JPS: Moving Back To Hold After The Drawdown

Summary

- The Nuveen Preferred & Income Securities Fund is a closed-end fund from Nuveen that focuses on preferred shares.

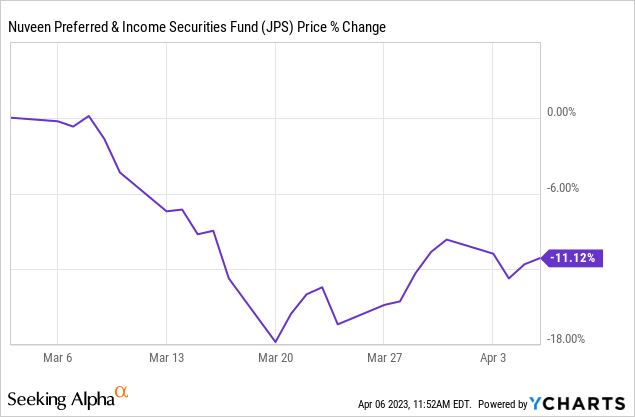

- We gave the CEF a Sell rating at the beginning of the regional banks' crisis, expecting a -10% drawdown.

- Our expectations were promptly met, with the fund nosediving as panic took hold.

- We now feel the bank-preferred market has re-priced lower, with the current liquidity being correctly priced, and JPS is no longer a name to sell out of.

Gary Yeowell

Thesis

As the regional banks collapse was starting, we warned CEF holders that the ride was going to get rough for JPS:

It all started with Silvergate Capital (SI) and is now continuing with SIVB. We see weakness in JPS due to its leveraged exposure to regional banks and a -10% potential down move. A retail investor would be best suited to reduce exposure here.

Surely enough the CEF proceeded to sustain a -10% drawdown:

An informed reader needs to understand that closed end funds usually are just leveraged takes on certain sectors in the market. When those sectors experience distress, the CEF structure just magnifies that move. Cyclical sectors like financials will have drawdowns during recessions, thus they are not to be treated as buy-and-hold investments.

An informed reader needs to be able to trim exposure as needed and adapt, in order to save themselves a couple of years' worth of dividends. It is the case here with JPS which has a high leverage ratio of 40%.

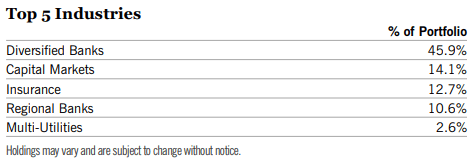

The Nuveen Preferred & Income Securities Fund (NYSE:JPS) is a closed end fund from Nuveen that focuses on preferred shares and contingent capital securities. This CEF has come to our attention due to its high concentration in regional banks preferred securities:

Industries (CEF Fact Sheet)

Market Developments

Since we wrote our initial article on JPS several banks have failed, and the Fed has backstopped many liquidity issues via its BTFP facility:

The Bank Term Funding Program (BTFP) was created to support American businesses and households by making additional funding available to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors. The BTFP offers loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging any collateral eligible for purchase by the Federal Reserve Banks in open market operations (see 12 CFR 201.108(b)), such as U.S. Treasuries, U.S. agency securities, and U.S. agency mortgage-backed securities. These assets will be valued at par. The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution's need to quickly sell those securities in times of stress.

After the initial panic period which saw both common and preferred equity prices plunge, we have now seen a stabilization in yields. Market participants are more comfortable with the outlook for certain institutions and are now more inclined to price in net interest margin compressions rather than bankruptcies:

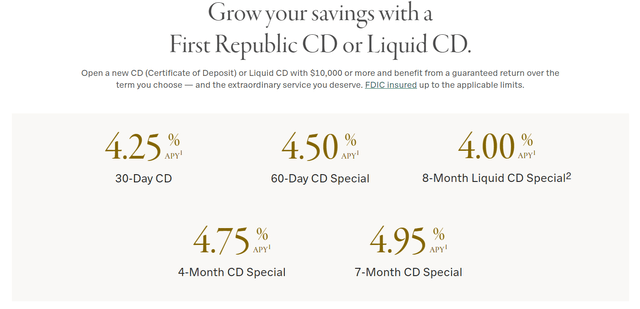

First Republic is a nice example of the soaring cost of funds for some institutions. The bank is now extremely competitive on the rates it offers on CDs, from paying a blended 1% cost of funds not so long ago.

What is next for JPS?

JPS is going to continue to pay its yield and be correlated to the wider risk-on sentiment. We feel the fundamental weakness is now priced in, with market participants having re-priced the entire bank preferred market post the regional banking crisis.

Make no mistake about it - JPS is still highly leveraged, but the expected drawdown from the panic selling has occurred already. We are of the opinion that 2023 will prove itself a good year to having bought into this asset class, however there is more volatility to be had in the asset class.

The original thesis for our Sell rating has now played out, and we are now neutral on the name.

Conclusion

JPS is a CEF that focuses on bank preferred equities. The fund runs a high leverage ratio of 40% and was deeply affected by the regional banks crisis. We wrote an article at the beginning of the move where we warned investors regarding the impeding drawdown. Cyclical instruments such as bank preferred equities with 40% leverage on top are not pure buy-and-hold instruments. An investor needs to trade around the position as markets ebb and flow. We now think bank preferred equity has been re-priced lower to embed the new liquidity risks, and JPS is now forming a bottom. Our initial drawdown target being met we are moving from Sell to Hold for this name.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.