In today’s digital age, paying taxes online has become an increasingly popular option for many who owe taxes to the Internal Revenue Service (IRS). Not only is it convenient, but it is also secure and fast. This article will provide you with a step-by-step guide on how to pay the IRS online. Additionally, we will discuss the benefits of online tax payments, how to set up an online account with the IRS, and answer some frequently asked questions related to this topic.

Benefits of Paying Taxes Online

There are several benefits to paying taxes online. Firstly, it is convenient. You can pay your taxes from the comfort of your home or office without visiting an IRS office or mailing a check. Additionally, online payments are processed quickly; you will receive a payment confirmation almost immediately.

Secondly, paying taxes online is secure. The IRS uses encryption technology to protect your personal and financial information. Furthermore, online payments are processed through a secure government website, which reduces the risk of fraud and identity theft.

Finally, paying taxes online is cost-effective. You do not have to worry about the cost of stamps, envelopes, or transportation to an IRS office. Online payments are also processed more quickly, which can help you avoid penalties and interest charges for late payments.

Steps to Pay IRS Online

Here is a step-by-step guide on how to pay the IRS online:

Step 1: Determine the Amount You Owe

The first step in paying your taxes online is determining how much you owe. You can find this information on your tax return or by contacting the IRS directly.

Step 2: Choose an Online Payment Option

Several online payment options are available, including debit cards, credit cards, and bank transfers. Each option has a processing fee, so be sure to choose the best option.

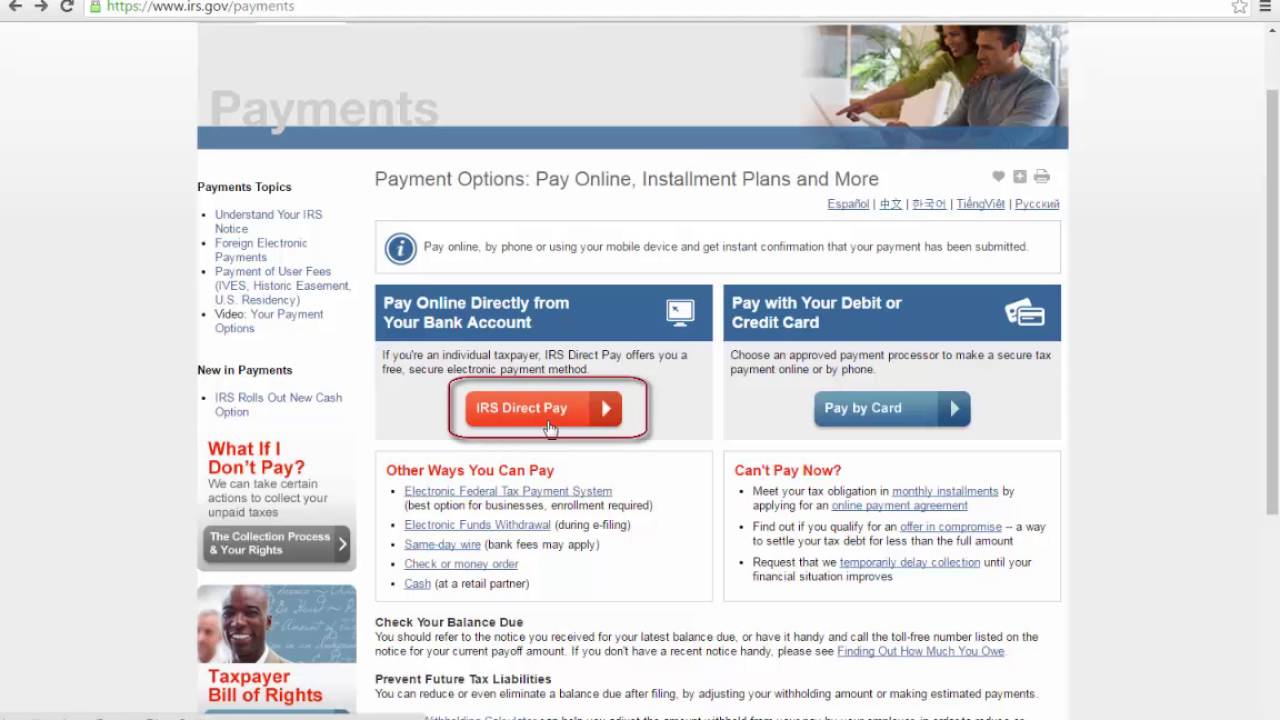

Step 3: Visit the IRS Website

To make an online payment, visit the IRS website at www.irs.gov/payments. From there, you can choose the payment option that you prefer.

Step 4: Enter Your Payment Information

Enter your payment information, including the amount you owe, your name, and your contact information. Be sure to double-check all of your data before submitting your payment.

Step 5: Submit Your Payment

Once you have entered all of your payment information, submit your payment. You will receive a confirmation of payment almost immediately.

If you do not already have an online account with the IRS, you must set one up before making an online payment. Here are the steps to set up an online account with the IRS:

1. Visit the IRS Website

Visit the IRS website at www.irs.gov/payments.

2. Click on “Create an Account”

Click on the “Create an Account” button.

3. Enter Your Personal Information

Enter your personal information, including your name, Social Security number, and date of birth.

4. Choose a Username and Password

Choose a username and password for your online account. Be sure to choose a strong password that is difficult to guess.

5. Verify Your Identity

Verify your identity by answering questions about your credit history and financial information.

6. Submit Your Information

Once you have completed all of the steps, submit your information. You will receive an email from the IRS confirming your account.