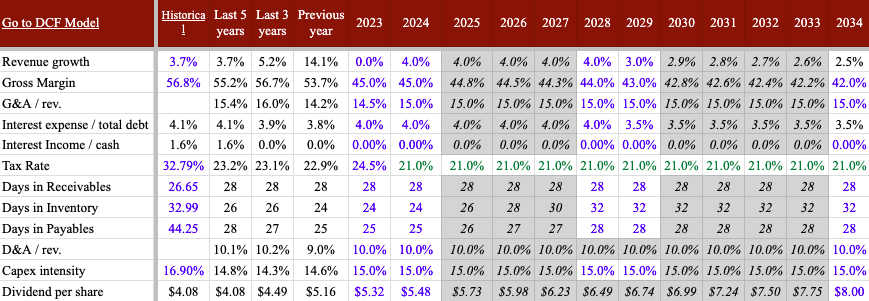

I estimate the share price at $145, using a DCF valuation method. This is based on a cost of capital of 6.5%, derived from an unlevered beta of 0.94 for the railroad industry. While I anticipate flat revenues for 2023, I expect revenue growth to average 4% over the medium term, driven by the economic recovery. I expect UNP's margin to deteriorate in the long-term as its underinvestment will make UNP less efficient. Here are the rest of my assumptions:

Author estimates & company filings

Conclusion

UNP has undeniably demonstrated its competitive advantages and solid financial performance. However, UNP's aggressive strategy of returning cash to shareholders through increased leverage and underinvestment in its business raises concerns about its long-term sustainability. This article has explored UNP's strengths, financials, and outlook, shedding light on the potential adverse consequences of its debt financing and capex reduction policies. If UNP persists in underinvesting, we can expect margins to gradually deteriorate.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.