Seadrill Q4 2022 Earnings: A Leaner And Larger Opportunity, But Not At A Great Price

Summary

- Seadrill reported mixed results for the final quarter of its 2022 fiscal year, with revenue missing but earnings blowing past expectations.

- The company has done well to pay down debt, and its overall financial condition is undeniably decent.

- SDRL stock is cheap compared to similar firms but not cheap enough to account for industry risks.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

grandriver

April 5th proved to be a rather fascinating day for shareholders of offshore drilling company Seadrill (NYSE:SDRL). Earlier in the day, shares of the business were up as much as 9.5%. However, they ended up closing lower at the end of the day by nearly 0.4%. This extreme volatility was driven by the company's fourth-quarter earnings release for its 2022 fiscal year. What data was provided by the company was rather mixed compared to what analysts anticipated. In addition to this, the company has not provided significant guidance when it comes to the 2023 fiscal year. Although these are negatives, there were some positives as well. For instance, management continues to focus on debt reduction. On top of that, it recently completed an acquisition that had the effect of boosting backlog. Purely from a risk perspective, this data does seem to indicate that the company is fairly solid. Though shares are not cheap enough, unfortunately, for me to be all that bullish about it.

A look at Seadrill's Q4 earnings

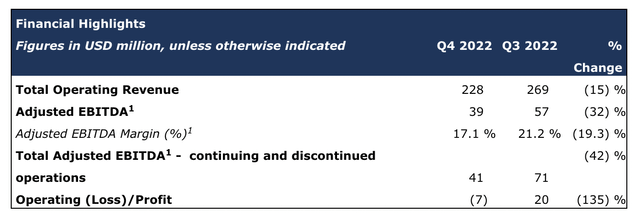

On the morning of April 5th, the management team at Seadrill announced financial results for the final quarter of the company's 2022 fiscal year. On the top line, the business reported operating revenue of $228 million. For perspective, analysts were anticipating sales to be about $27.8 million higher than that. Normally, I would have liked to compare the company to the year prior. But because of the nature of its restructuring activities that resulted in $5 billion of deleveraging and that was completed in February of last year, I don't believe that year-over-year comparisons are all that appropriate in this case.

In lieu of this, management has compared the company's results to what they were only one quarter prior. For the third quarter of the 2022 fiscal year, sales were $269 million. That implies a 15.2% decline sequentially. This, management said, was driven largely by fewer rig operating days across the company's fleet. During this time, Seadrill also experienced a decline in profitability. For instance, EBITDA during the quarter came in at $39 million. That compares to the $57 million on a continuing operations budget seen only one quarter earlier. Earnings per share, on the other hand, skyrocketed, coming in at $4.75 compared to the $1.04 experienced one quarter earlier. This actually exceeded analysts' expectations by $5.41 per share. Digging deeper, however, we find that this massive disparity was driven in large part by a $272 million after-tax profit from discontinued operations. Actual operating profit for the company came in negative to the tune of $7 million compared to the $20 million profit experienced only one quarter earlier.

Assessing what kind of opportunity Seadrill offers is complicated by the fact that management has been somewhat vague about future prospects. In addition to this, the firm recently completed a merger with Aquadrill, another firm dedicated to the offshore drilling space. That transaction was an all-stock deal initially valuing the enterprise at $958 million. But after seeing shares of rise in recent months, the effective buyout price on the day the deal was completed was $1.24 billion. The real benefit behind this transaction, in addition to the roughly $105 million worth of cash acquired, was the additional backlog. You see, at the end of the 2022 fiscal year, Seadrill Had backlog of $2.3 billion. This was thanks to a $187 million increase seen in the final quarter of the year. But with the purchase of Aquadrill, the backlog rose to roughly $2.6 billion. That stacks up favorably against the $2.2 billion worth of backlog the company had as of the end of its 2021 fiscal year.

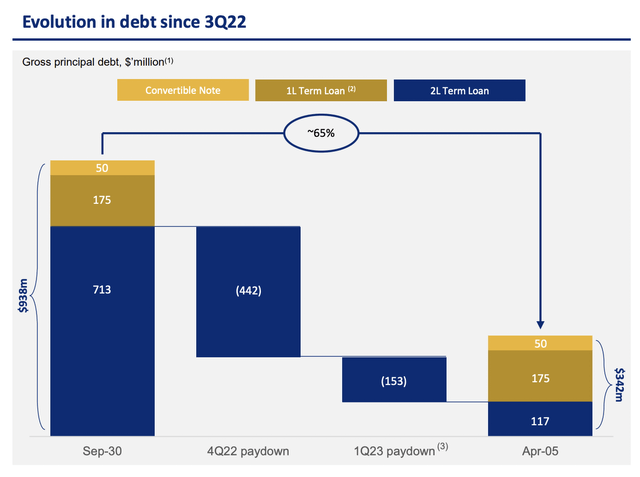

The transaction with Aquadrill, combined with the significant amount of cash that Seadrill had on hand as of the end of the final quarter last year, allowed it to pay down some debt subsequent to the end of the quarter. You see, the company paid down $442 million worth of debt on its term loan in the final quarter of last year. Subsequent to the end of the quarter, it made a voluntary payment of $153 million to pay this down even further. The actual net outflow of cash during this time was a bit higher at $162 million. But the difference between these two numbers consists of accrued interest and exit fees that the company was responsible for. Although we won't know until management comes out with more data, I estimate that the company has cash exceeding its debt in the amount of $185 million. Although gross debt as of this writing is approximately $342 million.

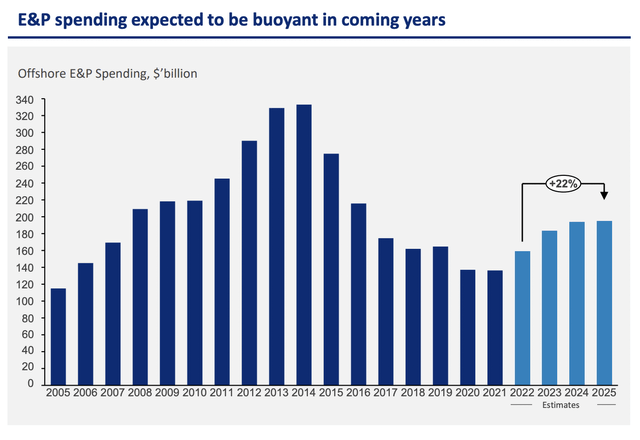

Because of this cash versus debt position, the company looks fundamentally sound. But it also has a couple of other things going for it. For all intents and purposes, the offshore drilling market really peaked back in 2014. Pretty much every year since then has been a year-over-year decline. In 2021, overall spending in the market was somewhere between $120 billion and $140 billion. That's down from the roughly $340 billion that the market saw in 2014. Although this trip lower has been painful for all the companies involved, with many of them even going bankrupt or being absorbed by more stable enterprises, the expectation by Seadrill is that, between 2022 and 2025, overall annual spending in the offshore exploration and production market should climb by roughly 22% in total. Add on top of this the aforementioned elevated backlog, and the potential for $70 million in synergies associated with the merger with Aquadrill, and the company definitely does have some catalysts moving forward.

Of course, this only makes sense if the terms are correct. After all, market conditions can change on a dime and synergies are not guaranteed to come through. On the market conditions side of things, I must also be fully transparent when I say that I don't believe the offshore drilling space is all that appealing to begin with. The high cost of production makes the players in this space marginal providers of product. What I mean by this is that, when times get tough, these high-cost projects are often the ones given the boot or scaled down.

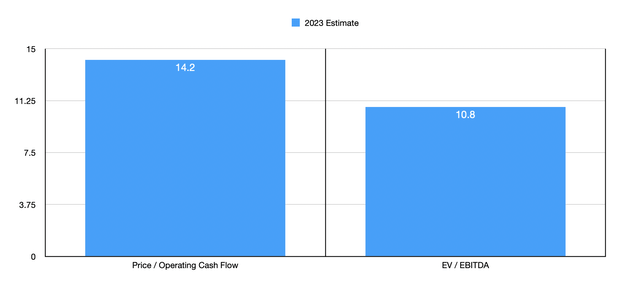

Because of the absence of guidance, we don't really know what even 2023 holds. But with the prospect of synergies, the rise in backlog, and the pay down of debt, it stands to reason that financial performance in 2023 should not be worse than what it was last year. So a conservative estimate regarding profitability might be EBITDA of $265 million to match what the company reported for last year. After factoring in the changes in debt subsequent to the end of the quarter, and using EBITDA minus interest as a proxy for operating cash flow, we get an estimate for that metric of $214.9 million.

Based on these figures, Seadrill should be trading at a forward price to operating cash flow multiple of at least 14.2. If synergies come to fruition, or if the rise in backlog translates to even greater revenue, then this number might ultimately come in lower. Meanwhile, the EV to EBITDA multiple for the company should be about 10.8. As part of my analysis, I also compared the company to four similar firms. On a price to operating cash flow basis, these companies ranged from a low of 10 to a high of 133.1. And using the EV to EBITDA approach, the range was between 0.8 and 65.4. In both cases, three of the four companies were more expensive than Seadrill is.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Seadrill | 14.2 | 10.8 |

| Transocean (RIG) | 10.0 | 13.5 |

| Valaris Limited (VAL) | 36.4 | 13.1 |

| Borr Drilling Limited (BORR) | 20.9 | 65.4 |

| Diamond Offshore Drilling (DO) | 133.1 | 0.8 |

Takeaway

Operationally speaking, the picture for investors in Seadrill is quite positive. The company has reduced leverage, including after the end of the most recent quarter. It is true that both revenue and earnings were down sequentially. But with a nice move higher in backlog, the future should look better instead of worse. Relative to similar players, Seadrill is trading near the cheap side of the scale. But considering how volatile this space is and how unappealing it can be when the bottom falls out, it's not cheap enough for me. Because of this, I've decided to rate the business a 'hold' for now.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.