VHT: Why Vanguard's Healthcare ETF Outperformed Last Week

Summary

- Vanguard's cost-efficient (0.10% expense fee) Health Care ETF is an excellent defensively-oriented fund to hold during challenging economic times.

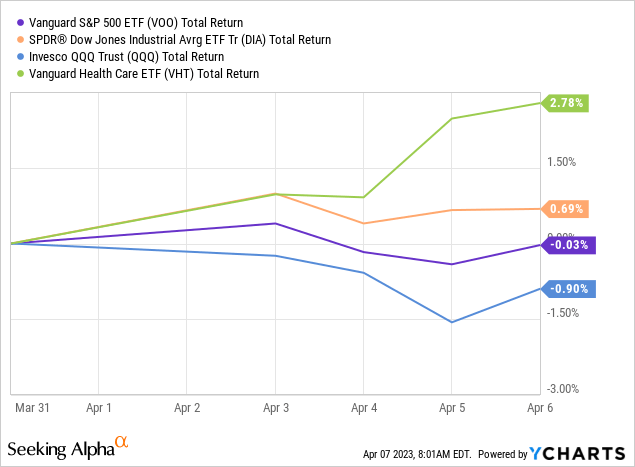

- That being the case, the VHT ETF significantly outperformed last week when soft economic data and rising oil prices pressured the broad market.

- In addition, Johnson & Johnson, a major component in the sector, jumped 6%-plus on hopes for a potential settlement on its seemingly never ending talc litigation.

- The VHT has a 10-year average annual return of 12.7%. In addition to JNJ, top holdings also include UnitedHealth Group, AbbVie, Merck, and Eli Lily.

AzmanL

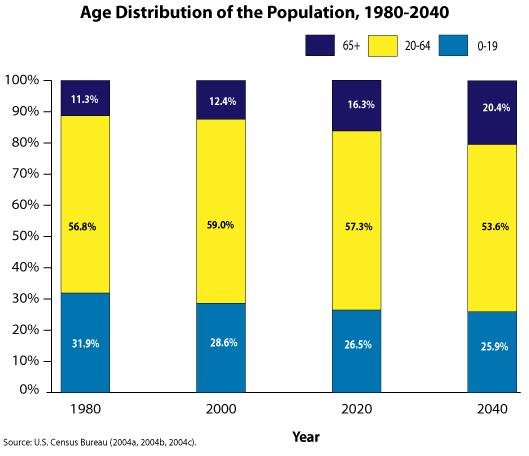

In addition to exposure to the broad market averages, a well-diversified portfolio built for the long-term should have direct exposure to defensive sectors such as utilities, consumer staples, and healthcare. Last week demonstrated why: While the broad market averages struggled due to weak economic data and higher oil prices, defensive sectors outperformed. The Vanguard Health Care ETF (NYSEARCA:VHT) climbed 2.8% even as its sister fund, the Vanguard S&P 500 ETF (VOO), ended the week slightly negative (see graphic below). Longer term, the VHT ETF should benefit from a U.S. population demographic that is aging and will require more care. Today, I will dig into the VHT ETF to see if it would be a good addition to your portfolio.

Investment Thesis

Boring old defensive sectors like utilities, healthcare, and consumer staples typically outperform when inflation is high and the broad economy struggles. That's because these sectors can typically pass higher costs directly through to consumers and their earnings and cash flow are more stable because their products and services remain in demand even when the economy is weak.

Last week was a perfect example. As Seeking Alpha reported, economic data indicated that industrial and labor markets were cooling even as the OPEC+ decision to cut production by 1+ million bpd was likely to push oil prices and inflation higher. As a result, defensive sectors were the top performers:

#1: Utilities +3.11%, and the Utilities Select Sector SPDR ETF (XLU) +3.13%.

Sub-sector Electric Utilities which contributes 65% to the index was up 3.08% and multi-utilities which contribute 29% to the index was 3.3% higher.

#2: Healthcare +3.08%, and the Health Care Select Sector SPDR ETF (XLV) +3.14%.

Pharmaceuticals, Biotechnology & Life Sciences which contributes 58% to the index was up 2.8%, while balance contributor, Healthcare Equipment & Services was up 3.49% during the week.

Meantime, the Urban Institute reports an additional tailwind for the healthcare sector: The percentage of the population 65-plus is growing because of demographic changes and because life expectancy continues to rise:

Urban Institute

With that as background, let's take a look at the VHT ETF to see how it has positioned investors to benefit going forward.

Top-10 Holdings

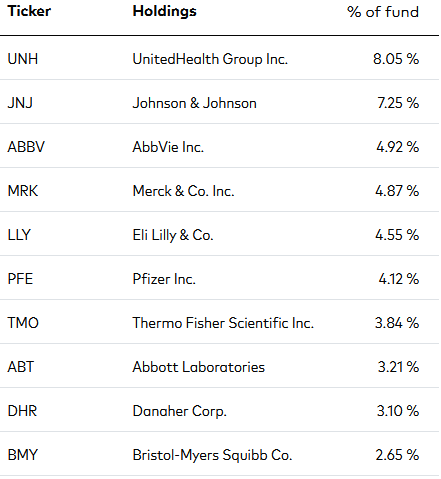

The top-10 holdings in the Vanguard Health Care ETF are shown below and were taken directly from the VHT ETF webpage where you can find more detailed information and the fund and all its holdings:

Vanguard

Despite holding 409 companies, I consider the top-10 holdings - which equate to 46.6% of the entire portfolio - to be relatively concentrated in the top-two weighted companies and in the big pharmaceutical companies in general.

UnitedHealth Group is the #1 holding with an 8.1% weight. UNH is a diversified healthcare company that offers consumer-oriented health benefit and services plans for Federal employers, public sector employers, small businesses, and individuals. The company also offers Medicare and Medicaid plans and wellness services for individuals age 50-plus. Somewhat surprisingly, UNH stock is down 3.6% over the past year but popped 5% higher last week.

As mentioned in the bullets, the #2 holding Johnson & Johnson (JNJ) - with a 7.3% weight - jumped last week on positive investor reaction to a potential $8.9 billion settlement to the company's ongoing talc litigation. Analysts said the new settlement plan could lift the dark cloud that has been hovering over the company for many years and "would allow investors to focus on the upcoming consumer health division separation." As a result, Cantor Fitzgerald rates JNJ as "overweight" with a $215 price target (the stock closed Friday at $165, implying 23% upside). Wells Fargo has a $195 price target on JNJ and said it gives the $8.9B settlement a "50/50 chance of going through" because it's not convinced the court - which rejected a previous bankruptcy filing - will accept this latest bankruptcy attempt.

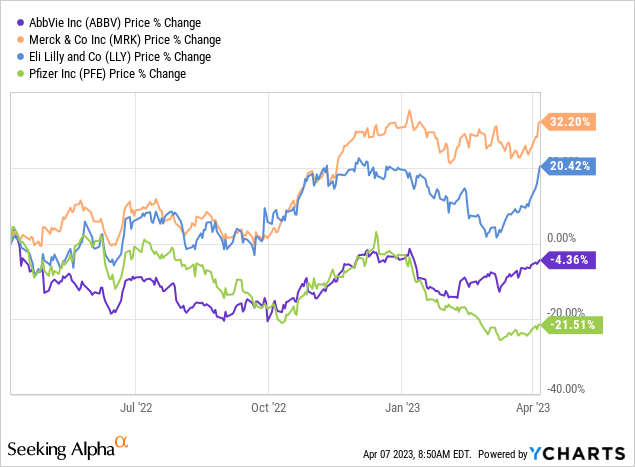

The #3-#6 holdings are four of the biggest pharmaceutical companies: AbbVie (ABBV), Merck (MRK), Eli Lily (LLY), and Pfizer (PFE) - which together have an aggregate weighting of 18.5% of the entire portfolio. These big pharma companies pay out decent dividends and yield 3.66%, 2.60%, 1.20%, and 3.95%, respectively. That said, the 1.38% SEC 30-day yield means the primary investor opportunity with the VHT ETF is long-term capital appreciation, not income.

Of this group, Merck and Eli Lilly have been the out-performers over the past year:

In early February, Merck released its Q4 and full-year 2022 earnings report and it was considered both a top and bottom line beat. For the year, sales of $59.3 billion were +22% (+26% in terms of constant currency). GAAP EPS of $4.86/share was up 17% yoy. In terms of two blockbuster drugs:

- KEYTRUDA Sales Grew 22% to $20.9 Billion; Excluding the Impact of Foreign Exchange, Sales Grew 27%

- GARDASIL/GARDASIL 9 Sales Grew 22% to $6.9 Billion; Excluding the Impact of Foreign Exchange, Sales Grew 27%

The #8 holding in the VHT ETF is Abbott Labs (ABT) with a 3.2% weight. Abbott stock is down 12.5% over the past year as it has faced two major headwinds: A baby formula shortage (and cost to build a new plant) and the roll-off of pandemic related sales (see Abbott Labs: Prepare For A Tough 2023). That said, the stock was 4.7% last week.

The top-10 holdings are rounded out by Bristol-Myers Squibb (BMY) with a 2.7% weight. BMY is another big pharma company with a decent yield (3.22%). BMY was up 2.5% last week and trades at what I consider to be a dirt-cheap valuation of only 8.8x forward earnings.

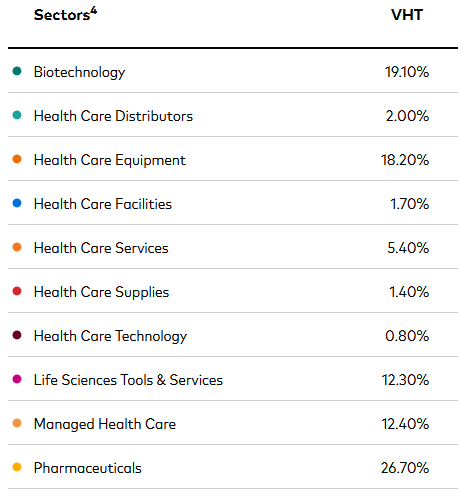

From a total portfolio perspective, the VHT ETF is most exposed to the pharmaceuticals, healthcare equipment, and biotechnology subsectors:

Vanguard

Performance

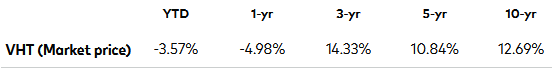

As mentioned earlier, and despite being down ~5% over the past year, the VHT ETF has a strong 10-year performance track record with an average annual return of 12.7%:

Vanguard

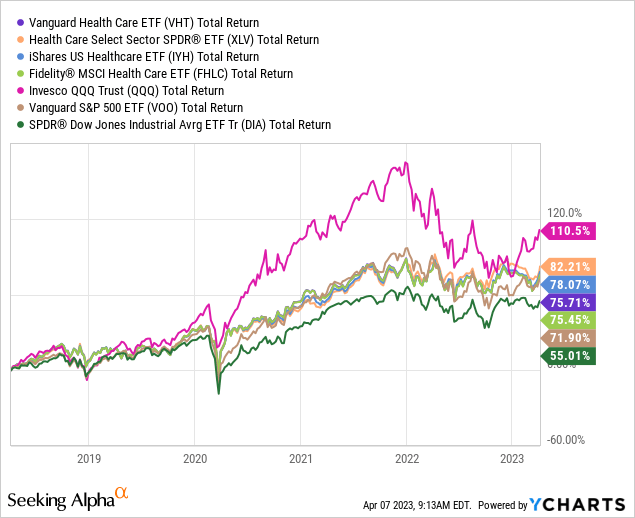

The following graphic compares the five-year total returns of the VHT ETF with some of its direct competitors, including the SPDR HealthCare Sector ETF (XLV), iShares US HealthCare ETF (IYH), and the Fidelity MSCI HealthCare ETF (FHLC) as well as with the S&P 500, Nasdaq-100 (QQQ) and DJIA (DIA) ETFs for some broad market perspective:

As can be seen, for the healthcare specific ETFs, the winner was the XLV ETF - which outperformed the VHT ETF by 6.5% over the past five years.

Risks

The healthcare sector, while generally more resilient to the pressures of inflation and a slowing economy as compared to the broad market indexes, are not totally immune to those risks.

Considering the big weighting in the pharmaceuticals sector, the VHT fund is exposed to President Biden's policy to let Medicare negotiate prices on drugs. For drugs on the market more than nine years, a minimum 25% discount is required, greater than 12 years, 35%, and ford drugs on the market longer than 16 years, 60%. Some of the highest Medicare spending on drugs include those from Pfizer, AbbVie, Bristol-Myers, and Merck.

Summary and Conclusions

The Vanguard Health Care ETF is another of the firm's cost-efficient funds (0.10% expense fee) with long-term track record of delivering strong returns for shareholders: A 10-year average annual return of 12.7%. That being the case, the fund should be considered by those investors who want to add some additional and defensively-oriented equity exposure to their well-diversified portfolios. VHT is a buy.

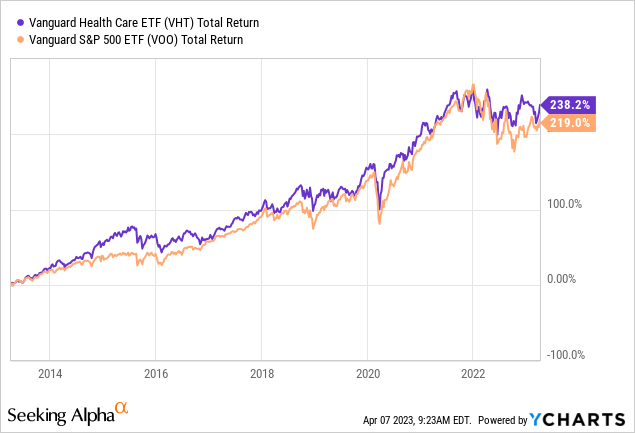

I'll end with a 10-year chart of the VHT ETF and note that its total returns have actually out-performed the S&P500 as represented by the VOO ETF. Not bad for a "defensively" oriented ETF.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XLU, VOO, FHLC, QQQ, DIA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am an electronics engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.