The Case For Secular Inflation

Summary

- As a result of decades of globalisation and rising wealth inequality, we may well be entering a new regime - one of higher inflation and higher inflation volatility.

- These regimes shifts do not occur at once, but over time. Indeed, the past five to 10 years have seen a number of secular trends seemingly shift direction in unison.

- These shifting trends all have the potential to make for a very different investing environment over the next five to 10 years compared to what we have become so accustomed to in recent decades.

DNY59

The Era Of Secular Stagnation Is Coming To An End

Inflation regimes often coincide with changing political regimes and agendas, much of which stems from the rise of populism and fiscal dominance. As a result of decades of globalisation and rising wealth inequality, we may well be entering a new regime - one of higher inflation and higher inflation volatility. These shifting trends all have the potential to make for a very different investing environment over the next five to 10 years compared to what we have become so accustomed to in recent decades.

These regimes shifts do not occur at once, but over time. Indeed, the past five to 10 years have seen a number of secular trends seemingly shift direction in unison. Increased geopolitical tension, higher wages, shifting policies in favour of labour over capital, increased corporate capital expenditures, protectionism and re-globalisation along with a shift from monetary dominance to fiscal dominance all have the potential to create a decade of higher inflation and increased inflation volatility.

Herein, I will attempt to discuss these various trends and how they make result in a period of higher inflation, and how this could result in a very different investing environment going forward.

Wealth Inequality and The Rise Of Populism

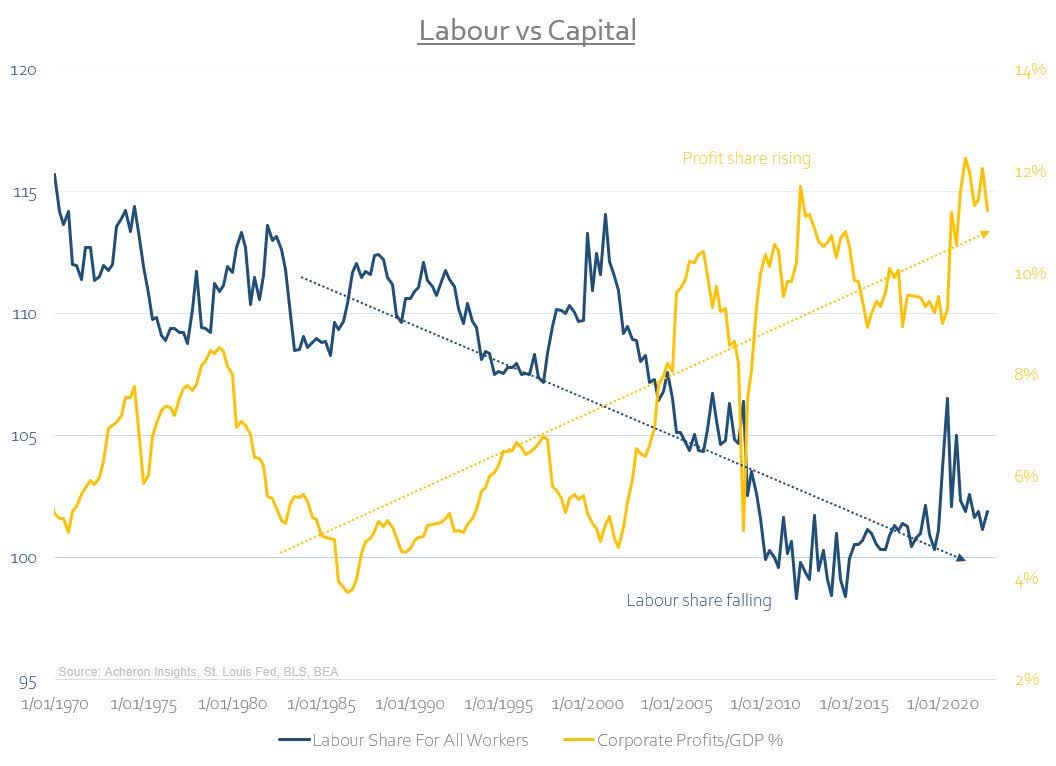

The cycle of wealth creation and wealth distribution is as old as history itself. Power is transitory. Indeed, we have seen throughout much of modern human history the balance of power shift between labour and capital. Once the pendulum swings too far in favour of one, we generally see a slow but meaningful shift back toward the other. Unequivocally, the past 40 years have seen capital take center stage in place of labour.

There have been a number of factors responsible for this recent trend of capital dominating labour, each playing their part. Globalisation was perhaps the most important, with China’s entrance into the World Trade Organization in the early 2000s the accelerant, forcing the labour force of most Western countries to compete with cheap offshore labour in the East. Pro-corporate policies and financial de-regulation saw most corporations attempt to maximise earnings per share, to which their stock prices were rewarded accordingly, all the while making full use of cheap offshore labour and cost-saving supply chains abroad. Capital controls were eased, seeing the rise of the Eurodollar market ensue and the global financial system become increasingly integrated, with the US dollar at its center. All of this saw inflation trend lower decade after decade. Labour lost their bargaining power and thus saw little wage growth, allowing central banks to prioritise easy monetary policy, resulting in ample liquidity, and thus, ever-increasing asset valuations.

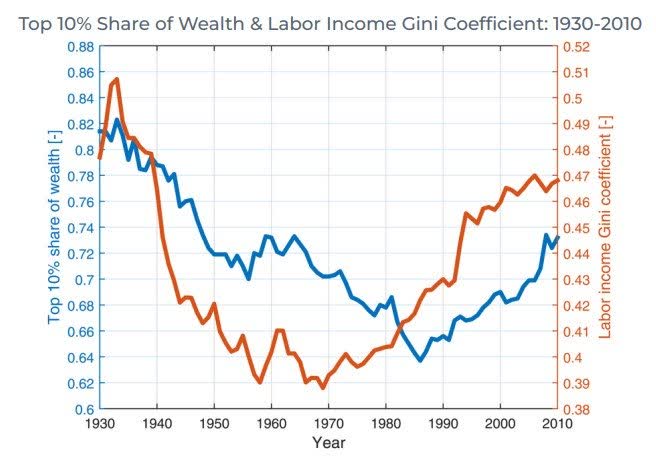

Unsurprisingly, wealth inequality has skyrocketed in the United States. Those who own financial assets have benefited handsomely, and those who don’t have benefitted little.

Source: Kai Volatility Advisors

Not only does the US now have a Gini Coefficient of around 0.49 (akin to an emerging market and roughly 25% higher than that of half a century ago), but approximately 70% of the entire share of US net wealth is held by only 10% of the population. The bifurcation between the haves and have-nots, between the asset owners and the blue-collar workers, and between labour and capital has reached its highest point in centuries. History suggests such trends cannot last forever. Just as capital took favour following the stagflation of the 1970s, it is time for labour to push back.

There is plenty of evidence to suggest this shift is underway. Over the past decade, we have seen an increasing level of civil unrest, leading to the rise of a populism movement. Not just in the US, but this is true in much of the developed world. The seeds of social unrest have been planted. Occupy Wall Street, Brexit, trade tariffs, energy subsidies, direct fiscal payments and student debt cancellation are likely only the beginning. These are policies that have resulted from civil unrest and wealth inequality.

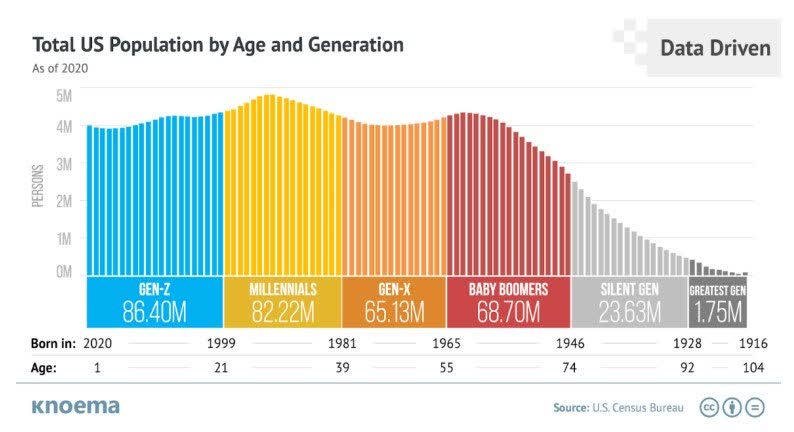

Wealth inequality is generally a seed for political change, and such political change is likely to be inflationary. Indeed, as the Baby Boomer generation ages and continues their exit from the workforce in the years ahead, the Millennial and Gen Z demographic will continue to gain voting share and positional power, such policies are likely to become increasingly mainstream.

Source: Knoema, US Census Bureau

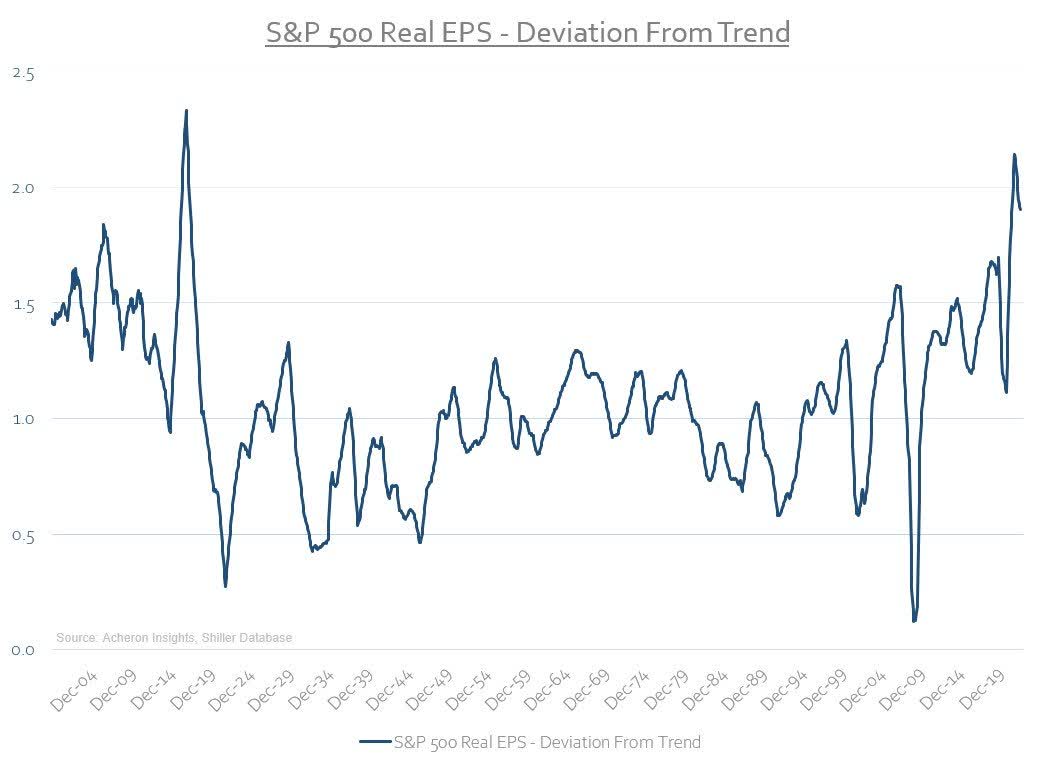

Millennials are entering their prime working age at a time where almost every major asset class is at historically high valuations. Not only is the S&P 500 CAPE ratio still ~70% above its historical average, but property market valuations in most developed nations are also materially overvalued relative to history. The Baby Boomers and older generations have been the primary beneficiaries of the era of easy monetary policy and asset price appreciation, while in contrast, the Millennials and the younger generations have benefitted little.

Kai Volatility Advisors highlighted this dynamic best in a recent publication, noting “household and wealth formation for Millennials has dramatically lagged. In 2016, the Federal Reserve calculated that ‘the typical Millennial family was 34% poorer than expected’ when compared to previous generations. Millennials’ homeownership rate trails that of their predecessors dramatically at the same point in their lives, with approximately half of Millennials still renting. When the Baby Boomers hit a median age of 35 in 1990, they owned nearly one-third of US real estate by value. In 2019, the millennial generation, with a median age of 31, owned a paltry 4%.”

As Millennials take an increasing share of power over the coming years, expect an increasing number of policies that help swing the pendulum back in favour of labour over capital. Policies that promote wage growth, that promote labour power, and policies that help bridge the gap between the younger and older generations.

The knock-on effects of this dynamic are significant. Just as globalisation helped give rise of rising inequality, deglobalisation, protectionism and increasing global conflict are forces coming into play that are both a result of and accelerant to the shift back from capital to labour, as we shall see later. While it is important to highlight this is a slow-moving trend likely to take years to play out, ultimately, wealth inequality leads to the rise of government's role in the economy, and importantly, leads to inflation.

The Joys of Fiscal Policy

Since 2019, policymakers worldwide have rediscovered the joys of fiscal policy. The COVID-19 lockdowns were the catalyst for true helicopter money, while the 2022 energy and food price spike (particularly in Europe) solidified the trend. Fiscal policy is back, and it’s here to stay.

As we have seen, the pendulum may be in the process of shifting from capital back to labour. This likely means the free markets we have become accustomed to in recent decades will cease to exist as we know them. The era of fiscal dominance is here, and the political appetite for it is abundant. This means a large part of capital allocation will be guided by government rather than solely by the market itself.

In all likelihood, Congress will no longer be constrained in their spending efforts to what they can do, but rather what they are politically obliged and incentivised to do. The populist movement is real, and policymakers respond to incentives. Driven in large part due to the error of quantitative easing, easy monetary policy and the continuous central bank bailouts of Wall Street at the expense of Main Street, it appears as though such measures as regular payments to individuals, universal basic income and straight-up MMT are indeed slowly becoming the norm.

We witnessed the power of fiscal spending during the height of the pandemic. Despite the temporary shutting down of the economy, income growth actually accelerated during this period - a result of the use of government transfer payments and direct stimulus to both the consumer and the corporation. The power of fiscal stimulus to incentivise spending and generate economic growth should be fairly obvious by now. While monetary policy has little impact on the real economy, but instead results in asset price inflation, fiscal policy has a direct and meaningful impact on the real economy.

To understand this dynamic, we must understand that we live a two-tiered financial system. In such a system, there are effectively two types of money: central bank reserves, which are used to transact between the Federal Reserve and the commercial banks (i.e., money for banks); and bank deposits, which are used to transact by non-bank entities (i.e., money for everyone). Without going too far into the financial plumbing weeds here, what is needed to be understood is that bank reserves are a liability of the Fed, and are the mechanism by which they conduct QE. Bank reserves can only be used by institutions who have an account with the Fed (i.e., commercial banks), so when the Fed undertakes QE and purchases debt securities from the commercial banks, these purchases are settled with bank reserves. Former Fed trader Joseph Wang describes this concept well:

“Since reserves can only be sent to entities who also have a Fed account, the total level of reserves in the financial system cannot be changed by account holders. Reserves can never leave the Fed’s balance sheet and are simply shifted from one Fed account to another on the Fed’s balance sheet. It is a closed system. The total level of reserves is determined by Fed actions, which create or destroy reserves.”

Fiscal stimulus does not have this problem. Direct stimulus payments, subsidies and infrastructure spending are received into the real economy (one way or another) as bank deposits. Anyone can transact with bank deposits. And as we have seen over the past few years, when money is given to consumers with the intent to drive consumption, consumers can be relied upon to do exactly that. Given its success, fiscal stimulus is now the politically appealing first point of call during any form of economic hardship for the foreseeable futures. The precedent has been set. The latest banking debacle is just another example of how the West has little appetite to tolerate pain, only now, it is consumers who will also become the beneficiaries.

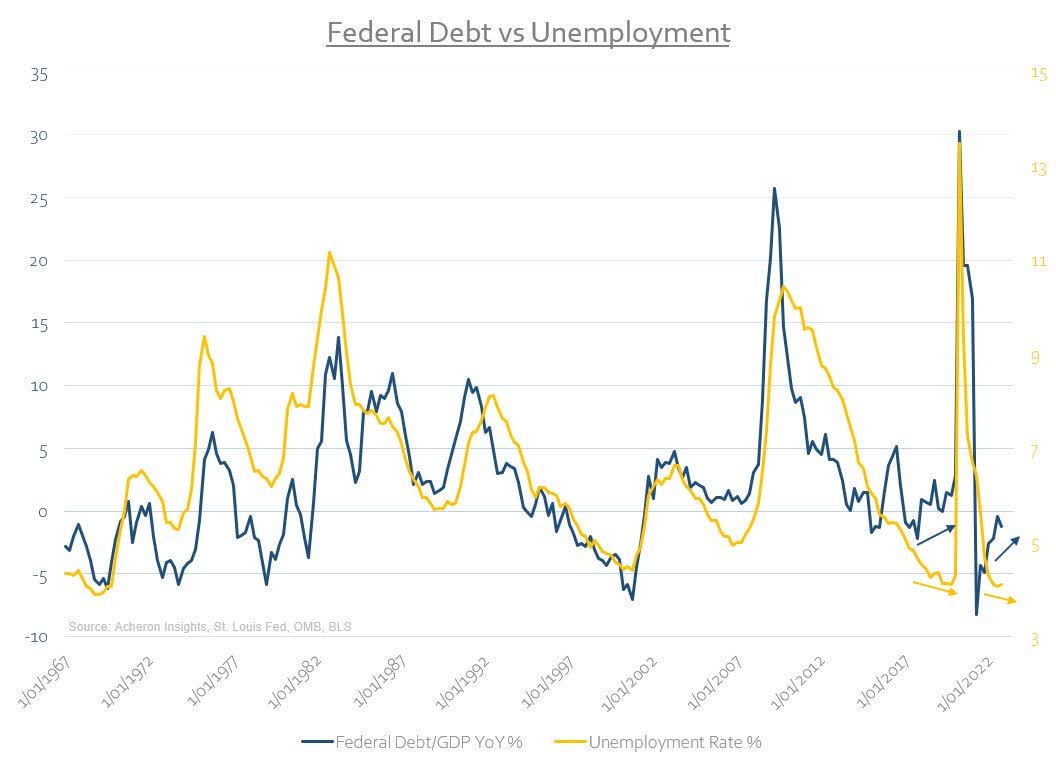

Perhaps the best visual representation of this dynamic is the relationship between the growth in government debt and the unemployment rate. As we can see below, the two have historically moved in line with one another. A spike in unemployment has always seen a spike in government spending. This all changed, however, when Trump implemented his tax cuts in 2017. For the first time in over four decades, we saw fiscal spending rise while unemployment fell. Expect this to continue.

Where will government spending take place going forward? I expect we will see this undertaken through a number of differing avenues. Most importantly, the precedent of direct payments has been set, and will again be the politically appealing choice should we experience any type of recession, economic hardship, energy spike or other unforeseen event. In addition, as I will discuss in further detail below, defence spending, supply chain security and infrastructure spending are all also likely. All are set to supply inflationary pressures into the economy.

The Green Energy Transition

Though well-intentioned, the green energy transition is going to be costly. Very costly. With higher costs comes inflation.

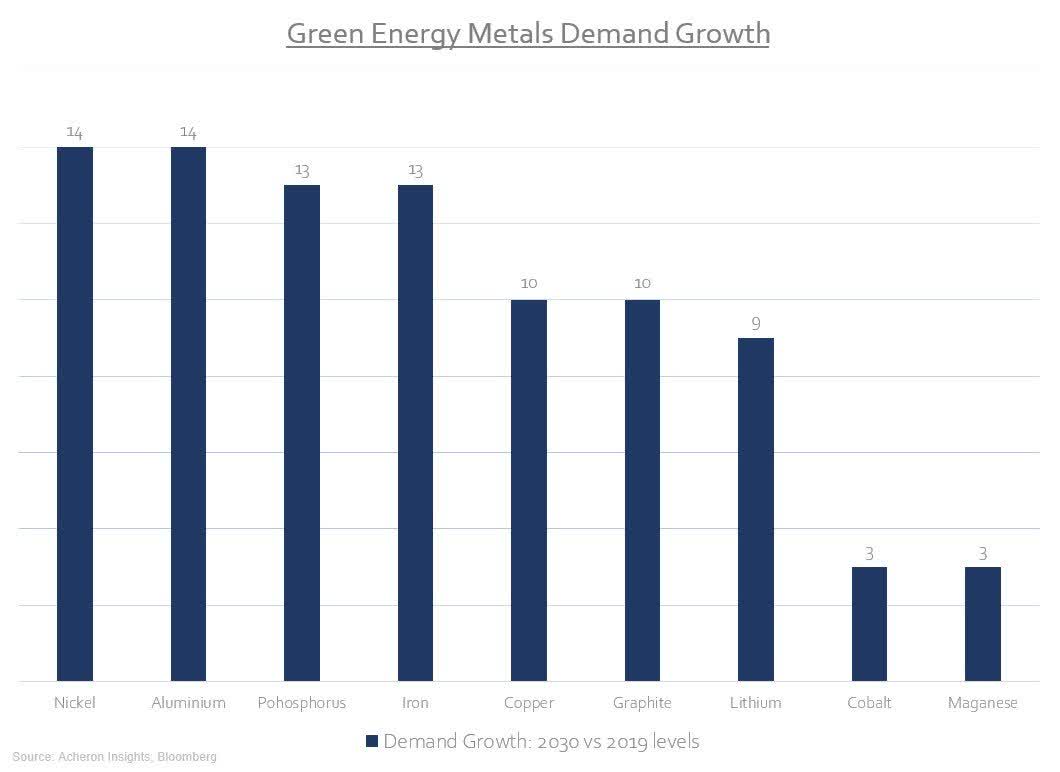

For the electrification of the world to truly come to pass, a significant amount of green energy-related metals and materials will be required. This includes a dramatic increase in mining for and funding new supply of green energy metals, all of which requires material amounts of capex, but will also likely see demand grow after a faster pace than supply. Metals such as nickel and aluminium are expected to see demand rise 14x by 2030, while others such as copper and lithium 10x and 9x respectively.

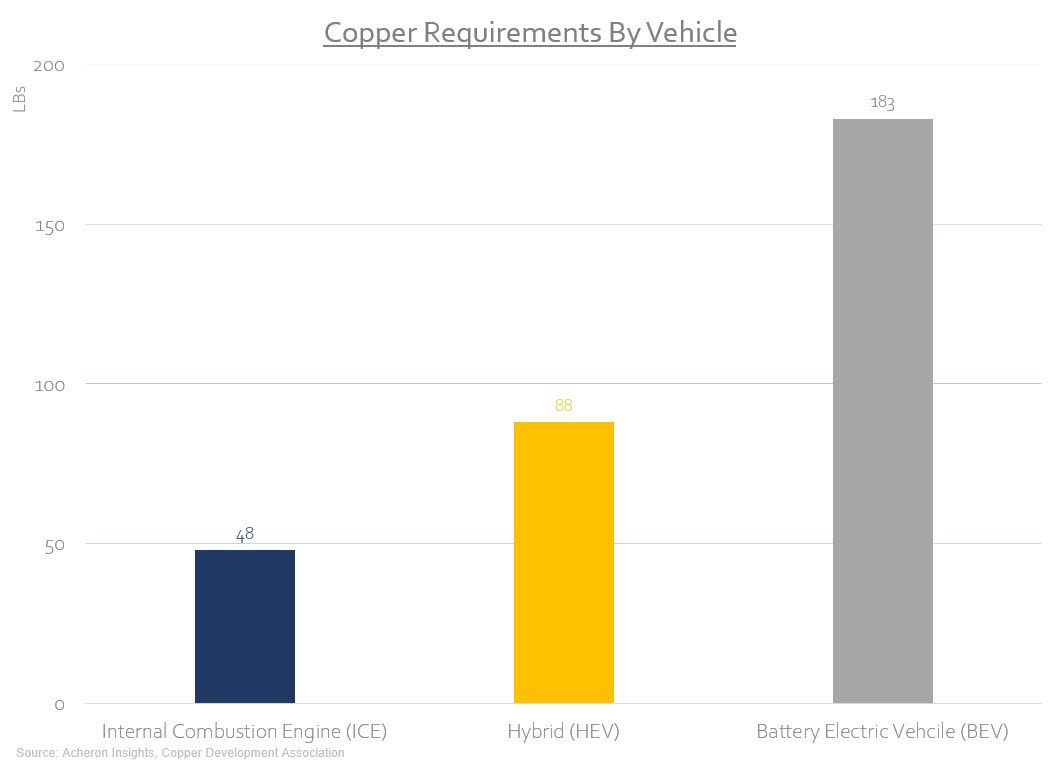

As it stands, the supply of these electrification metals is not anywhere near appropriate levels to meet this incoming wave of demand. Nowhere is this dynamic more evident than in the copper markets. According to the Copper Development Association, an internal combustion engine requires around 48 lbs of copper, while a fully battery-powered electric vehicle needs 183 lbs. That’s a four-fold increase in electric vehicles alone.

What’s more, the International Copper Association predicts electric vehicle charging stations will require anywhere from 0.7 kg to 8 kg each, equal to an additional 216,000 tons of copper demand by 2027. Meanwhile, the adoption of renewable energy sources is also heavily dependent on the use of copper in their construction. According to the Breakthrough Institute, a California-based environmental research center, "wind energy requires on average 2,000 tons of copper per gigawatt, while solar needs about 5,000 tons per gigawatt - several times higher than fossil fuels and nuclear energy." With copper at the center, there is a structural supply deficit in most green energy materials that is going to be both costly and inflationary.

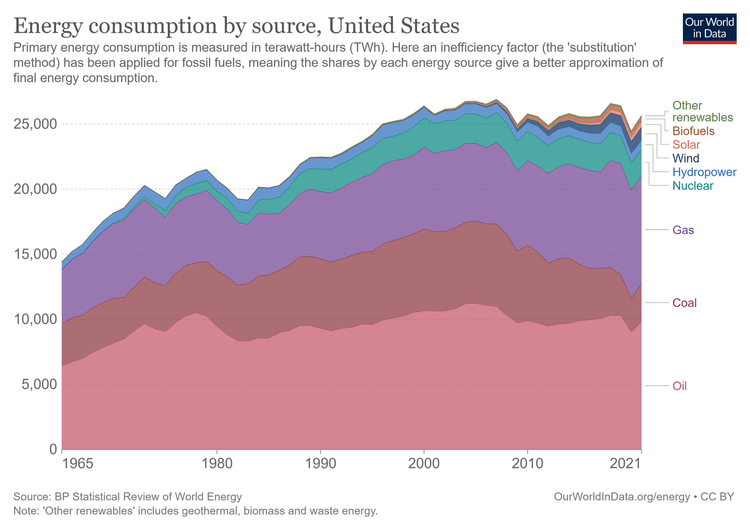

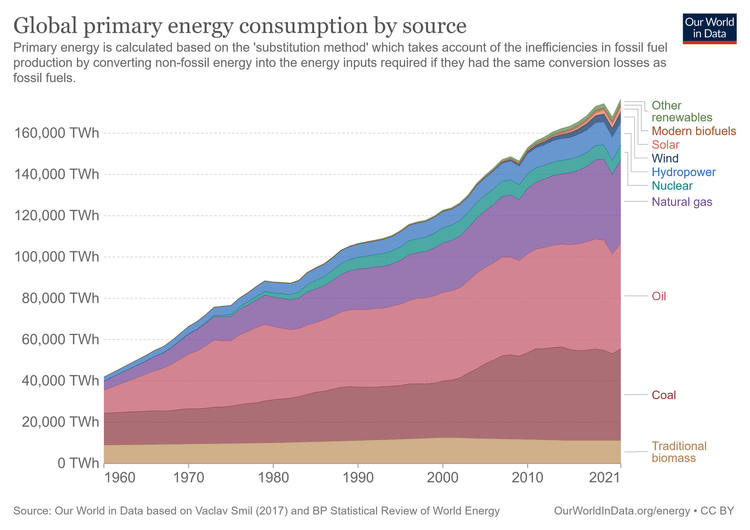

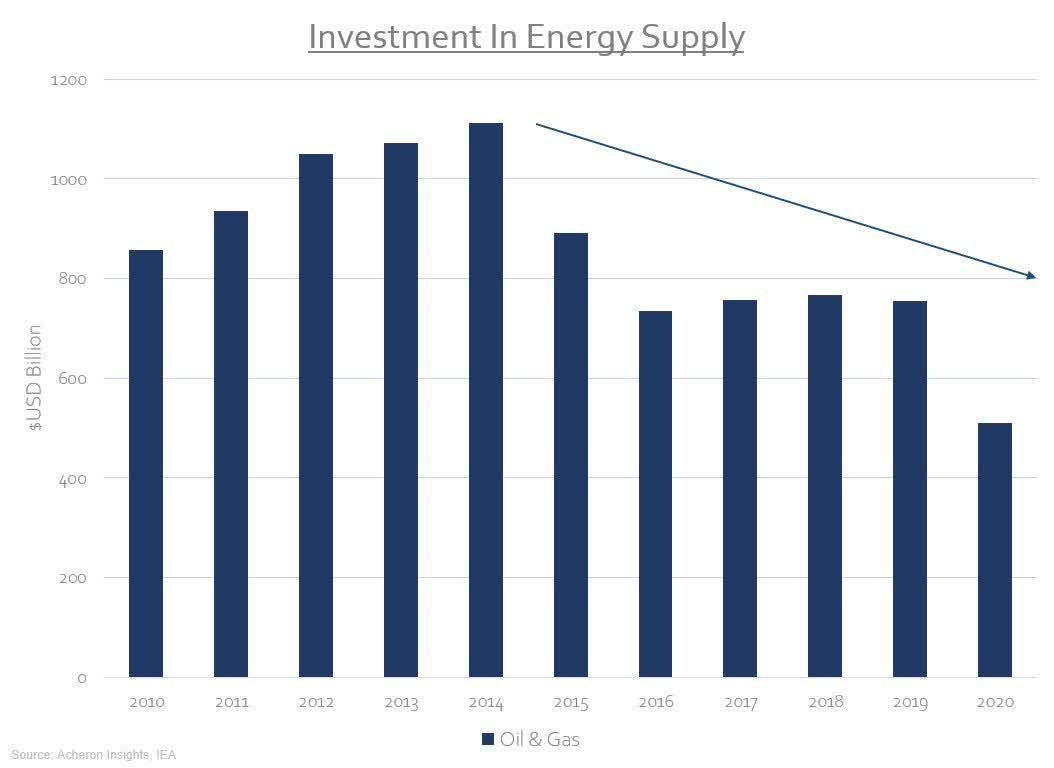

Unfortunately, the inflationary impulse from the green energy transition is unlikely to end there. In fact, what is perhaps even more likely to create consistently higher price pressures over the next decade is the rise in the cost of fossil fuels that stems from the rise of ESG and push to renewable energies. As much as we are trying to convince ourselves otherwise, the global economy is still almost entirely dependent on fossil fuels.

And a far too optimistic view on the efficacy of renewable energies to replace fossil fuels has led to a damning level of underinvestment within traditional energy markets. Until we embrace actual viable carbon-neutral energy sources, such as nuclear energy, this underinvesting in oil and gas supplies is very likely going to lead to continued energy spikes and higher energy costs for the foreseeable future.

Given the inefficiencies and inability of renewables to fully replace fossil fuels in the near future and the heavily reliance on fossil fuels, until higher energy prices are met with a response of investment in production and thus an increase in supply, higher energy costs are here to stay.

What’s more, an under-appreciated consequence of higher energy costs in likely to be higher food prices. Given how fertilisers are perhaps the largest input into food production and that most fertilisers are nitrogen-based (which is synthesised from natural gas), higher energy costs will ultimately lead to higher food prices, or at the very least, more volatile food prices and thus more volatile inflation.

Rising Geopolitical Tensions

The peace dividend is coming to an end. For the past few decades, geopolitical tensions between the proverbial East and West have taken a backseat to globalisation. Through China’s entry into the World Trade Organization and the fall of the Soviet Union, up until the past few years, free markets have won the day, while inter-country tensions have largely been muted or, at the very least, inconsequential for the global community. This period of peace has been very disinflationary. But thanks largely to Putin and Russia’s invasion of Ukraine in 2022, the world has changed.

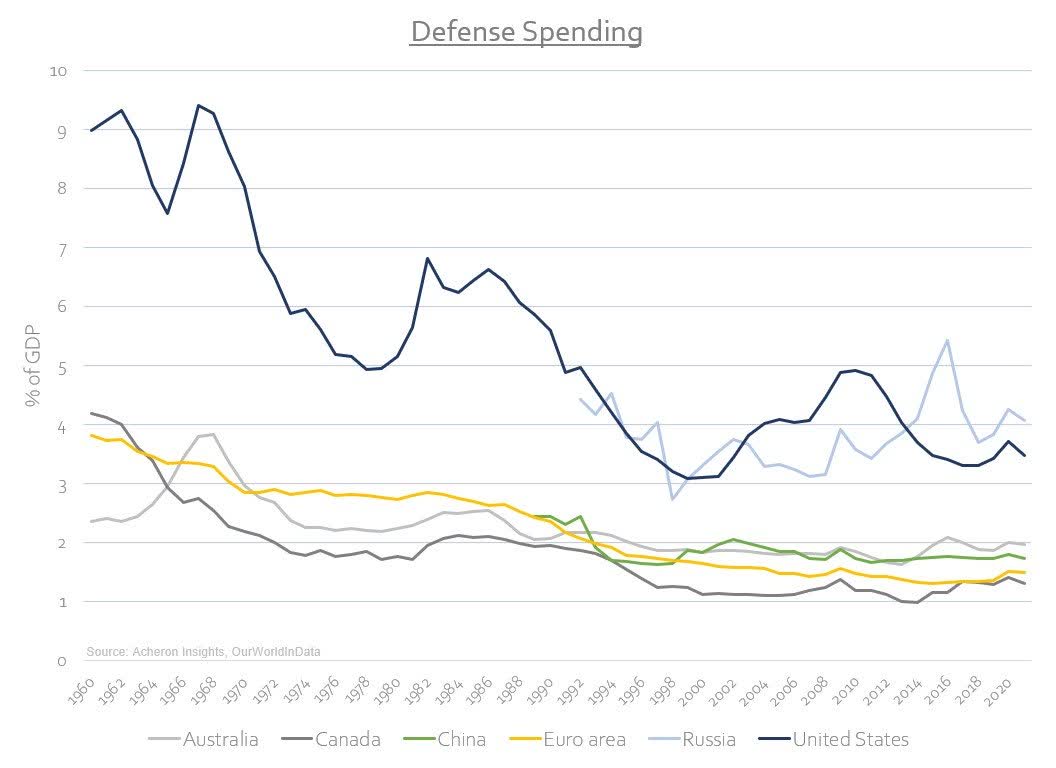

For the past 40 years (and longer), the United States has been the global superpower. Until recently, this status has been largely unchallenged. What was a unipolar world is seemingly turning to a multipolar world, whereby there are multiple world powers that exist side by side. China is the obvious emergent superpower here. Such multipolarity invites competition, tension and will likely see an increasing fragmentation of the global economy. We have already seen this take a number of forms: trade tariffs with China, the weaponisation of the SWIFT payment network and BRICS nations' move to de-dollarise the global financial system. We should therefore see a rise in defense spending from their secular lows for most major countries as a response to these trends. This is true of both traditional defense spending as well as cybersecurity.

Meanwhile, de-globalisation, the reallocation of supply chains and the onshoring of manufacturing capacity are a number of secondary effects stemming for rising geopolitical tensions that are likely to supply further inflationary trends to the economy.

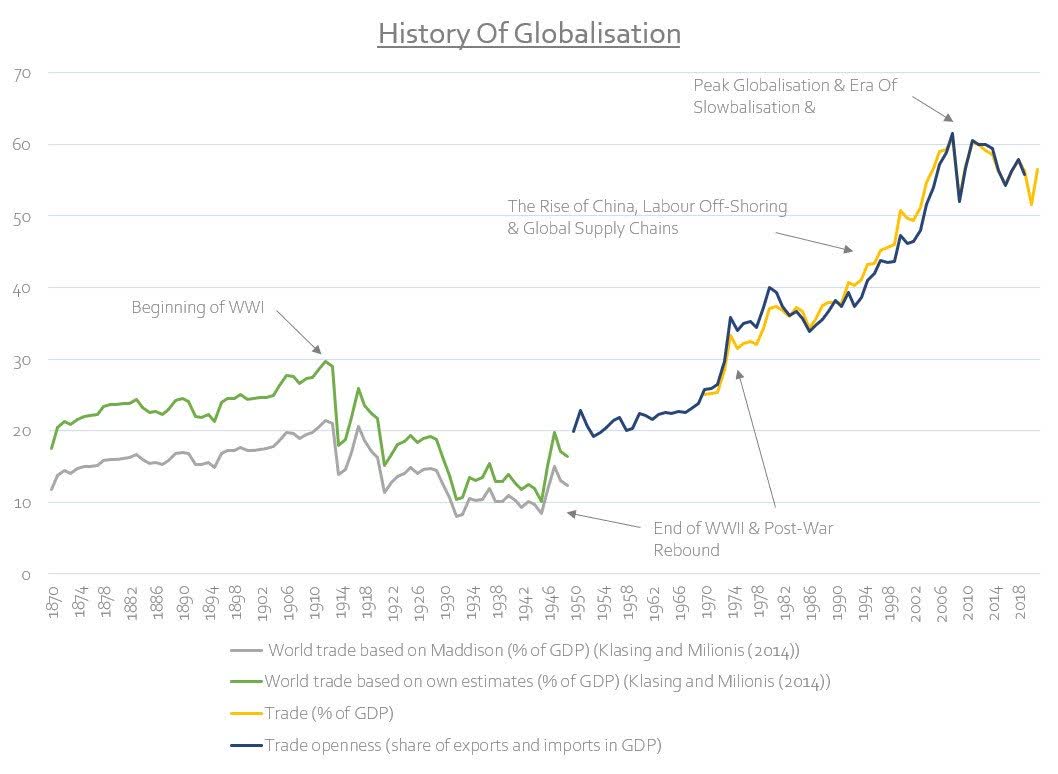

De-Globalisation, Supply Chain Security and Friend-Shoring

I’m somewhat hesitant to call what is likely underway outright de-globalisation. Peak globalisation, slow-balisation, protectionism and re-globalisation are perhaps more accurate descriptions. Take your pick. Alas, the trend underway is clear - globalisation is receding as the rise of geopolitical tensions gives way to supply chain security, friend-shoring and the return of domestic manufacturing. All represent significant changes to how the world will function going forward and are in stark contrast to that we have lived in over the past 40 years.

For decades, we saw a huge push for US corporations - and that of most developed nations worldwide - to shift their production and manufacturing abroad in search of cheaper labour and materials. This trend of globalisation, accelerated by the opening up of China to the rest of the world in the latter stages of the 20th century and their subsequent entry into the World Trade Organization, helped push down costs for corporations and boosted profit margins. Global trade and global competition thus expanded materially from the 1970s, reaching its peak around 2010.

Corporations profited handsomely from this arrangement. It was, after all, capitalism at work. Corporate America, as a result, saw profitability reach its highest levels ever. And as we have seen, the cost of this profit maximisation was wages.

But, as we have come to learn in recent years, globalisation has its flaws. COVID-19 and the Russian-Ukraine conflict have laid bare the vulnerabilities of the "just in time" supply chain system that had arisen during the era of globalisation, and are signifying the importance of supply chain security and friend-shoring. The events of the past few years have highlighted the cost of offshoring manufacturing and supply chains for many developed economies.

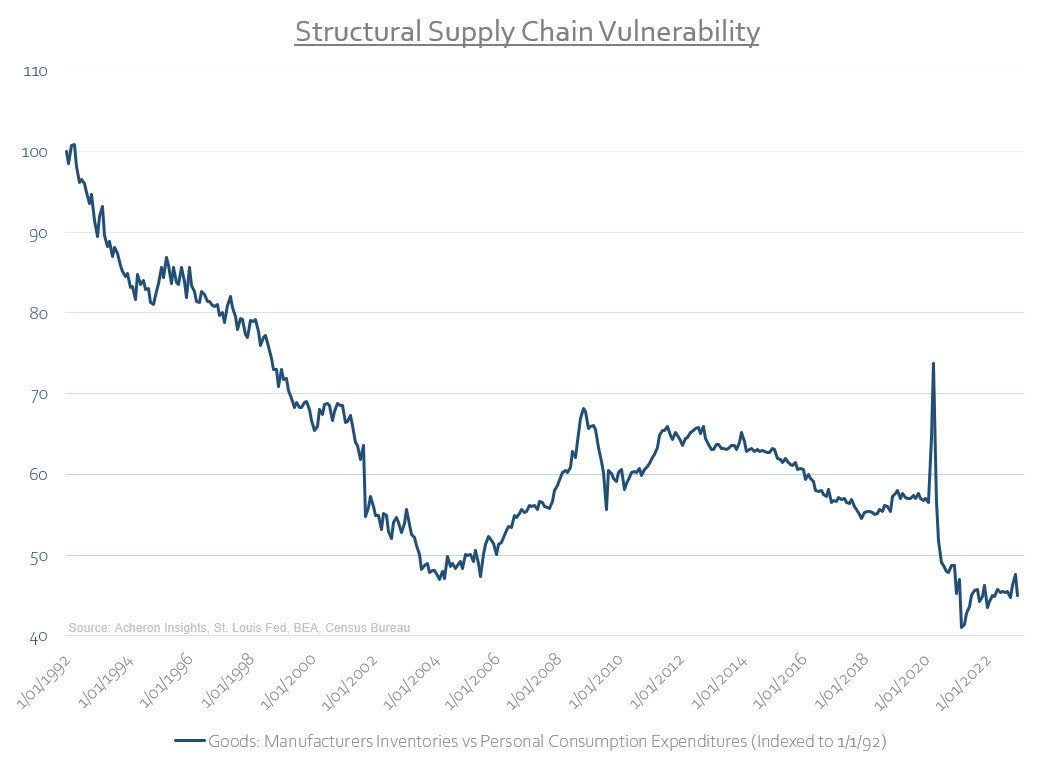

Unfortunately, supply chains remain highly vulnerable in the US. One proxy for measuring such vulnerability is measuring the ratio of manufacturing inventories to personal consumption expenditures for goods. We saw how this spiked to multi-decade highs during COVID from a level that was roughly in line with the average throughout the 2000s. Since COVID, this ratio has plunged to its lowest levels in over half a century. Any material pick-up in goods demand will seemingly see supply chains put to the test once again. Another inflationary period as a result will likely have material consequences and could see government enforce some kind of minimum in domestic manufacturing capacity.

The energy crisis which struck much of Europe and Germany in particular during 2022 is the prime example of the follies of relying on countries with suspect political agendas for commodity and energy supplies. Because of this, the political backlash from both corporations and government that has resulted, and is likely to continue to result, for those who choose to do business with countries, states and corporations whose ideals to not align with those of the West is likely to be continued. In addition to commodity and energy security, the burden will likely be placed on those willing to continue to use international supply chains to prove they are not doing business with anyone who may be deemed “naughty.” As such, we are likely set to see a shift to a world of trusted commodity suppliers.

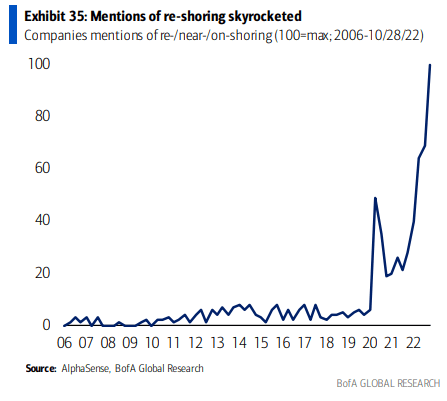

The awareness of corporations to this idea has become front and center in the past couple of years.

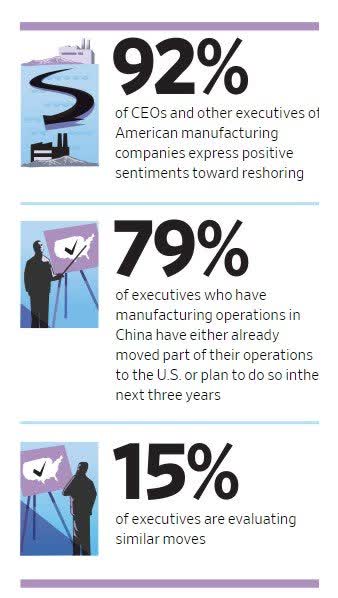

Source: Bank Of America Source: Kearney Reshoring Index - 2021

We have seen some 1,800 US firms signal their intent to reshore at least a part of their business or foreign supply chains back to American soil. This need for reshoring and supply chain security is perhaps nowhere more important than in the semiconductor industry. Aware of this situation is the Biden administration, which has recently flagged the importance of semiconductor chips, and has shown willingness to spend as a means to build up its domestic semiconductor industry. Likewise, other industries such as electric vehicles, vaccines and renewable energies are eligible for government support as a means of encouraging re-shoring back to the US.

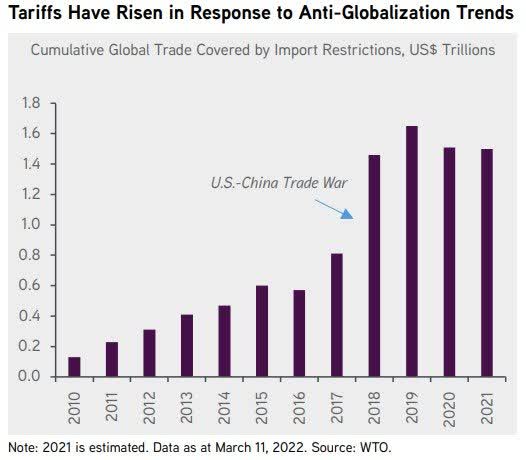

This isn’t just a post-COVID phenomenon, however. The seeds of protectionism were planted during the China-US trade war some years ago. In fact, import restrictions worldwide have been rising for over a decade now.

Source: KKR Global Institute

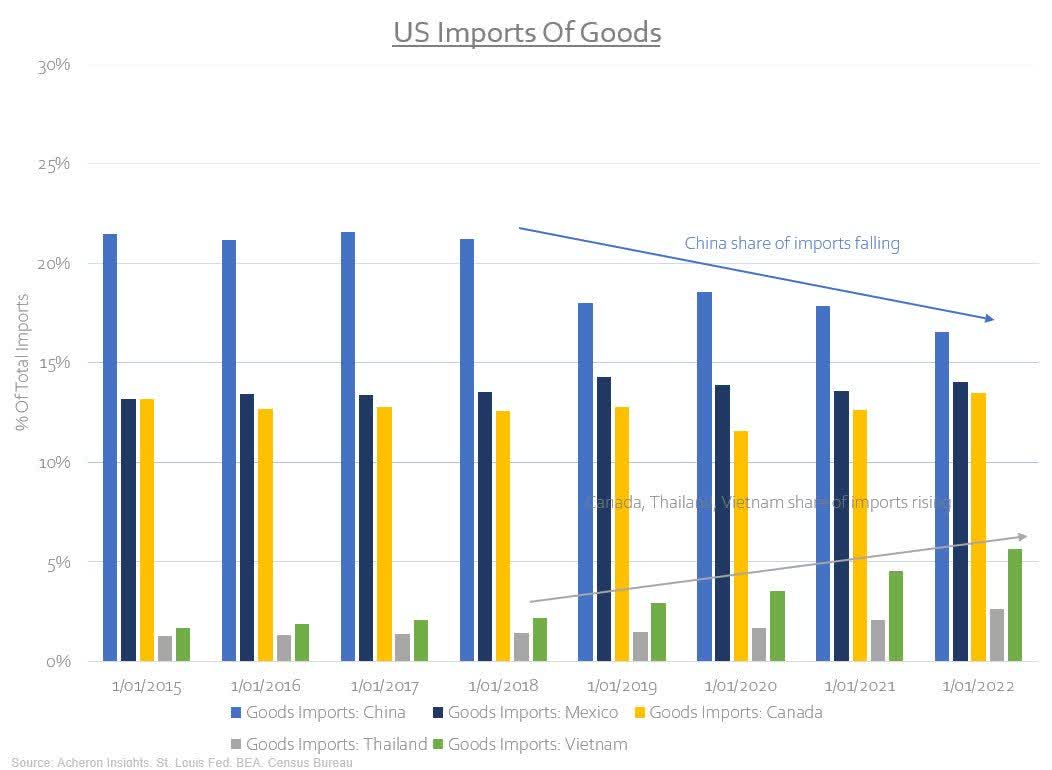

Conversely, US imports of Chinese goods has been steadily falling over recent years, while moves to import goods from more politically acceptable alternatives, such as Vietnam, Thailand, Canada as well as Mexico, are seemingly on the rise.

These trends don’t even necessarily need to be permanent to cause an increase in inflation volatility, and temporary bans or tariffs on imports and exports are enough to trouble supply chains given their vulnerabilities. China’s temporary ban of Australian coking coal is an excellent example.

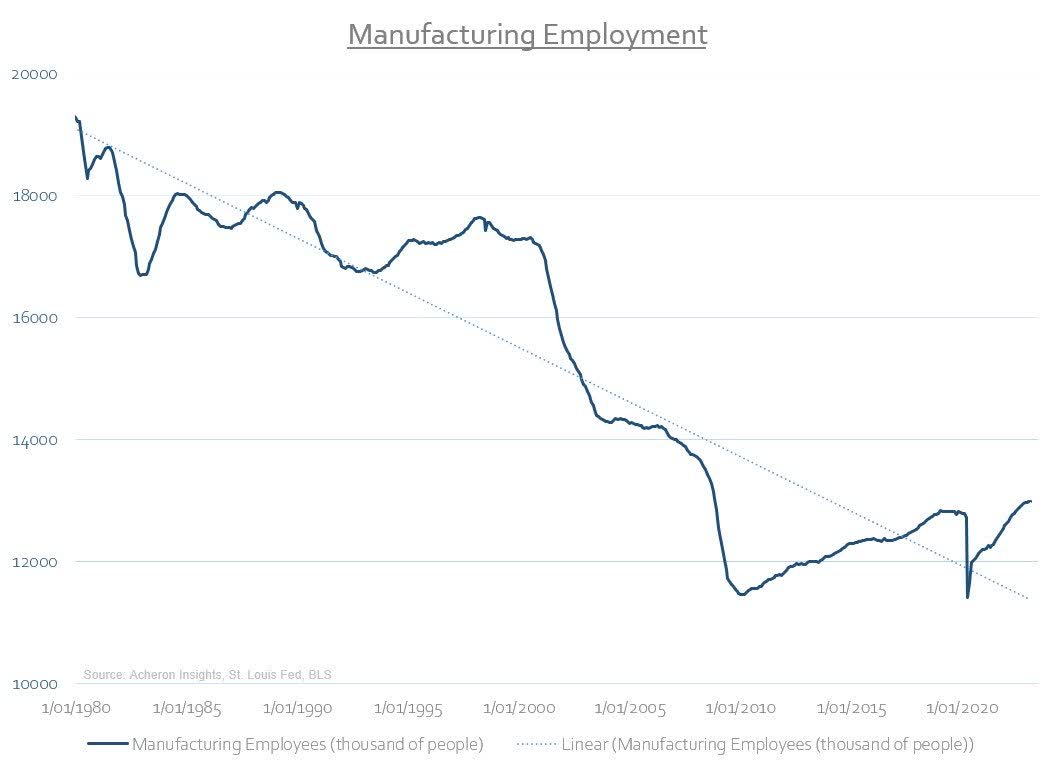

We are perhaps also seeing the beginning of a reversal in the decades-long trend of falling US manufacturing employment. As we have seen, one of the big drivers of disinflation that resulted from globalisation was the offshoring of the US manufacturing base. But as it stands, US manufacturing employment has just reached its highest levels in nearly 15 years and may be ending its four-decade downtrend.

As we can see, a number of long-term trends that arose in line with globalisation may be beginning to reverse. It is not necessarily that globalisation is dead, what appears more likely is a change in the dynamics of globalisation. Although global trade peaked nearly a decade ago, it does not necessarily have to fall further for these dynamics to add inflationary pressures to many economies. The reshoring/friend-shoring of supply chains, energy and commodity security, increased scrutiny on who can do business with whom all appear enough of a concoction to elicit increased price volatility, and thus, increased inflation volatility.

Although labour and manufacturing onshoring will ultimately be disinflationary in the long term due to automation, I believe it is likely to be inflationary before it becomes disinflationary. After all, automation and reshoring will require a significant amount of capital expenditures as well as government subsidies, which itself drives demand for raw materials and workers, and as such, we are likely to see a inflationary impulse for a number of years still.

The Capex Super-Cycle

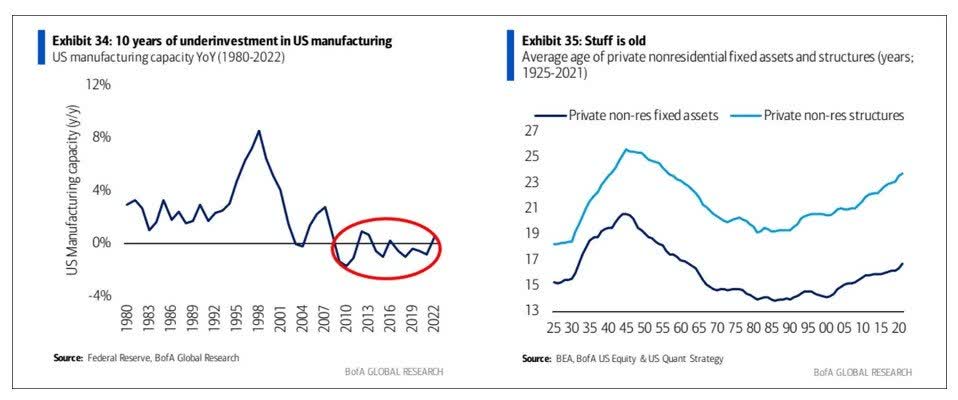

One theme commonly overlooked in the inflation debate is the potential for a sustained period of extensive capital expenditures within a number of developed economies, particularly the US. This potential capex super-cycle may, in fact, represent the culmination of a number of shifting trends that I have outlined thus far. Indeed, there are a number of factors at play that should see a rise in capital spending and investment over the coming years.

Firstly, the onshoring, reshoring and diversification of supply chains and commodity resources, as well as adding resilience to the global supply chain system, will require a material level of capital investment by both corporations and government. As I have discussed, COVID-19 and Putin have exposed the fragility of a system built upon a "just in time" supply chain system ahead of a "just in case" system, thus prioritising profits over national security. The reversal of these dynamics will be costly.

Second, the return of defense spending, a topic which I have already covered above, but again, defense spending in much of the developed world as a percentage of GDP is the lowest in decades. This should see a material increase in both private and public spending as we transition to a multipolar geopolitical world.

Third, the green energy transition, which will be both costly to implement and highly inflationary for the associated metals. What’s more, updating the electric grid - particularly in the US - to a level capable of handling the number of electric vehicles proposed by government objects in the coming years will be highly capital-intensive.

Fourth, government spending on infrastructure as a politically viable and appeasing means to implement fiscal policy. If we are returning to a world dominated by fiscal stimulus and thus government spending, given the age and state of the United States’ fixed asset base (including the electricity grid), spending on infrastructure seems the logical avenue through which fiscal dominance will be achieved.

Source: Bank of America

And finally, an increase in corporate capital investment as a whole as a response to wage growth. This dynamic is perhaps an overlooked aspect of why we may see a secular rise in capital spending, i.e., the prospect that higher wages will ultimately lead to an increased level of labour replacing investment. Weak wage growth has been the stalwart of the era of secular stagnation (particularly throughout the 21st century). While this is not the only reason why corporate investment and capital spending has been weak during this period, it is certainly a major contributor. Cheap labour does not incentivise labour replacing investment. Indeed, corporate investment is largely a function of the cost of labour. If wages are not increasing each year and wage growth is stagnant, then the payback period of labour replacing capital investment is long, thus creating a drag of profits and not incentivising wage replacing capex. Inversely, rising wages - similar to what we have at present - reduces the payback period of labour replacing capital spending, thus incentivising capex. This is one primary reason why higher wages leads to lower corporate profits. If higher wage growth and stickier wage growth are here to stay, expect a commensurate rise in labour replacing capex - a dynamic most likely to be inflationary before it becomes deflationary.

The capex super-cycle - if proven correct - is a long-term cycle likely to play out over a number of years, if not decades. Thus, it will have very little impact on either growth or inflation over this cycle or even the next cycle, but is likely to provide inflationary tailwinds for the next five to 10 years, and should help boost productivity as well as overall economic growth.

Implications and Conclusion

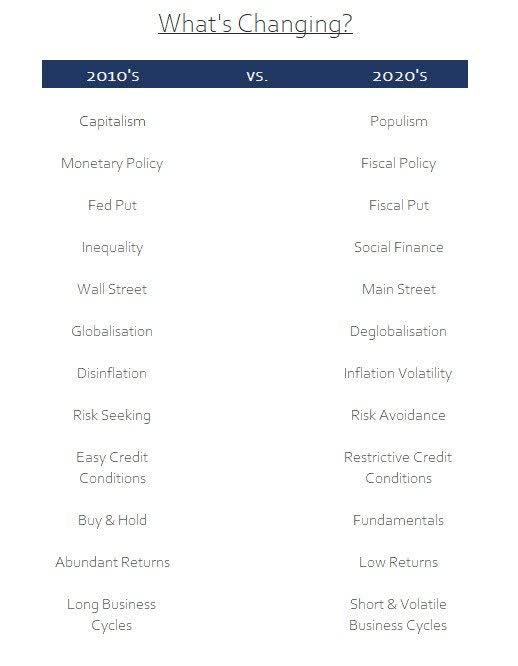

Increased geopolitical tension, higher wages, shifting policies in favour of labour over capital, increased corporate capital expenditures, protectionism and re-globalisation along with a shift from monetary dominance to fiscal dominance represent the intersection of a number of shifting regimes that have the potential to set the stage for an environment of more volatile inflation and thus higher average inflation over the next five to 10 years.

Now, I am not talking about hyperinflation or anything of the sort. In fact, my base case is that we will probably see inflation average around 3-4% in the 2020s, compared to the 1-2% during the 2010s. Whilst not a material change, such an increase should result in a material shift in a number of themes and dynamics which we have become so accustomed to in recent years.

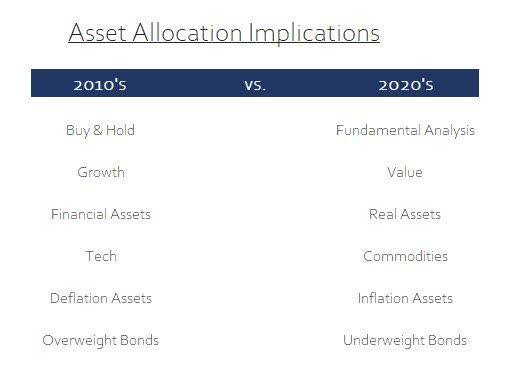

While I intend to delve deeper into how the 2020s are likely to represent a significantly different investing environment than that of the 2010s, I will provide a brief overview of how things may differ going forward. The following table highlights a number of these changing trends.

These trends are likely to impact the investing and economic environment going forward in a number of ways. Perhaps most importantly is in relation to interest rates, particularly so given how many assets and their prices are a function of yields. Put simply, higher inflation volatility should result in higher inflation uncertainly and increased volatility in the business cycle, both of which should translate into a higher term premium for bonds. This is a recipe for a secular bear market in bonds. Outside of tactical opportunities whereby both inflation and growth decline in tandem, the buy-and-hold approach to the bond market is likely to be unrewarding over the next five to 10 years.

This spells trouble for other asset classes and investing styles too, particularly those sensitive to duration. Higher rates and inflation won’t bode well for the traditional 60/40 portfolio. Higher rates and inflation will see the continued unwind of the TINA trade, and as a result, risk-seeking behaviour by institutions will be greatly diminished. While the traditional buy-and-hold approach for stocks will too likely be a recipe for underperformance given how these structural changes should see a change in stock market leadership. This, combined with less favourable reaction function for central banks (i.e., the Fed put will be struck far lower), likely creates a difficult environment for passive investors.

Indeed, the following table highlights what I believe will be some of the asset allocation implications of this regime shift.

Investors will do well to allocate to sectors, asset classes and companies set to benefit from these shifting trends. These include real assets, commodities, uranium, energy and green energy-related metals, whilst also including corporations exposed to the capex super-cycle (such as the defense and industrials sectors). Likewise, allocating to select global markets and countries set to benefit for an era of friend-shoring and protectionism seems wise. These conclude countries considered "safe" commodity producers, such as Australia, Canada and Brazil, along with countries such as Mexico which should benefit from the reorganisation of global manufacturing and supply chains.

Likewise, higher rates, higher inflation and higher wages likely equate to a reduction in financial engineering, reduced access to credit, lower profit margins and thus a change in market leadership. Companies that have been reliant on low interest rates to boost earnings via debt-financed share repurchases, or growth stocks that have been re-rated higher given they were the only ones able to generate earnings in a low-growth environment, are likely to move from market leaders to market laggards. Value-related stocks that are better able to generate profits when interest rates are higher should thus now be more rewarded for doing so. Fundamentals and true innovation will matter once more.

What seems clear is what worked so well during the previous era of falling interest rates is unlikely to perform as consistently well going forward. Investors are so often slow to realise such changes, as we are too often blind to change and too late to react to it. As such, you should at least reassess your long-term portfolio and stress-test it for a potential environment of higher and more volatile inflation and interest rates, as well as being more cautious of its exposure to certain markets. Things won’t be necessarily be bad going forward, just different. Prepare accordingly.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by