Penumbra: Deep Dive Answering Key Investment Questions

Summary

- Penumbra has demonstrated its capacity to unlock long-term shareholder value.

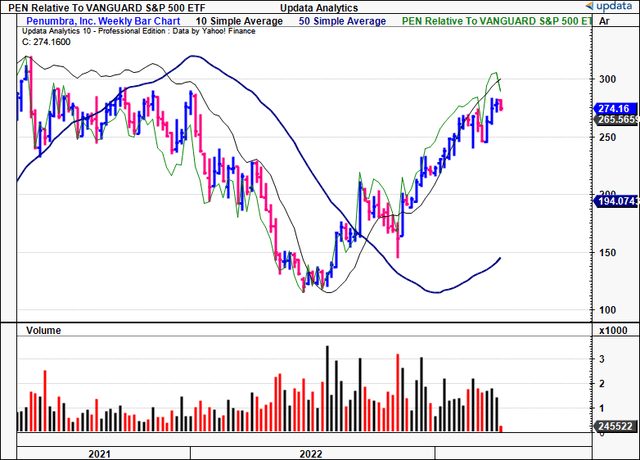

- After a lumpy performance in FY'22, shares have since re-rated more than 100% higher off lows.

- Findings from the deep dive presented here illustrate PEN's capacity to generate additional value for shareholders.

- Net-net, I re-rate PEN as a buy at a $338 price objective, with 20% upside potential.

wildpixel

Investment Summary

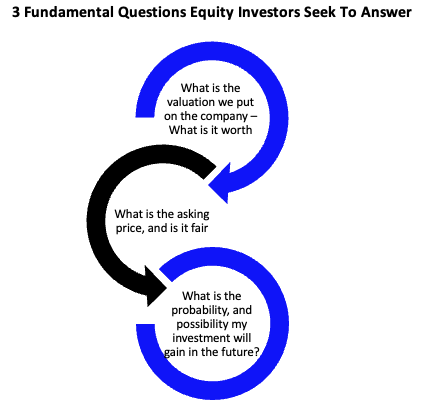

As equity investors, when assessing a prospective investment, we are really seeking the answers to 3 fundamental questions: 1) what valuation do I place on the company, 2) what is the price I am being asked to pay and is it fair, and 3) what is the probability my investment will come into the money and make a profit. Each question relates and feeds into the next creating a positive feedback loop to guide investment reasoning.

Data: Author

The investment conundrum arises because, at a glance, we have no idea whether or not the company's valuation, or the value of our investment, will increase over time.

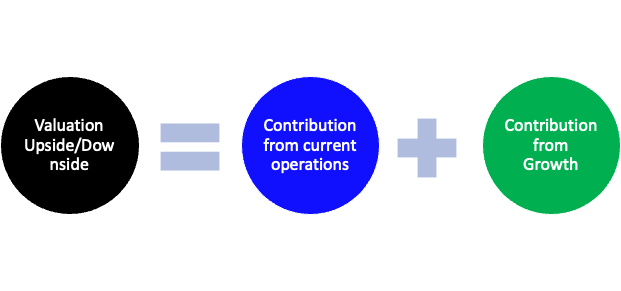

As such, a rigorous framework of analysis is needed to provide a common set of answers to all three questions. Ultimately, through extensive fundamental analysis, we can satisfy the conundrum, by solving for the following equation:

For a given company:

Data: Author

Where:

- Current operations = where the company stands today, what it's achieved to date

- Growth contribution = the firm's investment into future growth, and the outcome [rate of return] of these investments.

It is with this framework in mind that I've undertaken a detailed appraisal of Penumbra, Inc. (NYSE:PEN), a name that's been in and out of my equity risk budget over the last 3-years to date. I've covered the name extensively in the past, last coverage in June last year.

Here I'll run through the entire scope of the PEN investment debate by scrutinizing its current operations and future growth initiatives. With that, the overarching themes of the debate that need answering are:

- Has the market got PEN marked correctly at its current market cap and multiples?

- What value can PEN unlock for shareholders into the future?

With these key points, I can satisfy the 3 fundamental questions outlined earlier. Net-net, following this deep dive, I am re-rating PEN to a buy, citing its ability to unlock substantial value into the coming years, and an undervalued stock price with 20% upside potential. Rate buy.

PEN 2-year stock performance

Overview of current operations

Understanding PEN's current operations gives a detailed picture of where it stands today, what has it achieved to date. This involves a top-down approach, examining:

- Broad economic expectations

- What market's does the firm operate in, what's the forecasts for these markets

- What is the firm's business model

- How does it book revenue/how does it make money

- What kind of products/services does it sell

- How's it performed to date [last period's revenue, EBITDA, earnings, etc.]

- What level of OpEx and CapEx is required to sustain the current level of operations, how efficient is this.

I'll leave the macroeconomic forecasts for the experts, but you'd want to keep in mind the rates and inflation-driven story guiding the GDP and macro outlook. With respect to PEN's operating markets - it sells into the endovascular market. This is further divided into neurological (neurovascular and neurosurgical) and vascular (peripheral vascular and cardiovascular) segments. Within these two segments, the company sells thrombectomy devices that remove blood clots, and embolization devices to treat aneurysms and occlude blood vessels. The main conditions PEN's products are used for are strokes, deep vein thromboses ("DVT"), peripheral occlusions, pulmonary embolism ("PE"), and other vascular diseases caused by blood clots.

It's also worth mentioning that PEN also has a network in the immersive healthcare sector, where patients are undergoing rehabilitation from injury or illness.

The global market for stroke is continuing to grow as the world's populous increases, as well as with the ageing population. It is a leading cause of death and long-term disability worldwide. Around 14mm strokes are estimated to occur each year, with 80mm stroke survivors currently alive throughout the globe today. Meanwhile, ~1.4mm peripheral vascular clotting incidents occur within the U.S. each year and there's a good portion of these cases that could benefit from mechanical thrombectomy.

Revenue collection

PEN aggregates turnover by combining net product revenue, discounts, administration fees and rebates on sales. Revenue also includes shipping costs that are charged to PEN's customers. It sells its products directly to healthcare providers and hospitals through a network of distributors, that are eventually used by specialists to treat neuro and vascular patients. Sales are made via purchase orders, and it's worth noting that PEN has no long-term purchase commitments from its customer network. Importantly, it books revenue at the net sales price, on either:

a) the date of shipment,

b) the date the customer receives their product, or

c) with respect to products sent to hospitals (mainly coils), when the hospital actually uses the product in a procedure.

Sales are made through PEN's direct sales organization ("DSOrg") in the U.S., Australia and Canada, and through distributors into other international markets. However, the direct sales channel accounts for ~81% of top-line revenues, with the remaining 19% made via distributors, up from 14% in FY'20. Further, in its China market, it recognizes licensing, royalty and distribution revenues.

Where PEN stands today

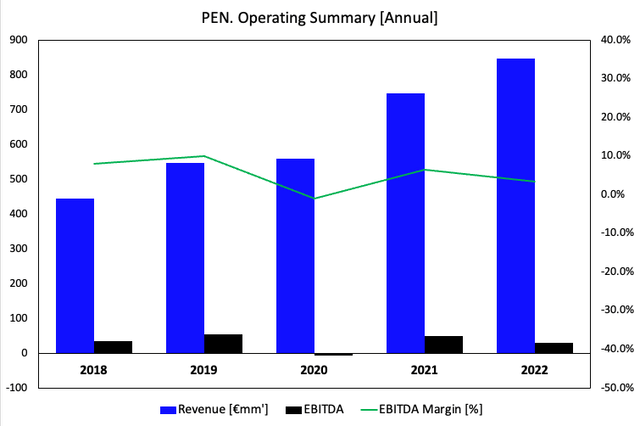

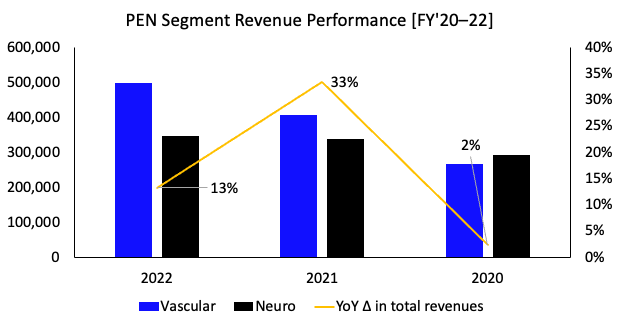

The revenue ramp from FY'18-22 has climbed at a decent gradient. Looking to the most recent set of numbers, PEN clipped $847mm in top-line revenues in FY'22, a 13.3% YoY growth rate [Figure 1]. Geographically, U.S. sales contributed ~70% of turnover, the remaining 30% from international sales, flat on the previous year. It pulled this down to $28.7mm in core EBITDA and $6.1mm in operating income, for a net loss of $2mm and used $55mm in cash operations for the year, due to changes in net working capital and beefing up inventory levels.

It's important to note these figures include the investment made to R&D, that is expensed on the income statement under GAAP accounting rules. Adjusting for this by capitalizing R&D as an intangible asset, and amortizing it on a straight line basis, the restated operating income was $85.5mm on restated earnings of $77.4mm for 2022. I firmly believe this is the correct way to treat the accounting of PEN's investment into R&D, as it has created substantial value for the firm to date, as discussed later. Further, R&D isn't required to maintain the current level of operations. From heron in I'll be doing the same.

Fig. 1

Looking at the divisional highlights, note the following, observed in Figure 2:

- Vascular revenues lifted 22% YoY to $499.4mm. Growth was underscored by U.S. and China sales.

- The catalyst didn't stem from price increases, instead was driven by higher sales volumes for its thrombectomy and embolization products, up 28% and 13.6% YoY respectively.

- Revenue on its neuro products lifted 270bps YoY to $347.7mm. Again, the uplift in turnover stemmed from volume increases, versus a change in pricing strategy.

- Specifically, neuro access and thrombectomy sales lifted 7.2% and 2.8% in 2022, respectively.

Fig. 2

Data: Author, PEN 10-K's

Hence, as it stands, PEN is a company doing ~$850mm in revenues on nearly $30mm in core EBITDA. To sustain this current level of operations, it requires $529mm in OpEx (including R&D), ~$19mm in CapEx, and ~$335mm in inventory value. The cost structure is mainly built from a combination of headcount, capital leases and variable costs tied to production at its manufacturing facilities.

On these expenditures, it can expect a 63% gross margin, 3.4% core EBITDA margin, and 10% adjusted operating margin to generate ~$83mm in adjusted pre-tax earnings. Looking at the capital structure, PEN hasn't issued any debt and $998mm of equity is holding up $1.37Bn in total assets, of which $166mm is booked as goodwill. As such, the only external financing obtained to get to this level of operations has been structured has been via equity. Therefore, the current operating income, adjusted for R&D, supports inventory turnover of 2.5x per year and a cash conversion cycle of 447 days, an increase of 47 days from FY'21 [Figure 3]. Contribution of fixed and intangible assets sits at 2.2x turnover, with a net working capital contribution of 1.4x.

Fig. 3

Data: Author, PEN 10-K's

After adjusting further for interest and taxes, the company produces $77mm in earnings (again, removing R&D as an expense), leading to a return on equity of 7.7%, and return on assets for the providers of capital to the company of 5.6%. Assuming zero future income growth or decline, and return on invested capital ("ROIC") that equals the cost of capital, there is a residual $77mm in free cash flow available to shareholders into perpetuity, because none of the firm's profits are needed to reinvest back into the business to grow.

Contribution To Value From Growth

At this 'steady-state', assuming no growth or decline in earnings, PEN is fairly easy to value. Retained earnings will continue flowing onto the balance sheet, increasing net asset value and shareholder equity. Two problems, however. One, inflation impacts that erode margins, and two, this doesn't create any additional value for the company's shareholders.

Subsequently, the contribution from growth is really the differentiating factor that satisfies the 3 fundamental questions raised at the start of this report. Growth (in operations, investment, and earnings) ensures valuation upside, gauges a fair price, and, if the value of our investment will gain in the future. It is therefore crucial to understand the key facts associated with a firm's growth trajectory. For PEN, this is abundantly true, and here's why.

I'd first like to lay the groundwork that highlights the importance of a company's investments for growth.

Firms can grow operations in several ways:

- Increasing current capacity, selling more units/providing more service

- Launching new products or services, therefore introducing more revenue streams and diversifying income

- Making acquisitions, to potentially reduce execution risk of launching new products/services

- Cost reductions/efficiencies to promote margin growth, and grow profitability this way

- Combinations of each or all of the above.

Analysis from Mckinsey & Co. illustrates that innovation and launching new products/services creates the most value for firms, followed by increasing capacity, trailed by growth made via acquisitions.

For PEN, it has focused on innovating around its core offerings, launching a series of new products over the years, utilizing investments in R&D to achieve this. According to the company, "when we introduce a next generation product or a new product designed to replace a current product, sales of the earlier generation product or the product replaced decline." This becomes important because it suggests PEN is heavily vested into diverting capital towards growth initiatives.

Furthermore, as previously mentioned, growth requires additional investments to support the uptick in operations, no matter what route is chosen. In that vein, a detailed understanding of where, and exactly how much PEN needs to invest in order to hit its growth targets its absolutely paramount. Equally as important, what the rate of return on these investments is expected to be.

Moreover, we need to ask, how does the company intend to finance these growth investments. Firm's can obtain capital to invest via 3 main avenues:

- Externally, via issuing new debt, or

- Raising additional equity,

- Taking a portion of the profits it generates, and reinvest this back into the business to grow (called the reinvestment rate).

The third point is most commonly used for more mature companies who have an established presence in the marketplace.

Regardless, each method comes at a cost to equity investors.

New debt increases interest expense and clips earnings growth, despite the tax shield it provides. Whereas raising new equity capital has a dilutive effect to current shareholders. Further, taking profits that shareholders are entitled to, and reinvesting these back into the business, reduces the free cash flows available to investors at the end of the year. In effect, the firm is asking its shareholders to fund the growth themselves, through their share of the profits they are entitled to.

Hence, it is absolutely imperative the investments into new growth capital provide a rate of return that is justified to be successful. How to we gauge if the investments are successful? We benchmark the ROIC against two data points.

- First, if the ROIC is above the cost of capital, then any growth obtained into the future creates value for shareholders, creating an economic profit.

- Further, if the ROIC is higher than the reinvestment rate, this will be a net benefit to the free cash flows available to shareholders ("FCFE"). For example, if the firm reinvests 10% of its profits to grow, it needs to generate an 11% return to create shareholder value.

That means a $10mm reinvestment must return at least $11mm. If it doesn't, it will be a net loss in FCFE to shareholders. Further, if the ROIC is below the hurdle rate, any growth that's earned will be destructive to value, because it took free cash flows from shareholders and reinvested at a loss.

These points cannot be stressed enough. As equity investors, we don't necessarily want to be funding a company's growth trajectory through our share of the profits. We want the company to be doing this itself by generating a large return on its own investments. That's why, as a rule of thumb, if PEN can make investments to grow at high rates of return, and above the cost of capital, shareholders will benefit from the growth projected into the future.

Investments for Future Growth

Language from PEN's FY'22 10-K provides a detailed view of where the company intends to invest to sport its growth aspirations. First, it plans to increase its salesforce headcount, and each new recruit takes ~6months or more to generate breakeven sales.

It also needs to invest more into its facilities, operating systems and management personnel to continue its growth route. To this point, it is expanding and renovating its existing facilities, with particular focus on its California base. Further, it will be investing in additional equipment, investing further into R&D, and building out further production capacity.

That in mind, we can expect capital to be diverted from earnings back into the business to achieve this. To see how PEN's fared with this over the last 5-years, consider the following (all figures are adjusted for R&D as previous):

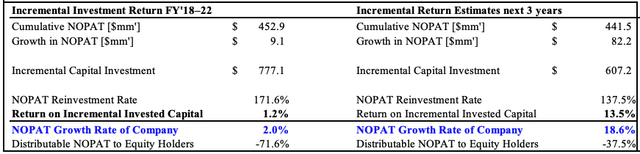

- Since FY'18, the firm has invested an additional $777mm in capital to generate a cumulative $453mm in net operating profit after tax ("NOPAT").

- The additional growth in NOPAT was $9.1mm, after a 32% YoY decline from FY'21.

- Consequently, on average 38.5% of NOPAT was reinvested back into operations to fund the company's growth.

- In total, this is a 171.6% reinvestment of the cumulative NOPAT generated over this time, leading to a 1.2% incremental ROIC, and 2% company growth rate [see: Appendix 1].

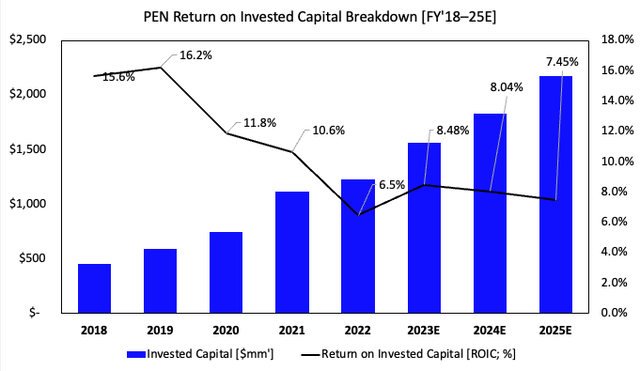

- On a per-year basis, the ROIC has declined from 16.2% in FY'19 to 6.5% last year [Figure 4].

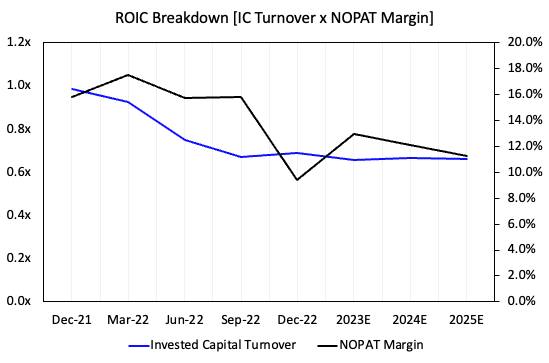

The breakdown of this is important too. PEN's adjusted NOPAT margin has decreased to 9.5% from 16% in 2018, whereas capital intensity has increased with the invested capital turnover decreasing from 1x to 0.7x in this time [Figure 5]. Combined, these two measures build ROIC for a firm. Alas, the requisite for PEN to generate high rates of return on its growth investments is absolutely quintessential to unlock value looking ahead.

To this point, as a reminder, I asked a key question in the introduction:

What value can PEN unlock for shareholders into the future?

This year, with strategic investments, PEN could generate an 8.5% ROIC in FY'23, clipping to 7.45% in FY'25 in my estimation. My assumptions call for PEN to invest a further $607mm in the next 3-years [Figure 4], generating an additional $82mm growth in NOPAT, or 13.5% incremental ROIC. This would lead to a 18.6% geometric growth rate in its operations over this time [see: Appendix 1]. Based on the uptick in sales volumes, new product launches, and investments made to ramp up production/sales capacity, my assumptions call for a 21.1% YoY growth in turnover to $1.02Bn this year, stretching up to $1.38Bn by FY'25. With adjustments for R&D, I'd call for earnings of $126mm this year, $140mm in FY'24. This makes the estimate forward ROE of 11.8% look more attractive, and a reasonable return for equity holders.

These are attractive numbers and demonstrates to me that PEN is well positioned to unlock long-term value, and should be rewarded handsomely by the market.

However, this will be very costly to shareholders - 137.5% reinvestment of NOPAT - so the firm must generate an investment return above the cost of capital to create value.

Fig. 4

Data: Author Estimates, PEN 10-K's

Fig. 5

Data: Author, PEN 10-K's

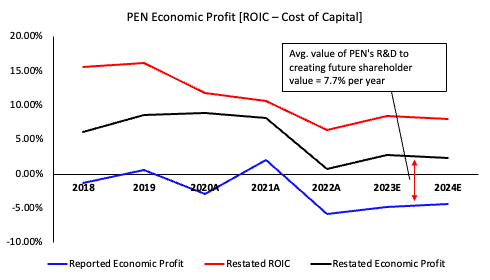

As I've already stated, a firm creates additional value for its shareholders only when the return on its growth investments exceeds the cost of capital (i.e., ROIC > WACC). This generates an economic profit, perhaps the major inflection point investors must consider when talking about profitability. We want an economic profit, not just an accounting one. For PEN, this is crucial. The key differential being, its investments toward R&D.

PEN's R&D investments serve three integral functions:

- Innovating and developing new products for launch (key to creating value, as mentioned).

- Increasing revenues and operating income from the same.

- Subsequently, increasing the amount of free cash flows available to equity holders at the end of the year.

This is precisely why I opt to capitalize the firm's R&D investments as an intangible asset, versus an operating expense. This is far more accurate. In fact, you can clearly observe the value of PEN's R&D to its economic profitability in Figure 6. From FY'18 to date, the firm has consistently delivered an economic profit (ROIC less the WACC hurdle, 5.8% in FY'22/23) when R&D is capitalized. This can't be said when taking the reported earnings on face value (blue line). On average, the value of PEN's R&D has been an additional 7.7% per year, and I expect this trend to continue over the next 2-years as shown.

Fig. 6.

Data: Author, PEN 10-K's

It's been a high-growth period for PEN over the last 3-5 years. However, what we can therefore deduce from this analysis, is that:

- Growth has absolutely been accretive to shareholder value, because the return on PEN's investments has beaten the hurdle rate, generating an economic profit.

- PEN's management haven't chased these high growth rates at the expense of shareholders, directly explaining the 127% gain in share price since FY'18, and the 107% return off lows since my last report in June last year.

In my best estimation, intelligent investors would agree that there's an attractive value proposition on hand with the projections made from PEN's growth contribution.

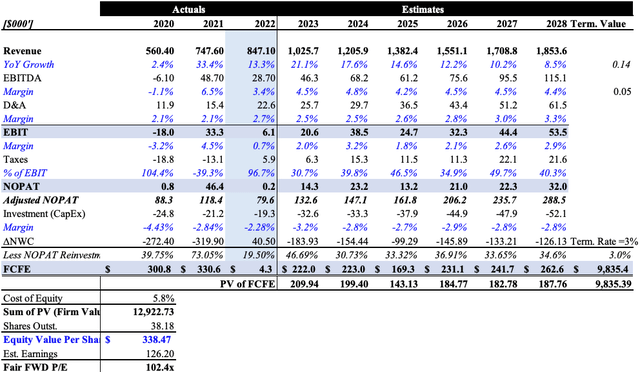

Valuation

The second point I originally raised in the debate asked:

Has the market got PEN marked correctly at its current market cap and multiples?

Here's where we need to make an honest appraisal of what valuation upside we can expect with an investment into PEN's equity. First, the stock is trading at an off-putting premium at 10.8x book value, making my estimated ROE of 11% much less attractive for the investor at just 1% if paying that multiple. This, coupled with a 1.2% forward earnings yield on my forward earnings assumptions. At the time of writing, the market has PEN priced at an unrealistic 235x consensus forward earnings. With my own forward EPS assumptions of $3.31, the market has it priced at 85x forward P/E.

The asking P/E multiple is also integral to understand because it tells us about the payback period/duration of our investment. If we were to assume no growth or decline in earnings, high P/E = long payback. Similarly, low P/E would mean shorter payback. Hence, the aspect of growth again presents as the key differentiator.

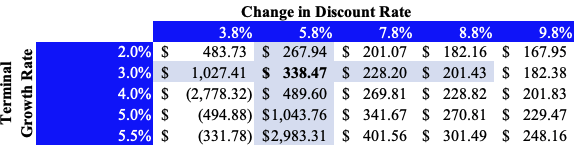

Turning back to PEN, the payback period/duration on an 85x P/E multiple is 85 years, assuming zero growth/decline in earnings, and shareholders retain 100% of earnings. Hardly attractive. However, baking in the growth assumptions discussed earlier, at the incremental ROIC of 13.8%, the payback period drops to just 4 years, and is thus very attractive in my estimation. Further, building the DCF out over a 5-year investment horizon with a 3% terminal growth rate, the stream of FCFE over this time presents with substantial value when discounted at PEN's WACC hurdle of 5.8%. This arrives at a firm valuation of $12.9Bn and equity value of $338, a 20% upside potential at the time of writing. This assumes a reinvestment rate of 30-47%. This would value the stock at 102x forward earnings with my FY'23 earnings assumptions, a good portion of upside on the 85x P/E touted earlier. The sensitivity to the inputs used to build the DCF valuation are observed in Figure 8.

Fig. 7

Fig. 8

Data: Author

In short

PEN presents with the characteristics that satisfy the 3 fundamental questions raised at the beginning of this report. Based on findings from this deep dive, the firm is attractive at an intrinsic value of $338, the asking price is in fact fair, and we can expect valuation upside should PEN convert on its growth targets looking ahead. With this in mind, I am re-rating PEN as a buy, looking to a 20% return objective before reappraising the investment. Rate buy.

Appendix 1.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.