Vertex Pharmaceuticals: A Promising Portfolio After A Year Of Growth

Summary

- Growth in sales of their cystic fibrosis portfolio that they are pushing to expand further.

- Stable financial position with low debt and good cash reserves.

- Completed submission of their gene therapy for treatment of two hematological treatments.

microgen/iStock via Getty Images

Overall thesis

Vertex Pharmaceuticals (NASDAQ:VRTX) have shown a good year of share price increases after a good year of increasing revenues from their cystic fibrosis portfolio. The main new story about them is that they have completed submission of their gene therapy treatment for two haematological conditions. Their annual report shows they have a good financial position, and they appear set for future growth.

Main news

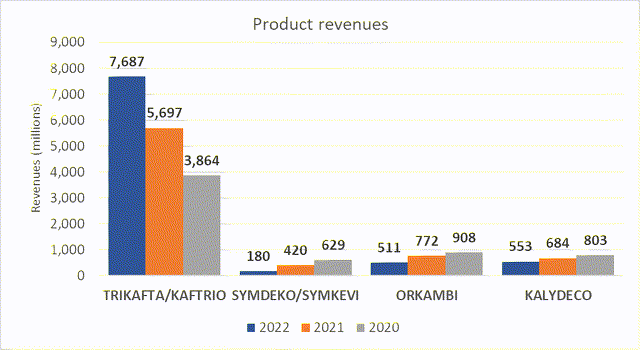

Vertex currently have six approved medications in different forms indicated for treatment of cystic fibrosis. Of these, it is their combination therapy Trikafta (elexacaftor/tezacaftor/ivacaftor and ivacaftor), also known as Kaftrio in the EU that is their main selling product. It has shown impressive growth from 2020, increasing from $3.8 billion to $7.6 billion in 2022, and has been the major driver of the company’s revenues, seeing as sales of their other product have steadily dropped over the same period. Revenues for Trikafta are expected to continue to grow with expansion into further markets.

Source: Vertex annual report 2023

Vertex have been going through a period of acquiring several companies over the past few years. Most recently in 2022 they acquired ViaCyte, a company focused on delivering novel stem-cell derived treatments, including for type 1 diabetes, as well as Catalyst Bioscience’s portfolio of complement directed therapies. In 2019 they also acquired Exonics, a company focused on developing gene-editing therapies for neuromuscular diseases.

Pipeline

In addition to their approved product, Vertex have several products in their pipeline nearing completion, with two phase III trials ongoing for cystic fibrosis. They have also filed for approval of Trikafta for treatment of cystic fibrosis in children aged 2–5 years old, with the PDUFA date set for April 28 2023.

The key catalyst for this year I believe is their gene-therapy product, exa-cell. Vertex, in collaboration with CRISPR Therapeutics announced submission of their gene-therapy product for beta-thalassaemia and sickle cell anaemia in the USA, as well as in the EU and UK. A decision is expected within 8 to 12 months. Sickle-cell anaemia is a genetic haematological disease affecting around 100,000 people in the US. Vertex estimate that approval of this treatment would be a multi-billion-dollar opportunity, with each treatment likely costing several million dollars. However, with lifetime costs for sickle-cell disease between $4–6 million, it overall works out cost efficient.

This would make them the first company to bring a therapy utilising CRISPR technology to market and would likely bring with it a lot of publicity. Although complex technologies like this are fraught with risk when submitting for approval and acceptance is far from guaranteed.

A big story here is that they have become an important competitor for the other leader in the field, Bluebird bio, a company I have written about several times. Bluebird bio was the first company to bring a gene therapy to market for beta thalassaemia; however, their latest submission for sickle cell disease has faced an FDA delay. While there are numerous gene therapies in development for haematological disorders, Bluebird bio are the only one with an approved product and another close to approval, making them a major competitor.

Other treatments in development include for pain management, with a phase III trial expected for completion in late 2023/early 2024, with fast track and breakthrough designations granted.

They also have a therapy for APOL1 mediated kidney disease with an investigational drug that has received breakthrough therapy and orphan drug designation by the FDA and EMA, respectively, with phase II/II trials ongoing.

Following acquisition of Semma in 2019 and ViaCyte in 2022, Vertex have established a presence in type 1 diabetes. They are developing a type 1 diabetes stem cell based therapy, currently in early trials.

Finally, they are also developing a gene therapy for Duchenne muscular dystrophy.

Vertex have some ambitious and interesting products in their pipeline. Their fourth quarter presentation expects five launches in five years, an ambitious but exciting goal that would see them with a diverse and likely valuable portfolio. While they are still in their early stages, they have potential to gain a lot of interest if they gain approval, although is some years off and by no means guaranteed, with many gene therapy and stem cell-based treatments failing before they get to market. But they are certainly ones to watch.

Risks

As with any pharmaceutical company, they are subject to the risk of negative approval decisions. Their gene therapy exa-cell, despite having a lot of publicity after their recent submission, may not receive approval. Furthermore, even with approval, their expected high price tag may be a challenge when convincing insurers and other payors of its value. Gene therapy is becoming a more busy space, although Bluebird bio currently represents the other major player with their gene therapy awaiting an FDA decision.

Their other products, including their pain medication may also fail to receive approval, leaving them out of pocket. Pain management is one of the largest areas in medicine, with a large market share dominated by traditional options such as opioids, NSAIDs or other over-the-counter treatments. Many other companies are also developing novel treatment options for pain, so Vertex are by no means the only active player here. Event with approval, entering this busy space and taking market share will be a challenge.

The cystic fibrosis treatments are currently the major source of revenues for Vertex. However, many other major pharmaceutical companies are also active in this area, and competitor products could easily eat away at their market share.

Financials

Vertex currently have a market cap of $82 billion; their share price is trading at around $324 after seeing around 18% growth over the past year. Vertex Pharmaceuticals do not currently pay a dividend. Vertex seem to be in a relative stable financial position. They have good cash reserves, with cash burn rate estimates seeing them through another year or two relatively comfortably, and a relatively low debt ratio of 0.23 for 2022, and a debt-to-equity ratio of 0.3. Their revenues have increased, mostly driven through the success of their cystic fibrosis treatment Trikafta. This has seen their income per share increase to $12.89 in 2022, up from $9.01 in 2021 and $10.29 in 2020, giving them a price-to-earnings ratio of around 25.

Conclusion

Vertex Pharmaceuticals seems like a company on a roll. Their cystic fibrosis portfolio is well established and growing, with plans to expand further into further indications that should support their already impressive revenue growth in this sector. Their gene therapy product has been submitted, which would put them in a good position for a lot of publicity excitement. They also have a healthy pipeline with several other treatments in development nearing submission. Vertex are in a good financial position and look ready to continue their growth after a series of acquisitions.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.