Tracking Ray Dalio's Bridgewater Associates 13F Portfolio - Q4 2022 Update

Summary

- Bridgewater Associates’ 13F portfolio value decreased from ~$19.75B to ~$18.32B this quarter.

- They increased Berkshire Hathaway and Estee Launder while reducing Procter & Gamble, Johnson & Johnson, PepsiCo, and Coca-Cola.

- The top three individual stock positions are Procter & Gamble, Johnson & Johnson, and PepsiCo and they add up to ~12% of the portfolio.

Kimberly White

This article is part of a series that provides an ongoing analysis of the changes made to Bridgewater Associates' 13F portfolio on a quarterly basis. It is based on their regulatory 13F Form filed on 2/13/2023. Please visit our Tracking Ray Dalio's Bridgewater Associates 13F Portfolio series to get an idea of their investment philosophy and our previous update for the fund's moves during Q3 2022.

Assets Under Management (AUM) is at around $150B. The 13F portfolio is less than ~20% of their total AUM. This quarter, the 13F portfolio value decreased ~7% from ~$19.75B to ~$18.32B. The holdings are diversified with recent reports showing around 1000 different stakes. Around 44 of them are significantly large (more than ~0.5% of the 13F portfolio) and they are the focus of this article. The top three individual stock positions are at ~12% while the top five holdings are close to ~18% of the 13F assets: Procter & Gamble, Johnson & Johnson, PepsiCo, Coca-Cola, and Wal-Mart Stores.

Note 1: The firm uses asset class diversification among uncorrelated positions to achieve absolute returns. As such the stakes can be on or against debt, equity, and other markets around the world. To learn more about their unique investment philosophy, check out their video channel and Ray Dalio's books.

Note 2: Although Ray Dalio is a Sinophile whose fascination for China goes back to 1984, it is interesting that only ~1% of Bridgewater's AUM is invested in China.

Stake Increases:

iShares Core S&P 500 ETF (IVV): A fairly large stake in IVV was built during the 2017-2018 timeframe at prices between ~$245 and ~$295. It was sold down during the two quarters through Q1 2021 at prices between ~$325 and ~$400. The last seven quarters have seen the stake rebuilt at prices between ~$359 and ~$477. The stock is now at ~$411 and the stake is at 4.33% of the portfolio.

Note: a much smaller stake in IVV was part of the portfolio during the 2012-16 timeframe.

Berkshire Hathaway (BRK.B), Estee Lauder (EL), iShares MBS ETF (MBB), and McKesson Corp (MCK): These small (less than ~0.65% of the portfolio each) stakes were increased this quarter.

Stake Decreases:

Procter & Gamble (PG): PG is currently the largest individual stock position at 4.13% of the portfolio. It was established in H2 2020 at prices between ~$120 and ~$144. H1 2021 saw a ~80% stake increase at prices between ~$124 and ~$139. The two quarters through Q1 2022 also saw a ~45% increase at prices between ~$139 and ~$164. This quarter saw a ~25% reduction at prices between ~$124 and ~$154. The stock currently trades at ~$152.

iShares Core MSCI Emerging Market ETF (IEMG): The 3.71% IEMG stake was first purchased in 2016. The position size peaked at over 15M shares in 2017. The stake had since been sold down. Recent activity follows. Q3 2021 saw a ~225% stake increase at prices between ~$61 and ~$67. That was followed with a stake doubling in Q1 2022 at prices between ~$51 and ~$62. IEMG currently trades at $48.76. There was minor trimming in the last three quarters.

Johnson & Johnson (JNJ): The 3.44% JNJ stake was a small position in their first 13F filing in Q4 2005. The stake has wavered. The current position was built during the four quarters through Q2 2021 at prices between ~$137 and ~$171. The two quarters through Q1 2022 had seen a ~55% stake increase at prices between ~$155 and ~$180. The stock currently trades at ~$165. There was a ~9% stake increase last quarter while this quarter saw a ~25% selling at prices between ~$160 and ~$180.

Coca-Cola (KO) and PepsiCo (PEP): The four quarters through Q2 2021 saw a ~8.2M shares KO stake built at prices between ~$45 and ~$56. That was followed with a ~40% stake increase in Q1 2022 at prices between ~$58 and ~$63. The stock currently trades at ~$63, and the stake is fairly large at 2.92% of the portfolio. There was a ~25% selling this quarter at prices between ~$54 and ~$64. PEP built up occurred in a similar fashion. The four quarters through Q2 2021 saw a 2.7M shares stake built at prices between ~$129 and ~$148. That was followed with a ~55% stake increase over the two quarters through Q1 2022 at prices between ~$150 and ~$176. There was a ~25% reduction this quarter at prices between ~$160 and ~$186. The stock is now at ~$184 and the stake is at ~3% of the portfolio.

Note: Much smaller stakes in these two positions were part of the portfolio during the decade through 2016.

Vanguard FTSE Emerging Markets ETF (VWO): VWO is a fairly large 2.94% of the portfolio stake. It was first purchased in 2009. The position size peaked at over 115M shares in 2014. This is compared to 13.83M shares currently. Recent activity follows. 2020 saw a ~45% selling at prices between ~$31 and ~$50 while in Q3 2021 there was a stake doubling at prices between ~$49 and ~$53. Next quarter saw a ~30% selling while in Q1 2022 there was a similar increase. The next quarter saw a one-third reduction at prices between ~$40.50 and ~$48. VWO currently trades at ~$40.50. The last two quarters have also seen minor trimming.

SPDR S&P 500 ETF (SPY): A small position in SPY was first established in Q1 2006. An amended filing in Q4 2007 showed a huge 40% of the 13F portfolio stake (~12M shares) established in the high 140s price-range. The position size peaked at ~21M shares by 2011. The decade through 2020 had seen the position reduced to 3.7M shares through minor selling in most quarters. H1 2021 saw another ~45% reduction at prices between ~$370 and ~$430. That was followed with a ~20% selling last quarter at prices between ~$357 and ~$430. SPY now trades at ~$409 and the stake is at 2.87% of the portfolio. There was a ~6% trimming this quarter.

CVS Health (CVS), Costco Wholesale (COST), Target Corp (TGT), and Walmart Stores (WMT): CVS is a 1.39% of the portfolio stake primarily built during Q2 2022 at prices between ~$89 and ~$107 and the stock currently trades at ~$77.50. There was a ~11% trimming this quarter. The 2.34% of the portfolio COST stake was built during the four quarters through Q2 2021 at prices between ~$305 and ~$395 and the stock currently trades at ~$486. There was a ~30% stake increase in Q1 2022 at prices between ~$477 and ~$577. There was a ~22% reduction this quarter at prices between ~$453 and ~$540. TGT is a 0.75% of the portfolio stake established in H2 2020 at prices between ~$119 and ~$180. Q2 2021 saw a ~55% stake increase at prices between ~$200 and ~$245. That was followed with a ~50% increase during H1 2022 at prices between ~$139 and ~$249. The last two quarters saw a ~40% reduction at prices between ~$141 and ~$180. The stock currently trades at ~$166. The 2.63% WMT position was purchased during the four quarters through Q2 2021 at prices between ~$119 and ~$152. Q4 2021 saw the stake sold down by ~45% at prices between ~$135 and ~$151. H1 2022 had seen a two-thirds increase at prices between ~$118 and ~$160. The stock is now at ~$151. The last two quarters saw a ~28% selling at prices between ~$122 and ~$154.

McDonald's Corp (MCD): MCD is a 2.27% of the portfolio position first built during the four quarters through Q2 2021 at prices between ~$184 and ~$237. The two quarters through Q1 2022 saw another ~55% stake increase at prices between ~$222 and ~$270. The stock is now at ~$283. There was a ~25% reduction this quarter at prices between ~$233 and ~$278.

Starbucks Corp (SBUX): The 1.41% SBUX stake was built during the four quarters through Q2 2021 at prices between ~$74 and ~$118. The two quarters through Q1 2022 saw another ~45% stake increase at prices between ~$79 and ~$117. The stock currently trades at ~$105. There was a ~13% trimming this quarter.

SPDR Gold Trust ETF (GLD): The position was first built in 2017 at prices between ~$110 and ~$128. 2020 saw a ~25% selling at prices between ~$140 and ~$191. That was followed with a ~40% selling next quarter at prices between ~$159 and ~$178. Q3 2021 saw a similar increase at prices between ~$162 and ~$171. There was a ~40% reduction during Q2 2022 at prices between ~$168 and ~$185. The stock currently trades at ~$187, and the stake is at 1.14% of the portfolio. The last two quarters saw minor trimming.

Abbot Laboratories (ABT), Alphabet Inc. (GOOG), Boston Scientific (BSX), Baidu Inc. (BIDU), Becton, Dickinson (BDX), Chipotle Mexican Grill (CMG), Colgate-Palmolive (CL), Dollar General (DG), Exxon Mobil (XOM), General Mills (GIS), Intuitive Surgical (ISRG), iShares iBOXX Inv. Grd. ETF (LQD), Kimberley-Clark (KMB), Li Auto (LI), Meta Platforms (META), Merck Inc. (MRK), Mondelez International (MDLZ), Mastercard (MA), Monster Beverage (MNST), NIO Inc. (NIO), Pfizer Inc. (PFE), PDD Holdings (PDD), Stryker Corp (SYK), Sysco Corp (SYY), and Visa Inc. (V): These small (less than ~1% of the portfolio each) stakes were reduced during the quarter.

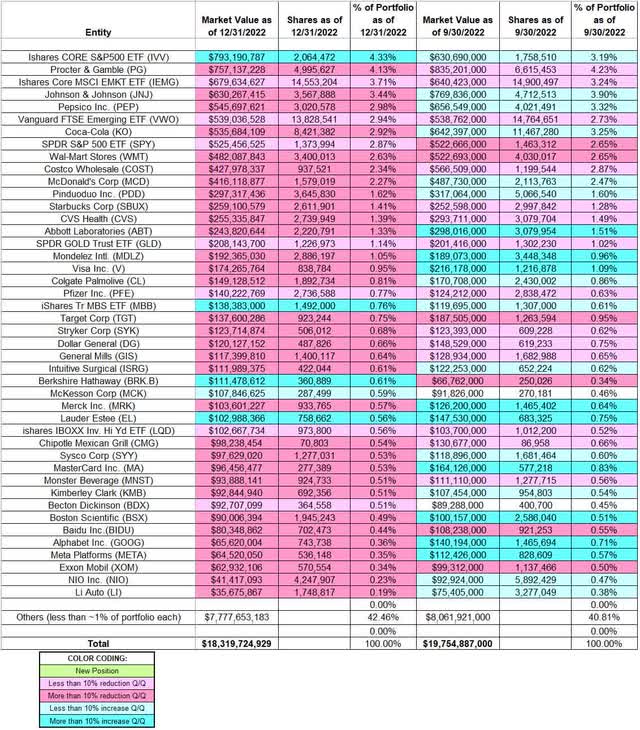

The spreadsheet below highlights changes to Bridgewater Associates' 13F holdings in Q4 2022:

Ray Dalio - Bridgewater Associates' Q4 2022 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Bridgewater Associates' 13F filings for Q3 2022 and Q4 2022.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.