ICL Group Is An Interesting Investment

Summary

- ICL Group Ltd has managed to build out an international presence and increased cash flows at an impressive rate, resulting in a generous dividend yield.

- With the market showing no signs of slowing down, I think ICL Group Ltd will be able to continue seeing hungry customers willing to buy their product.

- With a healthy balance sheet and a positive outlook, I will rate the company a buy.

onurdongel

Investment Summary

ICL Group Ltd (NYSE:ICL) is a global company that specializes in providing a wide range of products and solutions to various industries such as agriculture, food, and engineered materials. With a presence in over 30 countries, the company offers a diverse product portfolio that includes fertilizers, potash, and bromine compounds and also offers investors the opportunity to have more international exposure and in turn a more steady appreciation from investing in the growing demand in the industry.

The company had an impressive last earnings report and left investors satisfied as the company has been able to increase cash flows efficiently which translated into a nice dividend yield. I think the company is interesting and offers little downside risk and instead could provide some good appreciation as a long-term position.

Catalyst

ICL Group Ltd is a play on a growing demand to establish stable streams of food production. As the company provides a variety of products associated with ensuring there are sufficient crop yields and also mitigating the risk of crop losses, they benefit directly from this increased demand. According to a report by gminsights the CAGR between 2022 and 2030 for the fertilizer market is expected to be 2.6%. I think ICL Group Ltd will be very able to keep up with this growth and most likely outpace it given the competent management and that the company has a strong cash position that can be used to make strategic investments to stay ahead of the competition.

In addition to the fertilizer market, the seed market and crop protection market are also crucial components that contribute to the growth and well-being of crops. The seed market, comprising both conventional and genetically modified seeds, is projected to grow steadily in the future. Moreover, with the devastating impact of the war in Ukraine on the global grain and corn supply, there arose an urgent need for new areas to be cultivated and made ready for production. This led to a significant increase in demand for fertilizers, as farmers sought to replenish depleted soils and ramp up production quickly.

Risks

A risk for the seed protection industry is the increasing popularity of genetically modified (GM) crops, which are designed to resist pests and diseases. While this can reduce the need for seed protection products, it also poses challenges for the industry as GM crops require significant investment in research and development to create new varieties that can resist emerging pests and diseases. I think however the establishment of these GM crops is far away and in the meantime, the demand must be met now for fertilizers and ICL Group has the opportunity to do so.

Looking at the company more specifically, one could make the case the long-term debt of around $2.3 billion will stay a challenge for the company. But I think right now the company is making the necessary steps to stay ahead and utilize the immense cash flows they are currently generating. Instead, the risk of share dilution increase might be larger. If there are any interruptions in the production chain, costs might amount and the company could need to dilute shares to secure its cash position further. This would of course hurt investment in the company.

Financials

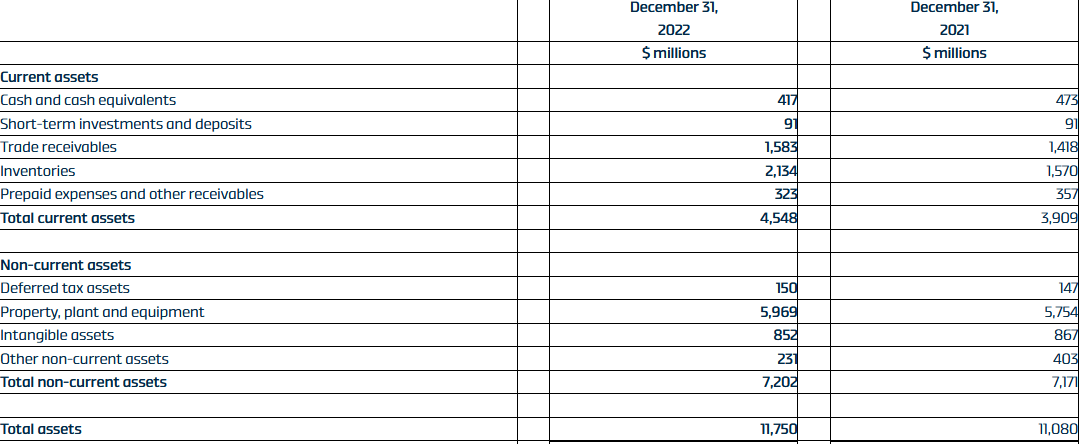

ICL Group's balance sheet for the years 2021 and 2022 shows a significant increase in its total assets from $11,080 million to $11,750 million, which is a good sign for the company's financial health in my opinion. It highlights the management's ability to make strategic investments and moves.

Assets (Balance Sheet)

Inventories showing the biggest increase from $1,570 million to $2,134 million showcase the increased demand for the products the company supply. I doubt this will become a liability for the company and inventory should stay slim and the company continuously ships it out to customers.

Liabilities (Balance Sheet)

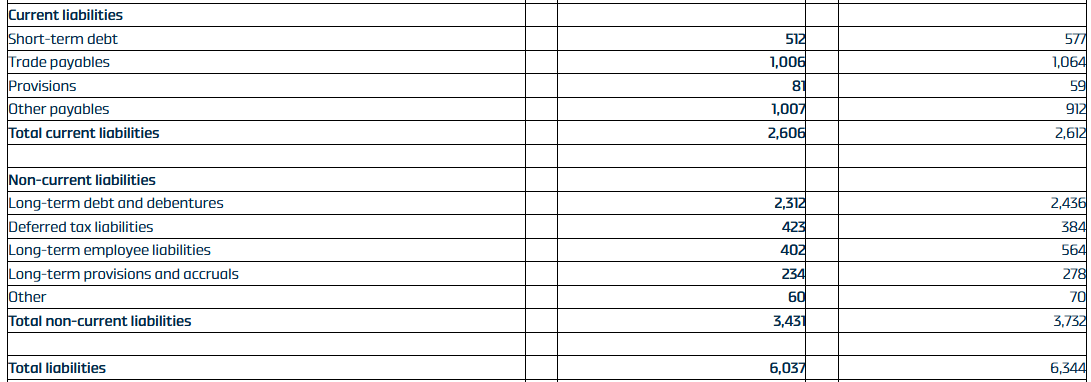

Looking at the long-term debt I don't see that much of a worry. It might be a fair bit over the cash position of $417 million, but very manageable as the company generated almost $1.2 billion in cash flows in the last 12 months. Given that the debt also decreases year over year I see little worry.

Overall, ICL Group's balance sheet shows a positive trend, with a strong increase in total assets and current assets. Moving forward I will keep a close eye on the way debt is paid back and whether or not it becomes too much of a liability and the company increases share dilution, although I find this right now quite unlikely.

Valuation & Wrap Up

Looking at the valuation of the company it's trading at a very low p/e to the overall industry. The worrying sign might be the forward p/e increasing, indicating estimates of fewer revenues are large. The current forward p/e is around 7 compared to sector 13. I still think investing right now offers more reward than risk.

Stock Chart (Seeking Alpha)

I think that the generous dividend the company is distributing is a sign of the robust balance sheet the company has. Long-term debt should not become an issue when the company has leveraged FCF margin of 12.16%. The company has even managed to generate a ROC of 26% which is incredibly impressive. This gives me further hope the management knows what they are doing and can make efficient investments and bring value to shareholders through further dividends. I would like to see a shift and have shares bought back also. But the dilution is quite small and not large enough to make a dent in an investment right now. If the company is able to stay on par with the industry's expected growth and demand for fertilizers stays on the course I think ICL Group offers a stable addition to a portfolio. Because of this reasoning, I will of course rate them a buy for the moment.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.